Key Takeaways

- SALT workarounds perplexing preparers.

- New sourcing rules for trucking?

- "State Flat Tax Revolution."

- Kansas moves towards single-factor apportionment.

- New Mexico reform package heads to governor.

- $288 million dollar move from Washington state to Florida.

- Tax credit for electric mowers and snowblowers?

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs.

Long Wait for IRS Guidance on SALT Workarounds Concerns Tax Pros - Angélica Serrano-Román, Bloomberg ($):

The IRS has no plans right now to issue additional guidance on the devices states have implemented to get around the 2017 tax law’s limit on state and local tax deductions, despite assurances the agency gave more than three years ago.

The lack of an update is leaving tax practitioners without clear direction in navigating the workaround regimes, although they have asked the IRS repeatedly.

The article points out some of the uncertainty involved in deducting payments under state pass-through entity tax (PTET) systems. These systems allow partnerships and S corporations to pay taxes on income that would normally be taxed only to partners and shareholders. In most of these PTET states, the entity awards a state tax credit to the owners for an amount approximating the entity tax to prevent double taxation.

Federal tax uncertainties relate to the timing and reporting of deductions and refunds arising from pass-through entity taxes. Among the issues tax pros are wrestling with this season:

- Timing of deductions when taxpayer elections to opt into entity level taxes aren't made until after the year for which the tax is paid.

- Reporting of deductions on entity returns under the limited IRS guidance.

- Issues relating to 1040 reporting for recipients of K-1s showing the deductions, including passive loss allocations, self-employment tax, and qualified business income.

- Nature and amount of taxation of tax refunds arising from tax credits received by partners and S corporation owners.

MTC Group Will Create Alternative Trucking Sourcing Rule - Michael Nunes, Law360 Tax Authority ($):

An alternative rule that would source trucking receipts to deliveries will be drafted after a work group of the Multistate Tax Commission voted Thursday to have its staff create a proposal, despite claims from some members that it would create more disharmony among states.

The MTC's Model Receipts Sourcing Regulation Review Work Group approved a motion to allow its staff to formulate an alternative to the current mileage-based sourcing rules for trucking company receipts, with four states voting in favor, one dissenting and another abstaining. The majority of the members didn't cast a vote during the meeting.

Apportionment by delivery location would be popular with high-population states, while the current rules based on miles traveled in-state would be popular with everyone else. That means trucking companies would likely face multiple taxation on the same income.

State Tax and Economic Review, 2023 Quarter 3 - Lucy Dadayan, Tax Policy Center. "Total state government tax revenue collections declined 1.2 percent in nominal terms and 4.3 percent in real terms in the third quarter of 2023 relative to a year earlier. The inflation-adjusted growth rates differed significantly across key revenue sources in the third quarter of 2023. Personal income tax revenues declined 2.9 percent, corporate income tax revenues declined 0.3 percent, sales tax revenues decreased 1.5 percent, and motor fuel tax collections increased 10.6 percent compared to the same period a year earlier."

