Key Takeaways

- IRS hiring freeze not affected by new hiring policy.

- Top Federal tax attorney resigns.

- Former Taxpayer Advocate warns of DOGE access to return data.

- Homeland Security calls for assigning IRS to border duty.

- Senate, House budget bills approach showdown.

- Tax Court doubts land goes from $2,500 / acre to $160,000 in three years.

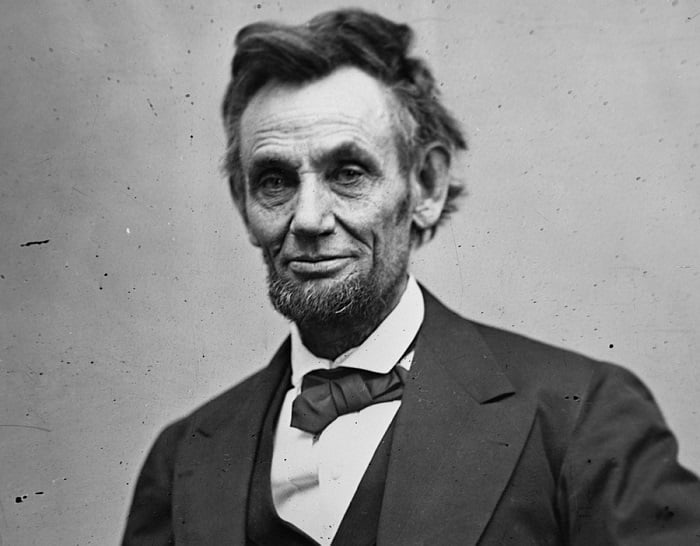

- Happy Birthday, Abraham.

Trump’s Order Could Mean Large-Scale IRS Workforce Reductions - Alexander Rifaat, Tax Notes ($):

Questions over the IRS’s preparedness for the 2025 filing season were raised when Trump signed an executive order on his first day back in the White House instituting a blanket federal hiring freeze. While other agencies are subject to only a 90-day hiring freeze under the order, the IRS hiring freeze won’t be lifted unless the Treasury secretary, in consultation with the OMB and DOGE, “determines that it is in the national interest to lift the freeze.”

Trump DOJ Forces Out Top Tax Enforcer in Civil Service Purge - Ben Penn, Erin Slowey, and David Voreacos, Bloomberg ($):

Hubbert’s departure comes on the heels of numerous other veteran career supervisors at the Justice Department receiving orders to choose between quitting or taking reassignments to the upstart immigration team. It creates a vacancy that current and former federal tax enforcers say they worry could ease the administration’s path to overhaul a division with immense authority over civil and criminal tax prosecutions.

DOGE and Treasury Data

Ban on DOGE’s Access to Treasury Records Remains Intact - Mary Katherine Browne, Tax Notes ($):

In a February 11 opinion, Judge Jeannette A. Vargas of the U.S. District Court for the Southern District of New York issued an order to uphold the ban until a hearing can be held on the matter. A hearing is scheduled for February 14.

While Vargas agreed that a temporary restraining order is warranted, she said the order wasn’t narrowly tailored to fit specific legal violations, and that it shouldn’t be extended to the Treasury secretary and senior Treasury officials.

Former Taxpayer Advocate Cautions on DOGE Access to Return Data - Benjamin Valdez, Tax Notes ($):

...

“We don’t know what they’re doing, so we don’t know if what they’re doing is actually pursuant to a legally authorized exception, or it’s not,” Olson said. “That’s where we have to have greater transparency on this, and I think the question marks are creating uncertainty and concern among taxpayers about how their information is being used and who’s getting it.”

Exceptions to section 6103 can only be authorized under statute. One exception allows for congressional committees to access tax return information under certain circumstances. Individuals who violate taxpayer information disclosure laws can face civil penalties of up to $10,000 or up to five years in prison.

