Key Takeaways

- Can Congress help with sales tax compliance?

- The workings of state corporation taxes.

- GILTI and the states.

- State news roundup with news from CA, CO, GA, IL, IA, LA, MA, MI, MO, MT, ND, OH, SD, WA.

Welcome to this edition of our roundup of state tax developments. Consider the Eide Bailly State & Local Tax team for your state tax planning, compliance, and incentive needs!

We Need a Uniform State Sales Tax System That Supports Commerce - Andrew Leahey, Bloomberg ($):

...

The Constitution grants Congress the authority to regulate interstate commerce, which implicitly limits states’ ability to do the same. If tax policies in one state discourage businesses in another from expanding, that could be an infringement on the latter’s economic sovereignty.

Also, a small online retailer can easily be required to track and pay sales taxes in dozens of states—and perhaps dozens more local jurisdictions, each with its own rules. The administrative overhead and substantial cost that comes with it can stifle commerce.

Related: The Influence of Wayfair on Sales and Use Tax.

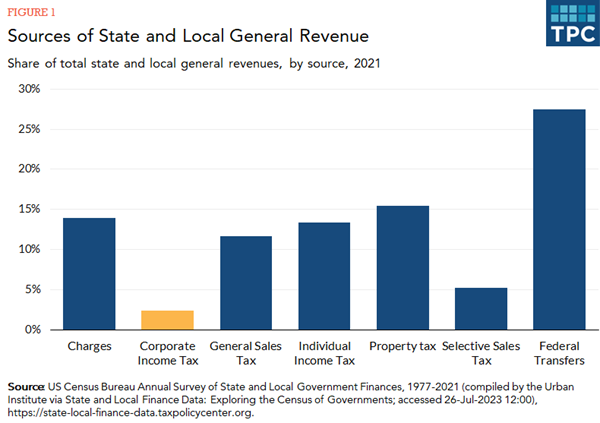

How do state and local corporate income taxes work? - Tax Policy Center:

State and local governments collected a combined $99 billion in revenue from corporate income taxes in 2021, or 2 percent of general revenue.

GILTI Tax Treatment by State, 2024 - Joseph Johns, Tax Foundation. "GILTI is meant to ensure that, regardless of where a US company does business in the world, its foreign subsidiaries pay at least a minimum rate of income tax, if not to other countries, then to the United States. When a US company’s controlled foreign corporations (CFCs) owe less than the specified minimum rate to other countries, then they owe taxes on GILTI as a form of “top-up tax” to the US."

State-By-State Roundup

California

San Francisco Voters to Decide on Sweeping Business Tax Reform Measure - Paul Jones, Tax Notes ($):

According to its ballot summary, the measure would reduce the number of business categories used to levy the city’s gross receipts tax from 14 to seven; increase the gross receipts tax exemption from $2.25 million (for 2024) to $5 million, with ongoing adjustment for inflation; and modify the gross receipts tax rates (current rates range from a minimum of 0.053 percent to a maximum of 1.008 percent, already set to increase in the future) to a minimum of 0.1 percent and a maximum of 3.716 percent.

Millions in Apple Sales Tax Revenue Go Back to Cupertino Coffers - Laura Mahoney, Bloomberg ($). "Apple Inc.'s hometown of Cupertino, Calif., has $74.5 million more to spend on city services after releasing funds no longer needed to pay back tax revenue it received improperly from Apple’s online sales."

Colorado

Colorado Voters to Decide on Firearms Tax, Expanded Property Tax Relief - Emily Hollingsworth, Tax Notes ($):

Proposition KK would allow the state to levy a 6.5 percent excise tax on the sale of firearms, their precursor parts, and ammunition, beginning April 1, 2025. The tax would be paid by gun dealers, manufacturers, and ammunition vendors; its revenue would be used to fund mental health services for at-risk youth, military veterans, and crime victims. H.B. 24-1349, which placed the measure on the ballot, was signed by Gov. Jared Polis (D) on June 5.

...

Amendment G would amend Article X, section 3.5, of the Colorado Constitution to expand the property tax exemption program for disabled veterans.

Seven Colorado Tax Bills Cleared for Introduction Next Year - Emily Hollingsworth, Tax Notes ($). "Draft Bill 1 would amend several tax credits, including the income tax credit for unsalable alcohol attributable to damage or destruction, which would be disallowed after December 31, 2025, and formally repealed effective December 31, 2030. It would also reduce from 2 percent to 1 percent the deduction for taxable gallons of fuel that are removed from a fuel terminal to account for fuel lost in transit. The bill was approved unanimously."

Georgia

Georgia Governor Promises Income Tax Rebates Totaling $1 Billion - Danielle Muoio Dunn, Bloomberg ($). "The proposal would return $250 to single filers, $375 to single filers who are heads of household, and $500 to married couples filing jointly, Kemp said at an event where he was joined by legislative leaders and others."

Illinois

Governor Pritzker Announces Relief Available to July Storm Victims in Illinois - Illinois Department of Revenue:

...

Affected taxpayers now have until Feb. 3, 2025, to file various state individual and business tax returns and make tax payments.

Relief is being offered to any area designated by the Federal Emergency Management Agency (FEMA). Currently, this includes Cook, Fulton, Henry, St. Clair, Washington, Will, and Winnebago counties. Individuals and households that reside or have a business in any one of these localities qualify for income tax relief. The same relief will be available to any county added later to the disaster area.