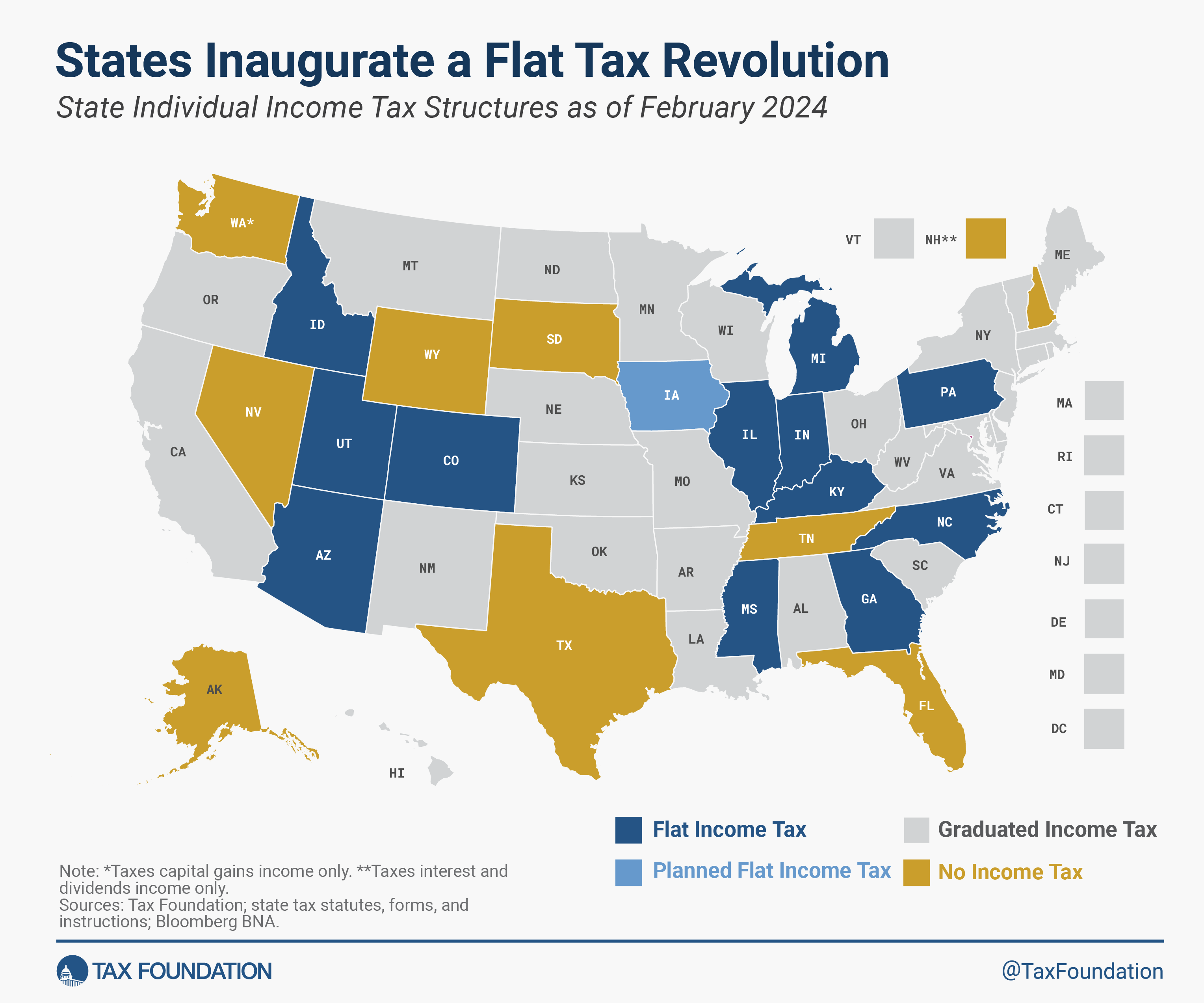

The State Flat Tax Revolution: Where Things Stand Today - Jared Walczak and Katherine Loughead, Tax Policy Blog. "Currently, 12 states have a flat individual income tax structure, while nine states do not levy an individual income tax on wage or salary income at all. Twenty-nine states and the District of Columbia have a graduated-rate tax structure, but one of these states (Iowa) is currently in the process of phasing in a flat tax."

State-By-State Roundup

California

Calif. Judge Stands Firm On Voiding Biz Tax Shield Guidance - Maria Koklanaris, Law360 Tax Authority:

California may not enforce its updated guidance on how the state should handle in the internet age a 1959 federal law that insulates businesses from tax on net income if the solicitation of tangible personal property is their only connection to the state, a California judge reaffirmed.

...

"The motion verges on the frivolous," Judge Schulman wrote in the order, upholding his December judgment in favor of a trade association advocating for remote sellers, later adding, "The FTB's motion is feckless."

Connecticut

Connecticut Governor Calls for 'Tax Fairness for Remote Workers' - Matthew Pertz, Tax Notes ($). "Lamont's fiscal 2025 budget adjustments, issued February 7, would provide a tax credit for residents who successfully challenge the denial of a New York income tax refund for remote work performed in Connecticut for New York-based companies. The incentive would be a 50 percent credit against any additional tax owed to Connecticut as a result of properly sourcing their income."

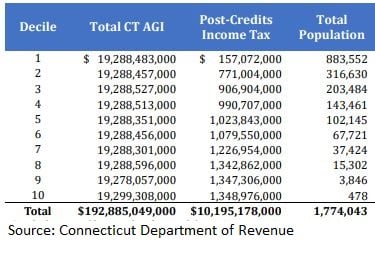

2023 Connecticut Tax Incidence Study: Tax Years 2011 - 2020 - Connecticut Department of Revenue. This report shows, among other things, how income taxes were paid by income class. 478 individuals (.0269% of taxpayers) paid 13% of income taxes paid in the state in 2020.

