Key Takeaways

- “2025 is going to be the year where we finish this race in terms of the ERC.”

- IRS renews 2023 break for partnership interest sale reports.

- Affects partnerships with ordinary income assets.

- Biden commutes sentence of major tax shelter figure.

- Deficits to take a back seat in Trump II tax policy?

- 10 tax myths.

- Crypto sentence, crypto fraud dangers.

- National Chocolate Covered Anything Day meats Barbie and Barney Backlash Day.

Werfel Points to Progress on ERC Claims - Lauren Loricchio, Tax Notes ($):

...

Werfel said the agency has “teed up another roughly 500 — 600,000 in claims for approval in 2025” and that “2025 is going to be the year where we finish this race in terms of the ERC.”

In December 2023 the IRS announced that it was sending an initial round of more than 20,000 letters to inform taxpayers of disallowed claims.

IRS Criminal Probes On Worker Retention Cases Still Early - Kat Lucero, Law360 Tax Authority ($):

The investigations are "targeting the most egregious cases," said Jose Gonzalez, acting special agent in charge with IRS Criminal Investigations. Gonzalez spoke at a conference on tax fraud and controversy hosted by the American Bar Association in Las Vegas.

So far, the most common of the extreme cases involve tax credit claims from fictitious companies, according to Gonzalez. These situations, he said, include businesses that were created after the credit was enacted into law, employment tax returns filed for periods preceding the entity establishment date and a lack of corresponding business income tax returns with the claims.

Partnerships: a reporting break and a reporting reminder.

IRS grants partnerships additional time to furnish complete Forms 8308 - Kevin Brewer, The Tax Adviser:

Notice 2025-02 provides relief similar to the relief provided in Notice 2024-19 from penalties under Sec. 6722 for failures by certain partnerships to furnish correct payee statements.

The tax law requires partners to notify partners who sell their partnership interests of the portion of the sale that will be ordinary income under the "hot asset" rules of Sec. 751. This often applies when a partnership owns depreciable fixed assets or has cash-basis accounts receivables. Farm partnerships are very likely to be covered.

From the notice:

(1) The partnership must timely and correctly furnish to the transferor and transferee a copy of Parts I, II, and III of Form 8308, or a statement that includes the same information, by the later of —

(a) January 31, 2025, or

(b) 30 days after the partnership is notified of the §751(a) exchange.

(2) The partnership must furnish to the transferor and transferee a copy of the complete Form 8308, including Part IV, or a statement that includes the same information and any additional information required under §1.6050K-1(c), by the later of —

(a) the due date of the partnership's Form 1065 (including extensions), or

(b) 30 days after the partnership is notified of the §751(a) exchange.

.02 The relief provided in this notice applies only with respect to a partnerships' furnishing of a Form 8308 to the transferor and transferee in a §751(a) exchange made during calendar year 2024.

Pardon me

Biden Commutes Sentence of Tax Shelter Figure

Background here.

Trump II tax policy

Tax Cuts Take Lead Over Deficit Worries in GOP’s Internal Fight - Richard Rubin, Wall Street Journal:

...

Congress will consider a tax bill against a fiscal backdrop that is starkly different from 2017, when Republicans last controlled the full government. Then, the deficit was 3.6% of gross domestic product and publicly held debt was 77% of GDP.

Now, after Republican tax cuts, bipartisan pandemic legislation and Democratic spending programs during the Biden administration, the annual deficit tops 6% of GDP, a threshold unprecedented outside of wars, emergencies or recessions. Publicly held debt, at almost $29 trillion, is nearing 100% of GDP and interest rates are higher.

Could the IRS Be Rocked by Regulatory Rollbacks Under Trump? - Caitlin Mullaney, Tax Notes ($):

Implementation of the rule, which would require online marketplaces and payment apps to report all payees that exceed a minimum threshold of $600 in aggregate payments, regardless of the number of transactions, has thrice been delayed by the IRS. It has also been met with several legislative amendment attempts at repealing or raising the threshold.

After the IRS announced in November the implementation of a phase-in of the threshold, House Ways and Means Committee Chair Jason Smith, R-Mo., accused the Biden administration of acting “unlawfully to save Democrats from the political fallout of this policy with another delay of what their own law called for.”

Trump Names A Politician To Lead The IRS, The First In More Than 80 Years - Joseph Thorndike, Forbes:

But once upon a time, politicos were a popular choice. To be clear, many commissioners, including recent ones, have been active in party politics. But there’s a difference between being a tax expert with political connections and a politician who ends up leading the tax agency.

