Key Takeaways

- Harris floats 33% top capital gain rate.

- IP-PINs as ID-theft protection.

- Courting small business on the campaign trail.

- IRS fixes currency regulation effective dates.

- UK capital gain rate increase proposal prompts warnings.

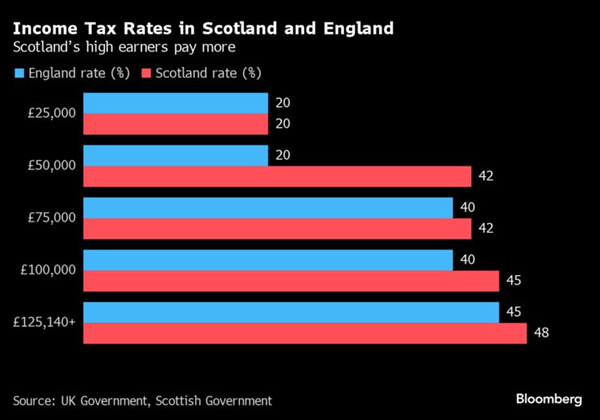

- Scotland, where you hit a 42% rate before taxable income hits $35,000.

- Consulting on the slot machine floor.

- National Cheese Pizza Day.

Kamala Harris Pares Back Biden’s Capital-Gains Tax Proposal - Andrew Restuccia, Tarini Parti, and Richard Rubin, Wall Street Journal:

...

Even at 33%, the all-in top capital-gains rate would be the highest since 1978. A rate that high could damp investment and reduce risk-taking.

Harris goes her own way on capital gains tax hike - Brian Faler, Politico:

...

It’s also possible that Harris’ plan may still be too much for some Democrats. In 2021, when Democrats controlled Congress and the White House, they considered increasing the capital gains tax rate to 28.3 percent before dropping the idea.

Some context on capital gain rates from The Tax Foundation:

IP-PINs as ID Theft Insurance

IRS Online Account and identity protection PINs protect against identity thieves and scammers - IRS:

...

After a taxpayer verifies their identity, the Get an IP PIN tool lets people with a Social Security number or individual taxpayer identification number to request an IP PIN online. Taxpayers should review the identity verification requirements before they use the Get an IP PIN tool.

Tax professionals should advise clients affected by identity theft to request an IP PIN. Even if a thief has already filed a fraudulent tax return, an IP PIN could prevent the taxpayer from being a repeat victim of tax-related identity theft.

Tax ID theft continues to be a problem. IP PINs can safe you months of frustration. Also, be careful with your personal tax data, and use your tax pro's secure upload portal instead of sending tax documents by e-mail.

More Campaign Trail Tax News

Tax Policy Becomes a Fault Line for Harris - Andrew Duehren, New York Times:

Raising taxes on the rich has long been a central talking point for Mr. Biden and other Democrats, and while Ms. Harris has said she would increase taxes on the wealthy, the capital-gains adjustment was a message to investors and corporate executives: Ms. Harris is a different type of Democratic nominee.

Harris Courts Small Businesses With New Tax Proposals - Alexander Rifaat, Tax Notes ($). "Speaking in New Hampshire September 4, Harris argued that increasing the amount small businesses can deduct for startup costs from $5,000 to $50,000 would help fuel a boom in economic activity."

Analysis of Harris’s Billionaire Minimum Tax on Unrealized Capital Gains - Garrett Watson and Erica York, Tax Foundation. "Harris’s billionaire minimum tax proposal would be a highly complicated new tax regime, creating new compliance costs for taxpayers and difficult administrative challenges for an already overwhelmed IRS without serving as a stable source of permanent funding. In addition, the economic harm could be substantial, as it would reduce saving, entrepreneurship, and economic dynamism. If lawmakers are seeking to raise revenue from top earners, they have much better options, such as progressive consumption taxes."

Corporate Tax Changes Could Move S&P Earnings by 5%-10%: Goldman - Esha Dey, Bloomberg ($):

- A tax cut scenario in which the federal statutory domestic corporate tax rate declines to 15% from 21% would boost S&P 500 earnings by about 4%, the strategists added.

- A tax hike scenario in which the rate rises to 28% would reduce earnings by about 5%, they said

International Terminal

Eide Bailly and its affiliates in HLB Global stand ready to help meet your worldwide tax compliance and consulting needs.

With Small Correction, IRS Makes Big Adjustment to Currency Regs - Andrew Velarde, Tax Notes ($):

...

With the changes, many corporations and partnerships filing returns in the coming weeks can use their original computations, [MIchael Mou of Deloitte LLP] said.

“Based on the correction, taxpayers wishing to make a [mark-to-market] election for taxable years beginning on or before August 19, 2024, can still rely on the procedures described in the 2017 proposed regulations,” Mou said. “They can be at ease with the election.”

