Key Takeaways

- GOP representatives defend IRA credits for committed projects.

- Misappropriation by other shareholders doesn't blow S election.

- Taxpayer Advocate rips IRS handling of international return penalties.

- $2.9 Million FBAR penalty not an "excessive fine," court rules.

- Bookkeeper embezzles $29 million, hides it from business return preparers.

- International Cat Day.

18 House Republicans ask Johnson not to target IRA clean energy tax credits - Zack Budryk, The Hill:

In the letter, first shared with Politico’s E&E News, members led by Rep. Andrew Garbarino (R-N.Y.) criticized the IRA as a whole but wrote that repealing the credits could undermine the growth in the energy sector spurred by its tax provisions. They noted that a number of companies have already broken ground on investments they made assuming the credits would remain in place, and that eliminating them could lead to a “worst-case scenario” in which billions of dollars have already been spent for financial benefits that no longer exist.

Related: How the Inflation Reduction Act is Boosting Energy Efficiency Incentives.

Americans tapped $8 billion in tax credits on home energy upgrades - Julie Zauzmer Weil, Washington Post. "The 2022 law dedicated roughly $370 billion to curbing harmful emissions and promoting green technology, as well as investments in health care and other components of President Joe Biden’s economic agenda. It also included an array of tax credits and rebates for energy-efficient residential improvements. The nonpartisan congressional Joint Committee on Taxation estimated the first-year costs of those incentives at $2.4 billion. In the next two years, it estimated that people would claim more than $4 billion per year in credits."

S Corporation Day in Tax Court

Tax Court Rejects Engineer’s S Corp Dissolution Defense - Caitlin Mullaney, Tax Notes ($):

In an August 7 memorandum opinion in Maggard v. Commissioner, Judge Mark V. Holmes held that James Maggard and his wife must include in their 2014-2016 taxable income the proportionate amount of income attributable to his ownership share in the engineering consulting partnership, despite disproportionate distributions, because the company was still classified as an S corporation.

Some tax pros think that every S corporation is just botched distribution away from blowing their S corporation status. This case shows that S corporations are more resilient than that.

S corporations are corporations that have elected, with owner consent, to have their income taxed directly to owners as earned; the earnings taxed to shareholders increase their share basis, reducing gain on a sale or avoiding tax on dividend distributions. This differs from non-electing corporations - "C corporations" - who pay tax on their own income, and whose distributions are taxed to the shareholders.

The tax law allows S corporations to have only one class of stock, though differences of voting rights of a single class are allowed. Years ago the IRS viewed minor differences in how shareholders were treated as creating a second class of stock. For example, the IRS might have argued that giving one shareholder a company car without putting it on the W-2, while leaving the other shareholders carless, would create a second class of stock.

The IRS backed off this approach when it released the current "single class of stock" regulations in 1992. Tax Court Judge Holmes explains how it affected this shareholder (my emphasis):

The regulation gives us a little more help. It generally treats a corporation as having only one class of stock so long as all the shares confer equal rights to dividends and liquidation proceeds. Treas. Reg. §1.1361-1(l)(1) (“[A] corporation is treated as having only one class of stock if all outstanding shares of stock of the corporation confer identical rights to distribution and liquidation proceeds”).

...

Maggard argues that his new partners in Schricker were looting the company when they made unauthorized and grossly unequal distributions to themselves. The Commissioner says that doesn't matter, because the regulation tells the IRS to focus on shareholder rights under a corporation's governing documents, not what shareholders actually do. On this point, we have to side with the Commissioner. The regulation plainly states that uneven distributions don't mean that the corporation has more than one class of stock. Treas. Reg. §1.1361-1(l)(2) (“[A] corporation is not treated as having more than one class of stock so long as the governing provisions provide for identical distribution and liquidation rights. . . .”).

Decision for the IRS.

The moral? It's hard to blow an S election under the single-class-of-stock rule unless you change the corporate documents to create a different class of stock. That doesn't mean it's impossible; a nontrivial number of LLCs that have made S corporation elections have boilerplate partnership distribution rules in their operating agreements that endanger S corporation status. But an S corporation with actual corporate documents is unlikely to foot-fault to a second class of stock.

International Tax Corner

The Good, the Bad, and the Concerning (Part 3 of 3) The IRS Responds to TAS’s Most Serious Problem Recommendations - Erin Collins, NTA Blog. Erin Collins is the National Taxpayer Advocate. While part of the IRS, her role is to be the protector of taxpayer interests within the agency. Every year she makes a report to Congress with recommendations. She is displeased with the IRS response to her recommendations to stop automatically assessing $10,000 penalties for late filings of foreign reporting forms. These include Forms 5471 for controlled foreign corporations, 5472 for foreign-controlled corporations, and 8865 for controlled foreign partnerships. Her recommendation (emphasis mine):

In other words, the IRS automatically assesses penalties even though it mostly abates them. The IRS disagreed with the recommendation to stop automatically assessing the penalties. The Taxpayer Advocate was not happy:

Cara Benson, Eide Bailly's specialist in abating these penalties, agrees:

Related: Eide Bailly IRS Penalty Help

$2.9 Million FBAR Penalty Doesn’t Violate Eighth Amendment - Andrew Velarde, Tax Notes ($). "A $2.9 million foreign bank account reporting penalty levied against a Hong Kong businessman does not violate the constitutional ban against excessive fines, a district court held, following in lockstep with earlier decisions."

