Key Takeaways

- California wildfire relief.

- Future of SALT deduction cap.

- Centralized partnership audits.

- Idaho updates conformity to federal tax code.

- Iowa to fund property tax cuts with new efficiency dept.

- Illinois joins IRS direct file.

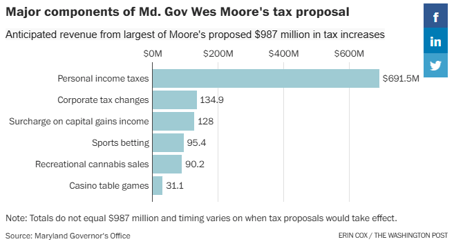

- Tax hike proposal in Maryland.

- Nebraska & North Dakota property taxes.

- Will Manhattan's congestion pricing solve issues?

- History of tariffs!

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

California Wildfire Relief

Governor Newsom extends state property tax deadlines for LA firestorm communities until April 2026 - Governor Gavin Newsom:

- Suspends until April 10, 2026, certain state tax laws that impose penalties, costs, and interest for late payments of property taxes due in calendar year 2025.

- Suspends certain additional state tax laws requiring the filing of various property tax statements.

- Applies to properties in ZIP codes 90019, 90041, 90049, 90066, 90265, 90272, 90290, 90402, 91001, 91040, 91104, 91106, 91107, 93535, or 93536.

The executive order.

Melissa Menter, an Eide Bailly SALT expert, adds:

IRS Defers 2024 Deadlines for Taxpayers Affected by Los Angeles Wildfires - Adam Sweet, Eide Bailly:

California has also granted deadline relief. California tax authorities have announced deadline relief mirroring the federal relief. Other states normally honor federal disaster extensions, but you should check with individual state tax authorities to be sure.

Centralized Partnership Audits

24 States Ready for IRS Centralized Partnership Audits - Amy Hamilton, Tax Notes ($):

SALT Cap

Why salty blue-state House Republicans are vital to saving Trump’s tax cuts - Jim Geraghty - The Washington Post:

The $10,000 SALT Cap Is Likely Dead. What Will the New Cap Be? - Richard Rubin, The Wall Street Journal:

...

Another way to limit the fiscal impact would be for lawmakers to restrict the property-tax portion of the deduction to primary residences, said Malliotakis, one of two New York Republicans on the Ways and Means Committee.

Trump Wants Higher SALT Cap, House Republican Says - Asha Glover, Law 360 Tax Authority ($):

State-By-State Roundup

California

Newsom Backs More Film Credit Funds, SALT Cap Workaround - Paul Jones, Tax Notes ($):

Newsom's fiscal 2026 budget also proposes to partially exclude military retirement benefits from state income tax and broadly exempt wildfire settlements from taxation for the next four years. The plan, released January 10, proposes $228.9 billion in general fund spending and $322.3 billion in total spending.

Calif. Revenues Through Dec. Up $8B Over Forecast - Michael Nunes, Law 360 Tax Authority ($). "State Controller Malia M. Cohen, in a memo published Thursday, said that so far this fiscal year the state collected $89.48 billion in revenue, outpacing estimates that $81.04 billion would be brought in. Higher-than-expected collection of the state's corporation tax and personal income tax drove up total revenues."

Idaho

Idaho House OKs Updated Conformity To Federal Tax Code - Zak Kostro, Law 360 Tax Authority ($):

The bill would update references to the IRC in Idaho's income tax code to mean the federal law as amended and in effect on Jan. 1, 2025, according to the bill text and a fiscal note statement. Under the state's current law, references to the IRC mean the federal code as amended and in effect on Jan. 1, 2024, according to the bill.

Iowa

Iowa Plans Efficiency Dept. To Fund Property Tax Cuts - Jaqueline McCool, Law 360 Tax Authority ($). "Iowa will create a statewide Department of Government Efficiency to find potential savings in order to fund property tax relief, Gov. Kim Reynolds announced, mirroring plans by President-elect Donald Trump for a similar body at the federal level."

