Key Takeaways

- Summary of Q4 2024 significant taxpayer wins and losses

- Streamlined Sales Tax Group to create 'mini model bills'

- State individual tax rates and brackets

- News from AZ, CA, CO, IL, IA, LA, MI NJ, NY, SD

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

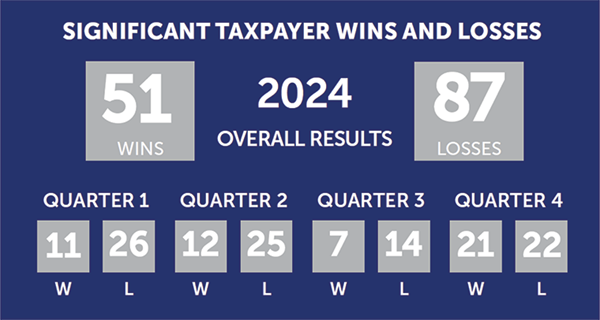

SALT Scoreboard - Q4 2024 - Eversheds Sutherland (US) LLP

Enjoy this look back at taxpayer wins and losses in significant state tax cases during the fourth quarter of 2024.

State Sales Tax Group Seeks Harmony Through 'Mini Model Bills' -Michael J. Bologna - Bloomberg ($):

The model laws would reflect features of the group's Streamlined Sales and Use Tax Agreement that nonmembers could implement without adopting the entire agreement, said Craig Johnson, executive director of the board.

Johnson didn't present a framework for launching the idea, but pointed to several features of the agreement that could be handled in small model bills, including sourcing of sales, product definitions, and sales tax holidays.

State Individual Income Tax Rates and Brackets, 2025 - Andrey Yushkov, Katherine Loughead, Tax Foundation

State-By-State Roundup

Arizona

Arizona Panel OKs Plan for Vote to End Grocery Tax - Sanjay Talwani, Law360 Tax Authority ($)

California

California Disasters Create Nonstop Budget, Tax Prep Complexity - Laura Mahoney, Bloomberg ($)

At the state level, postponed tax filing deadlines make budgeting tricky for the coming fiscal year, on the heels of unprecedented postponements due to a series of storms around the state in winter 2023.

California wildfire relief was previously addressed in Tax News & Views here and here.

Colorado

Colorado DOR Issues Special Tax Rules for Active Duty, Retired Military Servicemembers - Bloomberg ($) "The Colorado Department of Revenue issued a guidance detailing special tax rules for active duty and retired military servicemembers. The document covers topics such as residency determination, income tax exemptions, claiming the military retirement subtraction, and filing extensions for those service in combat zones."

Guidance can be found here.

Illinois

Why an Illinois Tax Tweak is Spooking the Bank Lobby - Punchbowl News

. . .

Banks sued in August, and the case is ongoing.

. . .

[B]anks, forever in the long game, are worried about what comes after Illinois if the law stands. Pickup from other states has been limited so far, though there's legislation in Pennsylvania that would mimic the Illinois law.

Iowa

Iowa Appeals Court Keeps Nonprofit Hospital Tax Exemption Narrow - Perry Cooper, Bloomberg ($)

"A Sales and use tax exemption for licensed nonprofit hospitals doesn't flow through to a corporation that provides shared services to institutions that do qualify, the Iowa Court of Appeals rules Wednesday."

Health Enterprises of Iowa vs. Iowa Department of Revenue

Louisiana

Residents Seek to Block La. Tax Overhaul Ballot Question - Maria Koklanaris, Law360 Tax Authority ($)

. . .

The March 29 ballot is meant to be the final step in implementing the tax plan signed Dec. 5 by Republican Gov. Jeff Landry.

See Tax News & Views for a summary of the legislation that was passed in December 2024.

Michigan

Flow-Through Entity Election Changes for Tax Year 2024 - Melissa Menter and Colette Sutton, Eide Bailly LLP

HB 5022 introduces a new deadline, and likely a new form, for flow-through entities (FTE) to make an election to file and pay the tax at the entity level. Prior to HB 5022, FTE elections were only valid if they met the following requirements:

-

The election payment was made before 15th day of the third month of the FTE’s tax year;

-

The election payment was an electronic payment through the Michigan Treasury Online (MTO);

-

Electronic payment was made on an FTE tax account; and

-

The election payment was directed to the initial year of the election.

With the passage of HB 5022, for tax years beginning on or after January 1, 2024, an FTE election can now be made up until September 30 after the end of the tax year.

Thus, if a taxpayer either made an invalid FTE election or simply forgot to make an election, they may still be able to make the election for the 2024 tax year. Some reasons which may cause an invalid FTE election include:

-

Payment made after the March 15, 2024 deadline;

-

Payment was not made electronically on the FTE tax account online;

-

Payment was incorrectly marked as another payment or for the wrong tax year (i.e. estimated payment, extension payment)

The DOR has provided limited guidance on how FTEs can make the election. Since HB 5022 is effective on April 2, 2025, taxpayers wanting to make an election for the 2024 tax year should wait until after this date to ensure their election is valid. Although the Michigan return due date is March 31, an FTE making the election after the return date is presumed to have made a valid extension request. However, to avoid penalty and interest, the taxpayer must pay its full liability on the day of the election.

Additionally, the passage of HB 5022 is not expected to impact taxpayers who have already made a valid FTE election. If a taxpayer made a valid FTE election in tax years 2022 or 2023, their election should remain valid for the 2024 tax year, as elections are irrevocable and remain in effect for two subsequent tax years. Likewise, if a valid FTE election was made in 2024, it is presumed to still be valid.

Michigan Tax Tribunal Finds Initial Electricity Sales To In-State Purchaser Requires Sourcing Taxpayer's Business Activities to Michigan For Corporate Income Tax -Cameron Browne, Tax Notes ($) "An energy company is not entitled to a Michigan corporate income tax refund on its wholesale sales of electricity because the sales were properly sourced to the state, according to the Michigan Tax Tribunal."

New Jersey

NJ Floats Rules To Follow MTC Stance On Internet Activities - Paul Williams, Law360 Tax Authority ($) "The proposed rules from the New Jersey Division of Taxation would consider certain internet activities, such as providing post-sale assistance through email or placing cookies on a customer's computer that gather market research for sale to third parties, to exceed the tax protections of the Interstate Income Act of 1959. That law, more commonly known as P.L. 86-272, shields businesses from a state's tax on net income when their only business activities in that state are soliciting orders of tangible personal property."

New York

NY Broadens Tax Break Guidelines For Development Projects - Zak Kostro, Law 360 Tax Authority ($) "New York state broadened the guidelines for determining whether some economic development projects may be eligible for property and sales tax exemptions based on the level of a project's on-site child care services under clarifying legislation signed by Democratic Gov. Kathy Hochul."

South Dakota

South Dakota Gives Remote Sellers 30 Days to Register and Collect Tax - Zak Kostro, Law360 Tax Authority ($) "South Dakota will allow remote sellers and marketplace providers at least 30 days to register and start collecting sales tax after they meet statutory criteria that require them to do so under a bill signed by the governor."

We're Here to Help