Key Takeaways

- Steps you can take to improve your next April 15.

- What will the IRS be like next April 15?

- Trump threatens Harvard tax exemption.

- Tariff update.

- National Librarian Day meets National Banana Day.

Happy April 16. This is the national holiday for tax preparers, who are mostly still asleep. For everyone else, it's a day of contemplation, reflection, and, in some cases, penance.

Rather than wallow in regrets, act now to make next tax season less stressful. If you do these things today, you are less likely to be scrambling next April to deal with an unexpected tax liability:

- Set up your IRS online account. Once you have this, you can check in on your refund, see whether you actually have made the payments you are supposed to, and make payments electronically from your bank account. No more telling your preparer "I made all the payments you told me to" without double-checking!

- Set up your estimated payments today. Once you have your online account, you can set up your quarterly payments in advance, to be withdrawn as they are due. Memory can fail, so this gives you a backup.

- Revisit your withholding. Many people with good jobs are good savers, which means over time they generate taxable investment income. If you don't adjust your withholding to cover the tax on your investments, you will always come up short at tax time.

- Max out your 401(k). If you are using a non-Roth 401(k), it's a great way to knock down your taxable income. If you are going the Roth route, terrific, but consider whether you are really going to be better off forgoing tax in your retirement years than saving tax now with a traditional 401(k).

- Reform your recordkeeping. If you do gig work, recordkeeping is everything. Setting up a good system through good online bookkeeping software will save you trying to recreate it all next year at tax time. It will also give you useful current information on the profitability of the time you are spending on your gig work.

Go forth and prosper!

The New IRS

What will Tax Day look like next year? - Jacob Bogage, Washington Post:

The article covers the reforms the DOGE-ers propose, like this: "So next tax season, under [a DOGE] proposal, you may be filing your return not to a government employee but to a contractor, who will feed it through scanning hardware and software and run the extracted data through AI."

A warning from 1985, the ‘tax season from hell’ - Terry Lemons, The Hill. "And like in 1985, tech issues loom large for 2026. The technology team has already lost important staff, with more contemplating leaving. IRS insiders note that the Department of Government Efficiency staff embedded within the IRS has recently started tinkering with the intricate programs that make tax seasons — and refunds — work. People inside and outside the IRS fear unfamiliar people interfering with the complex workings of the agency systems and tax law could be catastrophic for the 2026 tax season."

1985 was my first season, and it was hellish, but mostly on account of my employer at the time. Fortunately, they didn't keep me around. I might not have had the sense to leave on my own.

Trump Picks Investigator Behind Hunter Biden Tax Case as IRS Acting Leader - Richard Rubin and Ryan Barber, Wall Street Journal:

...

Like at other agencies, Trump has elevated someone perceived as an ally while pushing aside career civil servants. Since the beginning of the administration, the IRS has lost or is losing its chief financial officer, chief tax compliance officer, chief risk officer, chief privacy officer and its top lawyer and human-resources executive, among others. Shapley will now take over the agency without that core group of managers.

During the Biden administration, Shapley went to Congress with incendiary allegations that Justice Department officials interfered in the investigation of Hunter Biden. He said the inquiry into President Joe Biden’s son was unlike any he had experienced in his career at the tax agency. House Republicans seized on his testimony to argue that the Justice Department was shielding the then-sitting president’s son.

Tax War on Non-profits?

Trump Threatens to Revoke Harvard’s Tax-Exempt Status - Douglas Belkin, Sara Randazzo, and Tarini Parti, Wall Street Journal. "Trump wrote on social media Tuesday that Harvard’s decision to resist his administration’s demands to change its governance structure over campus antisemitism concerns could result in a loss of tax exemptions."

Trump Questions Harvard’s Tax-Exempt Status - Fred Stokeld, Tax Notes ($):

“Remember, Tax Exempt Status is totally contingent on acting in the PUBLIC INTEREST!” Trump added.

Trump’s Harvard Threat Raises Specter of IRS Nonprofit Crackdown - Erin Schilling, Bloomberg ($):

That concern is leading some organizations to wipe diversity, equity, and inclusion references from their websites, their lawyers said. It’s also causing a broader chilling effect, where nonprofits worry about carrying out their mission if it could be construed as the “illegal DEI” referred to by President Donald Trump in a January executive order.

Related: Eide Bailly Exempt Organization Tax Services.

Trump Income Tax Rate Boost?

Risk of failure looms large as GOP starts drafting the ‘big, beautiful bill’ - Jordain Carney and Meredith Lee Hill, Politico:

A Thursday House vote might have finalized a fiscal framework for the GOP’s domestic policy megabill, but completing that intermediate step exposed huge fissures between the House and Senate over a range of issues crucial to finishing the sprawling legislation that’s expected to span tax cuts, border security, energy and more.

Senate Taxwriters Discussing Hike in Top Tax Rate, Grassley Says - Cady Stanton, Tax Notes ($):

“It might surprise you that the list of possibilities we have on our working sheet that the members of the Finance Committee . . . are going to discuss is raising from 37 to 39.6” percent the tax rate on high-income individuals, Grassley said. “Now, that doesn’t mean it’s going to happen,” he added.

