Key Takeaways

- This year's major tax package could tweak, not overhaul, the international tax code

- Republicans will likely use the tax bill to strengthen retaliatory measures against the OECD tax

- The tax rates for international provisions like BEAT, GILTI will increase without a new law

- Congress could apply harsher tax treatment to foreign R&D

- Officials in Europe still support Pillar Two despite U.S. opposition

- Tariff impact already seen economic data, OECD says

With the threat of a government shutdown out of the way – at least for now – Congress is turning its focus to the budgetary process under reconciliation, including potential legislation to extend expiring provisions in the Tax Cuts and Jobs Act. If enacted, it would be the most sweeping tax legislation in nearly a decade. But it won’t actually affect the international tax code as much as other parts, because most of that was made to be permanent, and it has proven to be a durable framework that most lawmakers don’t want to scramble.

But there are many ways it could make some substantial changes in that area, which multinational taxpayers should pay attention to.

Among the biggest possible new provisions are retaliatory measures against foreign taxes enacted under the Organization for Economic Cooperation and Development's Pillar Two 15% global minimum tax. The Trump administration has already threatened to use existing laws to retaliate against taxpayers from countries which use Pillar Two taxes to target U.S. companies, and many Republicans in Congress have proposed legislation to target the OECD plan more formally. These wouldn’t raise much new revenue, but they could be included to make a statement, and would potentially put more companies in the crossfire.

While the TCJA’s international provisions won’t go away at the end of 2025, many of them are set to increase their tax rates. The deductions for global intangible low-taxed income and foreign-derived intangible income will both shrink, and the rate of the base erosion and anti-abuse tax will rise. The new GILTI rate of 13.125% would still be lower than the 15% global minimum tax mandated by the OECD, but it’s still a hike.

There are other areas where the international aspects are in the details. Take amortization. The TCJA temporarily gave businesses the ability to immediately realize R&D costs, but switched to an amortization schedule in 2022. That included a 5-year schedule for domestic costs, and a 15-year schedule for foreign R&D costs – the first time the treatment of R&D was split across country lines. A bipartisan tax agreement passed by the House of Representatives would have temporarily restored immediate R&D expensing for domestic costs, but not foreign. That bill died in the Senate, but if lawmakers are pressed to cut costs from the final package, a slower schedule for foreign R&D might be something they consider. And if it’s made permanent, this bifurcation could become a major new aspect of the federal tax code.

Pillar Two Optimism?

While Republicans in the U.S. are eager to bury Pillar Two once and for all, across the pond officials still see a future for the project.

EU Tax Commissioner Against Throwing Pillar 2 ‘in the Dustbin’ – Elodie Lamer, Tax Notes ($):

OECD Chief 'Confident' of Resolution to Minimum Tax Deal Impasse – Saim Saeed, Bloomberg Tax ($):

More Tariff Analysis

Canadian Tariffs and Cross-Border Taxes: Opportunity for a Reset – Mindy Herzfeld, Tax Notes ($):

OECD Report Highlights Slow Growth Due To Tariff Impact – Josh White, Law360 Tax Authority ($):

Liberty Global Case

Liberty Global Met With Skepticism in Foreign Tax Credit Appeal – John Woolley, Bloomberg Tax ($):

Judges Grill Liberty Global on Sourcing Limit in FTC Dispute – Michael Smith, Tax Notes ($):

Other noteworthy items from last week —

Latin America and the Caribbean’s Rise in Tax Cooperation – Nana Ama Sarfo, Tax Notes ($):

US Rebuffs Claim of Sharing Tax Data With Immigration Officials –Tristan Navera, Bloomberg Tax ($):

The IRS hasn’t received any requests for tax return information as part of stepped-up immigrant enforcement efforts under the Trump administration, lawyers from the department’s tax division said in a legal filing March 17. The federal tax agency also hasn’t released any information to the Department of Homeland Security, the filing said.

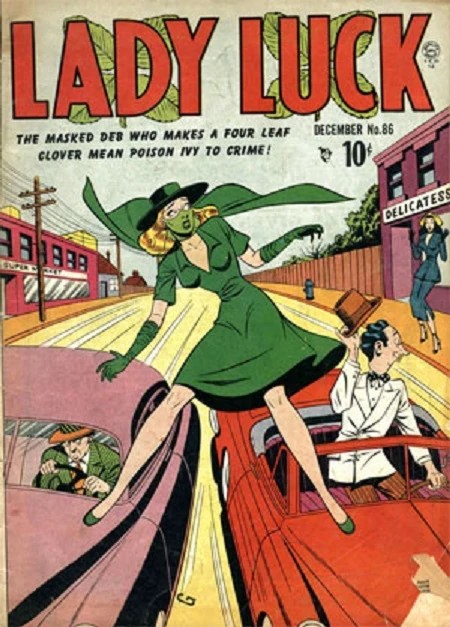

Public Domain Superhero of the Week

Every week, a new character from the Golden Age of Comics, who’s fallen out of use.

This week’s entry: Lady Luck

Debut Year:1940

Creators: Will Eisner, Dick French and Chuck Mazoujian

Debut Publication: The Spirit Section newspaper comic strip

Origin Story: A bored socialite and debutante who decided to become a masked crime-fighting vigilante in the mold of Robin Hood.

Superpowers: No superpowers but plenty of wit, resources, moxie, and—one assumes—luck.

Eide Bailly's International Tax Team and our affiliates at HLB, The Global Advisory and Accounting Network, stand ready to assist with your worldwide tax needs.

We're Here to Help