Key Takeaways

- Fuel tax scammers make IRS "Dirty Dozen."

- KC stadium tax referendum fails.

- Arizona suit to stop tax on 2023 rebates "unlikely to win."

- Tax time is scammer time.

- IRS Direct File use falls short of expectations.

- Bozeman contractor pleads to payroll tax crime.

- National Chocolate Mousse Day.

The Internal Revenue Service today warned taxpayers to watch out for promoters who push improper Fuel Tax Credits claims in the fourth day of the 2024 Dirty Dozen list of tax scams.

The Fuel Tax Credit is available only for off-highway business and farming use and not for most taxpayers. But the IRS continues to see instances where unscrupulous promoters or return preparers mislead taxpayers about fuel use and create fictitious documents or receipts for fuel.

The IRS has seen an increased number of fictitious claims for fuel tax credits on Form 4136, Credit for Federal Tax Paid on Fuels. By claiming the fuel tax, these promoters are looking out for their own financial interests by charging the taxpayers inflated fees. But taxpayers should realize the IRS has heightened scrutiny on this scam, and people claiming it improperly risk future compliance action by the IRS.

This is not the same thing as the Biodiesel and Renewable Diesel Income Tax Credit.

Voters Reject Stadium Tax for Royals and Chiefs, Leaving Future in KC in Question - Associated Press via US News & World Report. "Royals owner John Sherman and Chiefs president Mark Donovan acknowledged long before the final tally that the initiative would fail. More than 58% of voters ultimately rejected the plan, which would have replaced an existing three-eighths of a cent sales tax that has been paying for the upkeep of Truman Sports Complex — the home for more than 50 years to Kauffman and Arrowhead Stadiums — with a similar tax that would have been in place for the next 40 years."

Tax Season Tidbits

Arizona Unlikely to Win Early Bid to Bar IRS From Taxing Rebates - Perry Cooper, Bloomberg ($):

The state argues the IRS is treating Arizona’s rebates differently than it treated similar rebate programs in 21 other states and wants an injunction to stop the IRS. Judge G. Murray Snow of the US District Court for the District of Arizona questioned why that poses a redressable injury to the state and not just to individual residents who may incur federal income tax liability.

“I think the state is going to struggle to establish standing here, and that is a real issue,” Snow said.

Tax time is prime time for scammers and scheming tax preparers - Michelle Singletary, Washington Post:

But soon the IRS will have in place a system that could be extraordinarily helpful in protecting people from scammers impersonating the agency, according to IRS Commissioner Danny Werfel.

This is how it would work. If you get an email, call or text message, all you have to do is go to your IRS online account. Once you sign on, a green banner will indicate the agency is not trying to reach you. It will be a clear and easy way to verify whether someone is trying scam you.

But beware of scammers trying to "help" you set up your IRS account.

IRS direct file program struggles to find users after late launch - Tobias Burns, The Hill:

With two weeks until the 2024 tax deadline, only around 50,000 people have used the IRS’s new direct file online filing system, a number well shy of the hundreds of thousands the agency anticipated for this tax year in early projections.

While the IRS has pushed hard to alert taxpayers of the direct file system across the 12 pilot states where it’s being made available, the modest uptake is raising eyebrows about the rollout and leaving experts wondering why the program wasn’t launched at the beginning of tax season in January.

The article quotes Leslie Book:

“The product and technology is limited in terms of the number of taxpayers that are eligible to use it, at least in terms of this version of the pilot. But it seems to be a very user-friendly product, which is a promising start. It’s a good way for the government to test what works,” Villanova University law school professor Leslie Book, who has worked with the IRS’s taxpayer advocate service, told The Hill.

Tax software is hard to do well. Tax pros pay a lot for their software, and even the best comes out slowly during the tax season with constant upgrades to fix glitches and incorporate late tax law changes. It's hardly surprising that an IRS program started from scratch hasn't taken the market by storm in its first year.

The real problem is the tax law. Congress continues to use the tax law as the Swiss Army Knife of public policy, dealing with everything from child poverty to climate change. Until this approach changes drastically, the IRS will never be able to provide software for all taxpayers, let alone pre-filled returns.

