Key Takeaways

- How the tariffs would work.

- Who's spooked? "Almost everyone."

- Canada targets GOP states for retaliation.

- Mexico vows retaliation (secures one-month delay).

- Trump: "worth the price that must be paid."

- Congressional reaction.

- Quick tax bill timeline "unrealistic."

- National Carrot Cake Day.

Author's Note: This is a fast-moving news day. As this is written, reports say that the tariffs on Mexico are being delayed for one month, while talks continue with Canada.

Update, 3:46 p.m. CST: The Canadian prime minister has announced a 30-day suspension of the tariffs.

A 10% tariff on imports from China remains set to take effect.

How the U.S.-Canada-Mexico Tariffs Will Work—and What Products Are Targeted - Chao Deng, Wall Street Journal:

...

Prices of a host of items are likely to rise, from cars to gas, smartphones, and fresh vegetables.

Since the U.S. buys billions of dollars of lumber from Canada, the cost of home construction might go up. The U.S. also relies to a significant degree on Canada to supply its frozen french fries.

Here’s What to Know About Trump’s Tariffs - Danielle Kaye, New York Times:

The auto and electric equipment sectors in Mexico are most exposed to disruption from sweeping tariffs, as is mineral processing in Canada, according to economists at S&P Global. In the United States, the largest risks are to farming, fishing, metal and auto production.

Fact Sheet President Donald J. Trump Imposes Tariffs on Imports from Canada, Mexico and China - The White House. "The extraordinary threat posed by illegal aliens and drugs, including deadly fentanyl, constitutes a national emergency under the International Emergency Economic Powers Act (IEEPA)."

Reaction and Retaliation

Trump’s Move to Put Tariff Hikes Ahead of Tax Cuts Has Spooked Almost Everyone - Lindsay Wise, Wall Street Journal. "President Trump’s aggressive move to place tariffs on hundreds of billions of dollars in imports, ranging from crude oil and auto parts from Canada to Mexican avocados and raspberries has rattled investors, economists and some lawmakers, who are all wondering: What exactly is the goal?"

Donald Trump faces backlash from business as tariffs ignite inflation fears - Aime Williams and Joshua Franklin, Financial Times:

“We’re used to having frictionless trade in North America, and that’s been going on for some people’s whole lifetime,” Clausing said.

“So going from free trade to 25 per cent is really pretty dramatic and I think it’s going to lead to a huge shock to the US economy.”

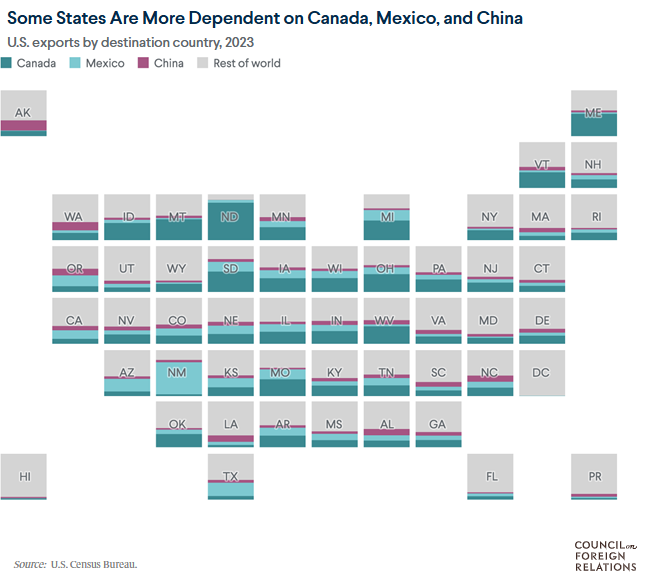

Canada’s tariff list targets Republican states, Trump allies - Mickey Djuric, Politico:

The full list, which you can read here, contains food and agriculture products, textiles and furniture.

Trump’s ‘Tariff Thrashing’ Spurs Crisis Response From Canada - Christine Dobby and Randy Thanthong-Knight, Bloomberg. "Government leaders in Canada also announced more retaliatory measures against the US. Several provinces, including Ontario and Quebec, will remove US products from liquor stores they control. In Ottawa, government staff gave more details on how Canada will bring in 25% counter-tariffs against more than 1,200 categories of US products within days."

Mexico vows retaliation to Trump tariffs without detailing targets - David Alire Garcia and Ana Isabel Martinez, Reuters:

For decades, the two neighbors have seen cross-border trade grow, including from a highly integrated auto industry, as well as massive volumes of crude oil, natural gas and motor fuels that move in both directions.

What Trump’s Trade War Would Mean, in Nine Charts - Shannon O'Neil and Julia Huesa, Council on Foreign Relations. "Certain sectors of the U.S. economy will be hit particularly hard, including the automotive, energy, and food sectors. Gas prices could surge as much as 50 cents per gallon in the Midwest, as Canada and Mexico supply more than 70 percent [PDF] of crude oil imports to U.S. refineries. Also at risk are cars and other vehicles, as the United States imports nearly half its auto parts from its northern and southern neighbors."

Trump says potential pain caused by tariffs ‘worth the price that must be paid’ - Brett Samuels, The Hill:

“This will be the Golden Age of America!” Trump continued. “Will there be some pain? Yes, maybe (and maybe not!). But we will make America great again, and it will all be worth the price that must be paid. We are a country that is now being run with common sense — and the results will be spectacular!!!”

What about Congress?