Tariff Update

Trump Says Tariffs Could Replace Income Tax - Natalie Andrews, Wall Street Journal:

Five Things To Know About Trump’s Income Tax and Tariff Idea - Erica York, Tax Foundation. "1. The Math Doesn't Work."

US Biofuel Industry Sees Threats to Feedstock From Trump Tariffs - Kim Chipman, Bloomberg via MSN:

While its plant in Georgia sits about 1,000 miles from the biggest US corn and ethanol hub in Iowa, it is positioning to take in shipments instead from South America. It’s not that LanzaJet doesn’t want to use domestic farm products for its fuel. Rather, those commodities aren’t deemed climate-friendly enough under US federal guidelines to qualify for a tax credit, known as 45Z, aimed at boosting production of low-carbon fuels — including sustainable aviation fuel, or SAF.

Help for Scam Victims

Some Online Scam Victims Can Now Seek Tax Relief on Firmer Ground - Tara Siegel Bernard, New York Times:

In a memorandum released on March 14, the Internal Revenue Service’s Office of Chief Counsel described which types of scams might qualify for tax relief, which included many investment schemes and some types of impersonation fraud. But it still excludes victims of other widespread digital crimes, including kidnapping schemes, for example, and romance-related fraud that did not involve investing.

Blogs and Bits

Is moving for tax reasons worth the effort? It depends - Kay Bell, Don't Mess With Taxes. "Tax matters are especially important to retirees who live on fixed incomes. Or, if they are relying on investments, who live on incomes that can fluctuate wildly when markets go crazy like they have in the wake of Donald J. Trump’s recent tariff impositions and backtracks."

IRS Provides Limited Penalty Relief for Certain Micro-Captive Disclosure Statements - Ed Zollars, Current Federal Tax Developments. "This relief is specifically targeted towards those who failed to file timely disclosure statements related to transactions identified as listed transactions or transactions of interest after the initial filing of tax returns or the point at which an advisor became a material advisor."

IRS Has Resumed Sending Automated Levy Notices - Margarita Stone, Eide Bailly. "All taxpayers with unpaid (and unresolved) balances are at risk of enforced collection action once the LT11 is issued, whether their case is assigned to a Revenue Officer or to the IRS Automated Collection Service (ACS) division."

Related: Eide Bailly IRS Dispute Resolution and Collections Services.

Foreign Stock Options: 6 Things American Expats Should Know - Virginia La Torre Jeker, US Tax Talk. "Each stage of stock options given in connection with employment from grant, to exercise, and a later sale of purchased shares has tax implications."

Taxation of Foreign Dividends - Kasia Strzelczyk, 1040 Abroad. "If you’re a U.S. expat, your dividends—whether from U.S. or non-resident corporations—must be reported on your income tax return."

Related: Eide Bailly Expatriate Tax Services

Tax Policy Corner

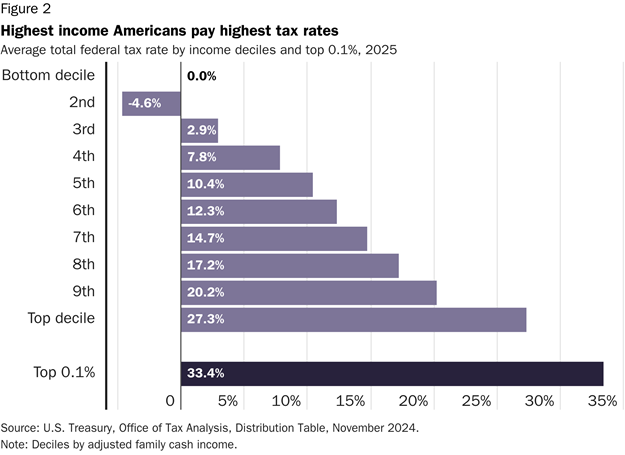

It’s Tax Season—Five Charts on Who Pays and What’s at Risk - Adam Michel and Joshua Loucks, Liberty Taxed. "The current US fiscal trajectory is unsustainable. Eventually, taxes will need to rise, or spending will need to be cut. Large, European-style welfare states cannot be sustainably financed when a narrow sliver of income earners pay the lion’s share of taxes—big government requires high taxes on the middle class."

Beware the Biggest Refund

Tyler tax preparer sentenced to federal prison for role in tax refund fraud scheme - IRS (emphasis added, defendant name omitted):

The Defendant pleaded guilty to making false and fraudulent statements on a tax return and was sentenced to 24 months in federal prison by U.S. District Judge Jeremy D. Kernodle on April 15, 2025. Johnson was ordered to pay $1,244,934 in restitution.

...

“Defendant in her role as a tax preparer, took advantage of those seeking assistance by filing fraudulent returns,” said Christopher J. Altemus Jr., Special Agent in Charge of IRS Criminal Investigation (IRS-CI) Dallas Field Office. “By fabricating deductions and business expenses, she filed hundreds of false returns, resulting in more than $1.2 million in fraudulent refunds. The women and men of IRS-CI remain dedicated to safeguarding our tax system and ensuring that individuals who engage in fraudulent activities face the full consequences under the law.”

Read your return before signing. If you have a business but your return has a schedule C, that's a red flag waving.

What day is it?

It's not only tax preparers sleep-in day, it's National Librarian Day! And National Banana Day. Out of consideration for your neighborhood librarian, don't leave peels in the stacks.

We're Here to Help