Key Takeaways

- Lawsuit filed to force IRS to end ERC moratorium

- EV rules under fire in Congress

- Microcaptive promoter settles $11.6M penalty for $5.2M.

- Audit surge targets.

- Data leak update.

- Moving business to US? Tax planning is critical.

- Transfer pricing and the Batman/Joker rivalry

- BBQ Day!

Employee Retention Credit Adviser Urges Court to Lift Moratorium - Lauren Loricchio, Tax Notes ($):

Stenson Tamaddon LLC is seeking an injunction requiring the IRS to resume its processing of claims for the ERC, according to a complaint filed May 14 with the U.S. District Court for the District of Arizona.

“Ultimately this is about our clients, not us,” Stenson Tamaddon CEO Eric Stenson told Tax Notes. “The IRS has done a wrestling maneuver and has pinned tens of thousands of small businesses to the ground. We are asking the court to order the IRS to do its job and process claims.”

A moratorium on processing new claims was announced last September in response to a flood of questionable ERC claims. IRS Commissioner Werfel has said as much as 90% of the claims coming in at the time were fraudulent or ineligible. An IRS spokesman said this week that the moratorium has yet to be lifted. Meanwhile, the IRS continues to receive thousands of new claims weekly. These are just going into a pile.

Given the depth of information the IRS is requiring for ERC claims that it is processing, even an immediate lifting of the moratorium might have minimal effect, other than reviving the business of some ERC promoters.

Related: IRS Puts Temporary Hold On New ERC Claims

IRS News: EV rules, microcaptive penalty settlement, data breach, more.

Bipartisan group takes aim at EV rules - Laura Weiss, Punchbowl News:

...

The Treasury Department and IRS finalized rules earlier this month for new EV tax credits included in the Democrats’ 2022 Inflation Reduction Act. But critics like Manchin and Brown were quick to blast the regulations, arguing they give automakers too much flexibility on sourcing rules meant to force supply chains out of China.

Any such resolution would almost certainly face a presidential veto.

Deep Discount on $11.6M Penalty Ends Microcaptive Promoter Case - Chandra Wallace, Tax Notes ($):

The May 15 order grants judgment to the government for the entire penalty the IRS assessed against Clark in April 2021, but once the terms of a settlement agreement between her and the Justice Department are satisfied — including the $5.2 million payment — the government has agreed to mark the judgment paid in full.

The section 6700 penalty arises from Clark’s promotion and arrangement of multiple microcaptive insurance transactions between 2008 and 2016, according to the IRS and court documents.

To be sure, when "victory" means paying a $5.2 million dollar penalty, you can get tired of winning in a hurry.

IRS says its number of audits is about to surge. Here's who the agency is targeting. - Aimee Picchi, CBS News:

-Large partnerships with assets of more than $10 million will see their audit rates increase 10-fold, rising to 1% in tax year 2026 from 0.1% in 2019.

-Wealthy individuals with total positive income of more than $10 million will see their audit rates rise 50% to 16.5% from 11% in 2019.

IRS Offers Update On Contractor Data Leak, Touts New Taxpayer Protections - Kelly Phillips Erb, Forbes ($). "Earlier this month, the IRS began notifying more taxpayers impacted by the Littlejohn data breach. Former IRS contractor Charles Littlejohn illegally accessed and distributed to certain news organizations the private tax information of corporate and wealthy individual taxpayers, including former President Donald Trump and fellow billionaires Elon Musk, Jeff Bezos, Warren Buffett and Michael Bloomberg. The IRS is required, by law, to give notice to any other victims of the breach it can identify, even if their names were never published."

The Treasury Inspector General for Tax Administration says that Littlejohn uploaded the stolen data to a private website. This would presumably make such a move more difficult.

Child Support Program Not at Risk for Tribes, IRS Says - Benjamin Valdez, Tax Notes ($):

“Contrary to published reports, Native American Tribes’ access to federal tax payment offsets through arrangements with states has not changed,” the agency said in a statement released May 14.

Blogs and Bits

Retirement plan tax rules when using the savings to recover from a disaster - Kay Bell, Don't Mess With Taxes. "Prior to the changes made by SECURE 2.0, there was no general disaster relief regarding retirement plan distributions and loans. Instead, Congress had to act separately, on a disaster-by-disaster or year-by-year basis, to provide relief to those in major disaster areas."

IRS Finalizes Proposed Generation-Skipping Transfer Tax Regulations Proposed in 2008 - Parker Tax Pro Library. "The IRS issued final regulations that provide guidance describing the circumstances and procedures under which an extension of time will be granted to make certain allocations and elections related to the generation-skipping transfer (GST) tax. The guidance affects individuals (or their estates) who failed to make a timely allocation of GST exemption, a timely election out of the GST automatic allocation rules, or certain other timely GST elections."

Related: Eide Bailly Wealth Transition Services.

Social Security Administration Announces Most Popular Baby Names Of 2023 - Kelly Phillips Erb, Forbes ($). "Once again, the most popular names for babies born in the United States are Liam and Olivia."

Tax Court's 2025 Budget Justification - Keith Fogg, Procedurally Taxing via Tax Notes. Quoting the Tax Court budget document: "In FY 2024, the Court expects to introduce DAWSON functionality that will permit taxpayers to electronically commence their case with an online form by responding to a series of prompts and questions that results in a completed electronic petition form. This will provide greater access to taxpayers who may not have the ability to complete a PDF and upload the document electronically. Further, the Court anticipates improving payment of the filing fee by integrating Pay.gov payment options and processing within DAWSON."