Who pays?

Correcting the Top 10 Tax Myths - Brian Riedl, Manhattan Institute.

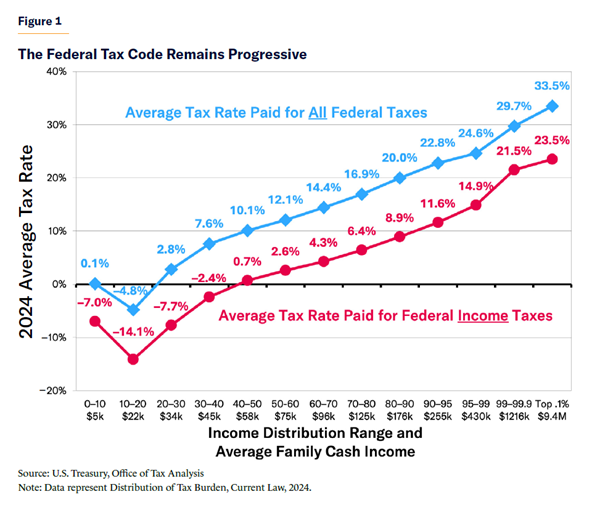

The conspiratorial populism that characterizes modern politics often suggests that virtually all government policies are designed to benefit the wealthy at the expense of everyone else. The tax policy version of this view is that wealthy families pay less in taxes than the middle class. This narrative is very common but spectacularly false.

Blogs and bits

Political, tax issues complicate Roth IRA conversion decision - Kay Bell, Don't Mess With Taxes. "Regardless of your age, or amount saved, it’s never a bad time to evaluate your retirement savings, how you can bolster them, and what the tax implications may be."

Senate Passes Federal Disaster Tax Relief Act of 2023 - Parker Tax Pro Library. "On December 4, the Senate passed the Federal Disaster Tax Relief Act of 2023, which extends the expanded personal casualty loss deduction under Code Sec. 165 under the Taxpayer Certainty and Disaster Relief Act of 2020 (Pub. L. 116-260) to taxpayers who suffered losses from major disasters occurring from January 1, 2020, through the date of enactment. The bill, which President Biden is expected to sign, also provides that payments that compensate taxpayers affected by certain wildfires and the East Palestine train derailment are excluded from gross income. H.R. 5863."

Suspension of Required Beneficial Ownership Information Reporting - Tax School Blog. "While this litigation is ongoing, FinCEN will comply with the order issued by the U.S. District Court for the Eastern District of Texas for as long as it remains in effect. Therefore, reporting companies are not currently required to file their beneficial ownership information with FinCEN and will not be subject to liability if they fail to do so while the preliminary injunction remains in effect. Nevertheless, reporting companies may continue to voluntarily submit beneficial ownership information reports."

New Wildfire Relief Payment Exclusion - Thomas Gorczynski, Tom Talks Taxes. "Sec. 3(a) states that a qualified wildfire relief payment is excluded from an individual’s income. The exclusion applies to qualified wildfire relief payments received by an individual during tax years beginning after December 31, 2019, and before January 1, 2026 (i.e., calendar years 2020 through 2025)."

Fraud and Punishment

Fraud-of-the-Preparer Rule Usage Creates Hardship, Attorney Says - Lauren Loricchio, Tax Notes ($):

In Allen, the Tax Court held that the extended limitations period of section 6501(c)(1) for assessing taxes based on a fraudulent return applies to an individual even if they had no intent to evade taxes but their tax return preparer had fraudulent intent.

Agostino said if the IRS usually has three years from the due date to assess tax under section 6501, the government should do something within three years. However, section 6501(c) lists exceptions, including one for false or fraudulent returns.

Another reason to be skeptical of preparers who magically seem to be able to generate refunds bigger than other preparers.

First Traditional Crypto Tax Sentence Draws Attention - Nathan Richman, Tax Notes ($):

...

Ahlgren was accused of misrepresenting the basis of the bitcoins he sold. According to prosecutors’ sentencing memorandum, Ahlgren sold bitcoins he bought in 2015 when the price never topped $500, but claimed on his 2017 tax return that he had paid 10 times that much.

Apparently crypto transactions may be more legible to the IRS than some might think:

Related: Eide Bailly IRS Exam Assistance Services

What day is it?

It's National Chocolate Covered Anything Day! It's also Barbie and Barney Backlash Day - nothing a little chocolate won't fix.

We're Here to Help