Key Takeaways

- Don't get scammed.

- New fuel credit report targets scam.

- It's 4th quarter estimated tax day!

- A deduction limit that costs the government.

- Ways and Means gets started.

- What are the sources of tax revenue?

- National Hat Day!

IRS Updates Scam Protections For 2025 Filing Season - Jack McLoone, Law360 Tax Authority ($). "The Internal Revenue Service announced changes Tuesday for the 2025 tax filing season designed to help protect taxpayers and tax professionals from scams and schemes, including updates to certain forms and increasing reviews and education."

The changes to protect taxpayers include a new form involving the Fuel Tax Credit that’s designed to make it harder for well-meaning taxpayers to be misled into claiming the credit by promoters. This specialized credit that’s been promoted on social media is designed for off-highway business and farming use. Taxpayers need a business purpose and a qualifying business activity such as running a farm or purchasing aviation gasoline to be eligible for the credit. Most taxpayers don’t qualify for this credit.

The IRS is also stepping up review on a variety of “other withholding” claims on Form 1040 that have been targets of scammers and schemers. And the IRS is reaching out to taxpayers who have potentially been using “ghost preparers” to prepare tax returns. These preparers don’t identify themselves on the tax return, which is a red flag for taxpayers to be misled into a scam or scheme.

The new fuel tax statement "asks for the business information, including name and Employer Identification Number or EIN (if applicable), and make, model and type of machinery or vehicle for which the fuel was purchased. The taxpayer will also be required to complete a table to show the relationship between the estimated purchase price of the fuel compared to the actual cost and gallons reported as being purchased on Form 4136."

Estimated Tax Day

Final 2024 estimated tax payment due Jan. 15 - Kay Bell, Don't Mess With Taxes:

- Debit or credit card or digital wallet. This is fast, easy, and familiar to most of us. The two Internal Revenue Service-approved vendors Pay1040 and ACI Payments, Inc. Note, however, that the card processors (not the IRS) charge a fee for the service.

- IRS2Go. The IRS' mobile app gives you access to Direct Pay or credit/debit card payment options.

- IRS Direct Pay. This option allows taxpayers to schedule a no-cost transfer directly from a checking or savings account.

- IRS Online Account. This option allows taxpayers to view their payment history, pending or recent payments and other tax information.

- Electronic Filing Tax Payment System, or EFTPS. EFTPS is an older online tax payment option. Since I’ve been paying taxes a long time, I use it. It’s free and offers selections such as scheduling payments a year in advance, paying estimated tax payments, and tracking and changing scheduled payments. However, you must have created an account before you can use it.

A Deduction Limit That Costs the Government

IRS Floats Counting Affiliate Pay In $1M Pay Deduction Cap - Anna Scott Farrell, Law360 Tax Authority ($).

...

The American Rescue Plan, which included pandemic relief and tax legislation, expanded the deduction limit to apply to any employee who ranked among the five highest-paid employees other than the principal executive officer and principal financial officer or the three highest-paid executive officers.

Public company compensation, when deductible, provides a 21% tax benefit to the corporation. The federal tax rate on the executive receiving the compensation will typically be 40.8%. By micromanaging executive compensation, Congress is outsmarting itself out of the difference.

Congress Gets Started With Taxes.

House Taxwriters Highlight Unresolved Hurdles to TCJA Extensions - Cady Stanton, Tax Notes ($):

The cost of those extensions, other legislative deadlines, and disagreement over legislative format and how to approach some provisions all present factors that could slow the attempt at swift action, even under a Republican trifecta of control in Washington.

Republicans may try budget math that doesn’t count Trump tax cuts - Jacob Bogage, Washington Post:

“It recognizes reality,” said Senate Finance Committee Chair Mike Crapo (R-Idaho), the leading proponent of the approach, which is called a “current policy” baseline.

House GOP tax writers call for cuts ‘as soon as possible’ - Tobias Burns, The Hill:

Increasingly, it looks like Republicans are going to opt for one larger bill instead of breaking it up into the two bills preferred by Senate leadership, but the matter isn’t settled.

IRS Direct File Tool Hated by Tax Prep Firms Target in GOP Bill - Zach Cohen, Bloomberg ($):

A pair of bills introduced by Sen. Marsha Blackburn (R-Tenn.) and Rep. Adrian Smith (R-Neb.), both members of their respective chambers’ tax-writing committees, would halt operation of Direct File or any successor program.

A Customs Bureau by Another Name

Trump says he’s creating ‘External Revenue Service’ for tariffs - Alex Gangitano, The Hill:

“It is time for that to change. I am today announcing that I will create the EXTERNAL REVENUE SERVICE to collect our Tariffs, Duties, and all Revenue that come from Foreign sources.”

History may not be the President-elect's strong suit. Meanwhile, a government agency asks "what are we, chopped liver?" And the idea that the sources of tariff revenue are "external" has problems.

