Key Takeaways

- Acting IRS head resigns after being bypassed in taxpayer data deal.

- Treasury agrees to share taxpayer info with immigration enforcement.

- Data deal threatens to hit tax collections.

- Tariffs take effect.

- Trading partners can't find anyone to negotiate with.

- Trump "fine" with tax rate increase on high earners.

- Trump tells House budget hawks to accept Senate deal.

- National Unicorn Day.

IRS chief to quit over deal to share data with immigration authorities - Jacob Bogage and Shannon Najmabadi, Washington Post:

...

Treasury Department officials in recent days sought to circumvent IRS executives so immigration authorities could access private taxpayer information, the people said. Those conversations largely excluded Krause’s input.

Treasury Secretary Scott Bessent and Homeland Security Secretary Kristi L. Noem signed an agreement Monday allowing the practice, although IRS lawyers had counseled that the deal probably violates privacy law. Krause learned of the deal after representatives from the Treasury Department released it to Fox News, the people said.

Acting IRS Chief to Depart, Extending Turmoil at Agency - Richard Rubin, Wall Street Journal:

Other IRS executives, including Chief Financial Officer Teresa Hunter and Chief Privacy Officer Kathleen Walters, are leaving the government or planning to leave, the people familiar with the matter said. Mike Wetklow, the chief risk officer, is also leaving the IRS.

Acting IRS Commissioner Krause to Depart Agency - Benjamin Valdez, Tax Notes ($):

Krause is also “troubled by the talent and institutional knowledge being forced out or deciding to leave because of these decisions,” the person said.

IRS Head, Privacy Chief to Quit After Immigration Data Deal - Erin Slowey, Bloomberg ($):

Current and former agency officials warned that such cooperation could be illegal. The agency’s acting top lawyer was reassigned to his old position after he was told that allies of Elon Musk viewed him as being uncooperative. He was replaced by a Trump ally.

About that agreement

Treasury Agrees to Share Tax Data for Immigration Enforcement - Mary Katherine Browne, Tax Notes ($):

...

Under section 6103, personal tax information is considered confidential and staunchly protected, with few exceptions. While information can be shared with law enforcement in limited circumstances, the IRS has traditionally rebuffed calls to share individual taxpayer information for immigration enforcement.

However, The Washington Post reported that DHS has widened its request for personal taxpayer information from 700,000 people to 7 million people suspected of being in the United States without authorization.

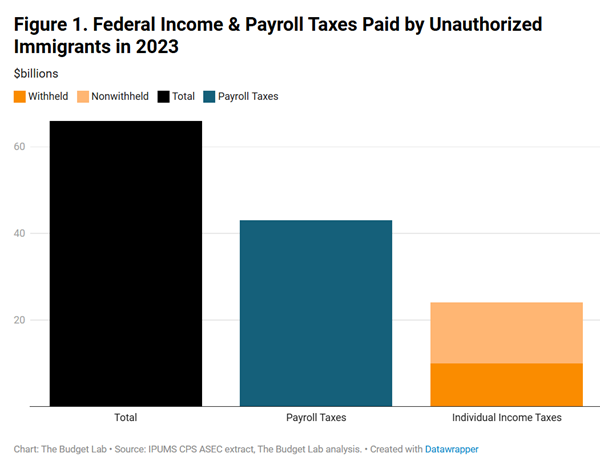

The Potential Impact of IRS-ICE Data-Sharing on Tax Compliance - The Budget Lab: "TBL estimates that the IRS-ICE agreement would cause federal revenues to be $12 billion for the remainder of fiscal year 2025, and $25 billion lower in fiscal year 2026. Over the next decade, revenues come in roughly $300 billion lower, roughly 0.1% of GDP on average (see table below), with a high estimate of just under $500 billion over the decade, and a low estimate of $150 billion. These are all current policy estimates that assume the Tax Cuts & Jobs Act of 2017 is extended over the next 10 years."

The implications may be broader than undocumented immigrants, per this from the Washington Post Early Brief:

For the purposes of the GOP tax bill, that has a monetary cost, and a big one. Sarin’s team at Yale found that rising tax noncompliance from undocumented immigrants — spurred by this new arrangement to provide tax data to immigration officials — could cost up to $479 billion over 10 years.

Some context: That’s nearly a quarter of the $2 trillion House Republicans say they want to cut over 10 years.

Meanwhile, There is Still April 15

Act now to file, pay or request an extension - IRS:

Filing electronically reduces tax return errors as tax software does the calculations, flags common errors and prompts taxpayers for missing information. Most taxpayers qualify for electronic filing at no cost and, when they choose direct deposit, usually receive their refund within 21 days.

Tariffs Take Effect

Trump upends global trade - Semafor:

Trump Dismisses Last-Gasp EU Push to Stop Tariffs Kicking In - Ben Sills, Bloomberg via MSN. "President Donald Trump rejected a European Union proposal to drop tariffs on all bilateral trade in industrial goods with the US, meaning that his 20% tariff on all EU imports is due to come into force Wednesday."

China hits US imports with additional retaliatory tariff of 50% - Joseph Leahy, Ryan McMorrow, and Demetri Sevastopulo, Financial Times. "The across-the-board tariffs, which will take additional levies being charged on all US goods from Thursday to 84 per cent, will hit American exports of machinery, semiconductors, agriculture and other goods."