25% of Gen Zers say they’ll need a therapist to deal with tax filing stress—here’s the first step to take to make it easier - Annie Probert, CNBC. "In fact, 1 in 4 Gen Z taxpayers said they’ll need a therapist to deal with the stress of tax-filing season, according to a recent Cash App Taxes survey. Additionally,54% said filing taxes has either brought them to tears in the past or expect it to this year."

I'll just say I question the survey methodology. Expletives? Of course. But tears? Therapists? Not the Gen Z I know.

In other news

IRS claws back money given to businesses under fraud-ridden COVID-era tax credit program - Mae Anderson, Associated Press:

The IRS said it received $225 million from a voluntary disclosure program, which ended on March 22, that let small businesses that thought they received the credit in error give back the money and keep 20%. That money came from over 500 taxpayers with another 800 submissions still being processed.

An ongoing program that lets small businesses withdraw unprocessed claims has led to 1,800 businesses withdrawing $251 million worth of claims. And finally, the IRS has assessed $572 million in audits of more than 12,000 businesses that filed over 22,000 improper claims.

Employee vs. Independent Contractor: DOL Issues New Guidance - Ashley Akin, Tax School Blog. "Given the updated guidance, a greater number of individuals presently categorized as independent contractors will be reclassified as employees. This shift entitles these employees to specific protections, including overtime wages and the minimum wage. They may also become eligible for retirement benefits or healthcare insurance."

IRS has started auditing some ERC claims - National Association of Tax Professionals. "The audit letters appear to be separate from the round of 20,000 letters the IRS said it was issuing in January to notify taxpayers that their ERC claims had been disallowed. The IRS said the initial round of letters focused on entities that did not exist or did not pay employees during the eligibility period."

Related: IRS Puts Temporary Hold On New ERC Claims.

Supreme Court Hears Tax Case That Could Significantly Impact Small Businesses - Kelly Phillips Erb, Forbes($)

Remember when I noted that life insurance is included in the gross estate if it's owned by the decedent? That's not the case here. The life insurance policy proceeds were payable to the corporation, so under section 2042 of the code, the life insurance proceeds are not on their own subject to federal estate tax.

However, since the life insurance was owned by and payable to the company, the IRS took the position that the $3 million in life insurance proceeds used for redemption should have been included in the value of the decedent’s stock shares. The IRS claimed the value of those shares was approximately $5.3 million.

Blogs and Bits

April 15 is not Tax Day for taxpayers abroad and in 11 states - Kay Bell, Don't Mess With Taxes. "You do, however, need to attach a statement to your return explaining that you live and conduct business in another country or are posted by the military abroad. That will alert the Internal Revenue Service to apply the June deadline to your return."

Note that you have to be actually living abroad to qualify for the June deadline. A quick April trip to Puerta Vallarta doesn't get it done.

Bozo Tax Tip #8: No Tax Form, No Income! - Russ Fox, Taxable Talk. "I explained to him that his uncle was correct in that many individuals do receive income ‘under the table’ and don’t report it. I also explained to him that not filing a tax return when you have income is a crime, and you can go to ClubFed for it. It’s a lot easier to file and pay your taxes and sleep peacefully at night then to do the opposite. My client agreed, and his return was filed."

How to Classify Activities for Tax Purposes - Thomas Gorczynski, Tom Talks Taxes. "The type of Form 1099 received by the taxpayer has no bearing on an activity’s classification. The payer lacks sufficient information to determine the taxpayer’s involvement level and profit motive in their own affairs."

Majority of Professor's Stock Sale Does Not Qualify for Preferential Tax Treatment - Parker Tax Pro Library. "The Court of Federal Claims held that a large portion of Dr. Ju's stock was not eligible for treatment as qualified small business stock under Code Sec. 1202 because it was transferred to Dr. Ju within five years of when he sold it. The court noted that both the settlement agreement and the stock certificate indicate that 53,441 shares of stock were issued to Dr. Ju in 2015, not at the time of original issuance and that Dr. Ju sold those shares in 2016, less than five years later."

Related: How to Receive Full Gain Exclusion with Qualified Small Business Stock.

