Key Takeaways

- How much do state taxes affect interstate populations shifts?

- Multistate Tax Commission guidance appealed to Supreme Court.

- State and local fines and fees.

- Louisiana enacts flat tax.

- Updates from Alabama, California, Illinois, Iowa, Michigan, North Carolina, Utah.

- Apportioning non-business income?

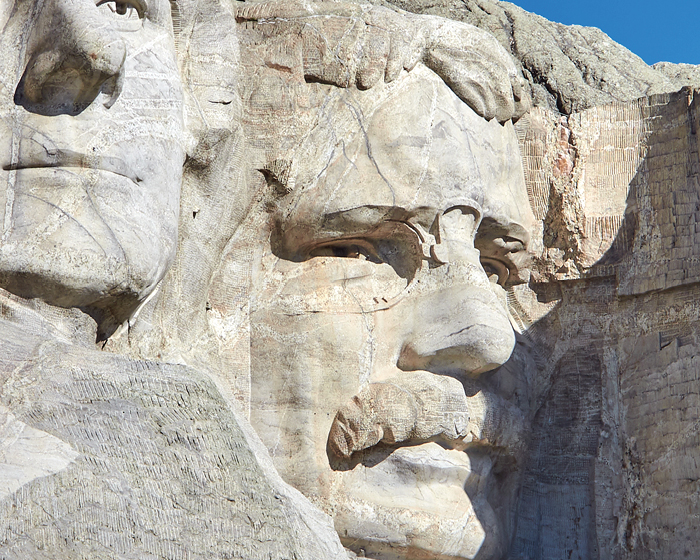

- Breaking news from 1907: Teddy Roosevelt tees up income and estate taxes.

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

Tax Competitiveness and Interstate Migration - Andrey Yushkov, Tax Policy Blog:

In contrast, states in the bottom 10 of the STCI lost an average of 213,000 residents over the same period, amounting to 2.4 percent of their 2021 population. The largest net losses were observed in California, New York, and New Jersey, which lost 1,017,581; 706,638; and 211,163 individuals, respectively.

MTC’s P.L. 86-272 Guidance Reaches U.S. Supreme Court - Amy Hamilton, Tax Notes ($):

...

The MTC’s revised Statement of Information on P.L. 86-272 is cited as one particularly relevant “source of confusion and controversy” in a section of the petition arguing that the issue of inconsistent interpretations of P.L. 86-272’s safe harbor “is critically important nationwide and is recurring.”

“For example, the MTC Statement of Information asserts that any internet activity that is not limited to solicitation of orders for tangible personal property is sufficient to subject an out-of-state business to state income tax, regardless of whether such activity occurs within or outside the taxing state,” the petition says.

Five Facts About Fines and Fees Revenues - Aravind Boddupalli, TaxVox:

Further, fines and fees can unjustly burden Black, Latine, and other historically underserved families and create conflicts of interest for law enforcement and courts.

Key State And Local Tax Takeaways From November - Maria Koklanaris, Law360 Tax Authority ($). "The courts were busy, too. In a closely watched case in Oregon, Microsoft sought reconsideration of a state tax court ruling that rejected the company's proposals for alternative treatment of its repatriated foreign earnings. Meanwhile, a federal judge dismissed Arizona's challenge to the Internal Revenue Service's position that rebates paid by the state to taxpayers were subject to federal tax."

State-By-State Roundup

Alabama

Alabama Tribunal Voids Tax Bill for Bogus Form 1099 - Matthew Pertz, Tax Notes ($). "A taxpayer has convinced the Alabama Tax Tribunal that she didn't receive almost $300,000 in nonemployee compensation from her ex-husband's business and that she is therefore not liable for income tax on the amount."

California

California Court Formally Overturns San Francisco's Vacancy Tax - Paul Jones, Tax Notes ($):

However, Cheng said that “the city has made it clear that they will appeal the decision, and so there is still further debate ahead and we will need to continue our advocacy.”

Calif. Gov. Promises EV Tax Credit If Trump Axes Federal - Juan-Carlos Rodriguez, Law360 Tax Authority ($). "In 2022's Inflation Reduction Act, Congress established a $7,500 credit for buying new EVs, known as the Section 30D credit, as well as an up-to-$4,000 credit for buying used or preowned EVs, known as the Section 25E credit. President-elect Donald Trump has indicated that he doesn't favor the EV tax credits, but Newsom said he wants to make sure they remain available to Golden State residents."

Newsom-Backed California EV Rebate Could Exclude Tesla - Paul Jones, Tax Notes ($). "But Newsom's latest announcement took on an added political dimension when it was reported that the resurrected incentive program might not apply to Tesla and other carmakers in a bid to limit it to automobile sellers with a smaller share of the market. That spurred some to speculate that the proposal’s exclusion might be partly a political dig a Musk, who is closely allied with Trump and supported his candidacy."

