Key Takeaways

- Energy credit boom a magnet for abuse?

- Lobbying for 2025 tax expirations gears up.

- IRS names leadership for expanded partnership examination efforts.

- Campaign tax math.

- Tariff administration by special favor.

- Info thief crackdown.

- Corporate lawyer skips filing for four years, gets 8 months.

- National Candy Corn Day.

Investments In Energy Tax Credit Boom Could Draw IRS' Eye - Kat Lucero, Law360 Tax Authority ($):

...

Two years into the law, the IRS has already rooted out an emerging scam that exploits the clean energy tax credits and the new transfer mechanism. In July, the agency said the scam entails return preparers misrepresenting passive activity rules under IRC Section 469 in advising clients to report that they have purchased credits to offset their income tax from their main trade or business activity.

In upcoming audits, the IRS may also identify trending issues or discrepancies in tax return claims for the new bonus credits, which can substantially increase the value of the base tax credit amount if projects meet strict requirements, such as those embedded in the prevailing wage and apprenticeship rules, according to practitioners.

Related: Maximize Energy Efficiency Tax Credits and Deductions

TCJA Expiration Lobbying Continues Ticking Upward in 2024 - Cady Stanton, Tax Notes ($):

If previous tax reform years are any indication, lobbying on tax issues is expected to skyrocket in 2025 as taxwriters work out how to address the $4.6 trillion in expiring tax provisions from the TCJA, and many lawmakers have made clear that the entire tax code will be on the table for consideration next year.

...

Filings mentioning section 199A — the 20 percent qualified business income deduction for passthrough business owners set to expire at the end of 2025 — also increased 46 percent from the first quarter to the third quarter.

Mark your calendars for December 19, when Eide Bailly's National Tax Office will look ahead to the 2025 legislative season.

IRS staffs up new partnership exam practice leadership

IRS hires new Associate Chief Counsel to focus on partnerships and other passthrough entities - IRS:

The new Associate Chief Counsel, Jeffrey Erickson, is expected to join the IRS in January 2025. Most recently, he served as a Principal in Ernst & Young’s National Tax Passthroughs Transaction Group.

Holly Porter will be the Associate Chief Counsel for the Energy, Credits, and Excise Tax office, which also will be drawn from the current Passthroughs and Special Industries office.

IRS Taps EY Attorney to Lead New Chief Counsel Partnership Office - Mary Katherine Browne, Tax Notes ($):

The IRS has been turning its attention to partnerships and other passthroughs by using its increased resources under the Inflation Reduction Act. Other efforts in the area include a guidance package addressing related-party basis shifting and the creation of a new group within the Large Business and International Division that will be auditing passthrough entities. That new unit officially started operations October 22.

Taxes and Politics.

Billions in taxes hang in balance for US companies as election nears - Stephen Foley and Radhika Rukmangadhan, Financial Times:

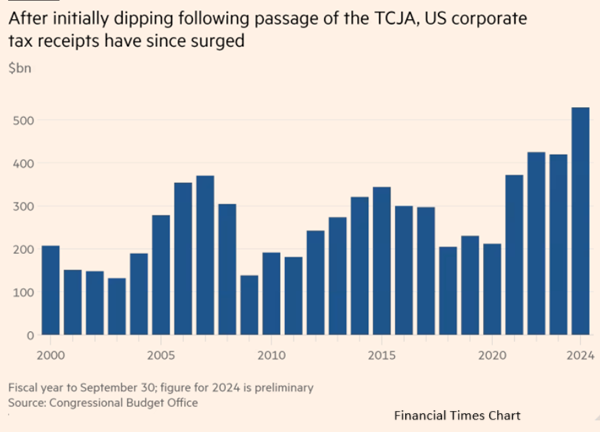

The potential price tag is thanks to the differing tax policies of the two candidates, one of the most crucial distinctions between them for corporate America. Kamala Harris is promising to partly reverse Donald Trump’s big reduction in the corporate rate, while the former president says he will lower it further, intensifying a debate over the legacy of his 2017 reforms and setting the stage for a year of wrangling with the new Congress that will also be elected on November 5. Big business, meanwhile, is gearing up to protect its gains.

In Ellipse Speech, Harris Promises Tax Cuts for Middle-Class Families - Ken Thomas, Wall Street Journal. "The vice president said she will deliver tax cuts to middle-class families and press for a federal ban on price gouging on the cost of groceries. Harris said she will also push to help first-time home buyers and build millions of new homes."

