Key Takeaways

- IRS firings official; more to come?

- Firings foreshadow delays.

- White House downplays layoffs.

- “I’ve never seen a person who was laid off for poor performance say that they were performing poorly.”

- DOGE denied access to personal tax data.

- Senate passes budget without tax provision.

- Commerce Secretary says cruise lines use "loopholes."

- Disaster and Taxes.

- National Sticky Bun Day.

I.R.S. Fires 6,700 Employees Amid Tax Filing Season - Alan Rappeport and Andrew Duehren, New York Times:

The job cuts at the I.R.S. are hitting probationary employees who were recently hired around the country. More than 5,000 of those workers are part of the agency’s compliance teams, which deal with auditing and collections. The layoffs are coming a week during tax filing season, when the I.R.S. will be inundated with paperwork and questions from taxpayers.

The I.R.S. employs about 100,000 accountants, lawyers and other staff across the country.

IRS Begins to Fire 6,000 Workers, Threatening Tax-Season Delays - Brian Schwartz, Ashlea Ebeling, And Katherine Long, Wall Street Journal:

Still, for those who owe taxes, failing to file and pay on time means stiff penalties that add up quickly. With reduced personal service, mistakes such as an incorrect Social Security number for a dependent could mean having to wait in a long queue.

Thousands of IRS Firings Foreshadow Delays, Enforcement Drop - Erin Slowey and Erin Schilling, Bloomberg ($):

“We’ll see in a year and a half that high-net-worth clients who support this administration are upset because they didn’t get their refund, and they’re going to be demonizing the IRS over that and not connecting that consequence with this action today,” said Megan Brackney, tax controversy partner at Kostelanetz LLP.

White House Downplays IRS Layoffs - Alexander Rifaat and Nathan Richman, Tax Notes ($):

...

While the White House has argued that slashing the IRS workforce is necessary to achieve its goal of rooting out government waste and creating greater efficiency, the IRS firings are targeting probationary employees — those who have been employed with the agency for less than a year, or in some cases two years — ostensibly because they are easier to terminate. Neither the administration nor the Department of Government Efficiency — the intragovernmental organization headed by Elon Musk — has released details on any performance-based metrics being used as part of its firing process.

Asked about cases in which probationary employees were told they were fired for performance reasons, but hadn’t been in their jobs long enough to receive a review, Hassett said, “I’ve never seen a person who was laid off for poor performance say that they were performing poorly.”

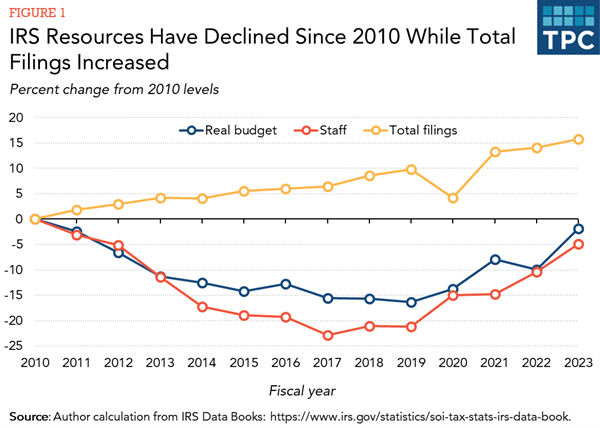

New IRS Employees Are Helping Taxpayers, Firing Them Would Be Costly - Barry Johnson, TaxVox. "DOGE might assume that these employees are expendable, but they are not. Probationary employees bring new energy, ideas, and cutting-edge skills to the IRS, improving taxpayer service and tax administration. Dismissing them and their contributions would be a severe setback to recent IRS reforms that have been shown to deliver tangible benefits to taxpayers and the nation’s financial well-being."

DOGE Denied Personal Data

Treasury agrees to block DOGE’s access to personal taxpayer data at IRS - Jacob Bogage, Washington Post.

Gavin Kliger, a software engineer with Elon Musk’s DOGE effort assigned to the IRS, will have read-only access to anonymized tax data, the same access granted to academic researchers and IT professionals who work on IRS systems, said the people, who spoke on the condition of anonymity to share details of the agreement.

Where's Billy?

The longer wait for Billy Long at the IRS - Punchbowl News:

But the longer timeline comes while the IRS is in the throes of its busiest period, tax filing season. And like much of the federal government, the IRS has been a target of the Trump administration’s hunt for spending cuts. Republican tax leaders are looking to get the nomination in motion soon.

Senate Passes Budget Without Tax Provision

Senate Passes Budget Resolution After All-Night ‘Vote-a-Rama’ - Siobhan Hughes, Wall Street Journal:

But the future of the House plan is unpredictable. House Speaker Mike Johnson (R., La.) is refereeing a tug of war between spending hawks and GOP factions concerned about protecting Medicaid programs in their districts, among other disputes.