Capitol agenda: Congress reacts to Trump’s tariffs, Musk’s power grab - Lisa Kashinsky and Mia McCarthy, Politico:

There are early signals of trouble ahead. Here’s the state of play:

Tariffs: Agricultural states will bear the brunt of Trump’s weekend tariff barrage aimed at Canada, Mexico and China. The American Farm Bureau, which is influential among Republican lawmakers, is warning that farmers will bear the brunt of retaliatory trade measures. Maine Sen. Susan Collins is speaking out about the impact on her state, and Sen. Mitch McConnell said in a “60 Minutes” interview that tariffs will hit consumers. Some Republicans, including House Ways and Means Chair Jason Smith, are backing Trump’s trade moves.

House GOP nears plan for Trump’s agenda — but may not have the votes - Jacob Bogage and Marianna Sotomayor, Washington Post:

Republicans return to Washington on Tuesday to embark on the challenge, fully aware that previous attempts to curtail spending and enact conservative policies have been derailed by fiscal hawks.

Quick Tax Timelines Unrealistic, Top Policy Watchers Say - Doug Sword and Cady Stanton, Tax Notes ($):

“So it’s not like they can go different directions on this,” Callas said, referring to the split between the House plan for one big reconciliation bill in the administration’s first 100 days and the Senate’s preference for two bills, including a tax package that would move later in the year.

“I think the over/under for enacting the reconciliation bill is like January 1, 2026 — that’s with tax,” Callas said.

Tariff Economics and History

A 25 Percent Tariff on Canadian and Mexican Imports Would Reduce Consumers’ Average After-Tax Income by 1 Percent - Lillian Hunter, Tax Policy Center. "Research has shown that importing businesses and their domestic consumers bear the costs of tariffs, not the exporting nation. Importers account for the cost of tariffs in their pricing. TPC estimates that after-tax incomes would fall, on average, by $930 (just under 1 percent) in 2026 because of the 25 percent tariff. The lowest-income 20 percent of households would be worse off by an average of $170 while the wealthiest quintile by an average of $3,280 in that year. "

Trump Tariffs: Tracking the Economic Impact of the Trump Trade War - Erica York, Tax Foundation. "We estimate the retaliatory tariffs will reduce US GDP and the capital stock by less than 0.05 percent and reduce full-time employment by 27,000 full-time equivalent jobs. Unlike the tariffs imposed by the United States, which raise federal revenue, tariffs imposed by foreign jurisdictions raise no revenue for the US but result in lower US output."

Tax History: Trump Ignores Inconvenient Facts About ‘Tariff Sheriff’ McKinley - Joseph Thorndike, Tax Notes Tax History Project. "In hailing McKinley for his aggressive protectionism, Trump is generally alluding to the famous Tariff Act of 1890 — popularly known as the McKinley Tariff after the Ways and Means chair who would become president six years later. But in the short term, McKinley’s famous tariff came back to bite him. Just a month after Congress passed the tariff bill in 1890, McKinley lost his bid for reelection. Popular unhappiness with the tariff played a central role in that defeat. And two years later, Grover Cleveland rode the anti-tariff sentiment back into the White House for the second of his two discontinuous terms."

Filing Season Upheaval

Tax Filing Season Reshaped by Trump Upheaval: What to Know - Erin Slowey and Erin Schilling, Bloomberg ($):

With the tens of billions in extra cash from the 2022 tax-and-climate law, the agency said it outperformed many of its goals last filing season after it hired thousands more customer service representatives and improved some technology.

An exit of IRS employees would likely mean phone wait times get longer, audits drop for the most complex tax forms, and regulations get delayed.

Crapo, Wyden Pitch Harsher Tax Pro Fines In IRS Revamp Bill - Asha Glover, Law360 Tax Authority ($). "The discussion draft of the Taxpayer Assistance and Service Act would make a bevy of administrative and customer service-targeted changes, including expanding the definition of tax return so tax preparer penalties apply to preparers who alter returns after the taxpayers have signed them. The proposal also would increase the penalties for improper tax preparation or misappropriation of refunds. In the case of preparers failing to furnish a copy of a return or a claim for a refund for taxpayers, failing to sign a return copy or a refund claim, or failing to furnish a preparer's identifying number, the penalty would increase from $65 per offense to $250."

Blogs and bits

Feb. 3, 2025, is Tax Day for some extended 2023 tax returns - Kay Bell, Don't Mess With Taxes:

The Feb. 3 deadline for filing extended 2023 returns also applies to filers in parts of Arizona, Connecticut, Illinois, Kentucky, Minnesota, Missouri, Montana, New York, Pennsylvania, South Dakota, Texas, and Washington state.

IRS Finds Most Expenses Related to Taxpayers’ In Vitro Fertilization and Surrogacy Will Not Be Deductible Medical Expenses Under IRC §213 - Ed Zollars, Current Federal Tax Developments. "The taxpayers sought a ruling that would allow them to deduct all the listed expenses related to IVF and surrogacy as medical expenses under Section 213 of the Internal Revenue Code."

Proposed Regs Provide Guidance on Sec. 45W Commercial Clean Vehicle Credit - Parker Tax Pro Library. "The IRS issued proposed regulations that would provide guidance on the qualified commercial clean vehicle credit enacted under Code Sec. 45W by the Inflation Reduction Act of 2022 (Pub. L. 117-169)."

Related: IRA Credits Remain in Place Despite Mixed Signals.

Improving Tax Systems - Annette Nellen, 21st Centuray Taxation. "Provide the detailed reasons for tax changes, who is affected including breaking it down by income groups including breaking it down for the wide range of income levels comprising the top 1% of individuals. Find ways to help individuals understand their own taxes (such as covering it in high school civics classes) and understand how spending occurs through our tax system and how it compares to the direct spending you can see in looking at budgets of government agencies."

What day is it?

It's National Carrot Cake Day! Carrots are an important part of a healthy diet.

Make a habit of sustained success.