Key Takeaways

- Tax Foundation study links taxes and migration.

- Tucson tax on Expedia struck down.

- California wealth tax falls flat.

- Colorado Governor calls for tax cuts.

- Iowa retirement exclusion rules go final.

- Kansas flat tax passes as veto bait.

- Wisconsin considers reviving tax pact with Minnesota.

- Nebraska property tax bill, ad tax controversy.

- New Jersey sales tax exemption for bullion vetoed.

- NM pushes manufacturing credits.

- NY Governor pushes housing incentives.

- Oklahoma gets tax cut special session.

- Supreme Court lets Washington gain tax stand.

- West Virginia tax cuts pushed.

- Tax Policy Corner features Montana and Nebraska.

- The Danegeld.

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs.

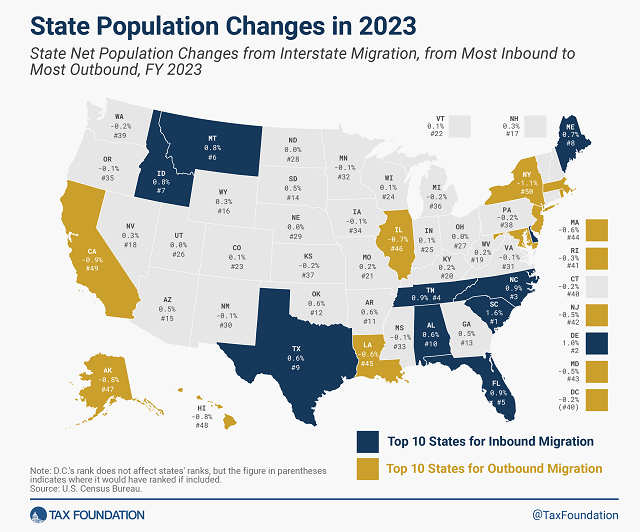

Americans Moved to Low-Tax States in 2023 - Katherine Loughead, Tax Foundation:

This population shift paints a clear picture: Americans are leaving high-tax, high-cost-of-living states in favor of lower-tax, lower-cost alternatives. Of the 32 states whose overall state and local tax burdens per capita were below the national average in 2022, 24 experienced net inbound migration in FY 2023. Meanwhile, of the 18 states and D.C. with tax burdens per capita at or above the national average, 14 of those jurisdictions experienced net outbound migration.

Though only one component of overall tax burdens, the individual income tax is particularly illustrative here. In the top third of states for population growth attributable to domestic migration, the average combined top marginal state income tax rate is about 3.8 percent. In the bottom third (including D.C.), it’s 3.5 percentage points higher, at about 7.3 percent.

As those of us who spent part of the morning moving snow will attest, there are reasons to move besides taxes, but while taxes aren't everything, but they are certainly a thing.

State-By-State Roundup

Arizona

Expedia Not Subject to Tucson's Hotel Tax, Arizona Appeals Court Holds - Paul Jones, Tax Notes ($). "In its January 11 opinion in City of Tucson v. Orbitz Worldwide Inc., the Arizona Court of Appeals, Division One, determined that the city of Tucson's hotel tax doesn't apply to Expedia and its other online hotel booking businesses, including Orbitz, Hotels.com, and Hotwire, vacating a superior court's $400,000 judgment in favor of the city."

California

Revived California Wealth Tax Bill Gets Cold Shoulder in Committee - Paul Jones, Tax Notes ($):

A returning California wealth tax proposal recently got a cool reception from the State Assembly's tax and revenue committee and does not appear likely to advance.

A.B. 259, which was heard by the Assembly Committee on Revenue and Taxation on January 10, was not voted on and was moved to the committee's suspense file.

“I appreciate the conversation, but this isn't going to become law,” said Assembly member Joe Patterson (R), who noted that Gov. Gavin Newsom (D) reaffirmed his opposition to the measure January 10 during a news conference on his budget.

Data Processor Seeks $32 Million in R&D Credits From California - Richard Tzul, Bloomberg ($):"Information technology company Electronic Data Systems Corp. & Subsidiaries sued the California Franchise Tax Board to receive a refund of about $32million in research and development tax credits because that amount is authorized under an applicable calculation method."

Related: Research & Development Tax Incentives

Colorado

Colorado Governor Calls for Income, Property Tax Reductions - Emily Hollingsworth, Tax Notes ($):

Colorado Gov. Jared Polis (D) is calling for reductions to income and property taxes, along with expansions of the affordable housing tax credit and greater flexibility for the senior homestead exemption.

...

But Polis reiterated his opposition to using TABOR refunds to offset property taxes. “I believe that’s shortsighted,” he said, adding that property tax relief measures should protect funding to local services, such as schools or fire departments.

