Key Takeaways

- 2025 state tax policies to watch

- Will the Supreme Court step in on state and local taxes?

- Whither the SALT deduction cap?

- Streamlined voluntary compliance proposal falls short.

- State and local developments around the U.S.

- What taxes looked like 100 years ago.

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

State And Local Tax Policy To Watch In 2025 - Paul Williams, Law360 Tax Authority ($):

Although the number of states enacting combined reporting has dwindled in recent years as roughly 30 states have now adopted the policy, [Eversheds Sutherland partner Jeffrey] Freidman expects debates about the policy to resurface in some states where it is perennially raised as a key tax issue, including Pennsylvania and Maryland.

Combined reporting requires related entities to file together in a state, whereas separate reporting treats each individual corporate entity separately for income tax purposes. Advocates of combined reporting generally argue that the policy cuts down on profit shifting from multistate businesses, while opponents contend that combined reporting rules can be complex and lead to compliance burdens without necessarily raising revenue for the states.

Potential U.S. Supreme Court SALT Cases for 2025 - Christopher Jardine, Tax Notes ($):

The Pennsylvania Supreme Court ruled that Philadelphia did not unconstitutionally discriminate against interstate commerce by not granting an additional credit for taxes the taxpayer paid to another state.

Tyler Martinez of the National Taxpayers Union Foundation, which submitted an amicus brief in support of Zilka, told Tax Notes that the state supreme court got the decision wrong “because ‘local’ taxes are actually state taxes for constitutional purposes. Restrictions on state taxes apply to local taxes, and a state can't escape that by recategorizing things.”

State And Local Tax Cases To Watch In 2025 - Maria Koklanaris, Law360 Tax Authority ($):

The founder in question, Craig Welch, was a nonresident when he sold his shares in the company, AcadiaSoft Inc. He and his wife, Natalia Welch, have told the Massachusetts Court of Appeals that the gain from the 2015 stock sale occurred after they moved from Massachusetts to New Hampshire.

Future Uncertain for SALT Cap Workarounds as Congress Debates Extension - Paul Jones, Tax Notes ($):

...

For taxpayers, in addition to evading the cap, “some businesses find entity-level taxation less complex and prefer it for compliance purposes,” Jared Walczak of the Tax Foundation said in an email to Tax Notes.

“Entity-level taxation can also shield passthrough business income from the effects of the federal alternative minimum tax,” Walczak said, noting that the AMT was limited by the Tax Cuts and Jobs Act, a curtailment that is also set to expire. The end of the limitation “could make the AMT relief these entity-level taxes provide even more salient,” he said.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround

Remote seller sales tax voluntary disclosure proposal falls short

SSTGB Remote Seller Voluntary Disclosure Proposal Fails - Emily Hollingsworth, Tax Notes ($):

...

A three-fourths majority vote from member states is needed to approve amendments to the Streamlined Sales and Use Tax Agreement. The proposal sought to amend section 402 of the SSUTA to create a voluntary disclosure program with a limited lookback period aimed at qualifying remote sellers.

There is no statute of limitations preventing assessment of taxes if no returns are filed. The program would encourage non-filers to start filing by protecting them from old back taxes as a reward.

Despite the SSTGB vote, most states have their own voluntary disclosure programs. Eide Bailly can help.

State-By-State Roundup

Iowa

Iowa's income tax rate has dropped to 3.8% - Katraina Sostaric, Iowa Public Radio. "Iowa’s income tax rate dropped to 3.8% Wednesday for all residents who pay income tax, the result of several rounds of tax cuts passed by Republican lawmakers in recent years."

Idaho

North Idaho woman who embezzled from grandfather convicted of tax evasion - Idaho State Tax Commission (Defendant name omitted). "In 2019, Defendant used her power of attorney access to her grandfather’s bank account to embezzle money. Defendant only had access to the account to help her grandfather manage his finances. She didn’t have permission or authority to spend the money on herself. Defendant embezzled more than $306,000 through unauthorized payments, transactions, and ATM withdrawals."

Illinois

Federal Judge Partially Blocks Illinois's Ban on Credit Card Swipe Fees - Emily Hollingsworth, Tax Notes ($). "An Illinois law banning swipe fees on the tax and tip amounts of credit or debit card transactions can't be applied to national banks or federal savings associations, according to a federal judge."

Illinois Pensions: How Did We Get Here? Where Will They Go? - Mary Pat Campbell, STUMP - Meep on public finance, pensions, mortality and more:

...

It doesn’t really “protect” the pensions, as it doesn’t call the money to pay pensions into being.

Indiana

Special Rules for Employees Who Work in Indiana for 30 Days or Less in a Calendar Year - Indiana Department of Revenue. "For 2024 and later, IC 6-3-2-27.5 permits an income tax exemption for employee compensation if the employee is a nonresident of Indiana and works less than 30 days during a calendar year (the “30-day safe harbor”)."

Kansas

With Kansas food sales tax eliminated, what is the tax on groceries in Topeka? - Jason Alatidd, Topeka Capital-Journal. "For the past decade, Kansas has had a 6.5% sales tax that applies to most goods sold in the state. But in 2022, lawmakers and the governor agreed to a gradual elimination of that tax as applied to grocery food. The state sales tax of 6.5% remains in place on other goods, including food at restaurants."

