Key Takeaways

- State flat taxes advance.

- SALT deduction cap fights.

- California doctor loses residency fight.

- Colorado woos Sundance with tax credits.

- Iowa to back off state incentives?

- North Dakota governor promises property tax reform.

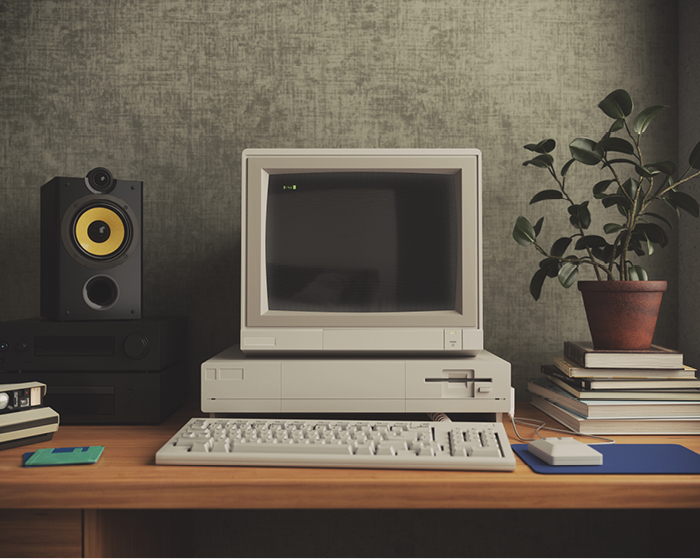

- E-filing when they had to turn on a modem for each return.

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

The State Flat Tax Revolution: Where Things Stand Today - Jared Walczak and Katherine Loughead, Tax Policy Blog:

In the 15 months from July 2021 to September 2022, five states enacted laws to transform their graduated-rate income taxes into single-rate tax structures: Arizona enacted flat tax legislation in July 2021, followed by Iowa in March 2022, Mississippi and Georgia in April 2022, and Idaho in September 2022. A sixth state, Louisiana, joined them in December 2024 with the enactment of a comprehensive tax reform law that included converting the state’s graduated-rate individual income tax into a single-rate structure as of January 1, 2025.

SALT Boost Gets New Push by GOP Lawmaker Ahead of Trump Meeting - Zach Cohen, Bloomberg ($):

The 2017 tax law during the first Trump administration capped that deduction at $10,000 for federal returns. That, along with other individual provisions of the signature legislation, expire at the end of the year absent congressional action.

Cost of SALT Changes Creates Headache Under GOP’s Slim Majority - Cady Stanton, Tax Notes ($):

Extending all the expiring provisions from the TCJA — without any changes to the SALT cap — would cost an estimated $4.5 trillion over 10 years, according to the Congressional Budget Office. Trump has also recently suggested that he wants his proposal to end taxation on tips to be included in reconciliation legislation, which could cost from $62 billion to $195 billion over 10 years, according to estimates from the Budget Lab at Yale University.

Raising or eliminating the cap would increase the overall cost.

State-By-State Roundup

California

Doctor Stuck With $2.37 Million California Income Tax Bill - Richard Tzul, Bloomberg ($). "A former doctor owes about $2.37 million in income taxes because he failed to prove he was a Nevada resident, a California tribunal held."

The case shows that taxpayers wishing to change residency need to really mean it. From the administrative law judge opinion:

Appellant also continued his professional pursuits throughout the years at issue. Appellant pursued the reinstatement of his license to practice medicine in California through July 2009. Appellant’s business, Top Surgeons, also remained active in this state for each of the years at issue, maintaining eleven offices and advertising its operations throughout Southern California.

When you leave a state, leave.

