Key Takeaways

- New Hampshire worldwide tax push "collapses."

- State taxes to watch this year.

- How businesses were taxed by states in FY 2022.

- 2024 outlook: more state tax cuts?

- Pass-through entity taxes proliferate.

- Developments in CA, IA, MI, NE, NY, WA, WI.

- Which state tax departments are the best?

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs.

Business Tax Overhaul Collapses in New Hampshire Legislature - Michael Bologna, Bloomberg ($):

The state House voted 192 to 176 to block H.B. 121, which would have abandoned New Hampshire’s “water’s edge” income reporting rule and replaced it with a worldwide combined reporting regime. Mandatory worldwide reporting would have forced businesses to calculate their taxes based on global income attributable to New Hampshire—permitting the state to reach for tax revenue beyond US borders, or the “water’s edge.”

No state currently applies mandatory worldwide combination for all businesses, although 10 states permit it as a return filing option. Alaska is a minor exception, requiring worldwide reporting for oil and gas production companies.

Attempts to impose a worldwide system in Minnesota nearly passed last year.

State And Local Tax Cases To Watch In 2024 - Maria Koklanaris, Law360 Tax Authority ($):

Businesses have long been frustrated with states' applications of P.L. 86-272, formally known as the Interstate Income Act of 1959, which insulates businesses from state taxes on net income when the soliciting of tangible personal property orders is their only connection to a state. They became even more frustrated after the Multistate Tax Commission released an updated statement in 2021 outlining when an out-of-state business' internet activities exceed P.L. 86-272 protections. The MTC's updated statement, focused on the internet age, brings in a host of new activities that would defeat the protections of P.L. 86-272.

Now, business frustration is beginning to appear as litigation.

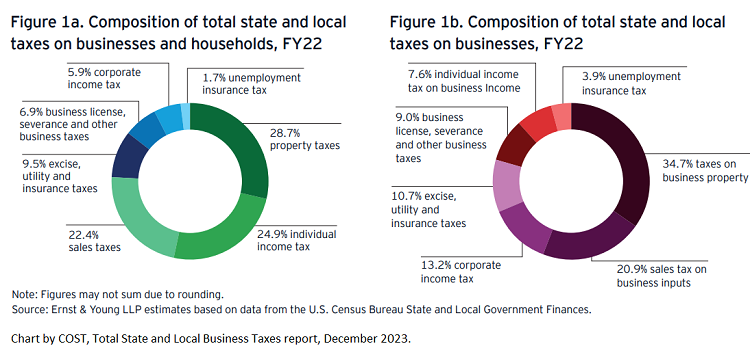

Businesses Paid More Taxes in Fiscal 2022, COST Report Says - Benjamin Valdez, Tax Notes ($). "The December 22 report — prepared by EY in conjunction with COST and the State Tax Research Institute, a COST affiliate — estimated the state and local tax burden for businesses during fiscal 2022 on a state-by-state basis. According to the report, businesses across all states paid a total of $1.07 trillion in state and local taxes over that period — or 44.6 percent of all state and local tax revenue — which was an increase of 13.7 percent over the amount paid in fiscal 2021."

New Tax Cuts Possible in 2024 in States With Stable Revenues - Michael Bologna, Bloomberg ($). "Fiscal analysts say most states continue to float on a cushion of cash that leaves lawmakers with little reason to raise additional revenue. Most states will enjoy modest but durable revenue growth after the surges seen in 2021 and 2022. Even California, which faces a $68 billion budget deficit for the coming year, appears to have reserves and budgetary devices to bridge the anticipated gap."

States’ Pass-Through Taxes Gain More Flexibility and Eligibility - Angélica Serrano-Román, Bloomberg ($):

Since the cap was introduced, 36 states and New York City have implemented various forms of pass-through entity taxes. These provisions allow partnerships and similar businesses to pay state income tax at the entity level, instead of passing income through to individual owners, who receive a state tax credit offsetting the federal deduction limit.

Seven states—Hawaii, Iowa, Indiana, Kentucky, Montana, Nebraska, and West Virginia—created PTET regimes in 2023, while legislatures in Maine, Pennsylvania, and Vermont explored it but didn’t get to enactment. And still more tweaked their laws as the scheduled December 2025 sunset of the SALT deduction ceiling draws nearer.

State-By-State Roundup

California

California FTB Seeks Revised Judgment in P.L. 86-272 Guidance Suit - Paul Jones, Tax Notes ($).

The California Franchise Tax Board is asking the San Francisco County Superior Court to modify its judgment striking down the board’s P.L. 86-272 guidance as "underground regulations."

...

P.L. 86-272 protects sellers of tangible goods from a state’s income tax if they limit their activities in the state to soliciting sales of goods and they exclusively accept orders at, and ship orders from, an out-of-state location. Like the MTC guidance, California’s TAM and Publication 1050 asserted that out-of-state sellers that conduct certain activities online, such as providing post-sale support services to a California customer through a website or accepting applications for employment from residents over the internet, constitute conducting those activities in California via the internet. The guidance said sellers engaged in those activities are doing more than merely soliciting sales in California and therefore lost P.L. 86-272 protection.

