Key Takeaways

- Taxpayer Advocate Annual Report lists top ten taxpayer issues with IRS.

- Slow ERC processing is #1.

- Scams and ID theft are high on the list.

- Estimated tax deadlines are also mentioned.

- IRS issues rules on energy credits for low-income communities.

- Canada tax boost still being enforced despite Trudeau resignation.

- Bad documentation betrayed by bad spelling.

- National Apricot Day!

National Taxpayer Advocate Delivers 2024 Annual Report to Congress - Erin Collins, National Taxpayer Advocate:

“For the first time since I became the National Taxpayer Advocate in 2020, I can begin this report with good news: The taxpayer experience has noticeably improved,” Collins writes. “In 2024, taxpayers and practitioners experienced better service, generally received timely refunds, and faced shorter wait times to reach customer service representatives…. After receiving multiyear funding, the IRS has [also] made major strides toward improving its taxpayer services and information technology (IT) systems.”

The Taxpayer Advocate is an independent office within the IRS tasked with helping taxpayers deal with the agency. Their website says "We’re here to ensure that every taxpayer is treated fairly and that you know and understand your rights. Our advocates can help if you have tax problems that you can’t resolve on your own."

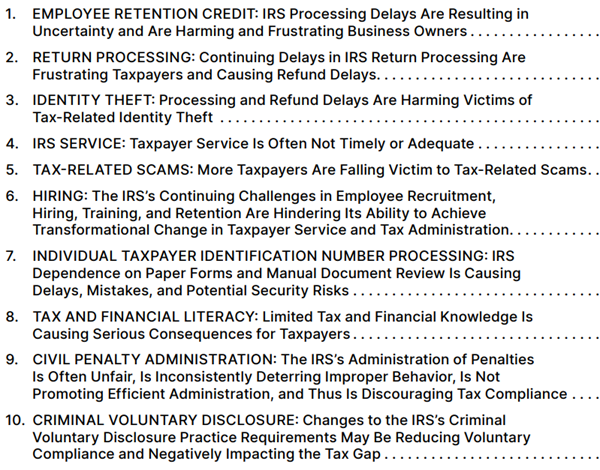

The report lists "the most serious problems encountered by taxpayers":

The report says this regarding the ERC:

The focus on scams is welcome. From the report:

Many of these scams operate in broad daylight, leading taxpayers to ask "if this is a scam, why isn't it being shut down?" Part of it is the inherently ponderous nature of government operations. Part of it is likely a management issue. But part of it is agency underfunding. Shutting down scams is an enforcement function. Politicians who say they are protecting taxpayers by cutting enforcement funding unwittingly empower scammers to fleece their constituents.

Other coverage:

NTA urges Congress to ease scam victims' tax burdens, simplify EITC, change estimated tax deadlines (and more) - Kay Bell, Don't Mess With Taxes:

...

Adjust individual estimated tax payment deadlines so that they actually fall quarterly as per the calendar. Right now, the description of quarterly simply means there are four payments, but then are not due on dates that align with the standard calendar quarters. They are the 15th day of April, June, September, and the following January.

“These uneven cutoff dates are confusing to taxpayers and can make it difficult for them to calculate their net income; few self-employed individuals and small businesses keep their books and records based on these dates,” says Collins.

Having quarterly payments actually be for three months would also enable the use of optional monthly vouchers, which would make budgeting easier for many gig economy taxpayers.

IRS requires sustained funding to continue to help taxpayers, report says - Martha Waggoner, The Tax Adviser:

Taxpayer Advocate Urges IRS to Prioritize Taxpayer Service - Benjamin Valdez, Tax Notes. "One area of service continuing to see major gaps is identity theft case resolution, according to the report. Collins estimated that in 2024 the time to resolve identity theft victim assistance cases ballooned to nearly two years. While the IRS has begun exploring ways to close more cases, it’s not enough, she said."

Very limited deadline break

The one-day extension applies to any return required to be filed with the IRS on Thursday, Jan. 9, 2025. It also applies to any required federal tax payment originally due on that day.

Energy credits for low-income communities

Government Amps Up Clean Electricity Low-Income Bonus Guidance - Mary Katherine Browne, Tax Notes ($):

The government has allocated 600 megawatts to facilities in low-income communities; 200 megawatts to facilities on Native American land; 200 megawatts to facilities that are part of federally subsidized residential buildings; and 800 megawatts to facilities for which at least 50 percent of the financial benefits of the electricity produced go to households with incomes below 200 percent of the poverty line or below 80 percent of area median gross income.

Related: Section 48(e) Low-Income Communities Bonus Credit

Meanwhile in Congress

After Trump visit, Republicans still divided on tax and border security plan - Jacob Bogage, Liz Goodwin, and Dylan Wells, Washington Post:

...

The result, lawmakers said, was a meeting that was mostly a question-and-answer session to fete the president-elect, who told reporters afterward that either legislative approach worked for him.

“Whether it’s one bill or two bills, it’s going to get done one way or the other. I think there’s a lot of talk about two, and there’s a lot of talk about one, but it doesn’t matter. The end result is the same,” Trump said.

International Terminal

Eide Bailly's International Tax Team and our affiliates at HLB, the Global Advisory and Accounting Network stand ready to help with your worldwide tax planning and compliance needs.