Newsom Says No New Taxes, No Deficit, In Early Budget Look - Maria Koklanaris, Law360 Tax Authority ($):

At the preview, Newsom said the state looks better fiscally now than it did in June, when he signed the fiscal year 2025 Budget Act after a protracted period of negotiations with state lawmakers. At that time, the state had a deficit of about $47 billion that stretched over three years. In June, California closed the gap with cuts, borrowing from special funds, withdrawing funds from the rainy-day account and delaying some funding.

But in the time since, Newsom said, a strong market, which translates into increased capital gains taxes, came to California's rescue. The state has seen an additional $16.5 billion in revenue and it still maintains about $16.9 billion in reserves, or rainy-day funds.

California Car Dealerships' Manager Liable for Unpaid Sales Taxes - Christopher Jardine, Tax Notes ($). "A member of a limited liability company that operated two California car dealerships is personally liable for the dealerships' unpaid sales taxes, the California Office of Tax Appeals (OTA) has found."

California Advises Vehicle Dealers Selling to Out-of-State LLCs - Laura Mahoney, Bloomberg ($):

The department revised forms that dealers and purchasers must complete to relieve them of the duty to collect tax and attest that vehicles are delivered out of state, according to the notice. If they both don’t complete the forms, the transactions will be subject to further investigation.

Colorado

Colorado Aims to Woo Sundance With Film Festival Tax Incentive - Emily Hollingsworth, Tax Notes ($):

Under H.B. 24-1005, global film festivals will be eligible to claim a maximum aggregate of $34 million in refundable income tax credits over a 10-year period, beginning on January 1, 2027.

Georgia

Georgia Watches as New Tax Court Starts Taking Shape in 2025 - Michael Bologna, Bloomberg ($):

The tax court will operate at the same level as the Georgia Superior Court, which functions as a trial court of general jurisdiction. Under the tax tribunal, appeals are currently routed through the Superior Court of Fulton County. The new tax court will grant taxpayers and the Revenue Department discretionary appeal rights directly to the Georgia Court of Appeals.

In many states, taxpayers can either appeal to an employee of the revenue department or take the case to a state court that has no specialized tax expertise. The results tend to favor revenue departments.

Idaho

Idaho Governor Pledges to Continue Providing Tax Relief - Emily Hollingsworth, Tax Notes ($):

...

Little provided no details on his proposed tax cuts. A budget highlights document says only, “Whether income tax relief, property tax relief, or grocery tax relief, Governor Little stands committed to the tradition of reducing taxes in times of continued economic prosperity.”

Iowa

Amid changes in Iowa's tax climate, incentives that lured data centers may be on way out - Lee Rood, Des Moines Register. "After a slew of tax cuts in recent years that has warmed Iowa's business climate, Debi Durham, Iowa's economic development chief, has said the state needs to change some tax credits and add new ones."

Kentucky

Income tax cut expected to be a top priority as Kentucky lawmakers convene for a 30-day session - Bruce Schreiner, Associated Press via yahoo!news. "Priorities will include a measure to reduce the individual income tax rate to 3.5% from 4%, to take effect in 2026. Top GOP lawmakers announced last year that the state had met the financial conditions needed to set in motion another cut in the tax rate."

New Jersey

New Jersey High Court Finds Tax Foreclosure Law Unconstitutional - Christopher Jardine, Tax Notes ($). "New Jersey’s Tax Sale Law (TSL) as in effect before a 2024 amendment is unconstitutional because it allows the forfeiture of surplus equity in a property without just compensation, the state’s supreme court held."

Link: 257-261 20th Avenue Realty, LLC v. Roberto

North Dakota

ND Gov. Pitches Property Tax Reform In Annual Address - Sanjay Talwani, Law360 Tax Authority ($). "In his first State of the State address, Republican Gov. Kelly Armstrong called property tax relief his top priority for the 2025 legislative session. He outlined a plan to triple the state's current $500 property tax credit for primary residences, at a cost of nearly $500 million annually, while also capping local spending growth."