Louisiana

Significant Louisiana Sales and Use Tax Legislative Changes Take Effect January 1, 2025 - Elizabeth Gray, Colton Timberlake, and Sara Weintraub, Eide Bailly. "Louisiana has increased its sales tax rate and broadened the sales tax base to include more transactions and taxpayers. The new revenues will pay for other tax reforms that include the repeal of the franchise tax, reductions in the corporate income tax rate, a flat personal income tax rate, and the repeal of certain income tax credits."

Michigan

Michigan Treasury Warns of Tax Scam Letters - Kennedy Wahrmund, Tax Notes ($). "In a December 19 notice, the department said the letters threaten to take property such as land, vehicles, wages, bank accounts, and refunds if a taxpayer doesn't call the enclosed telephone number and settle the liability. It warned that the scam letters are sent through the U.S. postal service and include compelling looking 'Form DR-1024' numbers and personal information that is available online, which make them appear more legitimate."

New Jersey

Netflix to Receive Aspire Tax Credits to Build Campus in New Jersey - Matthew Pertz, Tax Notes ($). "The company has qualified for Aspire credits worth up to $387 million to build a 12-soundstage complex in Eatontown, according to a December 19 news release from the New Jersey Economic Development Authority (NJEDA)."

New York

New York and New Jersey Spar Over Congestion Pricing, Convenience Rule - Matthew Pertz, Tax Notes ($):

In June 2024 New York Gov. Kathy Hochul (D) announced a pause on the congestion pricing toll but changed her mind after the election. The toll is essential to closing a $211 million budget gap at the MTA that is projected to triple by 2028, with declining subway ridership primarily to blame

Washington

Democratic state senator’s email reveals tax ideas WA lawmakers may debate - Jerry Cornfield, Washington State Standard:

...

A “wealth tax” is on her list as well. Last year, she proposed a 1% levy on intangible assets above $250 million such as cash, bonds and stocks. Gov. Jay Inslee last week called for a similar tax on wealth above $100 million. Frame’s PowerPoint includes a guesstimate of what might be raised if the threshold is lowered to $50 million.

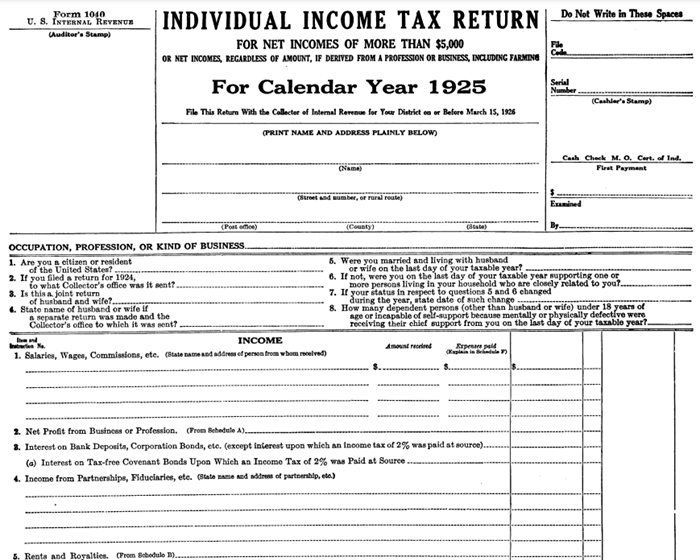

Tax History Corner

As we enter a new year, let's look back to what the Federal tax world looked like 100 years ago.

In January 1925:

- The top federal income tax rate was 46%, on income exceeding $100,000 (around $1,824,000 in today's dollars). There were 43 separate tax brackets (source). The current top rate is 40.3% on most income, for income for single filers exceeding $626,350. There are seven stated brackets; deduction and credit phase-outs and Affordable Care Act taxes create additional hidden brackets.

- The top corporate rate was 13%, on taxable income over $2,000 (about $36,500 in today's dollars). The current rate is 21%.

- In 1925, the top estate tax rate was 40% - the same rate as today. The first $50,000 (approximately $912,000 in todays dollars) was exempt from estate tax. The top bracket kicked in at $10,000,000, or around $182,366,000 in 2025 money. The 2025 exemption from estate tax is $13,990,000.

In 1925, 4,171,051 individual tax returns were filed, or about 3.5% of the population. In 2024, an estimated 128.7 million returns were filed, by about 37.8% of the population. As many of these returns were joint filings, the actual percentage of taxpayers covered was higher in each year.

The most recent tax legislation affecting 1925 rates was the Revenue Act of 1924, signed by President Coolidge. This legislation continued the reduction of the high wartime rates of the Wilson administration. The 1923 rates topped out at 58%, which was down from the 1918 high of 77%. Individual rates would decline further under Coolidge, with the Revenue Act of 1926 setting a top rate of 25%.

Despite these big tax cuts, the government ran a surplus through the remainder of the 1920s. It was a different fiscal world.

We're Here to Help