Illinois

Gov. Pritzker and Illinois Department of Revenue (IDOR) Announce Participation in IRS Direct File Service - Office of Govrenor JB Pritzker:

After filing federal taxes, the program also connects taxpayers to Illinois' free state income tax filing system, MyTax Illinois, where they can file and complete their Illinois state returns.

Maryland

Moore launches sales job on his budget and politically dicey tax hikes - Erin Cox, The Washington Post:

...

The bulk of the proposed tax revenue — $819 million — would come from levying higher income taxes on the wealthy, but Moore has also pitched doubling the tax rate on sports betting, boosting the tax rate on casinos’ table games from 20 to 25 percent and bumping up the tax rate of recreational cannabis sales from 9 to 15 percent. The plan also closes a corporate tax loophole and lowers the corporate tax rate, which together would bring in more state revenue than it loses, he said.

Maryland Gov. Moore includes income tax increases for wealthy residents to help address $3B deficit - Brian White, AP News:

Under the plan, which requires approval by state lawmakers, Moore said nearly two-thirds of state residents would receive a tax cut, with relief targeted to low- and middle-income Marylanders, and 82% will either receive a tax cut or see no change.

Mississippi

Mississippi House set to vote this week on income tax elimination-gas tax increase plan - Taylor Vance, AP News/Mississippi Today:

...

The legislation would reduce the income tax rate from 4% to 3% next year. Then, it would reduce the rate by .3% each additional year until the tax is eliminated in 10 years. The plan also trims the 7% sales tax on groceries to 2.5% over time. Under current law, Mississippi’s 7% sales tax is split between the state and municipalities where the tax is collected. To shore up the loss, the legislation would end the state’s 18.5% sales tax diversion to municipalities, meaning the full sales tax collected will go to the state budget.

Michigan

Michigan Bill Creates Corporate Income Tax Credit for R&D Expenses - Tax Analysts, Tax Notes ($):

An additional 5 percent credit is allowed for R&D expenditures incurred in collaboration with a research university, not to exceed $200,000 annually.

Nebraska

Neb. Gov. Vows To Keep Tackling Property Tax 'Crisis' - Michael Nunes, Law 360 Tax Authority ($):

In his State of the State Address, Republican Gov. Jim Pillen said while some changes made to the state's property tax code last year helped rein in the state's "spiraling property tax crisis," more had to be done in the new legislative session. The governor also voiced his support for eliminating the state's inheritance tax.

North Dakota

North Dakota’s new governor eyes ‘path to zero’ property tax on people’s homes. Can it be done? - Jack Dura, AP News:

The plan by Republican Gov. Kelly Armstrong would start with $483 million from the state’s general fund and a portion of earnings from the state’s $11.5 billion oil tax savings with the ultimate goal of wiping out primary residential property taxes in years to come.

New York

Hochul Proposes Sweeping Income Tax Cuts - Emily Hollingsworth, Tax Notes ($):

South Carolina

South Carolina Governor Calls for Accelerated Income Tax Cut - Kennedy Wahrmund, Tax Notes ($):

Wisconsin

Wisconsin DOR Revises Guidance on Credits for Taxes Paid to Other States - Tax Analysts, Tax Notes ($):

Tax Policy Corner

Nebraska Property Tax Relief After LB 34 - Abir Mandal and Jared Walczak, Tax Foundation:

Property taxes, when well-designed, have an important role to play in municipal taxation. This publication briefly makes the case for the property tax, embattled as it is in Nebraska, then surveys both LB 34 and the pre-LB 34 structure of state property tax relief, before offering recommendations for recalibrating to ensure that Nebraskans benefit from real, predictable property tax relief—without the state sacrificing economic growth or further distorting property markets.

Congestion Pricing Revived in Manhattan, But Will Its Lower Price Work? - Lullian Hunter, Tax Policy Center:

Tax History Center

Did you know?

History of Taxes, Tax Foundation:

We're Here to Help

.jpg?h=560&iar=0&w=700)