Chicago Should Consider Furloughs, Higher Booze Tax, Watchdog Says - Shruti Date Singh, Bloomberg. "To boost revenue, the Civic Federation says the city could look at raising levies for garbage to cover the cost of collection and consider boosting a liquor tax that hasn’t changed since 2007. Congestion pricing or revisiting a so-called head tax that large employers would pay — a measure the city phased out a decade ago — are also within the city’s jurisdiction, according to the report."

Iowa

IDR Announces 2025 Individual Income Tax Brackets and Interest Rates - Iowa Department of Revenue. "Since the enactment of Iowa Senate File 2442 in May, 2024, Iowa law provides for a flat tax rate of 3.8 percent for all levels of taxable individual income beginning with tax year 2025. There will be no income tax brackets in 2025."

Louisiana

Louisiana Ballot Measure Would Reform Administration of Tax Sales - Matthew Pertz, Tax Notes ($). "Amendment No. 4 will be on the ballot for the December 7 general congressional election. If endorsed by a majority of voters, the measure would strike the current state constitutional language on tax sales for tax-delinquent properties and require the Legislature to provide new rules for the process. But some rules would remain the same. For example, interest rates on property tax liens would remain at 1 percent non-compounding per month, plus a maximum 5 percent penalty, for the duration of the redemptive period."

Massachusetts

Massachusetts Tax Amnesty 2024 Announced - Massachusetts Department of Revenue:

The amnesty program will allow non-filers and taxpayers with outstanding tax liabilities to catch up on back taxes and save on penalties. The program aims to bring into compliance those taxpayers who have failed to file returns or have unpaid assessments.

...

Additional information is available on DOR’s Massachusetts Tax Amnesty 2024 Program web page, including frequently asked questions and a full list of eligible and ineligible tax types. The web page will also be updated with video tutorials, and a link to the Amnesty Request.

Michigan

Michigan Tax Tribunal Upholds Railroad Tax Credit for Wells Fargo - Cameron Browne, Tax Notes ($): "The state tax commission argued that Wells Fargo's APR was untimely filed because the company used the wrong form and because the company filed the form by mail rather than electronically, as required by a 2020 Department of Treasury memorandum. But the tax tribunal rejected that argument, finding that neither section 207.6 nor section 207.8 gives the tax commission the authority to prescribe the manner in which a company must file its APR. The tribunal concluded that nothing in the Public Utility Tax Act barred Wells Fargo from submitting its APR through the mail."

Wells Fargo has a subsidiary that leases railcars, in case you were wondering why a bank gets a railroad tax credit.

Missouri

Streaming, Satellite Giants Beat Missouri Service Provider Fees - Richard Tzul, Bloomberg ($). "Streaming and satellite television companies won their battle with the city of Creve Coeur over video provider service fees after a Missouri trial court dismissed the case without explanation in a pair of orders Monday."

Montana

Montana Could Reap Over $1 Billion From a 4 Percent Sales Tax - Kennedy Wahrmund, Tax Notes ($). "For example, a 4 percent statewide sales tax on some goods and services could bring in $1.31 billion in fiscal 2025, according to an October 10 presentation to the Modernization and Risk Analysis Committee by Sam Schaefer, a fiscal analyst with the state's Legislative Fiscal Division (LFD)."

Property Tax Discussion Heats Up During Montana Gubernatorial Debate - Kennedy Wahrmund, Tax Notes ($). "Both men agreed that reform is needed, but that's where the similarities ended during the October 16 debate."

North Dakota

North Dakota Gubernatorial Hopefuls Prioritize Property Tax Relief - Emily Hollingsworth, Tax Notes ($):

Measure 4 would prohibit localities from levying taxes on the assessed value of real or personal property, and would require the state to provide replacement payments at least equal to the locality’s current property tax levies. The measure’s fiscal note estimates that it would cost the state $3.15 billion beginning in the biennium ending in 2027.

Ohio

Taxation of Remote Workers in Ohio - Edward Bernert, Tax Notes ($). "Administering the local income tax is difficult and especially so because of the number of Ohio municipalities imposing the tax. The issues arising from the increased remote work were documented by the symposium. That difficulty notwithstanding, the municipal tax has a long history in Ohio and represents significant revenue for the localities. The time is ripe for the General Assembly to address the effect of increased work from home by employees."

South Dakota

SD Voters To Decide On Food Tax Exemption - Jaqueline McCool, Law360 Tax Authority ($). "Initiated Measure 28 would exempt food for human consumption from sales tax beginning Jan. 1 if it is passed in the November election, for which registration was set to end Monday. According to the measure, the exemption would not extend to alcoholic beverages or prepared foods, which are foods sold heated or with utensils."

Washington

Wash. High Court Lets Anti-Tax Ballot Measure Show Impact - Maria Koklanaris, Law360 Tax Authority ($):

In an opinion, the state's high court rebuffed arguments from Rep. Jim Walsh, R-Aberdeen, the chair of the state Republican Party. Walsh had sought a writ of prohibition preventing the attorney general from preparing — and the secretary of state from certifying — financial disclosure for Initiative 2109, which would repeal the capital gains tax, as well as for two other initiatives. Those two initiatives are I-2117, a cap-and-trade repeal, and I-2124, which would make participation in Washington's long-term care insurance program optional instead of mandatory, according to the opinion.

Tax Policy Corner

Sound Ideas And An Ill-Advised Gamble: SALT In Review - David Brunori, Law360 Tax Authority ($):

Tax History Corner

The 38th birthday of the Tax Reform Act of 1986 passed quietly this week. It was a bipartisan measure that lowered tax rates, eliminated popular but unwise and widely-abused deductions, shut down a generation of tax shelters, and broadened the tax base. We won't see its like any time soon.

We're Here to Help