Retaliatory Strikes - Alex Parker, Things of Caesar. "Republicans are eager to push back against the OECD's global minimum tax if and when they have power--but they'll have to chose their tool carefully."

Private equity warns UK capital gains tax overhaul could be ‘tipping point" - Harriet Agnew and Alexandra Heal, Financial Times:

...

Several private equity executives said they expected an increase to capital gains tax of at least five percentage points, although they had not completely ruled out a bigger move to align capital gains more closely with income

Scotland’s Chunky Tax Take Puts Top Earners on High Alert Again - Kimberly Mannion, Bloomberg ($): "Live in Scotland and your income tax bill rises as soon as you earn about £26,500 ($34,750) a year – less than the UK average. As your salary rises, the government takes an ever larger slice, such that an Edinburgh resident earning £250,000 would hand over about £9,000 more to the government than their counterpart in London."

Note the brackets below. For reference, £100,000 is approximately $118,640. The marginal rate on an additional dollar earned for a US taxpayer with taxable income of $60,000 is 22%, where it is 42% in Scotland. A US single-filer doesn't approach a 42% rate until taxable income exceeds $609,350.

Argentina’s Tax Reforms Aim to Change the Game for Investors - Juan Manuel Vázquez and Juan Pablo Baumann Aubone, Bloomberg ($):

The RIGI program applies to investments made in Argentina within seven broad economic sectors and for a minimum investment amount: The general amount required is $200 million, except for certain oil and gas investments, for which a higher amount may apply depending on the subsector involved.

Blogs and Bits

Maryland becomes 21st state to join IRS Direct File in 2025 - Kay Bell, Don't Mess With Taxes. "As with the prior participants, Direct File will only work for certain filers in each state. In Maryland’s case, that just 700,000 of its approximately 3.5 million taxpayers."

Creative Math, IRS Style - Russ Fox, Taxable Talk. "In the end, my client’s issue should be resolved without him owing additional tax or penalties; the IRS clearly erred. However, my client has to pay me for services that shouldn’t have been needed simply because no one at the IRS did anything with his correspondence. Frankly, the IRS today rarely reads their mail timely or correctly. And that’s a huge issue."

Tax Court Addresses Mismatched Effective Dates of Two TCJA Foreign Provisions - Parker Tax Pro Library. "With respect to the IRS's argument that allowing the deduction would produce an absurd result and an inappropriate windfall for a subset of taxpayers (i.e., taxpayers like Varian), the court said that an interpretation is absurd only if the result would be so gross as to shock one's general moral or common sense. The court found that the fact that its interpretation of Code Sec. 245A would reduce the amount of income tax owed by certain taxpayers did not mean that result was absurd."

Filing A U.S. Tax Return – Even When Not Required – A Very Smart Move - Virginia La Torre Jeker, US Tax Talk. "By filing a tax return, even when you do not need to, you create a record with the IRS. If a second return using your Social Security number is filed, the IRS will flag the attempt and notify you."

11th Circ. Finds $300,000 of $12.6M FBAR Fine In Violation of Eighth Amendment, Causing a Split - Ronald Marini, The Tax Times. "The Schwarzbaum opinion creates a split between two different U.S. Circuit Courts of Appeal. Circuit splits make U.S. Supreme Court review of an issue more likely. It remains to be seen if the United States (or the taxpayer who was still subject to other hefty penalties) will appeal Schwarzbaum."

Bad bets in Tax Court

Consultant’s Business Deductions Denied, Gambling Losses Allowed - Tax Notes ($). "The Tax Court sustained the IRS’s disallowance of business expense deductions an individual claimed for her software consulting business because she failed to substantiate her deductions but found that she was entitled to claim gambling losses to the extent of her winnings related to her alleged development of a casino gambling app."

While TikTok and Instagram tax advice videos weren't what they are now in 2011-2016, this taxpayer anticipated modern social media tax theory in her tax filings for those years. She filed a Schedule C for a "consulting" business to help finance slot machine losses through her 1040. From the Tax Court opinion (my emphasis):

Petitioner identified no income traceable to her “casino app” activity. Rather, all income reported on the Schedules C2 consisted of ordinary gambling winnings. She likewise identified no expenditures relating to development of a “casino app.” The “fees and commissions” reported on her Schedule C2 for 2011, like the “COGS” reported on her Schedules C2 for 2012–2014 and 2016, consisted of alleged gambling losses. She testified at trial that she ceased her “casino app” development in August 2012 when she became a full-time employee of JLL. She thus concedes that she had no “casino app” trade or business during 2013, 2014, or 2016, the years for which she reported losses.

That didn't work for the years involved, and, despite what someone on Instagram may have said, it doesn't work now.

What day is it?

We're in luck - it's National Cheese Pizza Day!

Make a habit of sustained success.