Key Takeaways

- Interstate migration, by county.

- Can states attract tax personnel with "boot camps?"

- NHL salary cap - should it be tax-adjusted?

- News from AK, CA, CO, DE, IL, MA, MI, MO, NE, NJ, UT, WA, WV, WY.

- Breaking tax news from the second century BC.

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs!

Taxes and Interstate Migration: 2024 Update - Andrey Yushkov, Tax Foundation:

As I like to say, taxes aren't everything, but they are surely a thing.

Among the 10 counties with the highest net losses are four California counties: Los Angeles County (-52,921), Orange County (-14,997), Santa Clara County (-12,457), and Alameda County (-11,991); three New York City boroughs (which are coterminous with counties): Queens (-25,056), the Bronx (-23,549), and Brooklyn (-22,467); Cook County, IL (-29,463); Miami-Dade County, FL (-13,998); and Philadelphia County, PA (-9,901).

Tax Foundation interactive map.

States Try ‘Boot Camps’ to Address Tax and Audit Staff Shortages - Danielle Muoio Dunn, Bloomberg ($):

In North Dakota, special training courses have helped the state auditor’s office decrease its reliance on a shrinking number of accounting graduates. New York’s tax department is using the method to onboard hundreds of IT professionals as it races to complete a $75 million upgrade of its aging computer systems. Others are offering tuition reimbursement and mentoring to help get more college students interested in public sector work earlier in their careers.

I have no military experience, but from what I understand about boot camp, it may not be the attractive employment perk state officials seem to think it is.

NHL official talks about system some say benefits teams in jurisdictions without state income tax - Joshua Clipperton, The Canadian Press:

...

Florida, Nevada, Tennessee, Texas and Washington are among the states that don’t have taxes on income. That could mean the difference of millions of dollars over the life of a player’s contract.

State-by-State Roundup

Alaska

Alaska Governor Vetoes App-Based Car Rental Tax Bill - Paul Jones, Tax Notes ($). "Alaska Gov. Mike Dunleavy (R) has vetoed a bill to require app-based car rental platforms to collect and remit the state’s vehicle rental tax."

California

California Lawmakers Approve Larger Tax Break for Equipment - Paul Jones, Tax Notes ($). "A.B. 52 would temporarily provide manufacturers with a state tax credit for the local sales tax they paid on qualified equipment purchases, bill sponsor Assembly member Timothy Grayson (D) told lawmakers on the Assembly floor ahead of an August 29 vote to concur with changes made by the Senate. 'Senate amendments added a trigger that would only enact the credit upon appropriation,” he said, adding that the bill “has bipartisan support and has had zero ‘no’ votes.'"

‘Suits’ Spinoff, Janis Joplin Biopic Earn California Tax Credits - Benjamin Freed, Bloomberg ($):

...

California issues up to $330 million in tax credits annually to attract film and television productions to the state amid increasing competition from other states’ and foreign countries’ incentive programs. Lawmakers in 2023 extended the program through 2030 and made it refundable, allowing recipients to use their credits in years they don’t owe state taxes. The commission in July awarded $58 million in credits to five television productions.

California Legislature Approves Electronic Tax Notice Bill - Paul Jones, Tax Notes ($). "The goal is to make it easier for the department to issue notices and avoid lost letters. The service would be deemed complete 'at the time the department electronically transmits the notice via the taxpayer’s secure web portal, without extension of time for any reason,' the bill says. The electronic communication method would apply to notices for sales tax, the motor vehicle fuel tax, alcoholic beverages tax, tobacco taxes, and more."

Colorado

Ballot Measures Withdrawn, Colorado Enacts Property Tax Law - Emily Hollingsworth, Tax Notes ($):

In a September 4 release and letter to the Colorado House of Representatives, Polis said that H.B. 24B-1001 will provide property tax relief in the short term and long term, while “protecting our schools and local taxing districts from the devastating effects of current ballot initiatives.” Polis noted that the bill was a culmination of efforts by the state legislature during its special session, which began on August 26 and ended August 29.

Delaware

Delaware to Return Thousands of Dollars in Unclaimed Property - Tyrah Burris, Tax Notes ($). "Under the Money Match program, unclaimed property is automatically returned in the form of a check by mail to its owner, without requiring the taxpayer to file a claim or submit documents. The program compares the state's unclaimed property database with the verified addresses listed in taxpayers' most recent income tax returns."

Illinois

Chicago Halts Hiring as Deficit Tops $1 Billion Through 2025 - Shruti Singh, Bloomberg. "Johnson’s administration is also looking for revenue. The budget gaps he faces come amid a drop in the so-called personal property replacement taxes from the state and because the city’s school district isn’t sending $175 million to pay a portion of pension contributions for its non-teaching staff that participate in the city’s municipal employee retirement fund, according to Guzman’s statement. Rising personnel, pension and contractual costs 'alongside ongoing revenue challenges' are driving the shortfall next year, according to the statement."

Massachusetts

Massachusetts State Rep Tells Patriots to ‘Stop Complaining’ About Millionaires Tax - Lance Reynolds, Boston Herald via CPA Practice Advisor. "State Rep. Michael Connolly, D- Cambridge, took to social media ahead of Week 1, slamming Patriots players and former head coach Bill Belichick for arguing that the 4% surtax on incomes over $1 million makes it hard for New England to compete and attract top free agents."