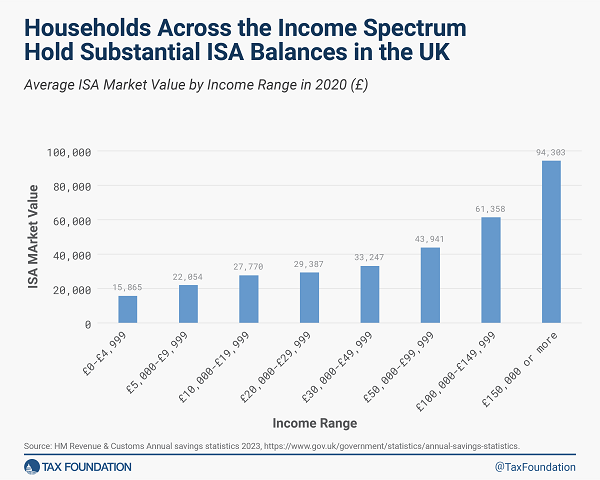

America Should Learn from Successful Universal Savings Policy Across the Pond - Garrett Watson, Tax Policy Blog:

Individual savings accounts began as personal equity plans (PEPs) in 1986, which were intended to broaden investment opportunities for savers in the UK. The PEPs originally allowed for contributions up to £2,400 annually. In 1999, the PEPs were replaced by ISAs, and the maximum annual contribution was increased several times to £20,000 (about $25,000) annually in 2024. ISAs supplement the UK’s retirement savings system, which includes pensions that operate like U.S. traditional 401(k) plans.

International Tax Corner

Entrepreneurs Moving to the US Skip Tax Planning at Their Peril - Shannon Smith, Eide Bailly via Bloomberg:

The corporate and individual tax issues involved with entrepreneurs moving to the US can be overwhelming, costly, and prevent a successful entry. With proper planning, these issues can be avoided or mitigated.

The Arm's-Length Standard and Formulary Apportionment - Alex Parker, Things of Caesar:

Two diametrically opposed, mutually incompatible systems, almost like religions to their adherents and advocates on both sides, who passionately argue against each other for their preferred visions of global taxes.

And yet, in the past decade–and especially since the Organization for Economic Cooperation and Development’s two projects on international tax avoidance–the two philosophies have been forced into an awkward embrace.

3 Key Takeaways From Floated Foreign Trust Reporting Rules - Natalie Olivo, Law360 Tax Authority ($). "Under the proposed Section 6039F anti-avoidance rule, the Internal Revenue Service could recharacterize purported loans and other transfers from foreign trusts as gifts if the agency determines the transfer 'is in substance' a gift, Treasury said in the guidance's preamble. Under Section 6039F, undisclosed large gifts from foreign individuals could result in penalties of up to 25% of the gift."

Related: Eide Bailly Foreign Trust & Estate Tax Compliance & Planning

No U.S. Tax Honeymoon When Americans Marry Non-U.S. Citizens - Virginia La Torre Jeker, Forbes. "Beyond the romantic bliss, this union introduces various complex U.S. tax considerations not faced when both partners are U.S. citizens."

How to File Taxes If Spouse Does Not Have SSN or ITIN - Kasia Strzelczyk, 1040Abroad. "No, you cannot file as single if you are married to a nonresident alien. Understanding your household filing status is crucial, especially when married to a nonresident alien, as it affects your tax obligations and benefits. Once you are married, you must file as either Married Filing Jointly or Married Filing Separately."

It’s Time to Defund the OECD - Adam Michel, Liberty Taxed. "President Biden’s Treasury Department has been the key driver of the Organisation for Economic Co‐operation and Development’s (OECD’s) project to create a global tax system that raises the cost of international investment and taxes the most profitable American companies. As the global tax begins to be implemented around the world, it has become clear that the administration negotiated a bad deal for American businesses, their employees, and the US Treasury."

Tax Crime Corner

Trucking company operator indicted for tax evasion - IRS, defendant name omitted, emphasis added:

According to the indictment, Defendant set forth a plan to phase out Martin Logistics after it became burdened with tax debt in order to make herself, and Martin Logistics, uncollectable to the Internal Revenue Service. Defendant directed one of her employees to open a new company, TSA Transportation, which would serve as Defendant’s nominee trucking business. Beginning January 2013, contracts for trucking services were primarily bid under TSA Transportation’s name, but the income TSA Transportation received was directly deposited into a bank account for another entity that Defendant owned and controlled.. In addition, Defendant placed Martin Logistics’ assets, including trucks and trailers, into the name of yet another Defendant-owned company, Martin Global.

...

Defendant regularly failed to file individual and corporate tax returns related to her trucking entities or and failed to pay the taxes on her income. Defendant also made several misrepresentations to the IRS related to the finances of Martin Logistics. After her fraudulent scheme was discovered, Defendant caused several more misrepresentations to be made to the IRS related to the filing status of her income tax returns.

IRS trouble often begins when the agency realizes a taxpayer hasn't been filing. IRS computers eventually can notice this through payroll tax returns, third party information returns, and, in the case of trucking companies, fuel tax and other filings. The agency will get better at this as their technology upgrades continue. Things can get ugly when the agents feel the taxpayer is being misleading.

Taxpayers behind on their filings should get caught up. Hire a tax pro to help, and let the pros deal with the IRS.

Related: Eide Bailly IRS Exam Assistance.

What day is it?

It's National BBQ Day! "In fact, George Washington’s diary is said to have referenced a barbecue event that lasted for three days — that’s how deeply rooted barbecuing is in the country’s history!"

Make a habit of sustained success.