New York

New York Taxpayers Could Get Refunds of Up to $500 Under Hochul Plan - Benjamin Oreskes, New York Times. "If the proposal is adopted as part of next year’s budget, residents who file their taxes jointly and make less than $300,000 would receive $500 checks, while individuals making up to $150,000 would receive $300. The governor said she expected residents to receive the refunds next fall."

Hochul Floats Curbing Tax Breaks For PE Home Investments - Paul Williams, Law360 Tax Authority ($). "The Democratic governor said in a statement that she will aim to deny hedge funds, private equity firms and other institutional investors the ability to use interest deductions and depreciation deductions that are associated with the ownership of single and two-family residences. Such investors would also be subject to a 75-day waiting period to make an offer on those properties, she said."

Washington

Incoming Washington Governor Avoids Inslee's Wealth Tax Idea - Laura Mahoney, Bloomberg ($):

The Democrat offered $4 billion in cuts on Thursday in advance of taking office Jan. 15, in addition to $3 billion in one-time savings and delayed spending that Inslee offered in his final budget plan in December. Inslee’s proposal to enact a 1% tax on “worldwide wealth” over $100 million isn’t part of Ferguson’s budget outline.

Wisconsin

Wisconsin Governor and GOP Continue Fight Over Taxes, Ballot Measures - Paul Jones, Tax Notes ($):

Evers has consistently advocated progressive tax cut proposals aimed at lower-income residents, but GOP lawmakers have rejected them in favor of broader tax cuts, which the governor has largely rejected via his veto power. Republicans say they are set on once again using the state’s projected $4.6 billion surplus to pay for significant tax cuts this year.

Tax Policy Corner

Tops In Their Field: SALT In Review - David Brunori, Law360 Tax Authority ($, free on LinkedIn here):

The top 10 revenue departments for 2024 and their leaders, in alphabetical order:

- Arizona Department of Revenue, Robert Woods, director;

- District of Columbia Office of Tax and Revenue, Keith Richardson, deputy chief financial officer;

- Indiana Department of Revenue, Bob Grennes, commissioner;

- Iowa Department of Revenue, Mary Mosiman, director;-

- Kansas Department of Revenue, Mark A. Burghart, secretary;

- Comptroller of Maryland, Brooke Lierman, comptroller;

- New Hampshire Department of Revenue Administration, Lindsey Sheldon Stepp, commissioner;

- New Jersey Division of Taxation, Marita R. Sciarrotta, acting director;

- New Mexico Taxation and Revenue Department, Stephanie Schardin Clarke, secretary; and

- Virginia Department of Taxation, Jim Alex, tax commissioner.-

Tax History Corner

The IRS began accepting electronically-filed returns in the 1986 filing season - presumably in January, though the date of the first e-filing seems to be lost to history. From IRS E-File: A History:

...

Enter IRS e-file. The initial idea sprang from the IRS Research Division, which ran tests to prove the technical feasibility of Electronic Filing System (EFS), a concept it believed would simply the processing method.

In 1986, a pilot program was launched to test the costs and benefits of EFS and to gauge acceptance by preparers and taxpayers. Only five tax preparers in three metropolitan areas – Cincinnati, Raleigh-Durham and Phoenix – agreed to participate. Then, the system could only process returns that were due refunds.

“The processing system at that time consisted of a Mitron and a Zylog, which most people have never heard of,” recalled retired IRS employee Leonard Holt, who served as a branch manager in the e-file project office. The tax preparer would call a designated number at the Cincinnati Service Center and an IRS employee would plug the phone into the Mitron, which Holt described as a modem with a tape drive.

When the transmission was finished, the IRS employee would transfer the tape to the Zylog, a super mini-computer, which would massage the data into files that the IRS’ Unisys System could process.

To send the acknowledgement, the IRS employee would have to telephone the tax preparer who would plug the phone into his own modem and reverse the transmission process.

IRS e-file procedures have come a long way since than. Paper processing, not so much.

We're Here to Help