Key Takeaways

- The DOGE disruption in the IRS.

- The 25-year old who is running the agency.

- IRS modernization chiefs quit.

- Shutdown Countdown.

- Will IRA energy credits survive?

- Filings are down.

- Grassley: Billy Long seeks to change IRS initials.

- Optimism is fine, but appraisals are mandatory.

- Think of the pipes.

Stalled Audits and a Skeleton Staff: Inside Trump’s War on the I.R.S. - Andrew Duehren, New York Times. This is an excellent look at the impact of DOGE on IRS operations, and on the haphazard nature of the DOGE efforts:

Surely it's all part of a bigger, well thought-out plan, right? Well, no. (my emphasis):

“While no plan has been approved to date, modernization is necessary to keep up with the process by which Americans file their taxes, including the reality that over 90 percent of individual tax returns are filed electronically,” the spokesperson said. “These changes are aimed at improving taxpayer customer service and ensuring a smooth and successful filing season.”

The whole article is worth reading, including for its insights on the 25-year old who suddenly is basically running the agency.

Top IRS Modernization Officials Exit Agency - Benjamin Valdez, Tax Notes ($):

Padrino and Warsh both joined the IRS in 2023 shortly after the confirmation of then-Commissioner Daniel Werfel, who President Biden picked to lead the agency’s transformation efforts using nearly $80 billion in special funding from the IRA — an amount that has since been clawed back by $20.2 billion, with another $20.2 billion currently frozen under the government funding bill.

The departures call into question the future of the IRS’s strategic operating plan, which Padrino’s office was tasked with overseeing.

The IRS Bleeds - Liz Wolfe, Reason. "Though all I want in this world is to never be audited by the men with guns, there's a clear issue presented for budget balancers: What will happen to federal revenue if the IRS ceases to do its job? And what will happen when customer service is made even worse? Will we toil to pay the right amount without any help from the government agents who are demanding we do so?"

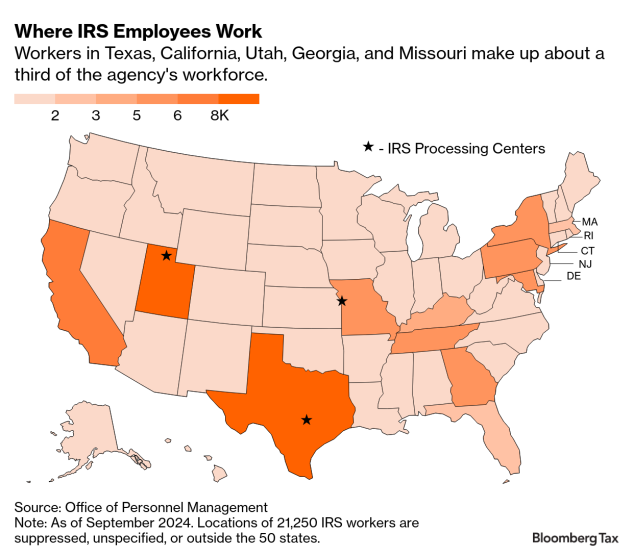

Republicans Hold Fire as IRS Workers Cut, Even in Red States - Chris Cioffi, Bloomberg ($):

Nearly 100,000 people worked for IRS as of September 2024, according to data from the Office of Personnel Management. Of the employees whose location information was publicly available, the highest number of IRS workers were in Texas, followed by Utah, California, Georgia, and Missouri, that data says.

Shutdown Countdown

Stopgap Bill Would Rescind Frozen IRS Enforcement Funds - Cady Stanton, Tax Notes ($):

The text of a continuing resolution released by House Republicans March 8 does not include language directly addressing $20.2 billion in enforcement funding from the Inflation Reduction Act that had been frozen by Congress as a result of previous stopgap measures. But a spokesperson for House Appropriations Committee Chair Tom Cole, R-Okla., confirmed to Tax Notes the funds would be clawed back under the CR.

Tariff Talk

Ontario slaps 25% tax increase on electricity exports to US in response to Trump’s trade war - Rob Gillies, Associated Press. "The new surcharge is in addition to the federal government’s initial $30 billion Canadian dollars ($21 billion) worth of retaliatory tariffs applied on items like American orange juice, peanut butter, coffee, appliances, footwear, cosmetics, motorcycles and certain pulp and paper products."

Congress Wrestles With Tax Priorities

Reading the Tea Leaves for the ‘Big, Beautiful’ Tax Bill - Marie Sapirie, Tax Notes ($):

The IRA’s energy tax credits might be in greater peril than originally appeared. The electric vehicle credits are the likeliest targets for repeal or reduction. Large wind farms are disfavored by the Trump administration, which promised that “energy policies will end leasing to massive wind farms that degrade our natural landscapes and fail to serve American energy consumers.”

21 House Republicans ask leadership to limit changes to energy tax credits in reconciliation - Rachel Frazin, The Hill:

...

The energy credits issue is tough for Republicans because a significant number of energy projects sprung up in red and purple districts or states — meaning a repeal of such credits could harm economies in some places where the GOP governs.