IRS in Trump II

House Panelists Push For IRS Funding, Tech Upgrade - Asha Glover, Law360 Tax Authority ($):

The agency should additionally lay out a detailed strategic plan for any future modernization efforts that includes transparent benchmarks and accountability safeguards in case those benchmarks aren't achieved, Pete Sepp, the president of the National Taxpayers Union, said before the House Ways and Means Committee's Oversight Subcommittee.

IRS Agents Tapped to Assist With Trump Immigration Crackdown - Ellen Gilmer and Erin Slowey, Bloomberg ($):

...

The IRS Criminal Investigation division, or IRS-CI, is the enforcement branch of the IRS and conducts financial crime investigations, including on issues like tax fraud, human and narcotics trafficking, money-laundering, public corruption, and healthcare fraud.

It has about 2,290 special agents who are authorized to carry guns and use lethal weapons—the only armed employees at the IRS. Many of these field agents are relatively new, with about 50% having five years of experience or less, Guy Ficco, IRS Criminal Investigations chief, told Bloomberg Tax in July, citing retirement as an attrition factor.

In Congress: House or Senate, One Bill or Two?

House Republicans at Odds as Markup of Giant Tax Bill Scheduled - Doug Sword, Tax Notes ($):

Cost figures being tossed about range from $4 trillion to $5.5 trillion, while a key House Freedom Caucus member said budget hawks are still demanding an additional $500 billion in spending cuts to agree to the package, which the Budget Committee slated for markup February 13.

House tees up budget markup — without text - Kadia Goba, Semafor. "House Republicans haven’t released the text yet, but Budget Chair Jodey Arrington, R-Texas, floated an updated framework of the proposal Tuesday morning, which included potential cuts of up to $2 trillion. They’re also capping the renewal of Trump’s tax cuts at $4.5 trillion, according to The Hill. Both moves highlight the House’s effort to catch up to the Senate, after Republicans in the upper chamber introduced their own border-first budget proposal last Friday (House Speaker Mike Johnson called it 'a nonstarter')."

The House this morning released a budget resolution. Doug Sword of Tax Notes reports "The resolution includes two instructions for the House Ways and Means Committee. Taxwriters are limited to a $4.5 trillion reduction in revenues, which is in line with the Congressional Budget Office’s estimated net cost for extending the 2017 tax overhaul, but falls short of the $5.5 trillion that Ways and Means Chair Jason Smith, R-Mo., has said is needed for the extension plus the tax cuts Trump campaigned on."

House Freedom Caucus plans to throw another tax plan into the mix - Benjamin Guggenheim, Politico:

...

Meanwhile, GOP leaders indicated Tuesday morning that their plan could be taken up by the House Budget Committee as soon as Thursday, though significant questions remain about the tax portion of the sweeping agenda.

Specifically, lawmakers expect that Johnson’s new draft plan, outlined by POLITICO on Monday, will include a budget reconciliation instruction for Ways and Means that would dip below $4.7 trillion in deficit spending. That would barely give the committee enough breathing room to extend all the 2017 Trump tax cuts that are expiring at the end of this year, which the Congressional Budget Office estimates will cost around $4.6 trillion — let alone Trump’s other tax priorities.

GOP Budget War - Jack Blanchard and Eugene Daniels, Politico:

The administration steps in: The Senate’s two-bill approach — which focuses on border and defense funding now, and punts taxes to a later date — received a helpful injection of urgency from the administration yesterday. DHS Secretary Kristi Noem, Defense Secretary Pete Hegseth and AG Pam Bondi sent a letter saying they need more resources for border security and mass deportations, Fox News’ Julia Johnson scooped. And border czar Tom Homan and OMB Director Russell Vought urged senators in person to pass the $175 billion for the border as quickly as possible, Axios’ Stef Kight reports.

The upshot: Senators believe, based on these signals and other private conversations, that Trump is increasingly content with their approach, though administration officials haven’t taken an explicit stance on one bill vs. two, POLITICO’s Jordain Carney reports.

