Key Takeaways

- 500,000 ERC claims paid a "good sign."

- IRS looks to boost .05% partnership exam rate.

- January 2025 AFR released.

- Continuing resolution still a mystery.

- Congress awaits Trump tax bill strategy.

- "To delay is to kill."

- Tariff worries may bring down Canadian Prime Minister.

- Sentence commuted for $53 million Illinois municipal embezzler.

- National Maple Syrup Day.

Tax Pros Parse Werfel’s Employee Retention Credit Announcement - Nathan Richman, Tax Notes ($):

Michael J. Scarduzio of McDermott Will & Emery pointed out the contrast between the number of claims to be paid and prior statements comparing a good ERC claim to a “needle in a haystack.”

...

Jose Gonzalez of the IRS Criminal Investigation division attributed the IRS’s progress on ERC claims, at least in part, to the agency’s work digitizing claims. He said the IRS is working on paying and denying claims.

Tax Firms Are Denied Early Injunction in Credit Processing Suit - John Wooley, Bloomberg ($). "StenTam and ERC Today, which sued the IRS last month, told the US District Court for the District of Arizona that the IRS had unlawfully used automated filters to summarily deny refunds for claimed employee retention credits in violation of the Administrative Procedure Act. But injunctive relief is inappropriate at this stage because the agency hasn’t yet appeared or been served, Judge Stephen M. McNamee said in a Dec. 13 order."

News from the IRS

IRS Aims To Ramp Up Partnership Audits, Official Says - Kat Lucero, Law360 Tax Authority ($):

For 2025, the Internal Revenue Service aims to examine 3,600 partnerships, which is 1,315 more partnerships than the actual amount audited from the previous fiscal year. The agency initially planned for 4,074 audits, but that goal fell short to 2,285, according to Hans Famularo, special counsel (pass-throughs) at the IRS Office of Chief Counsel.

IRS Criminal Investigators Seek Artificial Intelligence Tools - Nathan Richman, Tax Notes ($):

CI would also welcome tools to assist with the deconfliction process and to help find case leads to investigate, Jones said. However, humans would still be evaluating suggested investigations before CI opens a case, he said.

IRS Issues Applicable Federal Rates (AFR) for January 2025 - Bailey Finney, Eide Bailly. "The Section 382 long-term tax-exempt rate used to compute the loss carryforward limits for corporation ownership changes during January 2025 is 3.43%"

IRS expands online accounts, provides enforcement update - Martha Waggoner, The Tax Adviser:

-The ability of authorized individuals of C corporations and S corporations who can legally act on behalf of their corporation to view and pay tax balances and federal tax deposits.

-A feature that helps to speed up the lending process by providing sole proprietors and authorized individuals with access to the long-standing IRS income verification express service to approve or reject a tax transcript authorization request from a lending company.

-The availability of tax returns, account, and most entity transcripts in Spanish.

Meanwhile in Congress

Tick-tock: The CR is still under wraps, as a House vote slips to Thursday - Punchbowl News:

Congressional leaders spent the day wrangling over the farm bill extension and other key elements of the CR. One of the most difficult issues to solve has been a direct payment program to farmers. As we explained in Monday’s edition, Speaker Mike Johnson disagreed with the way the program was funded, leading to a scramble to get the package into shape. Democrats have Johnson in a corner and are demanding all sorts of policies in return.

IRS funding, while not mentioned in the story, may be in play.

Trump II tax policy: waiting and worrying.

Digging in on procedure - Bernie Becker and Benjamin Guggenheim, Politico:

But others in the party, including leading Republicans in the Senate, are advocating a two-step approach — using budget reconciliation to pass an early measure covering border security and possibly other issues,and then doubling back to deal with taxes.

Tax writers wait for Trump's word on 2025 strategy - Chris Cioffi, Bloomberg ($):

...

Delaying consideration of a tax package until later in the year gives tax writers more time to craft an extension of the 2017 tax law. It also hands leadership the option of maximizing end-of-year dealmaking pressure.

But combining fiscal policy with more politically palatable highlights from Trump’s re-election campaign would make it harder for members of the narrowly-divided House to vote against it.

Tax lobbyists worry border bill could derail reform efforts - Taylor Giorno, The Hill:

“To delay is to kill,” warned Grover Norquist, founder and president of Americans for Tax Reform, which opposes tax increases. “And all it takes is one bad car accident or an interesting scandal, and the Republicans don’t have the majority in the House anymore.”

Time to lay your tax cards on the table - Eugene Daniels and Rachel Bade, Politico Playbook. "With Republicans ready to start a 2025 reconciliation sprint, Sen. JOSH HAWLEY (R-Mo.) is pushing for a major increase to the child tax credit, from a max of $2,000 to $5,000 per child, Axios’ Stef Kight scoops. It piggybacks on a proposal floated by VP-elect JD VANCE but adds some twists: Parents could claim the credit as soon as there’s a pregnancy, and while Hawley is not proposing to make the credit fully refundable, he is proposing to apply it against payroll taxes as well as income taxes. The catch: It’s super expensive, to the tune of $2 trillion-plus over the 10-year budget window."