The R&D Sticking Point - Alex Parker, Things of Caesar. "Any way you approach it, the R&D credit is the stubborn sticking point, the roadblock that can’t be finagled around through creative diplomacy or political maneuvering. It’s not only the most consequential business tax credit in the U.S., but probably the most politically popular as well, with strong bipartisan support. Congress isn’t going to touch it. (Hence why CAMT specifically carves it out.) And it’s not going to convert it into a Pillar Two-favored refundable tax credit either, for reasons that seem obvious to U.S. policymakers but baffling to other countries, many of whom made that change without much fuss."

The post relates to the international "Pillar Two" system requiring a 15% effective tax rate on corporations.

Grounded By IRS: U.S. Passport Denied Or Revoked For Delinquent Taxes - Virginia La Torre Jeker, Forbes "Did you know that your U.S. passport could be denied, revoked, or not renewed if you owe significant back taxes?"

Italy doubles tax for wealthy foreigners - Amy Kazmin, Emma Agyemang, and Harriet Agnew, Financial Times. "The flat tax scheme, launched after the Brexit vote prompted many British-based Europeans to return home, allows new foreign residents to Italy, or Italians returning from at least nine years living abroad, to pay a flat tax on any foreign income or assets for 15 years."

Related: Eide Bailly Global Mobility Services.

Blogs and Bits.

Attention educational shoppers: Teachers can claim $300 in out-of-pocket classroom expenses - Kay Bell, Don't Mess With Taxes. "Qualifying educators (more on this in a minute) can deduct up to $300 of certain trade or business expenses that weren't reimbursed. If two married educators are filing a joint return, the limit rises to $600."

Tax Court Rejects $22 Million Easement Deduction Based on "Lost Development Rights" - Parker Tax Pro Library. "The Tax Court upheld the disallowance of a charitable contribution deduction claimed by a partnership based on its "lost development rights" resulting from an easement it granted over an historic office building that prohibited it from constructing a 34-story vertical addition on top of the building. The 34-story tower was in the court's view an unrealistic concept created to support a wildly inflated appraisal, and the court imposed a 40 percent gross valuation misstatement penalty after finding that the value of the easement claimed by the partnership exceeded its actual value by more than 200 percent."

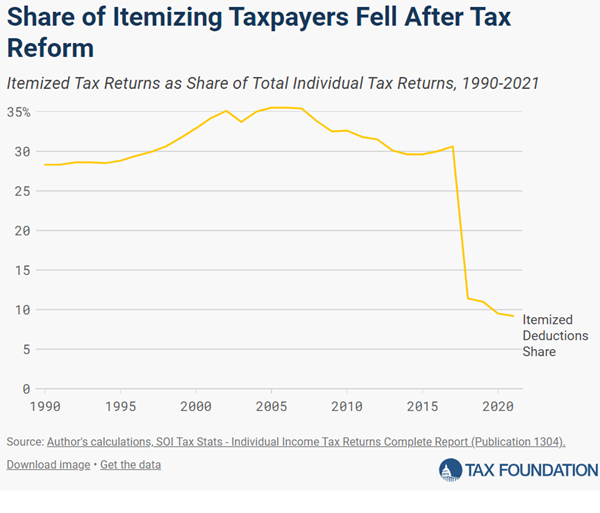

How Did the Tax Cuts and Jobs Act Simplify the Tax Code? - Alex Muresianu, Tax Policy Blog. "The TCJA shifted people to the simpler standard deduction thanks to a few major changes. First, the law nearly doubled the standard deduction, from $6,500 to $12,000 for single filers and from $13,000 to $24,000 for joint filers, both of which have since been indexed for inflation each year, while suspending personal exemptions. These changes were also connected to a broader reform of how the tax code treats families, which included an expansion of the child tax credit. The law also limited two major itemized deductions, capping the SALT deduction at $10,000 per taxpayer and reducing the limit on mortgage interest from interest on $1 million of principal to $750,000. It also eliminated miscellaneous itemized deductions."

Tax Crime Watch

Bookkeeper sentenced to 10 years after embezzling over $29 million - IRS (defendant name omitted. emphasis added):

According to court documents, Defendant, of Lewisville, admitted that starting in at least 2012, she abused her position as bookkeeper for the family’s companies and her signatory authority over the companies’ bank accounts to fraudulently write herself at least 175 checks, which she deposited into her personal accounts. To conceal her fraudulent conduct, she provided false paperwork to tax preparers misstating the year-end cash-on-hand numbers for the various accounts from which she was embezzling. She used more than $25 million of the stolen money to fund a construction business for which she was the president. She also used $6 million to pay off credit card debt.

That's a lot of embezzlement. Don't do that.

More importantly, don't make it easy to do that. Trusted employees can fall to temptation.

Related: The Impact of Internal Controls in Reducing Fraud Risk.

What day is it?

It's International Cat Day. Meow.

We're Here to Help