Key Takeaways

- IRS Commissioner pick Billy Long

- Republican's 2025 tax strategy on Capitol Hill

- TCJA expansion

- IRS foreign information reporting penalties

- IRS releases required retirement plan amendment list

- National mitten tree day!

He Promised Huge Tax Refunds. Now Trump Wants Him to Lead the I.R.S. - Andrew Duehren, New York Times:

...

If the Senate confirms Mr. Long to lead the tax collection agency, he will be in a position to ease access to the tax credit. During his time generating claims for the employee retention credit, Mr. Long said, he repeatedly tried to persuade potential clients to disregard the advice of their accountants, who doubted whether they could qualify for the credit.

Trump names his own pick for IRS commissioner, breaking from tradition - Julie Zauzmer Weil and Jacob Bogage, The Washington Post:

...

Long “is an extremely hard worker, and respected by all, especially by those who know him in Congress. Taxpayers and the wonderful employees of the IRS will love having Billy at the helm,” Trump posted on Truth Social, without mentioning that the role of IRS commissioner is currently filled.

Taxwriters to Probe Trump IRS Pick’s Qualifications - Cady Stanton, Benjamin Valdez, Tax Notes ($):

...

“What’s most concerning is that Mr. Long left office and jumped into the scam-plagued industry involving the Employee Retention Tax Credit,” Wyden said. “These ERTC mills that have popped up over the last few years are essentially fraud on an industrial scale, conning small businesses and ripping off American taxpayers to the tune of billions of dollars.”

TCJA

House and Senate Republicans Already at Odds Over 2025 Strategy - Richard Rubin, The Wall Street Journal:

The internal disagreements over how to proceed on Trump’s agenda offer an early look at the policy tensions within the party and how they could be exacerbated by the narrow nature of the Republican majorities, particularly in the House. So far, members have pledged to work together, and they will be unified by Trump’s popularity among Republicans and the scary prospect of tax cuts lapsing on Dec. 31, 2025.

All About That Base(line) - Daniel Bunn and Garrett Watson, The Tax Foundation:

...

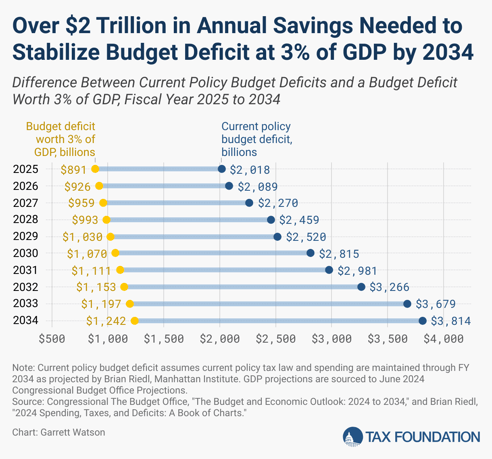

President-elect Trump’s nominee for Treasury Secretary, Scott Bessent, has argued that annual deficits below 3 percent of gross domestic product (GDP) by 2028 should be a priority. Bessent’s target is a laudable approach to fiscal discipline, but, in a current policy baseline context, Congress would need to achieve nearly $1.5 trillion in annual deficit reduction to meet it. This would likely require serious cuts to mandatory spending programs like Social Security, Medicare, and Medicaid, something that Congress has been unwilling to do for decades.

Blogs and Bits

Tax Court Reiterates Information Reporting Penalty Not Assessable - Andrew Velarde, Tax Notes ($):

Judge Mark V. Holmes issued an order and decision on December 5 granting summary judgment in favor of the taxpayer in Safdieh v. Commissioner. In so doing, the court ruled that the IRS could not proceed with collection of section 6038 penalties against Joseph Safdieh, a self-represented litigant, for the 2005 to 2009 tax years.

IRS Errors Allow Millions In Improper Refunds, TIGTA Says - Anna Scott Farrell, Law360 Tax Authority ($):

An investigation by the IRS' federal watchdog revealed that more than $8 million in overpayments across roughly 2,100 taxpayer accounts was "not offset because employees manually processed a refund or credit elect but did not correctly identify those taxpayers had outstanding tax debt."

IRS Issues Latest Required Retirement Plan Amendments List - Jack McLoone, Law360 Tax Authority ($). "The Internal Revenue Service released Thursday the 2024 edition of an annual list of required amendments for qualifying individually designed retirement plans. With Notice 2024-82, the IRS released the three-part list for eligible individually designed plans under Internal Revenue Code Sections 401(a) and 403(b)."

Tax Trouble

What Day is it?

It's National Mitten Tree Day!

We're Here to Help