Key Takeaways

- Noncompliance with Spending Freeze Block

- DOGE Treasury Access

- Tariffs

- Tax Cuts

- Senate Budget Resolution

- Erroneous Refunds

- Carried Interest

- Taxes Abroad

- Corporate Transparency Act

- Tax Legislation

- In the Courts

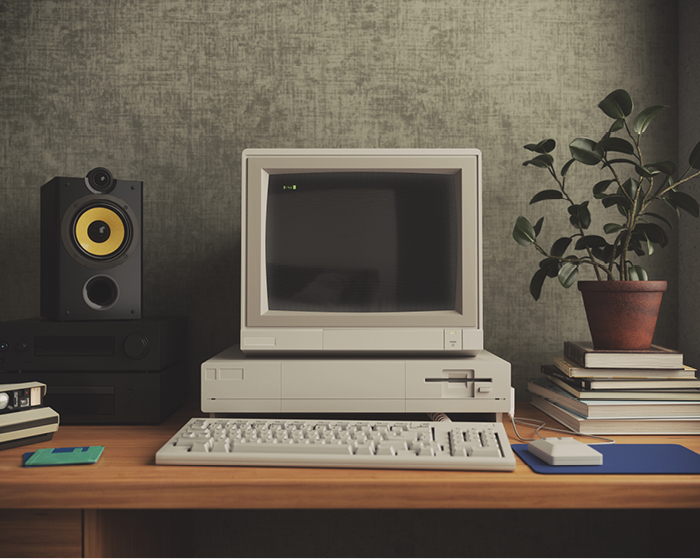

- National Clean Out Your Computer Day

Noncompliance with Spending Freeze Block

Trump Defying Court Block on Spending Freeze, State AGs Say – Maia Spoto, Bloomberg ($):

A coalition of Democratic-led states, including California, filed a motion in Rhode Island federal court on Friday to enforce the temporary restraining order.

…

Funds supporting greenhouse gas reduction, air monitoring, and solar energy are still frozen, according to the motion. Dementia research and global HIV prevention programs at universities are still halted, the motion said.

DOGE Treasury Access

DOGE Access to Treasury Payment System Blocked by Judge – Hailey Konnath & Pete Brush, Law360($):

The temporary restraining order by U.S. District Judge Paul A. Engelmayer of the Southern District of New York was made public in the early hours of Saturday morning. It restrains the Trump administration from giving "political appointees" and "special government employees" access to Treasury payment records and systems, and says any previously obtained material must be "immediately" destroyed.

Musk’s DOGE Team Now Seeks Access to Treasury’s Accounting Data – Gregory Korte, Bloomberg ($). “Elon Musk will dispatch a DOGE team to Parkersburg, West Virginia, next week, where it will gain read-only access to the US government’s central accounting system, according to a source familiar with the effort.”

Wyden Demands Clarification on DOGE's Treasury Access – Asha Glover, Law360 ($):

In a letter to Treasury Secretary Scott Bessent, Wyden pointed to news reports that Marko Elez, a former Musk employee and DOGE technologist, was granted "read-write" access to Treasury systems. Wyden, D-Ore., challenged the department's claim that DOGE officials only had been granted "read-only" access to the department's payment systems.

Warren Demands Watchdog Probe of Musk Team's Treasury Access – Chris Cioffi, Bloomberg ($). “Democrats led by Senate Banking Committee ranking member Elizabeth Warren (D-Mass.) called on Treasury and IRS watchdogs to probe federal payment system access granted to tech billionaire Elon Musk or his surrogates.”

Trump Suggests Musk Effort at Treasury Found Irregularities – Josh Wingrove & Gregory Korte, Bloomberg ($):

…

Trump didn’t elaborate on what problems Musk found. Musk’s so-called Department of Government Efficiency has sought access to Treasury Department payments data, but Musk’s statements on social media have largely concerned payments to contractors and grant recipients, not bondholders.

