Key Takeaways

- The deadline for Treasury to submit a report on retaliating against the OECD's global minimum tax has passed.

- The administration faces a choice--use an ungainly old law to fight back against foreign taxes, or wait for Congress to pass a new one.

- President Trump puts Ireland, and its tax policies attracting pharmaceutical investments, in the spotlight.

- Amount B--another aspect of the OECD plan--still faces technical issues.

- Will the Trump tariffs hit women harder than men?

Last Friday marked 60 days since President Trump took office. That was the deadline for the U.S. Treasury Department to draw up a report on potential retaliatory measures against the Organization for Economic Cooperation and Development’s 15% Pillar Two global minimum tax, according to an executive order Trump issued on his first day.

If you missed the deadline, you’re not alone. The day came and went without any announcement from the administration about Pillar Two, which Trump’s executive order rescinded all support for. That doesn’t necessarily mean that the president and Treasury aren’t planning to hit back against countries which try to use Pillar Two to tax American companies. But with Trump frequently announcing new tariffs (including today), this issue may not be a high priority.

Under President Joe Biden, the U.S. was a strong supporter of Pillar Two, and pushed for it to be more aggressive and expansive than it was originally planned. But Republicans have taken aim at the measure, calling it an encroachment on U.S. tax sovereignty which never should have gotten the green light. One potential way to push back against it is with Section 891, a nearly century-old, never-used statute allowing Treasury to double tax rates on taxpayers from countries which discriminate against the U.S.

This could be a tricky call for the administration, despite their clear opposition. Section 891 could be a very blunt tool to use, with the potential to cause harsh collateral damage to both U.S. and foreign companies. (Though that hasn’t always stopped Trump in the past.) The executive branch could also use tariffs against those countries, or include Pillar Two in the “reciprocal tariff” approach he’s already announced. But then this risks getting lost among all of the other escalating trade wars.

Republicans have also proposed new bills giving Treasury more power to retaliate against Pillar Two, in more targeted and comprehensive ways. Those would likely be a more ideal tool than Section 891. But the most likely vehicle to pass a version of those laws would be the reconciliation package to extend the Tax Cuts and Jobs Act, which could take until the end of the year.

By then, countries could be much further along in implementing the global minimum tax, and may be less likely to consider reversing it.

Noteworthy Items from the Week

Trump Tariff Talk Puts Overseas Pharma Profits in Crosshairs – Caleb Harshberger, Bloomberg Tax ($):

Technical, Policy Questions Still Swirl Around Amount B – Natalie Olivo, Law360 Tax Authority ($):

UN Tax Panel Floats Review of Various Topics in Transfer Pricing – Michael Rapoport, Bloomberg Tax ($):

Revisiting U.S. Transfer Pricing Disputes Using OECD Guidance – Ryan Finley, Tax Notes ($):

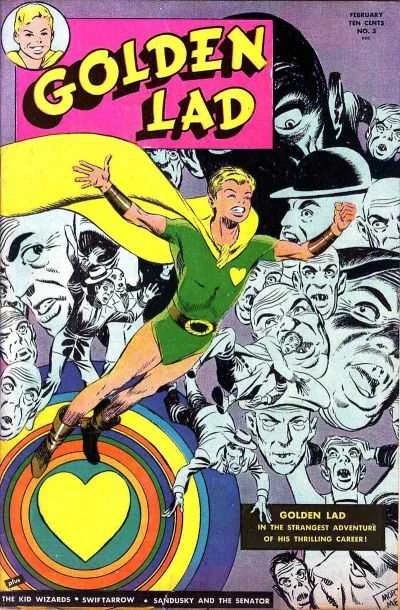

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: Golden Lad

Debut Year:1945

Creators: Joseph Greene & Mort Meskin

Debut Publication: Golden Lad #1

Origin Story: In his grandfather's antique shop, he came across an ancient golden Aztec artifact which grants superpowers only to the "pure of heart."

Superpowers: Flight, super-strength, x-ray/heat vision, and inability to be recognized after he says "heart of gold."

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

We're Here to Help