Art of The Deal

Trump, defiant on tariffs, claims trade deals are in the works - Giselle Ruhiyyih Ewing, Politico. "President Donald Trump barreled forward with his ongoing trade war Tuesday, saying that his administration is making progress toward deals with international partners in an effort to calm markets and show that his tariff plan is working."

US issues trade demands that go far beyond tariffs - Financial Times:

“To those world leaders who, after decades of cheating, are suddenly offering to lower tariffs — know this: that’s just the beginning,” Navarro wrote, citing a laundry list of unfair practices he said included currency manipulation, “opaque” licensing, “discriminatory” product standards, “burdensome” customs procedures, data localisation and so called “lawfare” of taxes and regulation hitting US tech firms.

The sheer breadth of the list presents huge challenges to trade delegations seeking deals with Trump, trade experts warned, as governments try to avoid alienating their own voters in politically sensitive areas like food standards or taxes on global tech giants.

‘We are all waiting for a reply.’ Countries say White House hasn’t responded on tariff talks. = Ari Hawkins, Nahal Toosi, Daniel Desrochers, and Katy O'Donnell, Politico:

The Philippines is still waiting for a reply to its request for a meeting, according to one official from the country. The United Kingdom pitched the White House on a framework for a trade deal but failed to avoid the tariff increases. Another foreign diplomat said their government was reaching out to various Trump aides at all levels, but many either were not responding or were unwilling to do anything beyond listen.

Companies Stung by Tariffs Explore Lawsuit Against Trump - Maggie Severns, Jacob Gershman, and Lindsay Wise, Wall Street Journal:

“Lawyers seem to be in consensus that this is illegal,” said Consumer Technology Association CEO Gary Shapiro, who declined to comment on the possibility of his group joining a lawsuit. “There will be lawsuits. And Congress will be forced to act,” he said.

Tillis on Trump tariffs: ‘Whose throat do I get to choke if this proves to be wrong?’ - Aris Folley and Sylvan Lane, The Hill. "Tillis is among a handful of Republican senators who have voiced concerns with Trump’s trade policy and the impact it could have on the U.S. economy. GOP critics of Trump’s tariffs cite the steep toll the president’s first-term trade wars had on American agriculture, which lost billions of dollars due to retaliation from other nations."

The Tax Cut Extension Front

Trump told Republican senators he’s open to raising taxes on highest earners - Burgess Everett, Semafor:

...

Trump would probably have to put some muscle behind convincing Republicans in Congress to get behind anything construed as an increase in taxes — even on those making hundreds of thousands of dollars a year... At the heart of the issue is the politics of the tax bill. Many Republicans are worried they may have to cut Medicaid to pay for some new tax cuts, which would embolden Democrats who are already attacking the bill as a giveaway to the rich at the expense of the poor. Raising taxes on higher earners could blunt those criticisms.

Trump gets sharp as House Republicans move budget toward the floor - Jake Sherman and John Bresnahan, Punchbowl News:

Trump’s stern suggestion to those members, as delivered in a tuxedo from the podium at the National Building Museum: “Close your eyes and get there. It’s a phenomenal bill. Stop grandstanding.” Trump said we are “one big, beautiful bill signing away from the greatest economy in the history of the world.”

GOP Lawmakers Resist Trump’s Pressure on Budget - Richard Rubin and Olivia Beavers, Wall Street Journal. "Trump and House GOP leaders have routinely melted internal party opposition this year with promises and appeals to Republican unity. That pattern could break this week because of firm opposition to the budget passed by the Senate on Saturday, though Republican leaders are optimistic they can get the measure through the House as early as later Wednesday."

Blogs and Bits

IRS payment plans available if you owe but can't pay in full - Kay Bell, Don't Mess With Taxes. "First things first. Even if you can’t pay all or even any of what you owe, file a tax return."

Market Crash from Trump’s Tariffs Opens Window to Renounce Without Exit Tax - Kasia Strzelczyk, 1040 Abroad. "If you were holding off on renouncing because your net worth had crept over $2 million, the market just did you a favor. Thanks to the recent plunge, you may now be under that threshold — and that means you may be able to renounce without triggering the exit tax."

Related: Eide Bailly Global Mobility Services.

Bozo Tax Tip #3: Foreign Trusts - Russ Fox, Taxable Talk. "By far the worst tax schemes in the view of the IRS are offshore (foreign) trusts."

Remitting Employment Taxes is No Luxury

Appleton businessman sentenced to 24 months’ imprisonment for failing to pay employment taxes - IRS (emphasis added, defendant name removed):

According to court records, Defendant was the owner and operator of Mods International, later known as Mods Client Services, which manufactured and installed residential and commercial buildings out of shipping containers. Defendant failed to pay over $1,000,000 in employment taxes his businesses owed over the course of nearly 14 years. At the same time, court records indicate that he spent significant money on luxuries for himself and his wife.

At sentencing, Senior United States District Judge William Griesbach highlighted the length and dollar amount of Defendant’s crime. Judge Griesbach also emphasized that Defendant has a significant history of fraud convictions, which date back to the 1970s and continue through Defendant’s adult life. Judge Griesbach noted that a higher sentence may have been warranted except for Defendant's failing health.

Not remitting employment taxes is something that the IRS will detect almost in spite of itself. Using the money on luxury goods is a reliable way to turn it into a criminal problem.

What day is it?

It's National Unicorn Day! As myths go, it at least doesn't affect public policy.

We're Here to Help