Key Takeaways

- All-cash real estate deals termed "a suspicious activity."

- Ways & Means chair calls for inquiry on stolen tax refund checks.

- Home energy credits scooped up by high-earners.

- Exempt orgs "strictly prohibited" from participating in campaigns.

- Inspector general questions IRS multinational exam strategy.

- Oklahoma church office manager sentenced for embezzling $735K.

- National Lemon Juice Day vs. International Cabernet Day.

Treasury To Require Reports On All-Cash Real Estate Deals - Kevin Pinner, Law360 Tax Authority ($):

Ample evidence shows that all-cash real estate transfers to legal entities are a suspicious activity that should be disclosed to the U.S. Department of the Treasury's Financial Crimes Enforcement Network, according to the rule, which expands the Bank Secrecy Act to any professionals involved in settling such deals. Real estate professionals will be required to report each entity's taxpayer identification number, whether it is issued by the Internal Revenue Service or by a foreign tax authority, according to the rule.

The rules are intended to fight money laundering, but they apply just as much to, for example, a purchase of a farm at auction by an LLC.

Smith Calls for TIGTA Inquiry Into Refund Paper Check Thefts - Cady Stanton, Tax Notes ($):

The letter follows a series of arrests and indictments over the past year of individuals stealing paper checks of tax return payments and attempting to fraudulently deposit or cash them, including alleged thefts by Postal Service employees in Malliotakis’s home state of New York. Malliotakis’s district has experienced a cumulative theft

While most taxpayers are comfortable with electronic filing and electronic fund transfers of payments and refunds, some taxpayers still worry that such transactions are not secure. This reminds us that you won't find airtight security in the postal system.

Wealthier homeowners nab billions in tax credits for energy efficiency - Thomas Frank, Politico:

...

The analysis found that the highest-earning 25 percent of households — those with taxable incomes of $100,000 or more — got 66 percent of the tax credits, worth a total of $5.5 billion. Meanwhile, the lowest-earning 25 percent, with taxable incomes below $25,000, received just $32 million.

Tax on the campaign trail

Staying Non-Partisan: Advocacy Strategies for Public Charities During Election Season - Mayumi Stella, Eide Bailly. "While 501(c)(3) organizations may engage in lobbying to a degree, they are strictly prohibited from participating in a political campaign, either for or against a candidate. This ban includes publishing or making statements that support or oppose any candidate."

Kamala Harris Has Big Plans For Your Taxes, Here Is What You Could Pay - Robert Wood, Forbes. "One of Biden’s proposals was a tax on unrealized capital gains for taxpayers with wealth greater than $100 million. This proposal, which proved highly controversial among certain experts, was recently confirmed as part of Harris’ tax agenda, and it has drawn criticism from politicians in her rival party. Proponents of the tax argue it targets extremely wealthy Americans who have previously taken advantage of the lack of such a tax to obtain a lower effective rate than many lower-income taxpayers."

Trump Superseding Indictment: More on the Defraud / Klein Conspiracy - Jack Townsend, Federal Tax Crimes. It quotes the Saltzman and Book treatise IRS Practice and Procedure on conspiracy indictments:

Kamala Harris' Plan To Hike Corporate Income Taxes Would Fall on All Americans - Eric Boehm, Reason. "Saying that tariffs penalize only importers is almost exactly like saying that a corporate income tax affects only corporations. Both are deliberately myopic attempts to ignore the consequences of these policies."

International Tax Terminal

Consider Eide Bailly and its affiliated firms in the HLB Global Network for your business needs in cross-border tax planning and compliance.

IRS Told to Review Exam Strategy for Multinational Tax Avoidance - Benjamin Valdez, Tax Notes ($):

According to the partially redacted report, dated August 26, an IRS employee highlighted difficulties with applying the economic substance doctrine to identify tax avoidance in certain foreign trusts and noted “concerns of undue influence on IRS policies and procedures facilitated by the revolving door and influence the largest law and accounting firms have on the IRS.”

Don't Do the (Tax) Time Warp Again - Alex Parker, Things of Caesar. "As in 2017, Congress faces a major overhaul of the tax code in the upcoming year. But if lawmakers think offshore cash can help cover the costs, like with the TCJA, they could be in for a shock."

Canada Planning 100% Surtax On Chinese EVs, 25% On Steel - Jack McLoone, Law360 Tax Authority ($)."The surtax on steel and aluminum products imported from China is planned to take effect starting Oct. 15, the department said. An initial list of goods subject to the tax was published Monday for public comment, with the final list to be announced by Oct. 1. The surtaxes would not apply to goods in transit from China to Canada on the day they take effect, the department said."

How Do Import Tariffs Affect Exports? - Erica York and Nicolo Pastrone, Tax Policy Blog. "Applying import taxes to intermediate and capital goods has a negative impact on downstream industries—or industries that use such materials to produce their own goods. So while protection may deliver higher production and employment in one industry, it may directly raise the cost of doing business in another industry."

Offshore Investments, U.S. Tax Traps: What Every American Must Know - Virginia La Torre Jeker, US Tax Talk. "American investors frequently face confusion when dealing with foreign investment products such as mutual funds, exchange traded funds, life policies, savings plans, and portfolio bonds. It is important not to be misled by labels. Many of these products typically involve investments in foreign pooled funds, and this means it’s crucial to check for Passive Foreign Investment Company exposure."