Tariffs

Trump’s Threatened Tariffs Fall Far Short of Paying for Tax Cuts – Jarrell Dillard, Bloomberg ($):

Those combined tariffs would raise less than a third of the estimated $4.6 trillion cost of extending Trump’s tax cuts over the next 10 years — if the import duties continued for a full decade, according to new projections of tariff revenue by non-partisan tax and budget policy groups.

CRFB Analysis: How Much Revenue Will Trump's Tariffs Raise?

Tax Cuts

Inside the House GOP clash over tax cuts – Benjamin Guggenheim & Meredith Hill, Politico:

The dispute is hindering Speaker Mike Johnson ’s plan to advance a budget blueprint this week, as different GOP factions continue to squabble over the costs of the tax plan, how to offset them to reduce their deficit impact and possible cost-saving changes to programs including Medicare and assistance for low-income Americans.

Trump Tax Cuts’ Cost Estimated at $5 Trillion to $11 Trillion – Steven T. Dennis, Bloomberg ($):

The Committee for a Responsible Federal Budget, which advocates for shrinking deficits, estimated the bulk of the cost would come from extending the 2017 Trump tax cuts for individuals and small business owners. Those cuts expire at the end of 2025. Trump’s overall tax plan would “explode” the debt and risk “a serious debt spiral,” the group said, unless they are offset with spending cuts or tax increases elsewhere.

CRFB Analysis: Trump Tax Priorities Total $5 to $11 Trillion

Senate Budget Resolution

Graham Releases Senate Budget Resolution; House Movement Awaited – Doug Sword, Tax Notes ($):

Senate Republicans formally launched their effort to bypass the filibuster to push the agenda forward, with Senate Budget Committee Chair Lindsey Graham, R-S.C., unveiling a budget resolution that focuses on the border and defense but leaves tax for a second bill later in the year.

Erroneous Refunds

Watchdog Finds IRS Issued Refunds Based on Dishonored Checks – Tyrah Burris, Tax Notes ($):

Refunds were issued before the IRS was notified that banks had refused to honor checks after tax overpayments, the Treasury Inspector General for Tax Administration said in a report released February 7. Checks can be dishonored because of insufficient funds, a closed account, an invalid account number, or a stop-payment order.

TIGTA Report: A Computer Programming Change Is Needed to Delay the Erroneous Issuance of Refunds Based on Dishonored Checks

IRS System Error Leads To $43.7M In Faulty Refunds – Jack McLoone, Law360 ($):

From Jan. 1, 2023, through March 28, 2024, about 7,800 individual taxpayers may have received the refunds because of a timing issue that caused the IRS' system to generate refunds before receiving notification of taxpayers' dishonored checks, TIGTA said in its report, dated Tuesday.

Carried Interest

Why Trump Wants to End the Carried Interest Loophole: QuickTake – Erin Schilling, Bloomberg ($):

During a meeting on Feb. 6, President Donald Trump told Republican lawmakers that he is prioritizing ending a tax break popular among investment fund managers. The same day, a group of more than a dozen Senate Democrats also reintroduced legislation to end the tax break.

While the average American worker must pay the standard tax rate on their income, wealthy private equity managers and venture capitalists are able to pay a lower capital gains rate on one of their main forms of compensation. That’s made the so-called carried interest loophole a favorite target of politicians, who call it part of a system rigged to benefit the rich. Despite that, through the years, the private equity industry has successfully lobbied to keep the provision. During his first presidency, Trump tried and failed to close the loophole, as did his successor, President Joe Biden.

Taxes Abroad

Trump Aide Hassett Says US Aims to Level Playing Field on Taxes – Josh Wingrove, Bloomberg ($):

National Economic Council Director Kevin Hassett said Trump wants “reciprocity” in trading relationships and how firms are taxed in an interview with Bloomberg Television on Friday.