Ruckus Up North

Canadian finance minister notes Trump tariff threat in resignation letter - Tara Suter, The Hill:

“Our country today faces a grave challenge,” Chrystia Freeland said in a letter addressed to Canadian Prime Minister Justin Trudeau. “The incoming administration in the United States is pursuing a policy of aggressive economic nationalism, including a threat of 25 per cent tariffs.”

“We need to take that threat extremely seriously,” she added. “That means keeping our fiscal powder dry today, so we have the reserves we may need for a coming tariff war. That means eschewing costly political gimmicks, which we can ill afford and which make Canadians doubt that we recognize the gravity of the moment.”

Blogs and Bits

IRS launches new tax enforcement campaign; focus includes offshore havens, deferred fees, whistleblower information - Kay Bell, Don't Mess With Taxes:

More than $1.3 billion of that total comes from wealthy, high-income individuals who have not filed taxes or paid overdue tax debt. Approximately $2.9 billion is related to the aforementioned IRS-CI work into tax and financial crimes. And another $475 million comes from proceeds in criminal and civil cases attributable to whistleblower information.

IRS releases Form 15620 to use for §83(b) elections - National Association of Tax Professionals. "Before the release of Form 15620, a taxpayer making a §83(b) election was required to draft a document explaining their election using sample language included in IRS guidance. Because the situation was explained by the taxpayer, there was a chance the IRS could reject the election for failure to include the proper language or information. Using Form 5620 ensures that taxpayers have included all of the necessary information when making their election."

Final Regs Reflect Inflation Reduction Act Amendments to Energy Investment Credit - Parker Tax Pro Library. "The IRS issued final regulations that set forth final rules relating to the energy credit under Code Sec. 48, including rules for determining whether investments in energy property are eligible for the energy credit and for implementing certain amendments made by the Inflation Reduction Act of 2022. The final regulations impact taxpayers who invest in energy property eligible for the energy credit."

Marriage markets in everything (tax arbitrage!) - Tyler Cowen, Marginal Revolution, quoting a Reddit Post:

I (unfortunately) lost a bunch of money this year with some risky gambles and have ~$1.2m of context of capital losses.

I would like to marry someone with very large ($1m+) short-term capital gains and split the difference on the tax savings.

"Loser seeks winner for marriage" may not be the greatest pick-up line.

Pardon Me II

Rita Crundwell commutation draws angry reactions from Dixon officials - NBC Chicago:

Crundwell, who pleaded guilty to wire fraud in connection with a scheme in which she embezzled nearly $54 million from the community over a period of 20 years, had her sentence commuted by Biden on Thursday as part of a broad commutation that covered individuals who were released from prisons during the COVID pandemic.

Biden said the commutations were targeted at individuals who had integrated back into society, mostly serving the remainder of their sentences under house arrest, but the decision in Crundwell’s case was met by fierce criticism.

Biden’s Recent Clemency Move Is Controversial (And It’s Not Hunter Biden) - Kelly Phillips Erb, Forbes ($):

To pull off the fraud, Crundwell opened a bank account that she created to look like a city account. She was the only signatory. She siphoned money from the city of Dixon to the account at a clip of about $2.5 million per year by creating false invoices. Despite the fact that the city’s annual budget fell between $8-$9 million per year, no one noticed. They did, however, notice that the budget showed a shortfall, forcing Dixon to make cuts, including to emergency services.

Background: How one woman stole $53 million from her hometown for over two decades without being caught

Related: Eide Bailly Fraud Prevention and Detection Services.

What day is it?

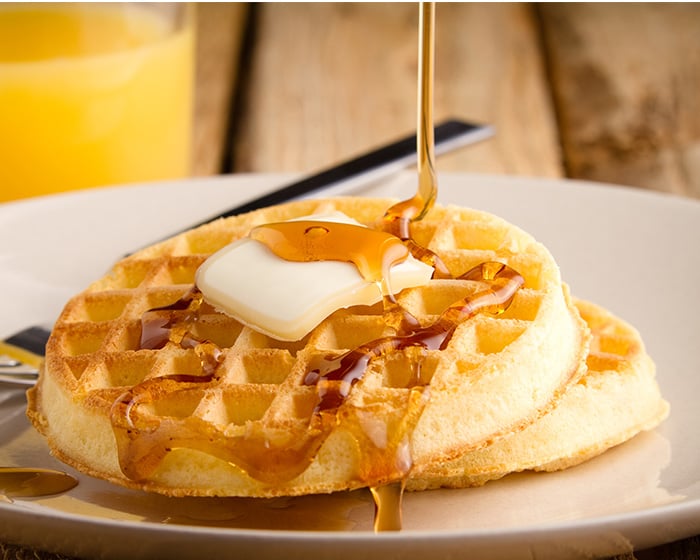

Why, it's National Maple Syrup Day! Pass the waffles, please.

Make a habit of sustained success.