Key Takeaways

- Tax regulation deluge at end of Biden term.

- Partnership rules pull in old transactions.

- Proposed corporate spin-off rules would require ongoing reporting.

- 401(k) auto-enrollment rules proposed.

- Tax law extension scoring pitfalls.

- Populists, business interests create Trump tax tension.

- Can a tax deal be bipartisan?

- International Kite Day.

Torrent of Tax Regs Considered Typical of Transition Period - Benjamin Valdez, Tax Notes ($):

On January 10, nearly a week ahead of President-elect Trump’s inauguration, Treasury and the IRS released more than 10 pieces of guidance, including final regs requiring taxpayers to disclose some partnership related-party basis adjustment transactions and final regs defining reportable microcaptive transactions.

...

One open question is whether Trump plans to repeat what he did at the beginning of his first term — and what presidents Biden and Obama also did — in issuing a freeze on any outstanding tax regulations.

...

Limited retroactive reporting for open tax years

To address comments on creating an unnecessary burden for taxpayers subject to the disclosure rules of the final regulations, Treasury and IRS limited reporting for open tax years to those that fall within a six-year lookback window. The six-year lookback window is the seventy-two-month period before the first month of a taxpayer’s most recent tax year that began before the publication of the final regulations. In addition, the threshold amount for a basis increase in a TOI during the six-year lookback period is $25 million.

Todd Laney, an Eide Bailly partnership expert, comments:

Proposed Corporate Reorganization and Spin-Off Rules

In connection with this proposed guidance, the IRS has posted to IRS.gov a draft version of new Form 7216, Multi-Year Transaction Reporting. These proposed regulations provide comprehensive, authoritative guidance with respect to core provisions of the Internal Revenue Code addressing corporate mergers and acquisitions transactions, and the new form will provide the IRS with necessary information with respect to corporate separations.

Eide Bailly Merger and Acquisition specialist John Kerrigan comments:

Released alongside this proposed regulation package is a draft version of new IRS Form 7216, Multi-Year Transaction Reporting, which is significantly more comprehensive than the historic reporting requirements for a tax-free corporate separation under the current Regulations. The new Form 7216 is intended to give the IRS increased visibility into these transactions, and as a way to monitor taxpayer compliance with the statutory requirements of a tax-free corporate separation once the transaction has been completed.

IRS Puts Out Spinoff Rules, Multiyear Reporting Regime - Kat Lucero, Law360 Tax Authority ($):

...

The IRS accompanied the new proposal on Monday with reporting guidance, which laid out the multiyear disclosure requirements for spinoff transactions. The increased reporting requirements would enable the U.S. Treasury Department and the IRS to "provide increased transactional flexibility through the proposed regulations," the agency statement said.

New Regulations address automatic plan enrollment

In general, unless an employee opts out, a plan must automatically enroll the employee at an initial contribution rate of at least 3% of the employee’s pay and automatically increase the initial contribution rate by one percentage point each year until it reaches at least 10% of pay. This requirement generally applies to 401(k) and 403(b) plans established after Dec. 29, 2022, the date the SECURE 2.0 Act became law, with exceptions for new and small businesses, church plans, and governmental plans.

The Coming Tax Fights

Republican Scoring Plan Poses Pitfalls for Future Tax Bills - Zach Cohen and Chris Cioffi, Bloomberg ($):

...

But an official score on an assumption of current policy could run into complications in the Senate. One of the chamber’s precedents, known as the Byrd Rule, requires that anything passed with reconciliation changes the government’s outlays or revenues.

That means each of the roughly 40 provisions in the 2017 law may need to be tweaked.

‘The million-dollar question:’ Trump’s populist economic promises meet Republican skepticism - Kadia Goba and Shelby Talcott, Semafor:

But Trump is now avidly pursuing new corporate partners and investments that line up with a fiercely pro-business — and conventional — Republican agenda, hosting tech industry chiefs at Mar-a-Lago as he forges a close alliance with Elon Musk and rolls out a $100 billion SoftBank investment. The contrast between Trump’s pro-working class talk and his pro-business actions has some of his own supporters asking whether any of his more populist ideas will end up becoming real administration policies.

Senate Democratic moderates say they want to work with GOP on tax cuts - Brian Faler, Politico:

...

No Democrats voted for Republicans’ original 2017 tax cuts, much of which are now due to expire at the end of this year. Rolling them over is projected to cost some $400 billion per year, and the price tag has become a major issue given the government is already running $2 trillion deficits.

The prospect of a bipartisan tax plan would raise a whole different set of challenges though, with the two sides likely to clash over issues like how much to charge businesses and high earners. The moderates signing the letter would also likely take heat from fellow Democrats who are opposed to the tax cuts and would be happy to see them expire.

Mining for a SALT deal - Bernie Becker, Politico:

A range of experts have also pointed out that other SALT changes could be used to offset the cost of raising the current cap, like limiting how much corporations can write off their state and local taxes, which could help ease the concerns of deficit hawks in the GOP.