Trump's Tariffs, GOP Tax Goals Pose Political Puzzle - Dylan Moroses, Law360 Tax Authority ($). "Alex Durante at the Tax Foundation, a conservative-leaning think tank, said the tariffs would generally harm lower-income consumers the most, while extending the jobs act could be perceived by opponents as disproportionately benefiting wealthy earners, which could create 'a PR problem' for lawmakers."

More on Tariffs

Trump Reciprocal Tariff Vow Further Breaks From Global Trading Norms - Gavin Bade, Wall Street Journal. "The plan could also go beyond simply matching other nations’ tariffs to take into account nontariff trade barriers, according to people close to the president. Those include taxes on American companies, such as value-added taxes, government subsidies for foreign companies in their home countries, or regulations that prevent U.S. companies from doing business in foreign countries."

Another Valuation Miss

Tax Court Rejects Easement Litigant’s Lack-of-Education Defense - Kristen Parillo, Tax Notes ($):

“While we are willing to accept that petitioner may be unsophisticated with respect to tax matters, we find him to be sophisticated with respect to the acquisition of land and development of quarry mines in North Carolina,” Tax Court Judge Christian N. Weiler wrote in a February 11 memorandum opinion in Green Valley Investors LLC v. Commissioner.

...

It is equally difficult to accept that Branch, who acquired the underlying 607 acres of land for about $2,500 an acre, or approximately $2.2 million, “could objectively conclude that just three years later this same property was in fact worth more than $160,000 an acre for a total collective value of $91 million,” Weiler continued.

Related: Eide Bailly Business Valuation Services

Blogs and Bits

2025 early tax filings down from last year, but refund amounts up - Kay Bell, Don't Mess With Taxes:

Basically, people are slow.

But many of those who filed their taxes as soon as possible are happy. They’ve already received their refunds, which is the main motivator of earlier filers every year.

U.S. DOJ Seeks to Lift BOI Reporting Injunction - Kristine Tidgren, Ag Docket. "On February 5, 2025, the U.S. DOJ filed a notice of appeal to the order granting the preliminary injunction issued by the district court in Smith v. U.S. Department of Treasury. The DOJ concurrently filed a motion to lift the stay in the case, pending resolution of the appeal."

Rail accuses truck industry of coasting on highway tax ‘subsidy’ - Valerie Yurk, Roll Call. "Railroads are pushing lawmakers to hike taxes on trucks to fix a crisis-level problem of federal road and bridge funding, putting pressure on their biggest competitor as each vies for freight market share"

Tax Professional in Tax Trouble

New Jersey CPA sentenced in syndicated conservation easement tax scheme - IRS (Defendant names omitted; my emphasis):

According to court documents and statements made in court, Defendant was a CPA and return preparer working for accounting firms in New Jersey and New York. From approximately 2013 to 2019, Defendant promoted and sold tax deductions to his high-income clients in the form of units in illegal syndicated conservation easement tax shelters created by convicted co-conspirators...

Defendant knew that, contrary to law, the transactions related to these illegal tax shelters lacked economic substance and that his high-income clients purchased units at his recommendation only to obtain a tax deduction on their tax returns. The charitable deductions purchased by clients were derived from the donation of land with a conservation easement or the land itself to a charity, and the deductions were based on fraudulently inflated appraisals for the donated land. Defendant and the promoters promised the clients a so-called ratio of “4.5 to 1” in charitable deductions for every dollar paid into the tax shelter.

In some instances, to make it appear that his clients had joined the partnerships before the date of the conservation easement donation — which was necessary to claim the tax benefits — Defendant and his co-conspirators also instructed and caused clients to falsely backdate documents, including subscription agreements and checks related to the partnerships. Each year from 2013 to 2019, Defendant and his co-conspirators assisted clients with claiming these false deductions on their tax returns.

Time travel and tax planning are a bad combination.

What day is it?

It's Abraham Lincoln's Birthday. Among other things, Lincoln signed America's first income tax into law.

We're Here to Help