Key Takeaways

- The Secretary of Defense gets an audit notice.

- He's not the only one.

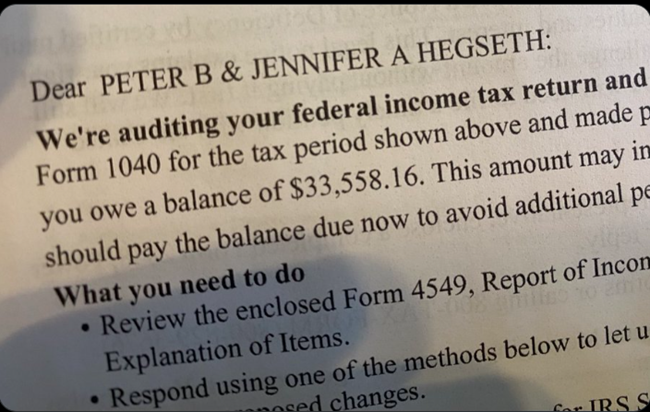

Pete Hegseth, the new Secretary of Defense, got a letter from the IRS:

The Secretary says that this was a parting shot from the Biden administration. Eide Bailly tax controversy specialist Elyse Katz says there is a less exciting but much more likely explanation:

The image shared by Secretary Hegseth doesn't include the explanation of the $33,558.16 proposed tax adjustment. There are a number of possible causes for the adjustment. For example, the motor vehicle credit is limited to $7.500, and it is disallowed for high incomes. A solar credit could have been submitted missing information.

Other than publicizing a notice on social media, what should a taxpayer who receives a similar notice do? Elyse has some ideas that may be more productive:

Elyse Katz is a Partner with the Eide Bailly Tax Controversy Team.

Make a habit of sustained success.