Microcaptives

Regs. identify microcaptive transactions as reportable transactions - Martha Waggoner, The Tax Adviser. "The final regulations, published Tuesday in the Federal Register, require material advisers and certain participants in the listed transactions and transactions of interest to file disclosures with the IRS and be subject to penalties for failure to disclose. The final regulations affect participants in these transactions as well as material advisers."

Blogs and Bits

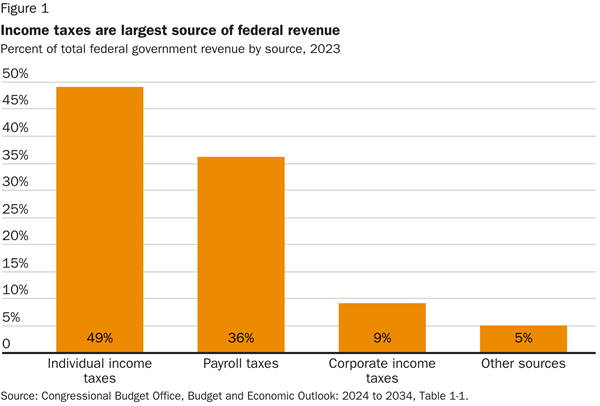

Cato Tax Bootcamp: Tax Code 101 - Adam Michel, Liberty Taxed. "About half of federal revenue comes from the individual income tax (Figure 1). The income tax includes revenues from taxes on wages, capital gains and dividends, and pass-through businesses. The United States is relatively unique in that a majority of business profits are 'passed through' to individual tax returns and taxed as personal income."

Is Your Company Ready for 2024 ACA Tax Reporting? - Tonya Rule, Eide Bailly. "Employer deadlines for IRS 2024 Affordable Care Act (ACA) reporting are just around the corner and it’s time to start preparing. Although the IRS reporting regulations remain unchanged for 2024, the risk of penalties and IRS audits are higher than ever. "

IRS Issues Proposed Regulations on Catch-Up Contributions to Address SECURE 2.0 Act Changes - Ed Zollars, Current Federal Tax Developments. "For taxable years after 2024, the applicable dollar catch-up limit is increased for participants who attain ages 60, 61, 62, or 63 during the year. For plans other than SIMPLE plans, the increased limit is 150% of the 2024 limit, with cost-of-living adjustments for years after 2025."

IRS Issues Final Regs, Penalty Relief for Certain Digital Asset "Middlemen" - Parker Tax Pro Library. "The IRS issued final regulations under Code Sec. 6045(a) regarding information reporting by brokers that operate within the segment of the digital assets industry commonly referred to as decentralized finance (i.e., DeFi brokers); the final regulations impose the same information reporting rules that apply to brokers for securities and operators of custodial digital asset trading platforms."

Zaxby’s Founder Wins Substantial Conservation Easement Refund - Peter Reilly, Forbes. " We don't get to know how big the refund was. He was looking for $43 million. Townley and the government entered into a confidential settlement. We know that the settlement amount was at least $2 million and one would think, given that it was a settlement, less than $43 million. The reason we know that the settlement was at least $2 million is that it was sent to the Joint Committee on Taxation for review."

Stop withholding for your employees? Here's how that works out.

Owner of construction companies sentenced to prison for tax and mail fraud - IRS (Defendant name omitted, emphasis added):

Defendant was sentenced by U.S. District Judge Indira Talwani to serve 18 months in prison, to be followed by three years of supervised release. Defendant was also ordered to pay restitution of $1,107,000 to the IRS and $244,000 to the Travelers Insurance Company. In May 2024, Defendant pleaded guilty to three counts of failure to collect and pay over employment taxes to the IRS and one count of mail fraud relating to underpaid workers’ compensation insurance premiums.

Between 2012 and October 2018, Defendant owned and operated TJM Construction, Inc. (TJM) and Point Construction, Inc. (Point). Defendant failed to report to the IRS the wages he paid to employees, failed to withhold required income taxes and failed to pay required employment taxes. Defendant also failed to disclose to Travelers Insurance Company the actual wages he paid to employees, which resulted in him paying less in workers’ compensation insurance premiums than he owed. As part of the scheme, Defendant recruited and paid two employees to establish three shell companies – companies that would make it appear as if TJM and Point’s employees were subcontractors to whom Defendant had no tax or workers’ compensation obligations. Defendant thereby failed to pay more than $1.1 million in employment taxes and defrauded Travelers of approximately $244,000.

There are scammers running around telling employers that they can stop withholding because the income tax is unconstitutional or some such. The IRS, every federal court, the U.S. Marshals, and the Bureau of Prisons are all big believers in the constitutionality of the income tax. Choose wisely.

What day is it?

It's National Hat Day. Doff one for those hardy souls who still never wear a suit outside without one.

Make a habit of sustained success.