Tax Policy Corner

Does the Federal Tax Code Privilege the Rich? - Noah Peterson, Tax Policy Blog:

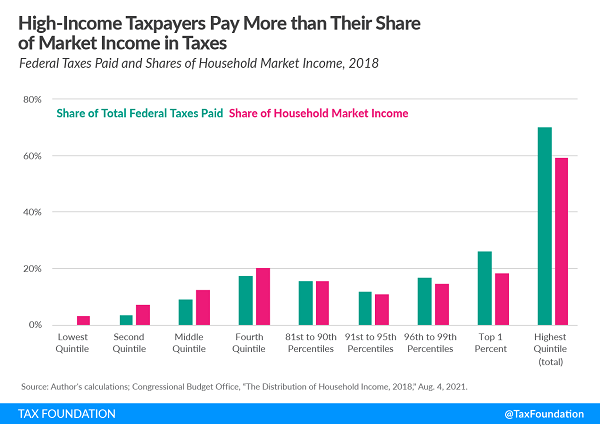

The federal tax system consists of individual, corporate, payroll, excise, and estate taxes. Some tax types are progressive (meaning people with higher incomes pay higher rates) while others are regressive (people with lower incomes pay higher rates). But taken together, the overall federal tax system is progressive.

This is because the rich have more of the country’s income, right? Not exactly. High earners actually pay more in taxes than their share of the country’s income and are subject to higher tax rates on their income.

The Home Mortgage Interest Deduction Reinforces Racial Disparities - Janet Holtzblatt, Robert McClelland, and Gabriella Garriga, TaxVox. "Consequently, while about three-quarters of White families owned their homes in 2019, only 45 percent of Black and 48 percent of Hispanic families did. And through most of the income distribution, White families are also more likely to pay interest on mortgages, thereby benefiting from the deduction."

Tax in the courtroom

Return Preparer and Businesses Permanently Enjoined, Ordered to Disgorge Gains From Fraudulent Return Preparation - Bloomberg ($). From the judge's opinion & order:

The evidence also supports the conclusion that Defendants prepared returns reporting fake Schedule C businesses and/or business expenses. Hawkins [manager of one of the enjoined preparation shops] testified that preparers were trained to change customers’ Schedule C forms to “put in the amount that would get [the customer] the most money back.” Trial Tr. V.4 at 31. She detailed how this was done by adding fake businesses if the customer had income below the maximum EITC range or adding fake business expenses if the customer had income above the maximum EITC range.

So that's not allowed. Remember, the biggest refund doesn't always identify the best preparer.

Bozeman construction company owner admits failing to pay payroll, withholding taxes of more than $800,000 to IRS - IRS (Defendant name omitted, emphasis added):

The owner of a Bozeman construction company accused of not paying to the IRS employee-related taxes of more than $800,000 admitted to tax crimes today, U.S. Attorney Jesse Laslovich said.

The defendant... pleaded guilty to failure to truthfully account for and pay over withholding and FICA taxes, a felony, and failure to file employer’s quarterly return and pay tax, a misdemeanor. Defendant faces a maximum of five years in prison, a $250,000 fine and three years of supervised release.

...

The government alleged in court documents that Defendant is the owner of Alpine Customs, Inc., a commercial construction company that has employed 60 or more individuals. Defendant acted as Alpine’s general manager and exercised control over every aspect of the business, including approving company payments and overseeing company bank accounts. Alpine withheld payroll taxes from employees’ paychecks, including federal income taxes and Social Security and Medicare taxes. Alpine also was required to make quarterly deposits of those payroll taxes and additional employer payroll contributions to the IRS.

Defendant did not timely deposit several employee or employer payroll taxes from 2018 to 2021. Defendant knew of the requirements and his bookkeepers and IRS officers repeatedly advised Defendant of these legal obligations. In total, Defendant failed to timely pay $803,374 in employer and employee payroll taxes.

Financing business operations with unremitted payroll taxes is a terrible idea. Even bankruptcy probably doesn't get you off the hook for paying them. And it doesn't take that much to turn it into jail time.

What day is it?

We're Here to Help