Which taxes can the UK government raise in the Autumn Budget? - Sam Fleming, Financial Times. 'The prime minister has already spelt out a handful of tax reforms, including axing “non dom” status and levying VAT on private school fees. But he has pledged not to increase income tax, national insurance or VAT, which account for two-thirds of government revenues. Given those constraints, economists expect chancellor Rachel Reeves to seek to raise at least £20bn of extra tax revenue on October 30 through measures targeting the wealthy, businesses and pension savers."

Companies Face Hefty Tax Bills Under India High Court Ruling - Shefali Anand, Bloomberg ($). "An Indian Supreme Court ruling that disallows companies from using a treaty clause to lower their tax bills will force them to pay millions of dollars in back taxes—and send them hunting for relief."

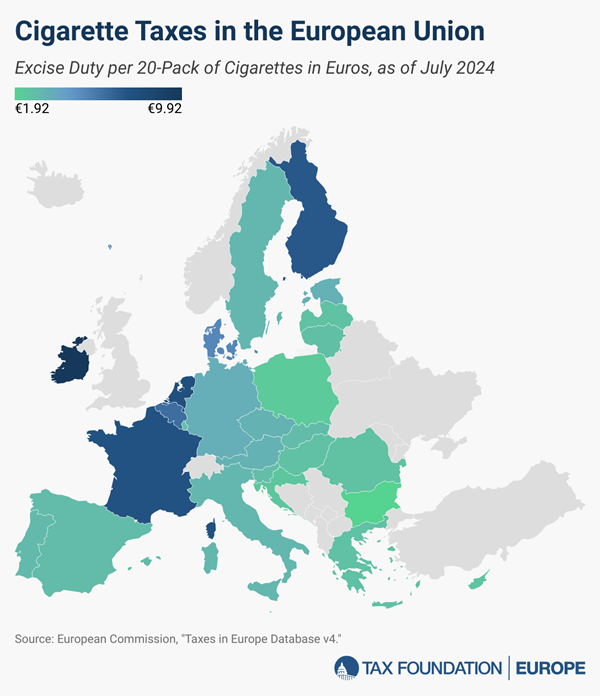

Cigarette Taxes in Europe, 2024 - Jacob Macumber-Rosin, Adam Hoffer, Tax Foundation. "The current minimum cigarette excise rates in the EU are €1.80 ($1.95) per 20-cigarette pack, and the minimum total excise duty is at least 60 percent of the national weighted average retail price, where the minimums have remained since 2014... The EU Directive only establishes minimum rates, but all countries levy higher rates."

The US federal cigarette excise tax is $1.01 per pack, with state taxes ranging from 17 cents to $4.35.

Blogs and Bits

Welcome, but limited, tax-free workplace help in paying down student loans - Kay Bell, Don't Mess With Taxes. "In 2020, educational assistance benefits got another option. They now also can be used to pay up to $5,250 in principal and interest on an employee’s qualified education loan."

S Shareholder Is Taxed on Income Stolen from Company by CFO and Corporate Secretary - Parker Tax Pro Library. "The Tax Court held that a married couple must include in income the husband's proportionate share of an S corporation's income despite not receiving such income and despite unauthorized distributions that two other shareholders made to themselves in excess of their proportionate ownership interests. The court also concluded that the S corporation neither authorized nor created a second class of stock and thus continued to maintain its S corporation status regardless of the disproportionate distributions made to the other shareholders."

It’s Back-To-School Season For Scammers, Too—What To Watch Out For And How To Protect Yourself - Kelly Phillips Erb, Forbes ($). "Related, some scammers may take advantage of those with student loans by making offers to pay down student loan debt or forgive existing loans altogether. In reality, scammers are just trying to solicit personal information to steal your identity or collect fees for "help" they do not plan on providing."

10 Less Harmful Ways of Raising Federal Revenues - Scott Hodge, Tax Policy Blog. "For example, corporate and individual income taxes are the most harmful taxes for economic growth, so raising those rates should be avoided. Similarly, tax incentives for saving and capital investments are key to increasing productivity and real wages and should be protected."

Tax Crime Watch: Oklahoma

Former church office manager sentenced for bank fraud and ordered to repay more than $910k - IRS. A case out of Tulsa (Defendant name omitted, emphasis added):

According to court documents, Defendant was a church office manager for more than 16 years. She was entrusted with various duties, including payroll, church bills, and bank deposits. In 2016, Defendant began abusing the trust bestowed upon her. As an authorized signatory, Defendant would sign checks she made out to herself and forge the additional signature needed. Defendant then tried to conceal her tracks by entering false descriptions into the church’s bookkeeping system.

While Defendant was receiving the fraudulent funds, she failed to report the increase in her income to the IRS. She also claimed more than $78k in fake medical and dental expenses in order to reduce her tax liability.

Sometimes you can trust a long-time employee, until suddenly you can't. That's why good accounting control systems are so important.

Related: How to Reduce Your Fraud Risk.

What day is it?

It's National Lemon Juice Day! Or, for something a little less tart, it's also International Cabernet Day.

We're Here to Help