Trump’s legislative agenda is a mess - Semafor. "The Senate GOP passed its budget resolution early this morning after an overnight vote-a-rama, with the House to follow next week. Both budgets set up competing approaches for implementing President Trump’s agenda, and it’s all a bit of a mess at the moment, Semafor’s Burgess Everett reports. Trump doesn’t really support the Senate’s border-first idea and prefers the House’s combined tax-border approach; the Senate doesn’t like the way the House is setting up its bill, with potential Medicaid cuts and possibly only a temporary tax cut. So how’s this going to end?"

Tariffs and Trade

Trump’s Growing Focus on Tariff Revenue Raises Trade War Odds - Shawn Donnan, Bloomberg via MSN:

Trump needs as much revenue as he can get as Republicans in Congress are working to iron out a plan to extend the 2017 tax cuts that are due to expire later this year, along with additional cuts, at an overall cost of $4.5 trillion over the next 10 years.

US commerce secretary vows ‘end’ to tax loopholes used by cruise lines - Alexandra White, Financial Times:

Royal Caribbean Cruises, Norwegian Cruise Line and Carnival Corporation state in their annual financial statements that they believe they are exempt from US federal income tax under Section 883 of the Internal Revenue Code, which excuses foreign corporations engaged in the international operation of ships or aircraft.

If you wonder why you don't see U.S.- flagged vessels in the cruise business, the answer isn't in the tax law.

Disaster and Taxes

What to Know if You’ve Been Affected By a Federally Declared Disaster - Erin Collins, NTA Blog:

The taxpayer may deduct the disaster-related loss in the year the loss occurred or in the prior year. However, the taxpayer can only deduct the loss in the prior year if the disaster occurred in an area warranting public or individual assistance (or both). Disaster-specific guidance will generally specify if the taxpayer has the option to deduct the loss in the prior year. Providing the ability to deduct the loss in the prior year allows taxpayers to obtain the tax benefits as soon as they can determine the amount of uninsured or unreimbursed disaster-related loss. When taxpayers want to claim the loss in the year prior to the disaster but they have already filed a return, they will need to file an amended return for that year claiming the loss. The taxpayer must make this election within six months from the due date of the tax return (without extensions) for the year in which the federally declared disaster occurred.

Related: IRS Defers 2024 Deadlines for Taxpayers Affected by Los Angeles Wildfires

Blogs and Bits

The current federal tax on Social Security benefits and efforts to end it - Kay Bell, Don't Mess With Taxes. "The immediate concern is the loss of the tax revenue and its adverse effects on not only Uncle Sam's overall bottom line, but also the longevity of federal retirement system. When Trump made his promise on the campaign trail last fall, numbers crunchers went to work."

Your Guide to Taxes for Retirees and Retirement Accounts - Laura Saunders, Wall Street Journal. "A cheat sheet on contributing to, withdrawing from and converting 401(k)s, traditional IRAs, Roth IRAs and other funds"

State Tax News & Views: Individual tax rates, state legislative and case law developments - Melissa Menter, Eide Bailly. "Enjoy this look back at taxpayer wins and losses in significant state tax cases during the fourth quarter of 2024."

Most BOI Reports are Now Due March 21 - Kristine Tidgren, Ag Docket. "Pending further court action, beneficial ownership information reporting obligations are back in effect. Reporting companies generally have until March 21, 2025, to file their initial or updated BOI reports."

Florida Man Prepares Returns

Miami Tax Return Preparer Agrees to Permanent Injunction and Disgorgement - US Department of Justice (Defendant name omitted, emphasis added):

The court also ordered Preparer to disgorge $245,275 in ill-gotten gains he received from his return preparation business. Preparer agreed to both the injunction and ordered disgorgement.

According to the complaint, Preparer, doing business as DJL Multi-Services, prepared returns for customers that claimed, without their knowledge, various false or fabricated deductions and credits, including falsifying charitable and mortgage interest deductions, knowingly reporting fake or inflated business expenses and fraudulently claiming various credits like the Fuel Tax Credit and American Opportunity Credit. The complaint further alleged that Preparer falsified customers’ income and filing statuses to increase the amount of the Earned Income Tax Credit, and that Preparer has prepared thousands of tax returns for customers for over a decade.

The biggest refund doesn't necessarily come from the best preparer. Under current law, the IRS has forever to assess fraudulently-prepared returns, even when the client doesn't know about the fraud. Be careful out there.

What day is it?

It's National Sticky Bun Day! And, unofficially, National I Have to Clean My Keyboard Day.

We're Here to Help