Key Takeaways

- The Senate Finance Committee's ranking Democrat issued a report blasting the tax structures used by a leading pharmaceutical company.

- The report points to an alleged flaw in the Tax Cuts and Jobs Act's international framework, which could raise significant revenue if changed.

- Republicans could consider a tweak to raise $70 billion towards the TCJA extension.

- Both businesses and other countries are preparing as best they can for a new Trump tariff onslaught.

- Is there still hope for the global minimum tax?

What do you do when you’re in the minority in Congress? This day and age, your job is mostly to harangue the other side on a daily basis. But sometimes, you can still influence policy.

For instance, Sen. Ron Wyden, D-Ore., the ranking member of the Senate Finance Committee, issued a report on March 27, alleging that the pharmaceutical firm Pfizer Inc. had engaged in "the largest tax-dodging scheme in the history of Big Pharma."

The report claims that, despite selling $20 billion worth of drugs to U.S. customers in 2019, it reported all of the profit from those sales offshore. Wyden was not alleging any illegal activity, stating that this maneuver was enabled by the 2017 Tax Cuts and Jobs Act. While Pfizer is a U.S. firm, it manufactures most of its products offshore, and can sell into the U.S. while benefiting from reduced tax rates meant for offshore income. Specifically, the income can be classified as global intangible low-taxed income (GILTI), which is granted a 50% deduction and taxed at 10.5%, rather than the overall 21% rate.

Pfizer disputed the report, calling it “incomplete,” and said it pays U.S. tax on “substantially all of Pfizer’s world income,” according to Bloomberg Tax.

Wyden's document is similar to reports highlighting the tax practices of other pharmaceutical companies his staff has authored in the past, including when he was chairman of the committee. As the ranking minority member, he can't use the gavel to hold hearings or press for specific legislation.

But the report could nevertheless play into the ongoing legislative drama surrounding how to extend provisions of the 2017 Tax Cuts and Jobs Act, which are set to expire at the end of the year. Renewing the TCJA will cost trillions of dollars, and Republican lawmakers are scouring the code for any potential source of revenue. Wyden noted that earlier versions of the TCJA would not have allowed this particular tax structure, known as “round-tripping.”

Even Republicans–who are not known for being eager to raise taxes on businesses–have considered whether to tweak this supposed loophole, according to news stories cited by the report. One proposal would only grant the GILTI deduction to income that is earned from offshore sales. (That requirement already exists for foreign-derived intangible income, a similar TCJA classification granted to domestic earnings.) That option–supported by former Republican Congressional staffer George Callas, who worked on the TCJA during its passage–would raise $70 billion over the next 10 years, according to an analysis by the Penn-Wharton Budget Model.

That’s hardly enough to cover the $4+ trillion cost for the overall TCJA renewal, but it’s still enough to help cash-strapped lawmakers. Wyden’s report and public statements could generate more support–or polarize the issue and generate a backlash.

Liberation Day Tariff Roundup

President Trump unveiled a long-anticipated "reciprocal tariff" regime today, finally adding some detail to long-promised retaliatory measures against what his administration claims are unfair policies. In the meantime, tax experts continue to struggle as they try to wrap their heads around the new international landscape.

International Consternation and Concern Over Trump Tariff Hikes – William Hoke, Tax Notes ($):

US Business Put Spending Plans on Ice With Tariffs, Tax-Cut Wait – Mark Niquette, Bloomberg News ($):

Business chiefs increasingly see that transition as a time for caution. Tariffs and uncertainty have come up more than 600 times during quarterly earnings calls for S&P 500 companies since Trump took office, according to a Bloomberg analysis of transcripts. Executives point to potential retaliation by other countries, along with US actions, as clouding the picture.

EU Readies ‘Strong Plan’ for Trump’s Global Tariff Strike – Jorge Valero and Alberto Nardelli, Bloomberg News ($):

Gov'ts Ready Concessions, Reprisals Ahead Of US Tariff Wave – Kevin Pinner, Law360 Tax Authority ($):

Other International Tax Items

However, based on discussions with his counterparts — including European Commission officials — in the past couple of months, there seems to be a genuine interest in trying to reach a compromise on the issue, he said. Levine spoke March 28 at a conference sponsored by the International Fiscal Association USA Branch.

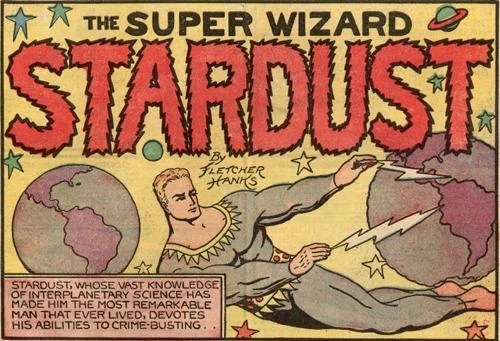

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: Stardust the Super Wizard

Debut Year:1939

Creator: Fletcher Hanks

Debut Publication: Fantastic Comics #1

Origin Story: An alien from far-away space, Stardust patrols the cosmos to fight criminals of all stripes, occasionally rescuing Earth from evil-doers.

Superpowers: Seemingly limitless powers including flight (through space), invulnerability, teleportation, and the ability to shoot destructive rays--which are actually all technology-based.

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

We're Here to Help