Key Takeaways

- Single Factor as Distortionary.

- It all started in Iowa.

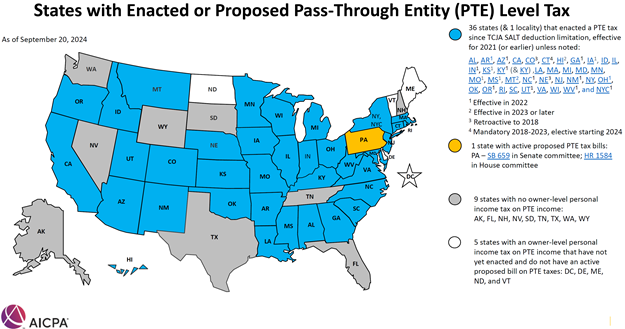

- SALT cap workarounds as revenue target.

- Legislation developments in AZ, IA, MN, MO, NJ, SD, TX, VA.

- Seattle voters approve 5% payroll tax on wages over $1 million.

- Happy Anniversary to the Revenue Act of 1918.

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

Taxpayers Should Challenge Single-Sales-Factor Methods, Attorneys Say - Paul Jones, Tax Notes ($):

...

Alysse McLoughlin of Jones Walker LLP argued that three-factor apportionment can help counter distortion. With three-factor apportionment “you have the ability to offset something [that’s] really distortive that might come from using one factor,” she said.

The panelists discussed avenues for seeking alternative apportionment formulas. "McLoughlin said seeking an alternative apportionment method can be difficult, since state rules vary."

State Tax Agencies Brace for Downstream Impact of IRS Cuts - Michael Bologna, Bloomberg ($). "Most states simply adopt the fundamental figure of federal taxable income to begin their analysis of taxpayers’ state income tax obligations, said John Valentine, Utah’s commissioner of revenue. They deploy more than 90% of their audit and collection resources to factors below that line. Any disruption at the IRS in calculations and compliance processes could filter down to the states, he said."

Trump’s SALT Tax Promise Hinges on Fate of an Obscure Loophole - Ben Steverman, Bloomberg Businessweek. The "obscure" loophole is the allowance of voluntary partnership and S corporation state taxes blessed by IRS Notice 2020-75. These allow entities to pay - and deduct - state taxes that would otherwise be paid by their owners on their K-1 income; the owners typically get a credit on their personal returns to prevent double tax. The owners would be unable to deduct the taxes on their personal returns because of the $10,000 deduction cap, but they instead get the deduction via reduced K-1 income.

From the article:

...

Plugging the SALT cap workarounds could help make that up, raising $180 billion, but business lobbyists are already crying foul. “What we’re trying to do right now is just dispel this notion that there’s somehow this pass-through loophole,” says Brian Reardon, president of the S Corporation Association. His members, privately held businesses that file taxes under so-called S corp rules, rely on the workarounds, while competitors—traditional corporations, or “C corps”—have long been able to deduct SALT under their own set of rules. Banning the workarounds means that “if I’m the hardware store in my neighborhood, I can’t deduct SALT, but Home Depot can,” Reardon says. “It’s just not fair.”

Some in Washington are listening: Another revenue-raiser under consideration is extending the SALT cap to cover big companies and other C corps, which the CRFB estimates could raise an additional $210 billion.

State-By-State Roundup

Arizona

Ariz. Senate OKs Surplus Trigger For Income Tax Rate Cut - Sanjay Talwani, Law360 Tax Authority ($). "If enacted, S.B 1318, passed by the Senate on a 17-12 vote, would require the state Department of Revenue to annually adjust the rate to reduce the state's expected budget surplus, if any, by 50%. For tax year 2026, that would reduce the state's individual income tax rate from 2.5% to 2.42%, saving taxpayers $174.7 million, according to a Department of Revenue estimate."

Ariz. Lawmakers OK Updated Conformity With Fed. Tax Law - Zak Kostro, Law360 Tax Authority ($):

The legislation would conform state income tax statutes to the IRC as amended and in effect as of Jan. 1, 2025, including provisions that took effect in 2024 but excluding changes to the federal law enacted after Jan. 1, 2025, according to a House summary. Current state law conforms Arizona's income tax calculation to the IRC as amended and in effect on Jan. 1, 2024, the summary said.

Colorado

Justices Won't Hear Challenge To Colo. Tax Ballot Title Law - Maria Koklanaris, Law360 Tax Authority ($). "The U.S. Supreme Court on Monday let stand a ruling by the Tenth Circuit that a Colorado law requiring that financial impacts be included in the titles of some tax-related ballot initiatives does not cause 'improperly compelled' speech."

Two tax credit bills advanced in the Iowa legislature this week. HF 132 would provide a nonrefundable 100% credit for the purchase of "firearms safety devices," up to $500; it cleared a House Ways and Means subcommittee.

The Senate Ways and Means Committee advanced a "nurse practitioner preceptor tax credit (SF 391) to the floor. from the bill explanation:

Amount of the tax credit. The tax credit is $1,000 per clinical preceptorship in which at least 100 hours of clinical learning experience is provided, not to exceed $2,000 in total.

Not everything is a tax problem. Don't enact tax breaks that are too small to audit.