California Tax Department's AI Project Hindered by Human Error - Emily Hollingsworth, Tax Notes Featured News:

The contract, awarded to Deloitte Consulting LLP, was for a data analytics and tax return processing solution that would use machine learning — sometimes defined as a type of AI that uses algorithms to identify patterns in data — to process tax returns more efficiently.

...

But the project hit a snag when a team member with the California Department of Technology, which helped CDTFA with the project, made a mistake on one of the calculations in the scoring system used to evaluate the performance of each bidder's proof of concept in the second phase of the procurement process.

Maybe they should have outsourced that scoring system to ChatGPT.

Illinois

Chicago Mayor Struggles to Find Revenue for Debt-Ridden City - Shruti Date Singh, Bloomberg via Yahoo! Finance:

Some aldermen oppose any increase. Others are polling residents to see if they would accept a smaller hike. It’s a tough sell given roughly 80% of the city’s property taxes go toward paying down the city’s $37 billion unfunded pension liability, not communities directly.

Former Illinois Governor Writing Bill to Create Millionaire Tax - Michael Bologna, Bloomberg ($). "Quinn said his plan for a 3% surcharge on income above $1 million to pay for property tax relief has momentum and should be placed before voters on Nov. 3, 2026, as an amendment to the state constitution."

Iowa

Iowa Court Denies Taxpayers' Claimed Capital Gains Deduction - Tax Analysts ($):

The taxpayers argued that they were in the business of providing services as an employee and the sale of goodwill they cultivated from sales and customer relations amounted to the sale of their business.

The court disagreed, finding the cultivated goodwill was owned by the taxpayers personally and its sale did not qualify for a deduction.

From the opinion:

The decision relates to a limited capital gain exclusion available for some pre-2023 business asset sales. Post 2022, the exclusion is limited to farm sales.

Louisiana

Louisiana Implements Major Tax Reform - Becca Stadtner and Mariah Trupp, Eide Bailly:

The corporate franchise tax will be phased out starting January 1, 2026. Related tax credits will be reduced by 25% annually, beginning in 2024, and fully eliminated by 2027.

Effective January 1, 2025, corporate income tax will transition to a flat 5.5% rate, replacing the tiered system. The reform removes various exemptions, deductions, and credits while allowing full expensing of qualified business expenditures. Research and experimental costs will be immediately deductible in the year incurred.

Individual income tax will also shift to a flat 3% rate, eliminating the current tiered structure.

Key changes to sales tax include:

-A new 2% tax on non-residential utilities.

-Permanency of the 0.45% levy.

-An expanded tax base, eliminating exclusions for services like repairs, installations, and rentals.

The state sales tax rate will increase from 4.45% to 5% starting January 1, 2025, reversing its previously scheduled reduction. Constitutional exemptions for necessities like food, residential utilities, and prescription drugs remain, while new taxes apply to digital products and services such as accommodations, personal services, and transportation. Local exemptions for manufacturing machinery and equipment will also be introduced.

Michigan

Mich. House Panel OKs Fix To Avoid Double Tax On Deliveries - Zak Kostro, Law360 Tax Authority ($). "The legislation seeks to address a practice under current law in which sales tax may be applied twice, both on a seller and a delivery network company, in certain circumstances, the analysis said. Proponents of the bill have said that permitting delivery network companies to claim deductions for "unnecessary sales tax paid" would alleviate their tax burdens and allow them to continue working with small businesses, according to the analysis."

North Carolina

NC GOP-Led Senate OKs Reducing Income Tax Cap - Maria Koklanaris, Law360 Tax Authority ($). "North Carolina's income tax cap would fall to 5%, instead of the 7% currently in the state constitution under a constitutional amendment approved Monday by the state Senate."

Utah

Utah Governor Proposes Social Security Tax Repeal in Budget Plan - Angélica Serrano-Román, Bloomberg ($):

Cox called repealing the Social Security tax a “cornerstone” of his plan, estimating it would provide relief to over 150,000 seniors and align Utah with more than 40 states that already exempt these benefits or have no state income tax at all. The governor’s proposal would cost the state $143.8 million in revenue annually, according to a budget brief.

Tax Policy Corner

Don't Do It! - David Brunori, Law360 Tax Authority ($), free to LinkedIn users here:

There is nothing to rethink. Nonbusiness income should be allocated to the commercial domicile of the taxpayer. There are a few limited exceptions, like the sale of real estate. But the current system has worked well. Contrary to Hamer's assertions, it is not difficult to identify commercial domicile.

Despite remote work, every company has a headquarters. Every company has a legal address. The idea of apportioning nonbusiness income, what Hamer hints at, has been a goal of some state tax administrators for decades.

Tax History Corner

This week in 1907, Theodore Roosevelt sent a message to Congress calling for an income tax and a federal inheritance tax. From the message (emphasis added):

It hasn't worked out that way. For Fiscal Year 2025, the Treasury estimates that Individual and Corporation income taxes will generate 55% of federal tax revenue. Social Security and Medicare taxes will account for 37% of federal tax revenue. Estate taxes? 0.85%.