Key Takeaways

- Government heads towards shutdown as House bill fails.

- Freeze on IRS enforcement funds.

- Senator introduces Rural Historic Tax Credit Improvement Act.

- Representative introduces Residence-Based Taxation for Americans Abroad Act.

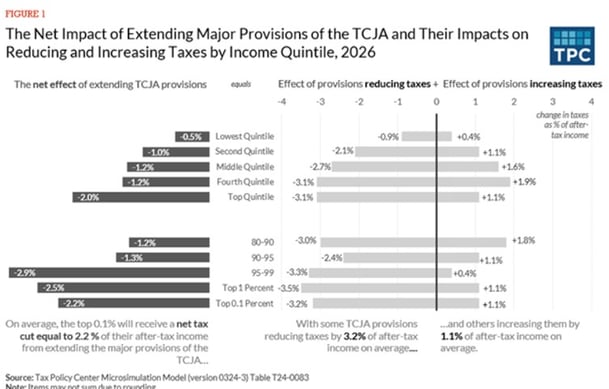

- Unpacking effects of a TCJA extension.

- IRS increases standard mileage rate for 2025.

- Direct File difficult to implement nationwide.

- National Go Caroling Day!

House Bill Fails

House Rejects GOP Plan Backed by Trump as Government Barrels Toward Shutdown - Lindsay Wise, Katy Stech Ferek, and Siobhan Hughes, The Wall Street Journal:

...

If no bill is passed and signed into law by President Biden by 12:01 a.m. Saturday, the federal government would partially shut down, furloughing hundreds of thousands of federal workers, though critical services would continue to function.

House Rejects Stopgap With Freeze on IRS Enforcement Funds - Cady Stanton, Tax Notes ($):

...

The CR would have extended government funding at fiscal 2024 levels until March 14, repeating a $20.2 billion clawback of enforcement funds for the IRS granted to the agency in the Inflation Reduction Act. The government is set to shut down at midnight December 20 without continued funding.

More on Capitol Hill

Capito Bill Would Enhance Historic Tax Credit in Rural Areas - Tax Analysts, Tax Notes ($):

IRS Updates

- 70 cents per mile driven for business use, up 3 cents from 2024.

- 21 cents per mile driven for medical purposes, the same as in 2024.

- 21 cents per mile driven for moving purposes for qualified active-duty members of the Armed Forces, unchanged from last year.

- 14 cents per mile driven in service of charitable organizations, equal to the rate in 2024.

The rates apply to fully-electric and hybrid automobiles, as well as gasoline and diesel-powered vehicles.

Taking Direct File Nationwide Would Be Challenging, GAO Says - Benjamin Valdez, Tax Notes ($):

...

“Even if state revenue agencies are willing to join, they may need approval from their governors or legislatures to participate in Direct File,” the GAO wrote, noting that state administrators’ decisions for not joining in 2025 vary. Some state officials cited low pilot participation as a reason, while some are focused on other priorities.

Tax Trouble

Tax Shelter Defendant Charged In Investment Ploy - Anna Scott Farrell, Law 360 Tax Authority ($):

...

The men worked with an unindicted, unnamed co-conspirator who ran a fund in the U.K. for which ROI was a feeder, according to the indictment. The U.K. fund, Hemingway Global Capital, began operating around 2019. The following year, McPhee began promoting it at seminars hosted by Private Banking Concepts, his supposed tax-mitigation business, prosecutors said.

What day is it?

Feeling in the holiday spirit? It's National Go Caroling Day!

We're Here to Help