Iowa

Iowa DOR Amends Rules on Retirement Income Exclusion - Emily Hollingsworth, Tax Notes ($). "The amended rules, ARC 7502C, were published on January 10. They implement 2022's H.F. 2317, which excludes pension and other retirement income of qualifying taxpayers from state income tax beginning January 1, 2023, and; S.F. 181, enacted in February 2023, which clarifies that excluded retirement income is not required to be withheld."

Kansas

Kansas Flat-Tax Bill Sent to Governor Kelly for Likely Veto - Michael Bologna, Bloomberg ($). "Although the Republican Party has strong majorities in both the House and the Senate, both chambers failed to pass the bill by veto-proof tallies. A spokesperson for House Speaker Dan Hawkins (R) confirmed the bill needs 84 votes in the House and 27 in the Senate to overcome a veto."

Link: HB 2284

Minnesota

Wisconsin lawmakers want study into reviving income tax deal with Minnesota - Sarah Lehr, Wisconsin Public Radio:

For more than 40 years, a reciprocity agreement allowed Wisconsinites who work in Minnesota and Minnesotans who work in Wisconsin to file one state income tax return instead of two.

But Minnesota ended that agreement in 2010 because of delayed payments from Wisconsin.

Nebraska

Nebraska Governor Urges Lawmakers on Plan to Cut Property Tax 40% - Michael Bologna, Bloomberg ($). "In his State of the State address, the first-term Republican urged lawmakers to pass bills reducing local property tax levies and capping local spending to reduce the tax impact on homeowners and businesses. Pillen said his plan, which would reduce total levies by school districts, cities, and counties to $3 billion from roughly $5 billion, could be covered from reserve funds, a higher sales tax, spending controls, and closure of 'tax loopholes created by special interests at the expense of the middle class.'"

Following Maryland’s Lead? We Guess Everyone Wants to Go to Court. Icy Challenges to Nebraska’s Advertising Services Tax Act Start to Emerge - Stephen P. Kranz, Mark Nebergall and Jonathan C. Hague, Inside SALT. "The heart of the controversy lies in the new advertising tax’s specifics. The tax only targets firms with US gross advertising receipts exceeding $1 billion, a threshold that effectively discriminates against out-of-state advertising service providers and implicates constitutional and federal laws governing interstate commerce."

New Jersey

N.J. Governor Vetoes Bill to Exempt Silver, Gold From Sales Tax - Danielle Muoio Dunn, Bloomberg ($). "The bill, A5294, would have provided an exemption from the sales and use tax for the sale of investment metal bullion and investment coins. The move would have cost the state between $4.8 million and $7 million annually, according the legislation’s fiscal statement."

New Mexico

New Mexico Governor Wants Manufacturing Tax Credit, Hospital Tax - Angélica Serrano-Román, Bloomberg ($). "During her State of the State speech Tuesday, the Democratic governor proposed to allocate 2% of the state severance tax permanent fund, totaling $170 million, to further advance energy sources such as hydrogen, geothermal, and battery storage. The allocation would be coupled with an advanced manufacturing tax credit, aiming to piggyback on the Inflation Reduction Act, to attract global companies."

New York

New York Governor Calls for NYC Housing Incentives, Tax Reform - Emily Hollingsworth, Tax Notes ($):

Her budget would authorize the creation of a New York City tax incentive program intended to replace the section 421-a program, which expired in 2022 and provided tax exemptions for the construction of multifamily or cooperative housing in cities with populations of 1 million or more. According to the budget, legislation would be introduced that would also allow New York City to provide tax incentives for the conversion of commercial properties into residential properties that include below-market housing.

The governor's budget would also create a $3,000 tax credit for small businesses that spend more than $12,000 on retail theft prevention measures. That commercial security tax credit program would be available for 2024 and 2025 and would be capped at $5 million annually.

NY Governor Would Replace Cannabis Potency Tax With Excise Tax - Danielle Muoio Dunn. "New York Gov. Kathy Hochul (D) wants to repeal the state’s cannabis potency tax, saying it would support expansion of the legal pot market by simplifying tax collection obligations for cultivators, processors, and distributors."

Oklahoma

Okla. Gov. Calls Special Session For Income Tax Cut Plan - Jaqueline McCool, Law360 Tax Authority ($). "In an executive order issued Tuesday, Republican Gov. Kevin Stitt called for an extraordinary session of the state's Legislature so representatives could vote on his plan to decrease individual income tax rates by 0.25 percentage points. In the news release, Stitt said the state was in a strong financial position, and he was calling on the Legislature to offer economic relief to its residents."

Rhode Island

Rhode Island Governor Pitches Modest Corporate Tax Cut - Angélica Serrano-Román, Bloomberg ($). "In his State of the State speech late Tuesday, McKee said he plans to submit a budget proposal to the General Assembly that includes a decrease in the corporate minimum tax from $400 to $350 and an increase in the threshold for taxable retirement income. Currently, Rhode Island allows a deduction of up to $20,000 for single filers and $40,000 for married individuals filing jointly."