Related: IRA Credits Remain in Place Despite Mixed Signals

Decision time - Bernie Becker, Politico:

That’s a goal that House Republicans share with their Senate colleagues. But turning that big-picture agreement into a fully fleshed out bill will be difficult.

In fact, the challenges that come with extending trillions of dollars’ worth of tax cuts is a major reason that House and Senate Republicans have been hung up on procedural questions for the last couple months.

Tariff Worry on Wall Street Pressures Trump to Speed Up Tax Cuts - Nancy Cook, Bloomberg via MSN. "Trump’s team is starting to warn of short-term pain as they pursue a drastic overhaul of trade and public spending. Tax cuts, which put more cash in consumer pocketbooks, could help soften the blow. Allies would ideally like to pass a bill by July, though there are plenty of hurdles."

House Republicans huddle with Bessent on tax policy menu - Benjamin Guggenheim and Jordain Carney, Politico. "Republicans in both chambers know they will eventually need to merge their work products, but how or when that happens is still unclear — and some Senate Republicans are continuing to push privately and publicly for their two-bill approach, which would deal with energy, defense and border issues first and taxes second."

Filing Season

Tax Filing Season Statistics Suggests Taxpayers Are Still Waiting To File - Kelly Phillips Erb, Forbes:

The IRS has apparently given up on excuses. After three weeks of offering an explanation for the lower numbers, explaining last week that the agency “expects the tax return filing numbers will level out in future weeks as the April filing deadline approaches,” the IRS didn’t offer any such platitudes this go round—just the numbers.

Don’t overlook free options for preparing and filing taxes in 2025; Direct File available in 25 states - IRS. "In addition to Direct File, IRS Free File also offers free tax preparation software through its partners on IRS.gov. Also, the IRS offers free, in-person, help through its Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs."

Blogs and Bits

Celebrating IRS' 36th e-filing anniversary - Kay Bell, Don't Mess With Taxes. "Rapid refunds remain the main allure today. But as the tax code has gotten more complicated, individuals and their tax preparers have come to appreciate the tax software that facilitates completing the forms and then e-filing them."

Lump-Sum Social Security Payments Going Out Now - Thomas Gorczynski, Tom Talks Taxes. "When a taxpayer receives a lump-sum payment of Social Security benefits attributable to prior tax years, the taxpayer can possibly reduce the taxable portion of that payment by making a lump-sum election under §86(e)."

That May 30th Tax Deadline (BE-10) - Russ Fox, Taxable Talk. "What, you’re saying? What tax deadline falls on May 30th? It’s one that impacts a small number of businesses—generally, larger businesses. It’s the BE-10 Survey..."

District Court Dismisses Attorneys' Complaint That IRS Retaliated Against Them - Parker Tax Pro Library. "A district court dismissed with prejudice a complaint filed against the IRS by a husband and wife, both attorneys, who claimed the IRS had targeted them in retaliation for their representation of taxpayers in civil and criminal tax cases."

Let's be friends

Grassley says Trump’s nominee to head the IRS wants it to be ‘more friendly’ - Matt Kelley, Radio Iowa:

...

“Instead of being feared, he wants to be a service for the American people, and we ought to applaud him on that because the IRS is actually feared by people,” Grassley says. “If you get a letter from the IRS, it just scares the heck out of you.”

Somehow I don't think it will be more fun to get a levy notice from, say, Happy Tax Friend agency, than it will be to get one from the IRS.

Optimism is fine, but the appraisal is mandatory.

No Charitable Deduction for Couple Without Qualified Appraisals - Tax Notes Research. This case shows the potential tax benefits of donating household goods, and the tax pitfalls of not checking all the boxes. Judge Lauber takes up the story:

The taxpayers were optimistic in the values they assigned to their donations (my emphasis)

- Petitioners claimed a deduction of $89,100 for the donation of 16,200 “granite cobblestones of various sizes.” Petitioners reportedly acquired these items in May 2013 at a total cost of $1,000. As of December 2019, they asserted that the 16,200 cobblestones were worth $5.50 apiece (for a total of $89,100).

- Petitioners claimed a deduction of $49,410 for the donation of 9,608 pieces of commercial vinyl tile and 10 four-gallon tubs of floor-tile adhesive. Petitioners reportedly acquired these items in January 2016 at a cost of $1,080. As of December 2019, they asserted that the vinyl tile was worth $4.75 per square foot (for a total of $45,638) and that the adhesive was worth $435 per tub (for a total of $4,350).

Unfortunately for the taxpayers, the appraisals they filed didn't explain how the values were determined. Worse, they were dated over two years after the returns were filed. Judge Lauber explains why this was a problem:

Judge Lauber also notes other problems with the appraisal; long story short, the allowed deduction is zero.

The Moral? You can donate personal property at fair market value, but you need a qualified appraisal if you claim a deduction over $5,000. If you don't get the appraisal and report it properly on your original return, your deduction is zero.

Also, if you are shrewd enough to buy stuff that is worth so much more than you paid for it, consider going into the resale business, rather than giving it away.

What day is it?

It's World Plumbing Day! You really appreciate the pipes when they stop working.

We're Here to Help