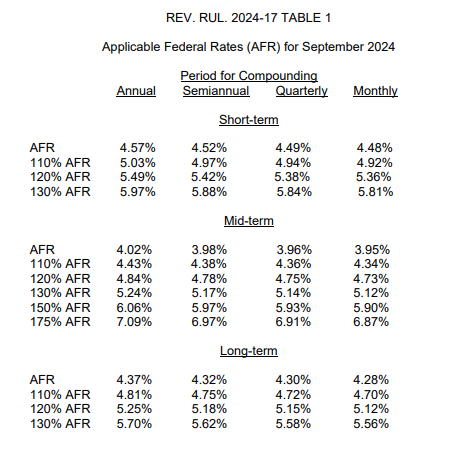

The IRS has released (Rev. Rul. 2024-17) the Applicable Federal Rates under Sec. 1274(d) of the Internal Revenue Code for September 2024. These rates are used for various tax purposes, including minimum rates for loans.

There are rates for "short-term," "mid-term," and "long-term" instruments. Short-term covers demand loans and instruments extending up to three years. Mid-term covers loans and instruments of over three years and up to nine years. Long-term covers loans and instruments with maturities longer than nine years.

The Section 382 long-term tax-exempt rate used to compute the loss carryforward limits for corporation ownership changes during September 2024 is 3.49%

The Section 7520 rate for September 2024 is 4.8%. Higher Sec. 7520 rates benefit Qualified Personal Residence Trusts (QPRTs) and Charitable Remainder Annuity Trusts (CRATs). Lower Sec. 7520 rates benefit Grantor Retained Annuity Trusts (GRATs), Charitable Lead Annuity Trusts (CLATs) and Private Annuities.

Related: Eide Bailly Mergers & Acquisition services; Eide Bailly Wealth Transition Services

Historical AFRs are available here.

We're Here to Help