Idaho

Idaho Lawmakers OK Tax Break For Tribe Members' Income - Zak Kostro, Law360 Tax Authority ($). "Idaho would exempt from taxation income earned on Native American reservations by registered members of tribes who live outside the state under clarifying legislation unanimously approved by state lawmakers and headed to the governor."

Link: H.B. 410

Kansas

Kan. Bills Would Require Single Sales Factor For Biz Income - Jaqueline McCool, Law360 Tax Authority ($). "H.B. 2796, introduced Monday by the state House Committee on Taxation on behalf of the Kansas Department of Revenue, and S.B. 507, introduced Tuesday by the state Senate Committee on Assessment and Taxation, would switch the state to single-sales-factor apportionment from its current three-factor apportionment method. The change would bring the state in line with the Multistate Tax Commission's tax compact. "

COST, NTU: Kansas Safe Harbor Bill Would Ease Withholding Burdens - Emily Hollingsworth, Tax Notes ($):

A Kansas bill that would exempt nonresident employees who work in the state for fewer than 30 days would bolster state economic activity and curb insignificant tax obligations, according to the Council On State Taxation and the National Taxpayers Union (NTU).

In February 14 letters to the House Taxation Committee, COST and the NTU expressed support for H.B. 2420, which would create a withholding safe harbor for nonresident employees who work in Kansas for 30 days or fewer. It would also exclude employers from income tax withholding requirements for those employees.

Massachusetts

Boston Faces $1 Billion Tax Deficit From Faltering Office Market - Brooke Sutherland, Bloomberg ($). "The persistence of Covid-era remote work policies and higher interest rates has eroded demand for offices across the country, particularly for older buildings and those in less desirable areas. About 15.8% of downtown office space in Boston was vacant in the fourth quarter of 2023, more than double the pre-pandemic rate, according to data from CBRE Group Inc."

Missouri

Mo. House Committee Backs Phaseout Of Corp. Tax - Michael Nunes, Law360 Tax Authority ($). "The state House of Representatives' Special Committee on Tax Reform voted to pass H.B. 2274, which would phase out the state's 4% corporate income tax. The bill seeks to eliminate the tax by 2028 by reducing the rate by 1 percentage point every year. While Republicans argued that eliminating the tax would make Missouri more attractive to businesses, critics said that further cuts would negatively impact the state's budget."

Mo. Senate Panel OKs Tax Credits For Office Conversions - Zak Kostro, Law360 Tax Authority ($). "S.B. 792, which the committee approved Monday, would allow a credit against a property owner's state tax liability equal to 25% of qualified conversion expenditures incurred for converting nonresidential real property from office use to residential, retail or other commercial use, according to the text and a bill summary. The credits would not be refundable but could be carried back three years or carried forward 10 years and could be transferred, sold or assigned, the summary said."

New Mexico

New Mexico Sends Tax Reform Package to Governor - Paul Jones, Tax Notes ($):

The House concurred with the Senate's amendments to H.B. 252 late February 13 on a vote of 39 to 27. The Senate approved its version of the bill on a 26-13 vote February 12. The package includes several tax reform provisions that are similar to those in a 2023 tax omnibus bill that Lujan Grisham (D) largely vetoed over concerns about its revenue impact. But H.B. 252 has better prospects: The governor signaled earlier this year her willingness to consider some tax cuts, the legislation includes some of Lujan Grisham's priorities, and the package is nowhere near as costly as last year's.

...

The final bill contains key reforms to the state's tax code. Beginning in tax year 2025, the bill would cut personal income taxes for lower- and middle-income levels by increasing the income ranges of brackets subject to lower tax rates, and adding another bracket.

New York

NY Seeing Rise In Challenges To Tax On Remote Workers - Paul Williams, Law360 Tax Authority ($). "Speaking at a joint legislative hearing on Democratic Gov. Kathy Hochul's proposed budget, Amanda Hiller, acting commissioner of the New York State Department of Taxation and Finance, said challenges to the state's so-called convenience of the employer rule are growing. She made the comment during an exchange with Assemblyman Edward Ra, R-Franklin Square, who noted that New Jersey is temporarily offering a tax credit to residents who are able to convince a court to order New York to issue them an income tax refund for days worked remotely."

