Key Takeaways

- Thwarting ID thieves.

- Deficits, bigger deficits.

- Caregiver tax credit floated.

- Historical context for candidate tax plans.

- Texas accountable care organization loses exemption battle.

- National day for cats, hermits, and oatmeal.

National Cybersecurity Awareness Month reminder: IRS and Security Summit supply online safety tips - IRS:

...

- Recognize scams and report phishing. It’s important to remember that the IRS does not use unsolicited email and social media to discuss personal tax issues, such as those involving tax refunds, payments or tax bills. Don't reply, open any attachments or click any links. To report phishing, send the full email headers or forward the email as is to phishing@irs.gov; do not forward screenshots or scanned images of emails because this removes valuable information. Then delete the email.

- Protect personal information. Refrain from revealing too much personal information online. Birthdates, addresses, age and financial information, such as bank accounts and Social Security numbers, are among things that should not be shared freely. Encrypt sensitive files such as tax records stored on computers.

- Use strong passwords. Consider using a password manager to store passwords.

- Enable multi-factor authentication (MFA).Use this for extra security on online accounts.

- Use and update computer and phone software. Enable automatic updates to install critical security updates, including anti-virus and firewall protections.

- Use a VPN. Criminals can intercept personal information on insecure public Wi-Fi networks. Individuals are encouraged to always use a virtual private network (VPN) when connecting to public Wi-Fi.

A big part of protecting personal information is being careful with tax information. Never send your social security number or tax documents by e-mail or text message. Use your tax preparer's secure web portal to keep your tax life out of the hands of identity thieves.

Candidates and Deficits

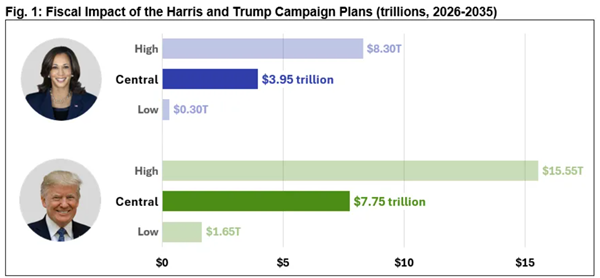

The Fiscal Impact of the Harris and Trump Campaign Plans - Committee for a Responsible Federal Budget:

Our estimates come with a wide range of uncertainty, reflecting both different interpretations and estimates of the policies. Under our low- and high-cost estimates, we estimate Vice President Harris’s plan could increase debt by between $300 billion and $8.30 trillion through 2035, while President Trump’s plan could increase debt by between $1.65 and $15.55 trillion.

No Tax on Police Officers, Firefighters, Veterans, and Active Duty Military: Basic Background - Ernie Tedeschi, Yale Budget Lab. "Looking forward, under conventional assumptions (e.g. no assumed employment shifts towards these occupations), TBL estimates that a military, veterans, and first responders exemption would cost roughly $2 trillion over the next decade (0.6% of GDP) if it just applied to individual income taxes, and $3.6 trillion (1% of GDP) if it exempted employee and employer payroll taxes as well."

Deficit Threat Drives Bond Yields Higher - Sam Goldfarb, Wall Street Journal. "Most investors expect the budget deficit to remain elevated no matter who wins in next week’s elections, with the cost of spending programs such as Medicare and Social Security climbing faster than federal revenues. Still, many think the budget gap will expand the most if Republicans sweep control of both the White House and Congress, leading to extensions of old tax cuts and the possible addition of new ones."

Taxes and the Election

Trump Proposes Tax Credit for Family Caregivers - Alexander Rifaat, Tax Notes ($):

Trump didn’t provide details on how his credit would be structured or elaborate on who would qualify as a “loved one.” A Trump campaign spokesperson didn’t respond to a request for comment by press time.

Can a Democrat Be the Candidate of Small Business? Harris Gives It a Try. - Lydia DePillis, New York Times. "Ms. Harris’s small-business package seeks to capitalize on that momentum, setting a goal of 25 million new-business applications in four years. She also proposes to multiply the start-up expense deduction tenfold, to $50,000, and to create a fund for zero-interest loans to help businesses expand."

