Key Takeaways

- This won't pass this year.

- Higher taxes on "corporations and wealthy."

- $1 million comp deduction cap for all C corporations.

- Capital gains hikes.

- TPAs would get ACA penalty exposure.

- Meanwhile, Senators "close to meeting" on House-passed tax bill.

- IRS broadens access to Direct File.

- When a tax preparer's documentation falls short.

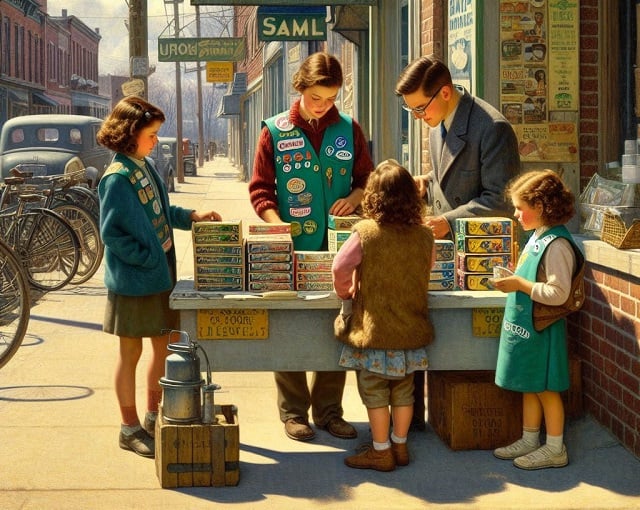

- Girl Scout Day.

Biden Budget Seeks More Aid for Families, Higher Taxes on Wealthy Households, Corporations - Andrew Restuccia, Andrew Duehren, and Richard Rubin, Wall Street Journal:

The proposal isn’t expected to gain momentum in Congress, but will be a cornerstone of Biden’s re-election campaign as he looks to contrast his economic policies with those of presumed Republican presidential nominee Donald Trump. The administration has yet to reach an agreement with Congress on the budget for the current fiscal year, which began Oct. 1, and House Republicans have blasted Biden’s new proposal as reckless.

...

The budget repeats many past Biden tax-increase proposals, including higher tax rates on corporations and high-income individuals along with minimum taxes on the wealthiest Americans’ unrealized capital gains. Biden rolled out several new tax increases last week, such as raising his new corporate alternative-minimum-tax rate to 21% from 15% and denying deductions when corporations pay any workers, not just top executives, more than $1 million.

Biden Calls for Higher Taxes on Corporations and the Wealthy - Alan Rappeport, New York Times:

Mr. Biden wants to raise the tax rate on capital gains such as stock sales for individuals who earn more than $400,000 to 39.6 percent. He also reiterated calls to close the so-called carried interest loophole that allows wealthy hedge fund managers and private equity executives to pay lower tax rates than entry-level employees.

The budget also includes another attempt at a version of a wealth tax, a complex concept that has long been an ambition of progressives.

The proposal would impose a 25 percent “billionaire tax” on individuals with wealth, defined as the total value of their assets, of more than $100 million.

White House Targets Million-Dollar Pay by Private Companies - Chandra Wallace, Tax Notes ($):

The White House wants to expand the $1 million limitation on tax deductions taken by public companies for top executives’ compensation by applying it to any employee of privately held C corporations.

The Biden administration’s fiscal 2025 budget proposal would disallow deductions “for all compensation over $1 million paid to any employee of a C corporation” — a change from current law, which denies the deductions “only for a small number of highly paid employees at publicly-traded C corporations,” according to the budget proposal, released March 11.

Capital Gains Hikes at Center of Biden’s Second-Term Tax Agenda - Laura Davison, Lauren Vella, and Erin Schilling, Bloomberg ($):

Biden is proposing to increase the 3.8% Medicare tax to 5% for those earning at least $400,000 to shore up the program’s trust fund. That would mean the richest taxpayers would pay a 44.6% federal rate on investment income and other earnings.

The plan also calls for taxing assets when an owner dies, ending a benefit that allowed the unrealized appreciation to go untaxed when transferred to an heir.

Treasury Seeks to Shift Health Plan Tax Liability - Caitlin Mullaney, Tax Notes ($):

The Biden administration has proposed amending the excise tax on employment-based group health plans to shift liability for noncompliance with IRS requirements to third-party administrators (TPAs) when applicable.

...

Employers are liable for a daily $100 excise tax for each day their health plan fails to comply with the list of required standards in section 4980D, but the TPAs that administer plans on behalf of employers face no liability. The green book explains that transferring the liability to TPAs when applicable “would make the excise tax more effective and increase compliance.”

Related: Eide Bailly Affordable Care Act Compliance & Consulting

What about the bill passed by the House in January? The bill that would restore deductions for domestic research costs and 100% bonus depreciation for 2023 filings due this week? Brendan Pedersen and Laura Weiss of Punchbowl news report: "Meanwhile, House Ways and Means Committee Chair Jason Smith (R-Mo.) was in the Senate again Monday night for meetings with GOP senators. Smith told us he’s getting close to meeting with most of the conference to discuss his bill."

"Close to meeting" doesn't sound like they are in a big hurry.

Elsewhere in tax

IRS Tax-Filing Pilot Opens Wide, With Aim of 100,000 First-Year Users - Richard Rubin, Wall Street Journal ($). "The system—IRS Direct File—is now open round-the-clock to all eligible taxpayers after a narrower pilot phase that started earlier this year with selected government employees. It is still available only to households with relatively simple tax returns in 12 states; the 15,000 figure includes people who have started returns but not finished them yet."

