Key Takeaways

- 25% tariffs announced for steel, aluminum.

- "No exceptions, no nothing."

- Price rises announced.

- Allies respond.

- Homeland Security asks for IRS agents to be reassigned to immigrant crackdown.

- House struggles to craft "one beautiful bill" extending tax cuts.

- SCOTUSblog founder tax charge bail revoked.

- Check's in the mail, for thieves to steal.

- National Latte Day.

Trump Imposes Global 25% Steel, Aluminum Tariffs - Gavin Bade and Alex Leary, Wall Street Journal:

“It’s a big deal. This is the beginning of making America rich again,” Trump said in the Oval Office, as he signed dual executive orders for steel and aluminum tariffs. “No exceptions, no nothing,” Trump added.

A White House official said the tariffs would take effect March 4.

Only some of the last round of tariffs took effect. Prepare for a blizzard of lobbying for exemptions.

Trump Sets Across-The-Board 25% Tariff On Steel And Aluminum - Alex Lawson, Law360 Tax Authority ($). "Even before the revamped tariffs were unveiled, they drew scorn from the United Steelworkers, who bashed the move as a too-broad approach to address steel overcapacity. Specifically, USW President David McCall said that Trump should offer flexibility to close allies like Canada."

The winners and losers of Trump’s steel and aluminum tariffs - Aaron Gregg, Shannon Najmabadi, and Jaclyn Peiser, Washington Post:

...

This time around, companies such as John Deere, Caterpillar and Boeing could also be hurt because their products use a lot of aluminum or steel, as could private developers and state and local governments trying to repair infrastructure, Irwin said.

Tariffs Helped a South Carolina Town. They Left American Shoppers Worse Off. - Chao Deng, Wall Street Journal. "The tariffs may have led to an additional 1,800 washing machine jobs created by Samsung and other firms. But price increases caused by the tariffs cost U.S. consumers about $1.5 billion annually, according to a study in the American Economic Review, or more than $800,000 per job created."

Nucor raises HRC prices for the third time since the beginning of the year - Vadim Kolisnichenko, GMK Center. "The price increase is likely to be driven by the revival of market activity and the adoption of new trade tariffs by the Trump administration."

New tariffs spark tensions with allies - Shelby Talcott and Morgan Chalfant, Semafor. "The European Union vowed 'firm and proportionate countermeasures' in response to the duties, which will take effect on March 12 and followed Trump’s imposition of a 10% tariff on imports coming from China."

Trump and Tax Administration

I.R.S. Agents Are Asked to Help With Immigration Crackdown - Hamed Aleaziz and Andrew Duehren, New York Times. "In the memo, Homeland Security Secretary Kristi Noem asked Treasury Secretary Scott Bessent to deputize I.R.S. agents to help with immigration enforcement efforts across the country. That work could include auditing employers believed to have hired unauthorized migrants and investigating human trafficking, according to the memo. Of its roughly 100,000 employees, the I.R.S. has more than 2,100 trained law enforcement officers who help investigate violations of tax law and other financial crimes."

Court Extends Temporary Block on Trump’s Buyout Plan - Mary Katherine Browne, Tax Notes ($):

The Office of Personnel Management (OPM) sent out a governmentwide memo January 28 that offered pay through September to those who don’t want to comply with the federal return-to-office mandate and other changes if they agree to resign.

Meanwhile in Congress

Bye-Bye Round Numbers, Hello Rate Tweaks for Rescored TCJA Bill - Doug Sword, Tax Notes ($):

...

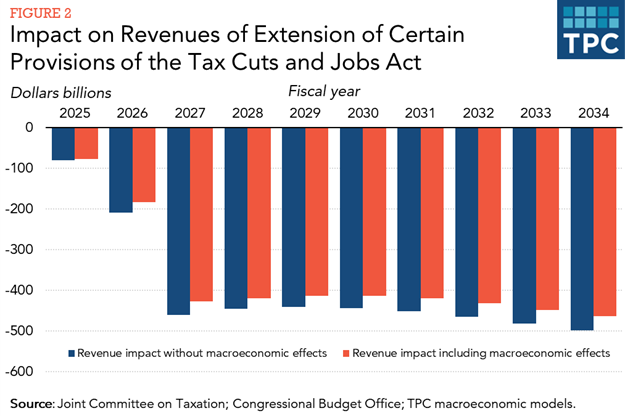

Even if Republicans argue that extending the tax cuts has no cost, the Congressional Budget Office’s estimate in January forecasting $21 trillion in deficits over the next 10 years is based on current law and the expiration of the TCJA, said Adam Michel of the Cato Institute. That means if the tax cuts are extended, the 10-year estimate of deficits grows to $26 trillion.

House GOP, still searching for common ground - Bernie Becker, Politico:

Those issues keep pushing back the House GOP’s timeline. House Republicans were hopeful they’d be able to roll out the details of a budget resolution late last week, ahead of a committee mark-up this week.

But Speaker Mike Johnson acknowledged on Sunday that his conference’s timeline might keep slipping. “The details really matter,” Johnson said on “Fox News Sunday.”

Trump expresses confidence Democrats will help extend tax cuts - Alex Gangitano, The Hill. "President Trump expressed confidence that Democrats will help Republicans extend his 2017-era tax cuts, despite the minority party showing no interest in helping with the president’s agenda."

