Key Takeaways

- Cost of Republican's tax cut agenda.

- Uncertain future for clean energy credits.

- SALT Cap Workaround challenged in court.

- Future of IRS Direct File.

- Taxes on sports betting.

- Tax trouble in Vancouver.

- National flower day!

Tax Legislation

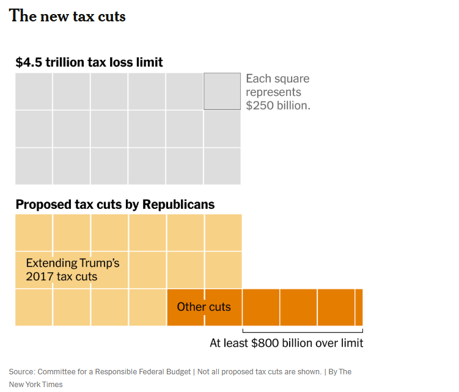

The Size of the Tax Cut - Andrew Duehren, New York Times:

...

But Trump wants to do more than just extend the tax cuts from his first term. During the presidential campaign, he outlined several new ideas, many of which call for exempting different types of income from taxation. These will be expensive. The Committee for a Responsible Federal Budget, a nonpartisan group, has estimated their costs over 10 years:

- At least $100 billion not to tax tips

- At least $250 billion not to tax overtime

- At least $550 billion to lower taxes on Social Security benefits

- At least $200 billion to increase the deduction for state and local taxes

Energy Credits and Incentives

The Man Behind the Republican Case for Clean Energy - David Gelles, New York Times:

...

“The president wants us to be an energy dominant country, and solar and wind has to be part of that discussion,” he said. “It takes 10 years to build a natural gas plant. We don’t have the technology right now for nuclear or geothermal to work on a large scale. We need energy now, and solar and wind are the quickest things to get online.”

Toronto excludes Tesla from EV incentive due to US trade war - Wa Lone, Reuters:

The cost of killing EV tax credits - Arianna Skibell, Politico:

...

Unwinding the EV tax credit would save the federal government $168 billion over a decade, according to another new study from Harvard University. Republicans want to use that money to help pay for tax cuts Trump has promised, which independent analysts have said will largely benefit wealthy citizens.

Related: IRA Credits Remain in Place Despite Mixed Signals.

DOGE

The parties initially agreed to an order restricting DOGE special government employees Tom Krause and Marko Elez to “read only” access to BFS records, although Elez left the DOGE Treasury team in early February. Kollar-Kotelly conducted a February 24 hearing concerning the plaintiffs’ request for a preliminary injunction.

In the Courts

An Analysis of the Domestic Production Activities Deduction for PBM Software: Loper Bright’s Impact - ED Zollars, Current Federal Tax Developments ($):

IRS SALT Cap Workaround Rule Unlawful, 2nd Circ. Told - Maria Koklanaris, Law 360 Tax Authority ($):

Blogs and Bits

Four Tax Tips I Tell My Children—When They’ll Listen - Laura Saunders, Wall Street Journal:

This rule extends to IRS correspondence. If using the U.S. Postal Service, always send by certified mail and keep the sticker. It can solve a world of problems.

People love the IRS’s free tax filing website. Its future is unclear. - Shira Ovide, Washington Post:

Those concerns reflect decades of distrust of the IRS, mostly from Republicans. Now, though, people on the left are wary of government agencies under the Trump administration, said Code for America CEO Amanda Renteria. She expects the concern to reduce use of Direct File and other government services.

If you’re worried about giving more information to the government, experts say there’s no difference in the amount of personal financial information in the IRS’s hands whether you file your return with Direct File, TurboTax, an accountant or on paper tax forms.

Haven’t filed your 2021 tax return? You might be missing out on a COVID stimulus check - Susan Haigh and Adriana Morga, AP News:

FBAR Due Date: Triggers And Key Compliance Rules For U.S. Taxpayers - Virginia La Torre Jeker, J.D., Forbes:

Tax Policy

As states mull tax hikes, sportsbooks insist they’re paying their fair share - Danny Funt, Washington Post:

Some lawmakers from both parties view steep taxes as an appropriate mechanism to rein in gambling, while sportsbooks say they deserve the freedom to flourish like any other business. Customers are being asked to choose sides. And as revenue from sports betting exceeds expectations, so does the demand for problem-gambling services, yet advocates say many states aren’t diverting enough tax revenue to adequately address public health harms.

Tax Trouble

Vancouver, Washington, high-volume tax preparer indicted for aiding and assisting false tax returns - IRS (defendant name omitted):

...

Between 2017 and 2021, Defendant prepared at least 12,000 tax returns. The grand jury alleges that his false entries on customer tax returns cost the U.S. Treasury more than $5 million in tax loss.

What day is it?

Spring is in the air, it's National Flower Day!

We're Here to Help