Washington

SCOTUS Rejects Challenge to Washington Capital Gains Tax - Paul Jones, Tax Notes ($):

The U.S. Supreme Court has declined to hear a challenge to Washington state’s capital gains tax, delighting progressive tax policy advocates and shifting opponents’ focus to a state ballot initiative to repeal the tax.

In a January 16 order, the Supreme Court denied cert in Quinn v. Washington, letting stand the Washington Supreme Court's March 2023 decision upholding the tax. The Court's decision is a setback to the tax's opponents, who had hoped to overturn it on U.S. constitutional grounds by seeking a direct review by the Court.

West Virginia

West Virginia Governor Details Proposed Tax Cuts - Benjamin Valdez, Tax Notes ($). "Justice on January 16 released the details of three tax cuts he’s including in his fiscal 2025 budget: a Social Security benefit exemption, a child and dependent care tax credit, and an increased property tax credit for senior taxpayers. The plan was first announced by Justice during his January 10 State of the State address."

Tax Policy Corner

Other Views On Administration And Land Tax - David Brunori, Law360 Tax Authority ($): "States should have an independent forum for appeals. There should be an opportunity to appeal before paying. Refunds and assessment statutes of limitations should be evenhanded. Interest rates on refunds and assessments should be equalized. There should be automatic extensions of state due dates based on federal extensions."

David refers to a Council on State Taxation report, The Best and Worst of State Tax Administration. The COST report has nice things to say about Montana (my emphasis):

Montana improved its overall score from a “B” in 2019 to an “A” in 2023, in large part through changes in the State’s laws governing the reporting requirements for federal tax changes. Notably, since the 2019 scorecard, Montana has statutorily defined “final determination” and increased the number of days to report IRS changes from 90 days to 180 days. Additionally, in 2022, Montana enacted legislation (H.B. 53, Laws 2022) which substantially aligns the State with the MTC Consensus Model for reporting federal partnership adjustments. Montana also made great strides in the area of fair and efficient administration by enacting legislation (H.B. 447, Laws 2023) which establishes a 30-day safe harbor for non-resident employees who travel to the State to perform work duties. While the bill is a step in the right direction, there is room for improvement. The bill adds unnecessary complexity by containing an exception to the 30-day safe harbor for employees who earn over $500,000 in compensation in the prior year. Finally, although not an issue covered by the Scorecard, Montana also deserves praise for legislation in 2023 (S.B. 246, Laws 2023) which removed the punitive tax haven “blacklist” contained in the State’s statutes.

Nebraska doesn't fare as well, according to COST:

Nebraska also dropped from a “C” grade in 2019 to a “D” grade in 2023. The State continues to labor in its tax administration without an independent tax tribunal for hearing cases before independent judges with significant state tax expertise. Nebraska offers only 60 days to report federal changes to the State, a process which can require hundreds, if not thousands, of amended returns for a multijurisdictional consolidated filing group. The State’s Department of Revenue also includes federal GILTI (global intangible low-taxed income) in the tax base without clear legislative authority. The State also imposes personal income tax liability on nonresident traveling employees (and related withholding on employers) as of the first day such employees step into the State. Although those rules are rarely enforced, the fact that they remain in the State’s laws raises the specter of selective or unequal enforcement against those who make a best-effort at compliance and those who choose to ignore the law altogether.

Tax History Corner

Taxing people who live elsewhere has a long history. Wikipedia explains the Danegeld:

Danegeld (/ˈdeɪnɡɛld/; "Danish tax", literally "Dane yield" or tribute) was a tax raised to pay tribute or protection money to the Viking raiders to save a land from being ravaged. It was called the geld or gafol in eleventh-century sources. It was characteristic of royal policy in both England and Francia during the ninth through eleventh centuries, collected both as tributary, to buy off the attackers, and as stipendiary, to pay the defensive forces.

While public opinion surveys in the ninth century have not survived, we can assume that the Danegeld was highly popular with the Danes. According to the Wikipedia article, the Danegeld taught the raiders an early version of the Laffer Curve:

In 994 the Danes, under King Sweyn Forkbeard and Olav Tryggvason, returned and laid siege to London. They were once more bought off, and the amount of silver paid impressed the Danes with the idea that it was more profitable to extort payments from the English than to take whatever booty they could plunder.

While certainly buying off raiders was not pleasant for that era's English kings, it had a side benefit: modernizing tax administration. Per Wikipedia:

Everywhere the tax was farmed (collected) by local sheriffs. Records of assessment and income pre-date the Norman conquest, indicating a system which James Campbell describes as "old, but not unchanging". According to David Bates, it was "a national tax of a kind unknown in western Europe"; indeed, J. A. Green asserts that the national system of land taxation developed to raise the Danegeld was the first to reappear in Western Europe since the collapse of the Western Roman Empire

In most jurisdictions, ravaging and pillaging defenseless neighbors has been replaced by more subtle techniques, like cookie nexus.

We're Here to Help