Cleaning Up the Tax Code Could Raise Trillions for Tax Reform - William McBride, Tax Policy Blog:

Finally, the business tax code includes several questionable preferences beyond green energy credits (which are mainly claimed by business taxpayers), carving out special treatment for certain businesses and industries. This includes the credit for low-income housing investments (estimated to cost $167 billion over the next decade), the exemption of credit union income ($32 billion), the new markets tax credit ($8 billion), and special tax benefits for Blue Cross/Blue Shield ($6 billion).

Extending TCJA Provisions Would Modestly Boost The Economy, But Not Enough To Offset The Cost - Benjamin Paige, TaxVox. "Overall, extending TCJA’s expiring individual and some business provisions would boost the economy modestly in the short run, offsetting a small portion of the revenue cost. But TCJA extension would worsen the nation’s already daunting long-term budgetary imbalance and eventually reduce output and incomes. Policymakers should consider those tradeoffs in determining how much of TCJA to extend."

Filing Season Notes

Is This the Year You Finally Get a Form 1099-K? - Erin Collins, NTA Blog:

The key purpose of the form is to ensure that individuals and businesses report their income accurately. The IRS uses this form to track payments that might otherwise go unreported or underreported, particularly those made outside of traditional payroll systems. It is important to remember, whether you receive a Form 1099-K or not, income from the sale of goods or services is taxable, and you will need to include it on your tax return.

The organizations that may send you a Form 1099-K include but are not limited to:

-Auction sites;

-Car sharing or ride-hailing platforms;

-Craft or maker marketplaces;

-Crowdfunding platforms;

-Freelance marketplaces;

-Online marketplaces (sale or resale of clothing, furniture, and other items);

-Peer-to-peer payment platforms or digital wallets; and

-Ticket exchange or resale sites.

Gathering records is the first step of tax preparation - IRS:

The Get ready page on IRS.gov offers practical tips and resources to help taxpayers prepare. It highlights key updates and important steps for making tax filing easier in 2025.

Blogs and Bits

Ways to electronically pay your tax bill - Kay Bell, Don't Mess With Taxes. "Here's a quick review of six e-payment options available this 2025 tax filing, and paying, season."

The Truth About Offers In Compromise And IRS Debts - Jessica Ledingham, Forbes. "If you owe a significant sum to the IRS, it’s crucial to be cautious when seeking help. Weekly, I hear from individuals who were convinced by a company that their IRS debt could be dramatically reduced. Unfortunately, this is rarely the case. These promises can lure taxpayers into paying hefty fees for services that might not deliver the desired results."

Related: IRS Controversy, Tax Debt Relief, and More: How We Can Help

Reminder to Republicans: Lots of Low-Hanging Tax Code Spending to Cut - Adam Michel, Liberty Taxed. "The political response is often that many of these reforms are not politically viable, which may be true of some. However, even the messy political process leaves many tax expenditures ripe for elimination or reform."

Don’t Substitute Tariffs for Income Taxes: You’ll Get Both - David Henderson, Econlog. "Within a decade, however, both elements of the tax-swap bargain collapsed. Congress quickly discovered that income taxes yielded far more revenue than the old tariff system they replaced."

Tax Crimes: Law Blogger, Outlaw Shelter Promoter, Mail Thieves.

Tom Goldstein Arrested AGAIN. Feds Claim SCOTUSblog Founder Made Secret Crypto Transactions - Kathryn Rubino, Above The Law:

Tax-Crime Suspect's Bond Revoked After Additional Charges - Anna Scott Farrell, Law360 Tax Authority ($; defendant name omitted):

...

[Defendant], who operated Private Banking Concepts from his home in Estes Park, was indicted on the tax shelter charges in September 2023 and accused of instructing clients to use sham trusts to hide business income and deduct the cost of family weddings and other personal expenses. Prosecutors say he caused tens of millions of dollars in losses from unpaid taxes.

U.S. Postal employee and co-conspirator receive prison time for stolen check scheme - IRS (Defendant names omitted, emphasis added):

Defendants, both of Charlotte, were sentenced to 60 months and 54 months in prison, respectively, followed by two years of supervised release... The defendants previously pleaded guilty to one count of conspiracy to commit financial institution fraud and theft of government property. The defendants were also ordered to pay $113,333.87 in restitution, jointly and severally.

According to court records, from March 2021 to July 2023, Defendant S was employed by the U.S. Postal Service (USPS) as a mail processing clerk at a distribution center in Charlotte. As Defendant S previously admitted in court, from April to July 2023, she conspired with Defendant G and Defendant C to steal incoming and outgoing checks from the U.S. mail, which Defendant G and Defendant C then sold to other individuals, including using the Telegram channel OG Glass House. The co-conspirators stole checks totaling more than $24 million, which includes over $12 million in stolen checks that were posted for sale on the Telegram channel OG Glass House, and more than $8 million in stolen U.S. Treasury checks. The defendants obtained hundreds of thousands of dollars in criminal proceeds of the mail theft scheme.

Some taxpayers are convinced that they should conduct their tax business by mail because they think electronic transmission of tax returns and payments is dangerous. This case shows how the mail has its own serious security issues.

What day is it?

It's National Latte Day! The caffeine offsets the calories, I believe.

We're Here to Help