Corporate Tax Rates Around the World, 2024 - Cristina Enache, Tax Foundation:

- Five countries with statutory corporate tax rates below 15 percent—Bulgaria, Hungary, Ireland, Lichtenstein, and Barbados—implemented the qualified domestic minimum top-up tax (QDMTT) rules from the Organisation for Co-operation and Economic Development (OECD) Pillar Two agreement, raising their effective corporate tax rate to 15 percent for large corporations.

Canada to Apply Capital Gains Change Despite Government Halt - Melissa Shin, Bloomberg ($, emphasis added):

The measure, which drew condemnation from business groups, didn’t make it into legislation before Trudeau announced his resignation on Monday and suspended Parliament until March 24. As a result, the increased rate can only become law if a new government reintroduces a bill containing it, but it’s unclear whether that will happen.

Canada Revenue Agency , the federal tax authority, has a standard practice of applying legislation as soon as its proposed, rather than waiting until a bill is passed into law.

India to Simplify Decades-Old Income Tax Filing Rules in Budget - Siddhartha Singh, Bloomberg via MSN. "India has been trying to modernize its tax laws for decades to reduce the bureaucratic burden on taxpayers and boost compliance. Tax disputes have more than doubled to 10.5 trillion rupees ($123 billion) in the decade through the fiscal year ended March 2023. Finance Minister Nirmala Sitharaman announced in July that a comprehensive review of the tax legislation will be completed in six months to make the rules more taxpayer-friendly."

UK recruiters report fresh slowdown in hiring as planned tax rises bite - Delphine Strauss, Financial Times. "A string of surveys suggest employers are seeking to freeze hiring or raise prices in order to lessen the impact of increases in national insurance contributions and the minimum wage from April, as well as the looming costs of compliance with new legislation strengthening workers’ rights."

Blogs and Bits

New Jersey Division of Taxation Wishes to Add More Identity Theft - Russ Fox, Taxable Talk:

Do not provide personal information through e-mail, text messaging, or social media.

Yet the Division of Taxation asked someone to email personal information.

Don't send copies of 1099s, W-2s, K-1s, or anything with your social security number in an unencrypted email. If you are sending it to a tax preparer, use the preparer's secure portal. Don't make it easy for ID thieves.

FBAR Penalties: Everything You Need To Know - Kasia Strzelczyk, 1040 Abroad. "Many Americans living abroad must file a Foreign Bank Account Report (FBAR) each year—but not everyone realizes this obligation, leading to unintentional violations and potential penalties."

Related: Eide Bailly Global Mobility Services.

IRS Grants Additional Penalty Relief to Partnerships Reporting Sec. 751(a) Exchanges - Parker Tax Pro Library. "Since the issuance of the October 2023 Form 8308, concerns have been expressed to the IRS that many partnerships will be unable to furnish the information required in Part IV of the Form 8308 to transferors and transferees by the January 31 due date, because, in many cases, partnerships will not have all of the information required by Part IV of the Form 8308 by January 31 of the year following the calendar year in which the Section 751(a) exchange occurred."

Offshore Tax Evasion: U.S. Clients Of Trident Trust Target Of IRS John Doe Summons - Virginia Law Torre Jeker, US Tax Talk. "The summons seeks information about U.S. taxpayers who may have used the services of Nevis Services Limited, or those of other entities within the broad Trident Trust Group in the time frame 2014-2023 to establish offshore structures to conceal ownership of financial accounts and assets. By obtaining these records, the IRS expects to be able to identify Trident Trust Group clients who used the Group’s services to avoid or evade U.S. taxes. Unfortunately, some innocent taxpayers may be caught in the net, especially those holding accounts and entities simply as a nominee. Hopefully, they have properly documented any nominee relationships."

A $20,000 SALT Cap Would Be Costly And Mostly Benefit High-Income Households - Howard Gleckman, TaxVox. "TPC found that the change would cut household taxes overall by an average of about $100. But almost none of the benefit would go to middle- or low-income households since the vast majority pay $10,000 or less in state and local taxes today. Few itemize under current law and TPC estimates only about 4 million more would do so if Congress doubles the cap for couples."

The Democrats' Tax and Supreme Court Dilemma - Alex Parker, Things of Caesar. "The taxation of income is justified on ability-to-pay principles, as well as the general intuition that income reflects how much you benefit from the markets and stability that government provides. The ownership of assets, in and of itself, raises different questions. Is it right to tax income that is only theoretical? Or assets which don’t do much more than exist?"

Alex has joined Eide Bailly, so you may be hearing more from him around here. Welcome, Alex!

Spelling Matters

Fake Substantiation Documents Result in Deficiency, Fraud Penalty - Tax Notes Research. "The Tax Court sustained an IRS deficiency determination and fraud penalty against a healthcare consultant who provided fraudulent documents to substantiate various itemized and business expense deductions, finding that the IRS provided clear and convincing evidence that her tax underpayment was due to fraud."

The little things matter when you are defending your deductions in Tax Court. Things like this from the opinion (emphasis added):

We find that these documents were digitally manipulated and are fraudulent. The purported invoices from Marriott show its website address as www.mariott.com, omitting an “R” from the company's name.

It went badly for the taxpayer:

...

We thus sustain respondent's determination that petitioner for 2019 is liable for a civil fraud penalty of $22,890.

The moral? Don't claim fake deductions. If you do, it's better to concede on the examination than to double down with fake supporting documents. Spelling is hard.

What day is it?

It's National Apricot Day! I assume apricot jam counts.

We're Here to Help