Key Takeaways

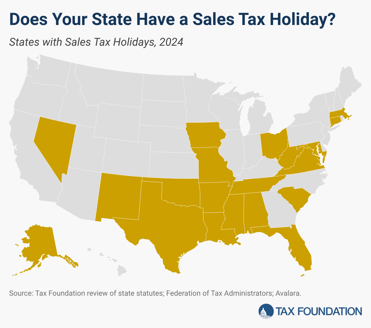

- Sales Tax Holidays.

- Disaster relief for multiple states.

- NJ, PA, and NM added to IRS Direct File.

- Alaska Child Care Credit.

- IL property tax refund limit.

- New Hampshire property tax exemption.

- MO Income Tax Cut.

- NE Property Tax Reform.

- NJ AI Tax Incentives.

- PA EV Tax.

- Tax Policy Corner.

- Tax History Corner.

Thanks for visiting Eide Bailly State Tax News & Views. Consider Eide Bailly's fine state tax services team for your state tax planning and compliance needs.

We continue our bi-weekly summer schedule for State Tax News & Views. Our next state post will appear August 16th.

Sales Tax Holidays by State, 2024 - Joseph Johns and Benjamin Patrick, Tax Foundation:

New disaster relief announced:

Texas; for those in 67 counties affected by Hurricane Beryl that began on July 5, 2024.

Missouri; for those affected by severe storms, straight-line winds, tornadoes, and flooding that began on May 19, 2024.

Kentucky; for those affected by severe storms, straight-line winds, tornadoes, landslides, and mudslides that began on May 21, 2024.

IRS Direct File:

New Jersey, Pennsylvania, and New Mexico announced they will join IRS direct file, and the IRS announces the program will remain. The other states now participating include Arizona, California, Florida, Massachusetts, New Hampshire, New York, Nevada, Oregon, South Dakota, Tennessee, Texas, Washington, and Wyoming.

U.S. Department of the Treasury Announces New Jersey to Join IRS Direct File for Filing Season 2025 - U.S. Department of the Treasury:

U.S. Department of the Treasury Announces Pennsylvania to Join IRS Direct File for Filing Season 2025 - U.S. Department of the Treasury:

U.S. Department of the Treasury Announces New Mexico Will Join IRS Direct File for Filing Season 2025 - U.S. Department of the Treasury:

State-By-State Roundup

Alaska

Alaska Creates Tax Credits for Cos.' Child Care Expenses - Zak Kostro, Law360 Tax Authority ($). "S.B. 189, which became law Monday without the signature of Republican Gov. Mike Dunleavy, allows an eligible person or business to claim a tax credit for expenditures made to operate a child care facility in the state for children of a business' employees, according to the bill's text."

Illinois

Illinois DOR Issues Guidance on Estimated Tax Payments - Tyrah Burris, TaxNotes ($):

Ill. Imposes 20-Year Time Limit On Property Tax Refund Claims - Jaqueline McCool, Law360 Tax Authority ($):

Ill. Rule Clarifies Investment Partnership Tax Liability - Jaqueline McCool, Law360 Tax Authority ($):

Illinois to Repeal Statewide Grocery Tax in 2026 - Tyrah Burris, Tax Notes ($):

The $53.1 billion fiscal 2025 budget signed on June 5 permanently eliminates the statewide tax on groceries as of January 1, 2026, one of Democratic Gov. J.B. Pritzker's budget priorities. The tax was suspended from July 2022 through June 2023.

Missouri

Mo. Hits Revenue Triggers For Continued Income Tax Cuts - Jaqueline McCool, Law 360 Tax Authority ($):

Nebraska

Neb. To Raise Interest Rate On Late Tax Payments in 2025 - Zak Kostro, Law360 Tax Authority ($). "Nebraska will raise the interest rate assessed on delinquent payments of taxes to 8%, an increase of 3 percentage points, starting next year, the state Department of Revenue said."

Nebraska Governor Testifies Before Committee on Property Tax Reform Bill - Tax Analysts, Tax Notes ($):

A key aspect of the governor's plan is the broadening of the state's sales tax base by eliminating over 100 sales tax exemptions.

New Hampshire

New Hampshire Bill Extends Business Tax Credits Carryforward Period - Tax Analysts, TaxNotes ($):

For the tax periods ending on or after December 31, 2029, the threshold for automatic refunds of the tax credits will be set at 250 percent of the taxpayer’s total tax liability and then reduced to 100 percent of the taxpayer’s total tax liability for the tax periods ending on or after December 31, 2031.

New Jersey

Gov. Murphy signs AI tax incentives into law - Nikita Biryuknov, New Jersey Monitor:

The $500 million program would extend tax incentive awards of up to $250 million to firms that draw more than half their revenue or devote more than half their staff to AI development.

New Mexico

NM Extends Filing Deadlines For Wildfire Affected Areas - Michael Nunes, Law360 Tax Authority ($). "New Mexico taxpayers affected by the South Fork and Salt wildfires will have until Nov. 1 to file taxes, matching the federal extension by the Internal Revenue Service, according to the state Taxation and Revenue Department."

Pennsylvania

Pennsylvania Replaces Alternative Fuel Tax on EVs With Flat Fee - Tyrah Burris, Tax Notes ($):

Tax Policy Corner

State & Local Tax Policy To Watch in The 2nd Half of 2024 - Paul Williams, Law360 Tax Authority ($):

...

Louisiana lawmakers may return to Baton Rouge for a special session later this summer to set the table for sweeping changes to the state constitution's tax rules.

Recent Apportionment Changes for Financial Institutions Could Be Unconstitutional - Paul Jones and Emily Hollingsworth, Tax Notes ($):

Leonore Heavey with the Council On State Taxation, in June 29 comments provided to Tax Notes, expressed concern that the apportionment requirements in Illinois and Massachusetts wouldn’t adequately reflect the location where the activity is taking place, and that they would fail the external consistency test.

Tax History Corner

Did you know...

We're Here to Help