Key Takeaways

- TCJA discussions continue

- Energy Credit requests

- Higher FDII, GILTI Rates

- Too much tax documentation?

- Statue of limitations for tax records

- Foreign tax credits

- Withholding of retirement plan payments

- Exascale Day

TCJA

Full TCJA Extension Could Lead to Market Meltdown, Yellen Warns - Alexander Rifaat, Tax Notes($):

At an October 17 event hosted by the Council on Foreign Relations in New York, Yellen argued that Republican presidential nominee Donald Trump’s plan to fully extend the provisions, which expire December 31, 2025, and his proposal to impose a blanket tariff on imports would widen the country’s fiscal imbalance and spook markets.

Energy Credits

Energy Industry Urges Less Rigid Community Bonus Credit Rules - Mary Katherine Browne, Tax Notes($):

Attendees at an October 17 public hearing requested that Treasury and the IRS remove the placed-in-service restrictions for relevant facilities, qualify energy storage technology for the credit, and make industry-friendly changes to the application portal when finalizing guidance for the section 48E(h) bonus credit.

Contact Eide Bailly’s energy efficiency specialists and business advisors! Related link: How the Inflation Reduction Act is Boosting Energy Efficiency Incentives

FDII, GILTI

Model Estimates Higher FDII, GILTI Rates Raise Extra $410 Billion - Andrew Velarde, Tax Notes($). "Scheduled rate increases for the foreign-derived intangible income and global intangible low-taxed income provisions in 2026 will raise an additional $410 billion over the following decade, according to the Penn Wharton Budget Model (PWBM)."

Documentation

Couple With ‘So Many Boxes’ of Documents Can’t Prove Biz Expenses - Chandra Wallace, Tax Notes($). "A married couple failed to substantiate business expenses and net operating losses, claiming instead that they had too many records to locate supporting documentation, the Tax Court ruled."

IRS audit statute of limitations guides tax record keeping - Kay Bell, Don't Mess With Taxes:

That could be weeks, months, or years from now. Some documents you might need to save forever.

Foreign Tax Credits

No Double Taxation in Liberty Global’s Japanese Sale, DOJ Says - Michael Smith, Tax Notes($). "The government is pushing back in its Tenth Circuit dispute with Liberty Global Inc. (LGI), claiming that approximately $242 million in foreign tax credits is unwarranted because none of the income is subject to double taxation."

Retirement Plan Withholding

IRS Retirement Regulation Finalized for Taxpayers Outside US - Martha Mueller Neff, Bloomberg($):

...

If a payee has provided the payor with a residence address outside of the United States, the payor is required to withhold income tax from designated distributions to the payee.

Eide Bailly's Global Mobility Professionals can help!

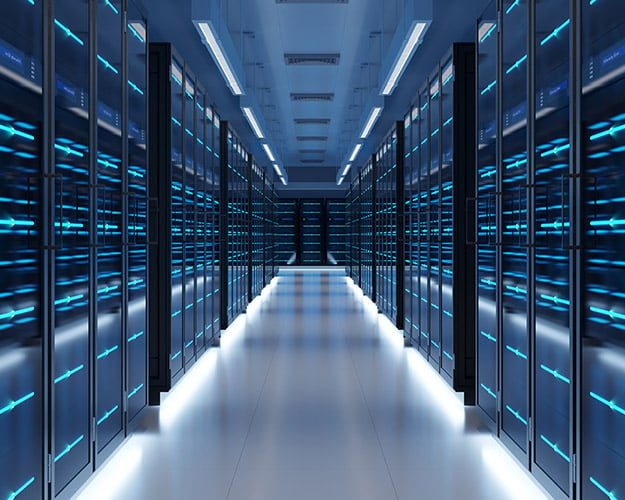

What Day is It?

National Exascale Day! "National Exascale Day celebrates the scientists and researchers who make breakthrough discoveries in medicine, materials sciences, energy and beyond with the help of some of the fastest supercomputers in the world." Cheers to these folks and enjoy.

We're Here to Help