Corporate Transparency Act

Feds Defend Corporate Transparency Act In 5th And 4th Circuits – Sarah Jarvis, Law360 ($). “The U.S. government defended the Corporate Transparency Act in the Fifth and Fourth Circuits on Friday, urging the former to reverse a Texas federal judge's nationwide injunction on the law and the latter to affirm a Virginia federal judge's rejection of a bid to block the law's enforcement.”

Tax Legislation

GOP Sens. File Bill to Make Pot Co. Tax Penalty Permanent – Mike Curley, Law360 ($):

Titled the No Deductions for Marijuana Businesses Act, the bill filed Thursday would amend Section 280E of the tax code — which bars businesses trafficking in Schedule 1 and 2 drugs from deducting business expenses — to include marijuana by name.

Benefits Industry Praises Bill Aiding Nonprofit Retirement Plans – Caitlin Mullaney, Tax Notes ($):

“The changes proposed in the bill will allow 403b plan providers increased flexibility to build more robust investment lineups for plan participants consisting of lower cost options that preserve principal and provide protected guaranteed lifetime income solutions,” Paul Richman of the Insured Retirement Institute said in a February 7 release.

In the Courts

American Express Hit With $235 Million Transfer Pricing Tax Bill – Caleb Harshberger, Bloomberg ($). “The IRS is seeking $235 million in unpaid taxes from American Express in a dispute over the company’s transfer pricing, according to financial filings. The company plans to contest the adjustment.”

4th Circ. Says LeClairRyan Founder May Duck Tax Liability – Jack Karp, Law360 ($):

A Virginia bankruptcy court and federal district court were both wrong to conclude that the agreement prohibited firm members like LeClair from withdrawing after the firm's dissolution, according to the appellate court.

Florida Couple Owed $14M Tax Refund, Court Told – Anna Scott Farrell, Law360 ($) (Taxpayer names redacted):

[Taxpayers] said they made estimated tax payments for 2015 through 2018 and each year elected to carry forward the surplus and apply it to future tax bills, according to their complaint, filed Wednesday.

For 2019 the couple broke the pattern and chose not to carry forward their credit. Instead, they asked the Internal Revenue Service for a $13.9 million refund of their overpayment.

Goldstein's Pro Se Filing Irks Feds Amid Murky Atty Situation – Elliot Weld, Law360 ($). “Prosecutors have asked a Maryland federal judge to strike a pro se motion from Tom Goldstein in his tax evasion case, saying the U.S. Supreme Court attorney and SCOTUSblog publisher shouldn't be allowed to personally make arguments to the court when he is represented by several experienced lawyers.”

Ex-NFL Star Romanowski's Bankruptcy Converted to Ch. 7 – Vince Sullivan, Law360 ($). “Former NFL player Bill Romanowski and wife Julie had their Chapter 11 bankruptcy case converted to a Chapter 7 on Friday, after a California judge called a filing from the couple seeking the case's dismissal full of "hyperbole" and said a trustee is needed to examine the pair's assets and liabilities.”

Ex-Mass. State Sen. Gets 18 Months for Pandemic, Tax Fraud – Julie Manganis, Law360($). “A former Massachusetts state senator was sentenced to 18 months in prison Friday after being convicted of fraudulently collecting pandemic unemployment benefits and failing to report consulting income he was also earning at the time on his tax returns.”

Court Dismisses Alleged Revenge Assessment Case – Mary Katherine Browne, Tax Notes ($). “A district court dismissed a lawsuit brought by two tax attorneys who claimed that the IRS was subjecting them to “relentless regulatory scrutiny” in retaliation for representing taxpayers against it in criminal tax cases.”

Closely Held Businesses Defend Claimed Charitable Deductions – Erin McManus, Tax Notes ($). “Two family-owned operations advised by the same entity are challenging imputed underpayments based on lack of economic substance arising from disallowed deductions for charitable contributions.”

What Day is it?

Beware your search history, its National Clean Out Your Computer Day!

We're Here to Help