Iowa

Iowa DOR Reminds Taxpayers About New Tax Abatement Law - Emily Hollingsworth, Tax Notes ($). "The instructions for the abatement application say it is for taxpayers seeking an abatement of a doubtful tax liability — which does not include a tax liability that has been established by a final court judgment or an administrative ruling — or for the promotion of effective tax administration."

Link: Department of Revenue news release.

Michigan

Michigan Treasury Issues Guidance on Sales Tax Sourcing - Emily Hollingsworth, Tax Notes ($). "According to the guidance, whether a sale is sourced to Michigan, rather than to another state, often depends on the location where the purchaser receives the tangible personal property. If a sale is sourced to Michigan, it is subject to the state’s 6 percent sales and use tax."

Link: Michigan Revenue Administrative Bulletin 2023-26.

Michigan Court: Taxpayer Entitled to Surplus Proceeds From Foreclosure - Cameron Browne, Tax Notes ($). "But the court found that the fact pattern in the case was distinct from Rafaeli because the taxpayer's property was not sold in a foreclosure sale and was instead transferred to a land bank. While no sale occurred and there were no surplus proceeds, the court held that the record did not imply that there was no taking of the property or that the property had no value. Noting that the case was what Michigan's takings clause was designed to prevent, the court concluded that Yono was entitled to the surplus owed on the property. The court remanded the issue to the circuit court to calculate the surplus amount after subtracting what Yono owed on it when the foreclosure occurred."

Nebraska

Nebraska Plan Would Expand Sales Tax to Fund Property Tax Cuts - Michael Bologna, Bloomberg ($). "Pillen’s plan recommends limits on property taxes and directs local governmental units to control their spending and trim services. Some of the revenue would be restored through a bump of up to two percentage points in the state’s 5.5% sales and use tax rate. Additional funds would be collected by expanding the sales tax base to certain services and eliminating sales tax exemptions on certain items."

New York

New York Adopts Long-Awaited Corporate Tax Reform Regs - Emily Hollingsworth, Tax Notes ($). "The State Department of Taxation and Finance on December 11 adopted amendments to its business corporation franchise tax, banking corporation franchise tax, and insurance corporation franchise tax regs under the State Administrative Procedure Act. The adopted regs were published in the New York State Register on December 27."

Washington

Washington DOR: Company’s Activities Created Nexus for Former Subsidiary - Cameron Browne, Tax Notes ($). "The tax review officer found that the parent company’s actions gave the taxpayer substantial nexus in Washington before the merger, citing Wash. Admin. Code section 458-20-193, which states that any activity performed in Washington on behalf of the seller that is significantly associated with establishing or maintaining a market within the state is sufficient to establish nexus."

Capital Gains Tax Repeal Could Be on Washington’s 2024 Ballot - Laura Mahoney, Bloomberg ($). "A group called Let’s Go Washington has submitted a ballot measure to repeal the tax—one of two anti-tax measures the group is hoping to place before voters in the November 2024 ballot. The other would prohibit the state or local governments from imposing an income tax."

Wisconsin

Tax Policy Corner

Revenue Agencies At Their Finest: SALT In Review - David Brunori, Law360 Tax Authority ($):

I sent out a survey to many practitioners asking which they thought were the 10 best revenue departments. I sent out a similar, albeit smaller, survey to revenue department officers asking the same question. They could not nominate their own departments, and I promised anonymity.

The criteria were simple: what revenue departments, and specifically their senior management, were committed to getting the tax laws right, so to speak, and providing taxpayers with the ability to solve problems without spending inordinate time and resources? A vast majority of taxpayers want their taxes done correctly. Most are not interested in being particularly aggressive — it's not worth the risk or the fight. The best revenue departments recognize this.

The top five revenue departments for 2023 and their leaders, in alphabetical order:

District of Columbia Office of Tax and Revenue, Keith Richardson

Kansas Department of Revenue, Mark Burghart

Indiana Department of Revenue, Bob Grennes

Iowa Department of Revenue, Mary Mosiman

Virginia Department of Taxation, Craig Burns

What do these five departments have in common? They have leaders at the top who are in fact committed to getting things "right." It is not merely about squeezing as much money as you can from people and businesses.

Tax Thought for the Week

"Plundering and extracting tribute from foreigners - or, more generally, from those regarded for some reason as outsiders (or, more generally, from those regarded for some reason as outsiders...) has always been a popular form of taxation. Rulers Prefer to extract their resources from people on whom their popular support does not depend."

-From Rebellion, Rascals, and Revenue: Tax Folllies and Wisdom Through the Ages, Michael Keen and Joel Slemrod.

Make a habit of sustained success.