But it’s also not hard to see how negotiations over SALT get more complicated, particularly if the blue-state Republicans push for a larger amount of relief and as Republicans engage in the heavy amount of horse-trading that might be required to pass all of their fiscal priorities this year.

An obvious revenue offset would be eliminating entity-level tax SALT deduction cap workarounds.

Link: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround

Reconciliation debate to test ‘tax cuts for the rich’ narrative - Caitlin Reilly, Roll Call. "Extending all of the expiring tax cuts would lead to tax savings at every income level, a dynamic Republicans have pointed to as they prepare legislation to avert the cliff, but the biggest benefit would go to those making the most, who have the highest tax bills."

Blogs and Bits

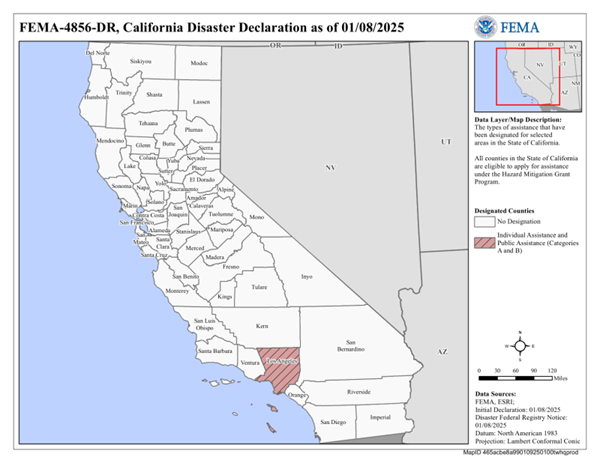

California wildfire victims qualify for tax relief, including delayed Oct. 15, 2025, filing and payment deadline - Kay Bell, Don't Mess With Taxes. "The most immediate item is more time to deal with annual tax filing. The L.A. area residents in the FEMA designated area (map below) now have until Oct. 15 to file various federal individual and business tax returns and make tax payments."

IRS Defers 2024 Deadlines for Taxpayers Affected by Los Angeles Wildfires - Adam Sweet, Eide Bailly. "Businesses and individuals that reside or have a business in Los Angeles County qualify for this tax relief. This same relief will be available to any other counties added later to the disaster area."

Micro-Captive Transaction Regulations Classifying Them as Listed Transactions or Transactions of Interest Released by the IRS - Ed Zollars, Current Federal Tax Developments. "These regulations, which are effective January 14, 2025, require material advisors and certain participants to file disclosures with the IRS, with penalties for non-compliance."

IRS Aims To Change Rules Governing Tax Professionals - Kelly Phillips Erb, Forbes ($). "The IRS encouraged taxpayers to be wary of promoters who charged a contingent fee because of concerns that the economic driver could push promoters to suggest ineligible people file a claim for the credit and that they might not inform taxpayers that they must reduce the wage deductions they claimed on their federal income tax return by the amount of the credit. Especially in cases where the contingent fee is collected upfront, the IRS has warned that in the case of an ERC denial (or audit), the taxpayer may be stuck with a reduced credit or penalty—and out the contingent fee."

National Tax Literacy Poll: Assessing Taxpayer Knowledge and Perceptions of the US Tax System - Zoe Callaway, William McBride, Yihan Chen, and Nicolo Pastrone, Tax Foundation. "These findings suggest that while higher education improves the likelihood of achieving a moderate level of tax literacy, a significant portion of even the most educated respondents struggle to reach a 'proficient' level. This highlights the need for more targeted tax education efforts to bridge the gap in tax literacy across all educational levels."

Taxes in Court

Hunter Biden special counsel defends probe, denounces Biden’s DOJ criticism - Perry Stein and Matt Viser, Washington Post:

...

When assessing whether to charge someone with tax crimes, Weiss said, prosecutors often consider whether doing so would deter people from evading taxes in the future. He said Biden failed to pay at least $1.4 million in federal taxes from 2016 through 2019, a period that included time when he was sober and knew that what he was doing was wrong.

“Mr. Biden failed to timely file and pay his taxes over a four-year period and then, after becoming sober, he chose to file false returns to evade payment of taxes he owed,” Weiss wrote in the report. “I concluded that the prospect of criminal penalties was necessary to accomplish the goals of both specific and general deterrence in this case.”

Aurora man indicted for defrauding surveying company and $2.3 million from COVID-19 relief programs - IRS (Defendant name omitted, emphasis added):

According to the indictment, from June 2019 until around November 2022, Defendant allegedly defrauded SurvWest, LLC, the surveying company in which he was majority shareholder of, to obtain over $843,452 for his own benefit, including to purchase an Aston Martin convertible, a Land Rover Range Rover Sport, and a Mercedes Benz G63.

The indictment further alleges that Defendant participated in a scheme to defraud the Small Business Administration and others to obtain emergency COVID-19 relief funds totaling over $2.3 million during the pandemic.

Everyone wants nice cars. It's interesting that there are no tax charges in the indictment; embezzlement is not usually disclosed on the 1040.

What day is it?

It's International Kite Day! Sounds fun, but it's a little chilly for that here today.

We're Here to Help