Michigan

Michigan Court Reverses Grant of Post-Tax-Sales Surplus Proceeds - Christopher Jardine, Tax Notes ($). "The Michigan state treasurer, acting as the foreclosing governmental unit, foreclosed on each of the properties with an effective date of March 31, 2021, and provided notice that any persons with an interest in the properties had right to file a claim for remaining proceeds under Mich. Comp. Laws section 211.78t so long as they filed a notice of intention by July 1, 2021."

Michigan can steal your home equity, provided you don't file the right paperwork within three months.

Missouri

Missouri Voters to Weigh In on Legalizing, Taxing Sports Betting - Matthew Pertz, Tax Notes ($). "The amendment would amend the state constitution to legalize mobile sports betting and levy a 10 percent tax on gross revenues. The first $5 million in proceeds would be reserved for the state’s Compulsive Gambling Prevention Fund and the rest would be earmarked for education."

Nebraska

Nebraska DOR Announces Automatic Property Tax Break - Emily Hollingsworth, Tax Notes ($):

The reduction will appear on property tax statements beginning in December, according to a September 6 information release from the DOR. The credit was enacted under L.B. 34, which was signed into law by Gov. Jim Pillen (R) on August 20.

New Jersey

New Jersey Joins Other States in Sparing Bullion From Sales Tax - Danielle Muoio Dunn, Bloomberg ($). "The exemption is limited to bullion sales of at least $1,000, and doesn’t apply to the sale of jewelry, arts, or commemorative medallions. The act provides a four-month window for the exemption to show up on receipts. It was passed unanimously by the Democratic-controlled Legislature in June."

Utah

Income Tax Earmarking and Grocery Taxes on the Ballot in Utah - Jared Walczak, Tax Policy Blog. "By dedicating the income tax to education, along with more typical dedications (like using gas tax revenues for infrastructure spending), architects of Utah’s tax code made the sales tax supremely important for funding the rest of government. Unfortunately, while income taxes continue to show robust revenue growth—which has led to several rate reductions in recent years, returning some of that growth to taxpayers—sales tax revenues are declining as a share of state tax collections."

Washington

Washington Court Upholds B&O Tax on Northwest BBB - Andrea Muse, Tax Notes ($). "A local Better Business Bureau owes business and occupation (B&O) taxes on annual membership dues, a Washington appellate court has held."

West Virginia

Justice calls legislators into special session for tax cuts, child care, & appropriations - RealWV.com. "In a video recording posted Monday afternoon, Governor Jim Justice called legislators into special session on Monday, September 30, in Charleston. The agenda will include a 5% personal income tax cut, a child care tax credit, and other appropriations of surplus dollars."

Wyoming

Wyoming Voters to Consider Property Tax Changes, but Sound Property Tax Relief Is Not on the Ballot - Manish Bhatt, Tax Policy Blog. "Wyoming lawmakers are right to seek relief for property owners, but asking voters to amend the constitution to further split the tax rolls and authorize the creation of a property subclass is an inefficient release valve for rapidly rising valuations. Levy limits can provide the relief and stability that lawmakers seek without saddling taxpayers with the consequences of unsound policies that they cannot afford and do not deserve."

Tax Policy Corner

Local Taxes And Repercussions: SALT In Review - David Brunori, Law360 Tax Authority via LinkedIn:

But the property tax has a significant political problem. People hate it. The profound dislike by the people who pay the tax has forced local governments to seek alternative sources of revenue.

Tax History Corner

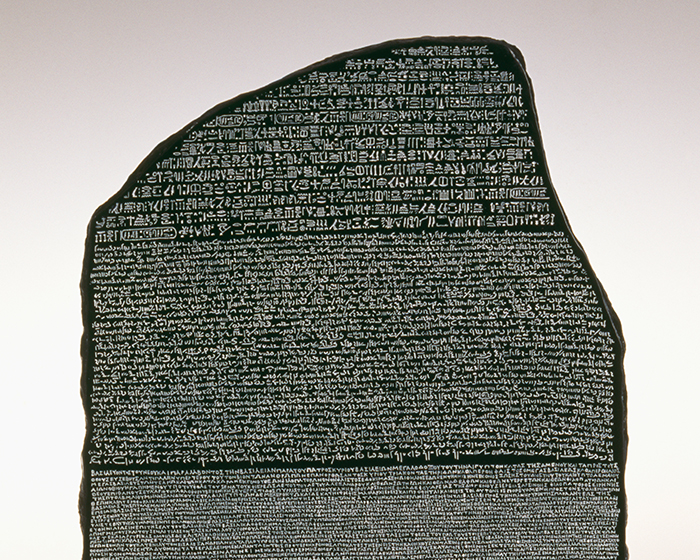

In any language, it's a tax break.

The Rosetta Stone was a key to unlocking ancient Egyptian Hieroglyphs. The stone is fragment of a monument commemorating a decree issued in 196 BC by King Ptolemy V Epiphanes. In one of the more unusual instances of tax research, it was found by French soldiers renovating a Fifteenth Century fort; the fragment had been incorporated into the fort's wall as building material.

Tax research, you say? Yes. Like many tax laws today, the decree provided tax exemptions for influential groups. For example, it granted priests exemption form an annual tax on silver and grain. Yes, it took decades to translate the Hieroglyphs after the stone was found, but if you've waited for 19 centuries for your tax answer, you can wait a little longer.

We're Here to Help