Placing Harris and Trump Tax Plans in Historical Context - Erica York and Nicolo Pastrone, Tax Policy Blog. "We find Harris’s tax plan would rank as the 15th largest tax increase since 1940 and the 6th largest tax increase outside of wartime over the same period. Trump’s combination of tariffs and tax changes would rank as the 6th largest tax cut since 1940. However, Trump has indicated he would pursue tariff hikes on their own without requiring Congressional approval. If tariffs rise without accompanying tax cuts, they would rank as the 7th largest tax increase since 1940, and the largest tax increase outside of wartime over the same period."

A More Aggressive Trump Tariff Would Lower Household Incomes By Nearly $3,000 - TaxVox:

A separate Trump proposal—a 200 percent tariff on auto imports from Mexico—would raise household taxes by an average of an additional $600, or about 0.6 percent, TPC estimated.

Fifth Circuit diagnoses Texas healthcare organization as taxable

Healthcare Group’s Tax-Exemption Rejection Upheld on Appeal - Caitlin Mullaney, Tax Notes ($):

...

MHACO argued that its operations are intended to increase the quality and lower the cost of healthcare for its community and that any private company benefits “are merely incidental.” It said the Tax Court improperly determined that the MHACO doesn’t qualify as a section 501(c)(4) organization operating exclusively for the promotion of social welfare.

5th Circ. Affirms Texas Health Coordinator Is Not Tax-Exempt - Anna Scott Farrell, Law360 Tax Authority ($):

"The vast majority of MHACO's operations pertain to creating cost savings that turn into revenue for insurance companies, private providers, and private payors," Judge Haynes said.

Link: Court opinion.

FATCA update

IRS Extends Relief For FATCA Filings Without ID Numbers - Jack McLoone, Law360 Tax Authority ($). "Foreign financial institutions that report information on U.S. account holders to the Internal Revenue Service without including the taxpayer identification numbers associated with those accounts won't be flagged for noncompliance for the next three years, the agency said Monday."

Blogs and Bits

More capital gains profits fall into wider brackets thanks to 2025 inflation adjustments - Kay Bell, Don't Mess With Taxes. "In addition, when the investments are long-term, again they are held for more than a year, the profit they produce is taxed at a lower rate. The top tax rates on those proceeds are 0 percent, 15 percent, and 20 percent."

BOI Reporting: A Reminder - Russ Fox, Taxable Talk. "If you have a business entity registered with a state, you likely have this filing requirement; less than one-third of businesses that need to file have filed. This requirement is by business, not by owner. If you have five LLCs (each one holding a rental property), you must file five reports. Individuals can obtain a FinCEN identifier so that they don’t have to type in duplicative ownership information (and, instead, just type the identifier number)."

Related: Corporate Transparency Act Mandates Stricter Federal Disclosures.

Automatic Foreign Gift Reporting Penalty For Late Filed Form 3520, Part IV Ending - Ronald Marini, The Tax Times. "Failure to disclose large foreign gifts can result in penalties of up to 25% of the gift under Internal Revenue Code Section 6039F, with the penalty being automatically assessed even though the gift is likely not a taxable event."

Tax Breaks: The We’re Already Planning For Next Tax Season Edition - Kelly Phillips Erb, Forbes:

While the IRS encourages all taxpayers to sign up, you should definitely consider doing so if you’ve received a Notice 5071C. (☆) The IRS sends out Notice 5071C when they have received a federal income tax return (that’s your Form 1040) filed using your Social Security number (SSN) or individual tax identification number (ITIN) and have concerns about who might have filed it. Before the IRS will process the tax return, they need you to verify your identity.

Good as Gold Tax Crime Beat

Delaware precious metals depository owner convicted of mail, wire and tax fraud - IRS (Defendant name omitted, emphasis added):

According to court records and evidence presented at trial, Defendant owned and operated First State Depository, a precious metals depository located in Wilmington, Delaware. First State Depository held over $100 million in customer assets, primarily in the form of gold and silver bars and coins. According to evidence presented at the trial, Defendant diverted customer assets to pay debts and finance his personal life, including two timeshares in Hawaii and luxury vacations. First State Depository’s records indicated that at least $58 million worth of customer assets had been misappropriated. Industry sources generally agree that this is the largest theft from a precious metals depository in U.S. history.

Regular readers won't be surprised that he didn't report the $58 million as taxable income.

The moral: The utility of precious metals as a store of value depends a lot on where you store it.

What day is it?

It's National Cat Day, National Hermit Day, and National Oatmeal Day, so a shout-out to everyone enjoying the day in seclusion with oatmeal and a tabby.

We're Here to Help