Trump’s income tax math doesn’t add up - Erica York, Washington Post. "Donald Trump has floated a proposal to replace the U.S. income tax system with a new system of tariffs, moving the United States back to the tax mix of the late 19th century. The plan, simply put, is a mathematical impossibility."

Taxes will go up no matter who becomes president. The question is, how much? - Sadek Wahba, The Hill. "The more basic truth is that anyone who occupies the White House in 2025, and any party that controls either house of Congress, will have to grapple with an increasingly intractable set of fiscal conditions. Ultimately, a new approach to revenue generation and investment will be needed."

How To Avoid Paying Tariffs? Have a Friend in Washington. - Eric Boehm, Reason. "In the study, four researchers reviewed 7,015 applications for exemptions that companies filed with the Office of the U.S. Trade Representative. Of those, only 1,022 were approved—but requests from companies that reported spending more on lobbying were more likely to gain approval. Companies with political action committees that made campaign contributions to Republicans were even more likely to score an exception, while those that donated to Democrats were more likely to have exemptions denied."

The Infostealers

U.S. joins international action against RedLine and META infostealers - IRS (emphasis added).

...

RedLine and META are sold through a decentralized Malware as a Service (MaaS) model where affiliates purchase a license to use the malware, and then launch their own campaigns to infect their intended victims. The malware is distributed to victims using malvertising, e-mail phishing, fraudulent software downloads, and malicious software sideloading. Various schemes, including COVID-19 and Windows update related ruses have been used to trick victims into downloading the malware. The malware is advertised for sale on cybercrime forums and through Telegram channels that offer customer support and software updates. RedLine and META have infected millions of computers worldwide and, by some estimates, RedLine is one of the top malware variants in the world.

Be careful out there.

Related: How to Prevent, Detect, and Respond to Cybersecurity Incidents.

Blogs and Bits

Nov. 1 is deadline for disaster-area taxpayers in 8 states - Kay Bell, Don't Mess With Taxes:

The Nov. 1, which also is this weekend’s By the Numbers figure, applies to the taxpayers in those states who earlier this year filed extensions to submit their 2023 tax year returns.

Those extension filers in parts of Arkansas, Iowa, Kentucky, Mississippi, New Mexico, Oklahoma, Texas and West Virginia now must get their 2023 Form 1040s to the IRS by Nov. 1.

IRS Announces 2025 Inflation Adjustments; Social Security Benefits Up 2.5% for 2025 - Parker Tax Pro Library. "In addition, on October 10, the Social Security Administration (SSA) issued a press release announcing that, in January 2025, a 2.5 percent cost-of-living adjustment (COLA) will take effect with respect to social security and supplemental security income benefits. The SSA also announced that, for 2025, the maximum amount of an individual's earnings subject to social security tax is $176,100."

Section 83(b) Election For Restricted Stock, Stock Options, And LLC Interests: Official IRS Form Coming Soon - Bruce Brumberg, Forbes. "For those concerned about IRS tax filings and rules, this is a very big deal. There are various scenarios with equity compensation—specifically restricted stock, stock options, and LLC interests—in which making a timely Section 83(b) election with the IRS can be an important move for tax planning and minimization. However, currently no official IRS form exists for making that election."

Fringe benefits for partners and S corporation shareholders - Jeremy Wells, Empowering Tax Professionals. "Partners and S corporations with multiple shareholders should also understand and consider how they will handle the provision of fringe benefits that may unequally affect them, especially when dealing with taxable benefits."

Tax Crime in the C suite

Moody's former top lawyer gets 8-month sentence in personal tax case - David Thomas, Reuters. " A former longtime general counsel to Moody's was sentenced by a New Jersey federal judge on Thursday to 8 months in prison for willfully failing to file personal federal income tax returns."

From the IRS press release (defendant name omitted, emphasis added):

In addition to the prison term, Judge Espinosa sentenced Defendant to one year of supervised release, ordered restitution to the IRS of $3.11 million, which has already been paid, and fined him $40,000.

I have many questions. The first is why restitution is only $3.11 million on $54 million of unreported income. The tax on $54 million would be around $19 million. My guess is that Moody's withheld taxes, leaving a smaller underpayment.

But then that leaves open the question of why a man who surely knew he was supposed to file tax returns - and who almost certainly got a W-2 statement from Moody's reporting his income and the tax withheld - never bothered to file. Was he that busy?

What day is it?

It's National Candy Corn Day. But don't try to pop it. Trust me on this one.

We're Here to Help