The IRS estimates that itwill receive 128.7 million 1040s this season overall.

CPAs Call For Broad Guidance On Excess Business Losses - Jared Serre, Law360 Tax Authority ($). . "The AICPA made suggestions relating to seven subjects, including definitions of business terms, treatment of certain gains, losses and other plans and the section's application to trusts and estates."

Link: AICPA recommendations.

Blogs and bits

Beware of products touted as eligible for tax-favored medical savings plans - Kay Bell, Don't Mess With Taxes:

There are several different inaccurate tax claims by these companies.

One seen frequently is the mistaken contention that notes from doctors based merely on self-reported health information can convert non-medical food, wellness, and exercise expenses into tax deductible medical expenses. Not true, says the IRS.

Taxpayer's Refund Request on Amended Return Was Untimely, Court Finds - Parker Tax Pro Library. "The taxpayer argued that the amended return was meant to clarify an earlier amended return, but the court found that the later amended return provided an entirely new basis for the refund and therefore was a new refund request."

There’s Still Time To Get A Covid-Related Tax Rebate Payment - Amber Gray-Fenner, Forbes. "Taxpayers eligible for recovery rebate credits for tax year 2020 have until May 17, 2024, to file a tax return to claim the payment."

Tax Policy Corner

Capital Gains Tax Rates in Europe, 2024 - Alex Mengden, Tax Foundation:

A number of European countries do not levy capital gains taxes on the sale of long-held shares. These include Belgium, the Czech Republic, Georgia, Luxembourg, Malta, Slovakia, Slovenia, Switzerland, and Turkey. Of the countries that do levy a capital gains tax, Moldova levies the lowest rate, at 6 percent, followed by Bulgaria and Romania, at 10 percent each.

On average, the European countries covered tax capital gains arising from the sale of listed shares at 17.9 percent. Across EU Member States, the average lies at 18.6 percent.

Denmark's 42% rate is the highest in Europe. The Biden budget proposes a 44.6% top rate, excluding state taxes. The linked post has an interactive map showing rates in 35 European countries.

Biden's Budget Would Impose Trillions in New Taxes - Demian Brady and Joe Bishop-Henchman, National Taxpayers Union Foundation. "Despite Biden's rhetoric that the rich are not paying their 'fair share' the tax code is very progressive. In Tax Year 2021, recently released by the IRS, the top 1 percent of earners paid nearly 46 percent of all income taxes, the highest level reported in the data that NTUF has gathered since 1980. In that year, the top earners paid 19 percent of all taxes. Even as tax reforms since then lowered the top marginal tax rates, the wealthy have borne a larger share of the income tax burden."

Tax in the courtroom

Suburban Chicago businessman sentenced to two years in prison for evading $3.7 million in income taxes - IRS (Defendant name omitted):

Defendant served as the president of World Security Bureau, a Chicago-area security firm that did business as World Security Agency. From 2010 through 2013, Defendant concealed his wages, compensation, and income from being reported to the IRS. Defendant directed the individual in charge of payroll to stop issuing payroll checks to Defendant and to instead pay him in the form of checks falsely categorized as “subcontracted services.” Defendant also caused the business to pay a wide range of personal expenses which Defendant caused to be falsely identified as business expenses.

Defendant failed to report approximately $10 million in income that he received, resulting in a tax loss to the U.S. and State of Illinois totaling approximately $3,708,065.

On the bright side, he will get two years of specialized security experience.

Careless Recordkeeping Leads to Penalty - Tax Notes ($). "The Tax Court, in a summary opinion, allowed some of a return preparer’s phone and transportation expense deductions that were disallowed by the IRS and upheld accuracy-related penalties, finding that she was careless in her recordkeeping and as a professional return preparer, she was familiar with the substantiation requirements for business deductions."

It's hard for me to look away when a tax preparer ends up losing deductions in Tax Court. While the IRS conceded some deductions, the taxpayer had a documentation problem. From the Tax Court opinion (taxpayer name omitted, emphasis added):

Moreover, the likelihood that some indeterminate portion of Taxpayer's reported vehicles costs was actually incurred for nonbusiness uses is exacerbated by the fact that her receipts show two or three same-day gas purchases on at least ten different days — days on which neither of the mileage logs shows an excessive number of miles driven. At trial, the Commissioner's counsel confronted Taxpayer with ten instances where, in the receipts she submitted to the Court, she identified two separate purchases on the same day as having been made for fuel. (In one case the number of purported same-day fuel purchases was three.) Taxpayer's records also identify a purchase for gas in Kings Mill, Ohio, on July 9, 2015, a date when both the MileIQ log and the modified mileage log indicate that she was in the Washington, D.C., area for a conference hosted by the IRS. In response to these various incongruities, Taxpayer speculated that [an employee] may have sometimes purchased gas using one of Taxpayer's debit or credit cards for a car owned by [an employee] or a third party, without Taxpayer's knowledge or permission.

The preparer didn't lose all of her deductions. She had enough documentation to support $6,669 of the $15,385 in travel deductions claimed on her return. Still, it was not enough to avoid the 20% "accuracy-related" penalty. The court noted that she "was almost surely familiar with the substantiation requirements for business deductions, given her professional experience as a tax preparer."

Related: the cobbler's barefoot children.

What day is it?

Cookies! It's National Girl Scout Day.

We're Here to Help