Minnesota

Walz Proposes to Eliminate Funding for Minnesota Free File System - Emily Hollingsworth, Tax Notes ($):

The account was created under 2023 legislation (H.F. 1938) and received a $5 million appropriation to develop a free state income tax return filing system that would allow users to file their returns directly with the Department of Revenue, mirroring the IRS's Direct File program.

But a provision in the budget recommendations released last month by Gov. Tim Walz (DFL) would repeal the account.

Minn. House Tax Panel Advances Delivery Fee Repeal Plan - Sanjay Talwani, Law360 Tax Authority ($). "In a party-line 12-11 vote with Republicans in support, the House Taxes Committee passed H.F. 5 as amended, sending it to the House Transportation Finance and Policy Committee. If enacted, the bill would repeal the state's 50-cent fee on retail deliveries of at least $100, stop inflation adjustments for motor fuel taxes and allow a subtraction for all Social Security retirement income, for a total revenue reduction of more than $900 million in two years, according to a Department of Revenue analysis."

Missouri

Missouri Senate Weighs Eliminating Income Tax by 2027 - Matthew Pertz, Tax Notes ($). "S.J.R. 31 would ask Missouri voters at the November 2026 election to amend the constitution to eliminate the individual income tax at the start of the following calendar year. Missouri’s top marginal rate is 4.7 percent, with scheduled cuts to reduce it to 4.5 percent over the next two years."

New Jersey

New Jersey Senate Passes Bill Raising Angel Investor Tax Credit - Danielle Muoio Dunn, Bloomberg ($). "The legislation (S3189) would boost the amount of tax credits available to taxpayers who back an emerging technology business or qualified venture fund, from 20% to 35% of their investment. It also would raise the bonus credit for investments in such businesses located in qualified opportunity zones and low-income communities, as well as for minority- and women-owned startups, to 40% of a taxpayer’s investment, up from 25%. The abatement is applied against the investor’s corporation business tax or gross income tax."

South Dakota

SD Updates Tax Law References To Internal Revenue Code - Zak Kostro, Law360 Tax Authority ($):

The updated references apply to certain property tax statutes, according to the bill, and to statutes governing income tax imposed on banks and financial corporations and retail sales and service tax refunds.

Texas

Texas Senate Looks to Boost Film Incentive Program - Kennedy Wahrmund, Tax Notes ($).

“It will consist of two parts: $48 million in grants for small films and TV commercials, and up to $450 million in new tax credits, including Texas residency requirements for workers. Texas gets $4 back for every $1 invested while creating new jobs for Texans," Patrick's release said.

Virginia

Virginia Lawmakers Approve Budget With PTE Tax Extension, Rebates - Kennedy Wahrmund, Tax Notes ($):

The budget would also increase the standard deduction to $8,750 for individuals and to $17,500 for married taxpayers filing jointly. It would provide funding for one-time income tax rebates of $200 for single filers and $400 for joint married filers. And it would increase the state's refundable EITC from 15 percent of the federal EITC to 20 percent for tax years 2025 and 2026.

Washington

Seattle Voters Pass Tax on Salaries Over $1 Million for Housing - Laura Mahoney, Bloomberg ($):

The new levy, offered as Proposition 1A, will be in addition to Seattle’s JumpStart Tax—imposed since 2021 on salaries above $150,000. The new tax takes effect retroactive to Jan. 1, 2025, and is expected to raise $50 million a year for affordable housing and homelessness services.

Tax Policy Corner

Outrageous Money Grabs - David Brunori, Law360 Tax Authority ($, free here on LinkedIn.):

Gov. Maura Healey wants to statutorily apply investee apportionment to gains that nonresidents receive from the sales of pass-through entity interests. If you passively invest in a pass-through entity that does business in Massachusetts and sell your interest, Healey would like to tax you. Oh, you say that you have never been in Massachusetts? You only invested money and had no other role in the company? Too bad. You are lucky that the governor will allow you to apportion the gain if the business is operating in more than one state.

The governor would also like to tax the gains that nonresident corporations realize from sales of interest in pass-through entities even if they weren't engaged in a unitary business. For the last 35 years, I was under the impression that a unitary business was a requirement. I may have misread the U.S. Supreme Court opinions on this subject. The governor says that this closes a loophole created in by the Massachusetts Supreme Judicial Court's 2022 decision in VAS Holdings & Investments LLC v. Commissioner of Revenue.

Tax History Corner

This week marks the anniversary of the enactment of the Revenue Act of 1918 (oddly, on February 24, 1919). From Wikipdia:

The top rate was increased to 77%, and applied to income above $1,000,000. The top rate of the War Revenue Act of 1917 had taxed all income above $2,000,000 at a 67% rate.

The act was applicable to incomes for 1918. For 1919 and 1920 the top normal tax rate was reduced from 12 percent to 8%. This reduced the top marginal tax rate that combined normal tax and surtax from 77% to 73%.

$1 million in 1919 dollars would be about $18,243,000 today.

Exemptions were $1,000 for single filers and $2,000 for joint filers, with an additional $200 for each dependent. That adds up to approximately $36,500 for a couple in 2025 dollars, which compares favorably to today's $30,000 standard deduction. Those top rates, though...

We're Here to Help