Key Takeaways

- MTC Updates

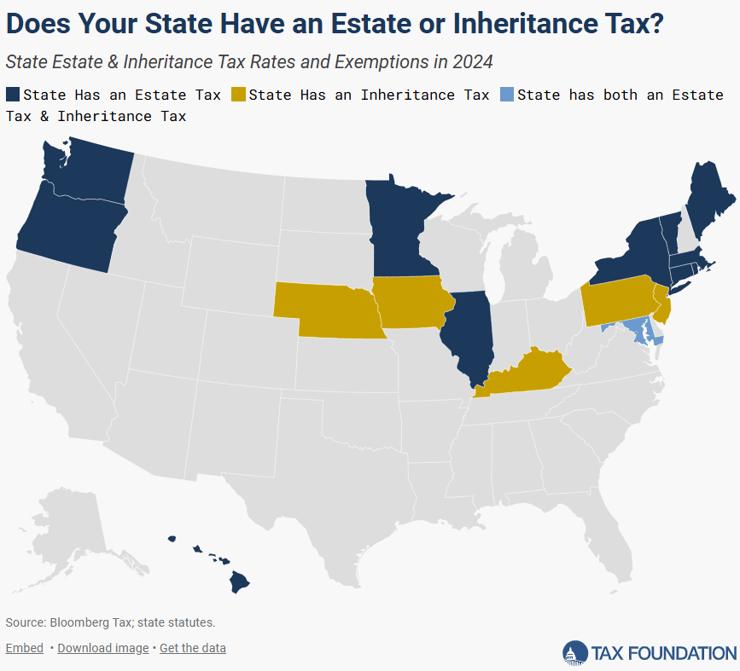

- Estate and Inheritance tax by state

- In the News: FL, LA, MI, MN, NJ, NY, OH, VA

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs.

MTC Partnership Group Eyes Sourcing Of Business Income - Maria Koklanaris, Law360 Tax Authority($):

As part of a much larger project that has stretched on for three years and is nowhere near conclusion, the group considered whether business income should be sourced to where the business is domiciled, or to where the owner is a resident, or to where the income is derived or created. The group's deliberations Tuesday took place during the commission's fall meeting, held in Santa Fe, New Mexico, and online.

MTC Panel Shelves Real-Time Sales Tax Audit Proposal - Paul Williams, Law360 Tax Authority($). "The Multistate Tax Commission's Audit Committee opted not to proceed with considering a tax practitioner's proposal to develop a real-time sales tax audit program, but the project could be revisited after the intergovernmental organization fills vacant auditor positions, the panel's chair said Thursday."

Estate and Inheritance Taxes by State, 2024 - Joseph Johns, Tax Foundation:

Estate taxes are paid by a decedent’s estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. Inheritance taxes are remitted by the recipient of a bequest and are thus based on the amount distributed to each beneficiary.

State-By-State Roundup

California

FTB Secure Email Process Change - ftb.ca.gov:

Effective November 23, 2024, FTB Secure Email users will no longer be required to register with FTB or login with a password to open an encrypted email. Instead, the user will have two options to view an encrypted message received from FTB:

1) Sign in to the email account r (e.g. Gmail or Yahoo account) to view the message, or

2) Open the message with a one-time passcode.

Florida Co.'s Purchases For Attractions R&D Are Exempt - Jaqueline McCool, Law360 Tax Authority($). "A Florida taxpayer's research and development expenses related to the development of new engineered attractions qualify for the state's research and development exemptions, the state Department of Revenue said in an advisement released Thursday."

Louisiana

La. Parishes Can't Change Property Values After Court Rulings - Paul Williams, Law360 Tax Authority($). "Louisiana parish assessors lack the authority to unilaterally change a property's assessment if they become aware of an error in the assessment after a local board or the state Tax Commission sets the property's value, the state attorney general's office said."

Michigan

Key Takeaways From 2024 In Unclaimed Property Law - Maria Koklanaris, Law360 Tax Authority($):

In addition to the battle at the Michigan Supreme Court in consolidated cases involving Disney and Dine Brands Global Inc., a long-standing unclaimed property case at the U.S. Supreme Court came to a final resolution this year. That case allowed 30 states to each receive millions of dollars in funds that had previously been held by the state of Delaware.

Minnesota

Minn. Tax Court Won't Revisit Stipulated $1M Property Value - Sanjay Talwani, Law360 Tax Authority($):

In an order Wednesday, the state tax court dismissed the case of Maya Goldstein and Muhammad Imran Khan, who disputed the $1 million value found by the County of Otter Tail as of January 2023. The court said the county and the previous owner had already stipulated to that valuation for that date, and the new owners were bound by it for the taxes in question, due in 2024.

New Jersey

NJ Court Must Revisit Assessor's Workplace Retaliation Claim - Michael Nunes, Law360 Tax Authority($). "A New Jersey trial court must revisit a municipal tax assessor's workplace retaliation claim as the case used by the court in its decision doesn't exempt assessors from the state's employee protection law, an appellate panel ruled Wednesday."

New York

NY Agency Says Ex-CUNY Employee's Payout Is Tax-Exempt - Maria Koklanaris, Law360 Tax Authority($). "A pension payment from the City University of New York to an employee who left CUNY before being vested in the retirement program is still tax-exempt retirement income, the state's tax department said."

NY Says LLC's Partners Can Subtract Payroll Expense Shares - Sanjay Talwani, Law360 Tax Authority($). "Partners of a New York limited liability company may subtract from their state taxable income their distributive shares of payroll expenses that were not allowed to be deducted from their federal income, the state's tax department said."

NY Says Couple Can't Carry Forward Charitable Deduction - Michael Nunes, Law360 Tax Authority($). "A New York couple cannot carry over a deduction for a charitable donation to subsequent tax years as there is nothing in the state's statutes that allows for such a move, the state's tax department said."

NY Resident Owes Tax On Bonuses For Work Out Of State - Dylan Moroses, Law360 Tax Authority($). "A New York resident who lived out of the country until late 2018 owes state and New York City tax on bonuses and stock units that were paid in 2019 for work done in prior years, the state tax agency said."

Ohio

Ohio City Tax Exemption Isn't Retroactive, Court Affirms - Jaqueline McCool, Law360 Tax Authority($). "An Ohio property in a reinvestment area is not eligible for a city's tax exemption offered to remodeled homes, as the remodel was completed before the property was included in the reinvestment district, an Ohio appellate court affirmed Thursday."

Virginia

Va. Tax Applies To Co.'s Service Fees, Tax Commissioner Says - Jaqueline McCool, Law360 Tax Authority($). "A furniture business that sells to customers in Virginia owes sales tax on delivery and installation fees because the services are provided in conjunction with products, the Virginia tax commissioner ruled."

2024 Thanksgiving Dinner Costs

Good news for folks in Iowa, Iowa Taxes Pumpkins To-Be-Displayed, Exempts Pumpkins To-Be-Eaten, but looks like bad news for those in Massachusetts Turkey Troubles: What Could Be Driving Up the Cost of Thanksgiving in Massachusetts?.

According to the 39th annual American Farm Bureau Federation (AFBF) Thanksgiving dinner survey, overall, the cost of a classic feast is down this year! Enjoy.

We're Here to Help