New York lawmakers cite audit results as they push for tax incentive reform - Jack Arpey, Spectrum News 1. "The study revealed that some state tax incentive programs provide as little as 2 cents to taxpayers for every dollar invested. That has advocates like Michael Kink, executive director of the Strong Economy for All Coalition, taking aim at New York's reliance on IDAs and economic development tax credits to drive job creation."

Ohio

Ohio Justices Uphold Local Taxes On In-State Teleworkers - Sanjay Talwani, Law360 Tax Authority ($). "In a 5-2 decision, the high court rejected an appeal from Josh Schaad, who sued Karen Alder, Cincinnati's finance director, over the city's income tax on remote workers in 2020. Schaad argued that the tax violated the due process clause of the 14th Amendment to the U.S. Constitution, which he said forbade a municipality from taxing a nonresident for work performed outside its jurisdiction."

South Dakota

South Dakota Bill Would Bar Paying Taxes With Some Digital Currencies - Emily Hollingsworth, Tax Notes ($):

A bill advancing in the South Dakota Legislature would prevent state agencies from accepting some digital currencies as tax payments.

Under H.B. 1161, state agencies would be barred from accepting domestic or foreign central bank digital currencies (CBDCs) “as payment for taxes, fees, tuition, admission, the settlement of any account or debt, or any other purpose.”

Tennessee

Tennessee Braces for 100,000 Refunds in Franchise Tax Rewrite - Michael Bologna, Bloomberg ($). "More recently, Sollie and Levine convened talks with the state Department of Revenue on strategies to settle the refund demands and remedy the constitutional infirmities within the franchise tax. Lee’s administration ultimately came up with a solution, described in the governor’s budget address last week and in tandem legislation, that would modify the calculation of the tax base and permit taxpayers to claim refunds for taxes paid going back to 2021. The budget puts the price tag at $410 million for fiscal year 2025, plus $1.2 billion to cover three yeas of refunds."

Washington

Jeff Bezos Reaps Florida Tax Benefit With $4 Billion Amazon Share Sale - Anna Edgerton, Bloomberg. "Washington state instituted a 7% capital gains tax in 2022 — something Florida doesn’t have — meaning Bezos’s relocation is likely saving him $288 million so far. Because Bezos has only ever bought a single share of Amazon, it’s safe to assume he’s owned the stock since the company was founded and therefore virtually all of their value would be considered capital gains."

Tax Policy Corner

Thinking Big And Soaking The Rich: SALT In Review - David Brunori, Law360 Tax Authority ($):

A bill in Maryland, S.B. 766, is called the Fair Share for Maryland Plan. I believe that anything with the inane term "fair share" in the title should be rejected a priori. Public finance has never seen a call for action so vapid or meaningless.

The bill would adopt worldwide combined reporting. I wonder how many of the sponsors really understand what that means. If asked, I would tell them that worldwide reporting is a terrible policy choice. No states currently require worldwide except for Alaska, under limited circumstances.

There is a reason. Worldwide reporting creates a tremendous compliance burden on businesses operating in Maryland. It also creates a real threat of double taxation. Furthermore, I might add, assessments that worldwide reporting will raise substantial revenue have been widely criticized. Maryland would best be served by sticking with water's-edge reporting. Actually, the state would be better off repealing its corporate tax. But I doubt the sponsors of this bill would agree.

Tax Bill of the Week

This is high season in state legislatures. Hundreds of tax bills are proposed, only a few of which are enacted. Some of these bills strike me as worth noting before they (probably) fade into obscurity. In that spirit, I will highlight a state tax bill that might otherwise go unnoticed.

I start with one right here in Iowa. HF 2471. This bill, listed as having nine sponsors, would create an "electric outdoor power equipment tax credit" of 20% of the purchase price of "battery-powered equipment used principally for outside service, including an aerator, auger, blower, chain saw, dethatcher, edger, trimmer, lawn mower, pole saw, snowblower, and tiller."

It would apply to purchases in 2024 and later. Naturally, I bought a battery-powered snowblower in 2023.

We're Here to Help