Key Takeaways

- IRS opens doors to returns January 29.

- Direct File to be "widely available mid-March."

- Taxwriters look to have a deal by January 29.

- House leadership "extremely skeptical" a tax deal can be done.

- Supremes decline to hear appeal of partnership that 'filed' return with IRS agent.

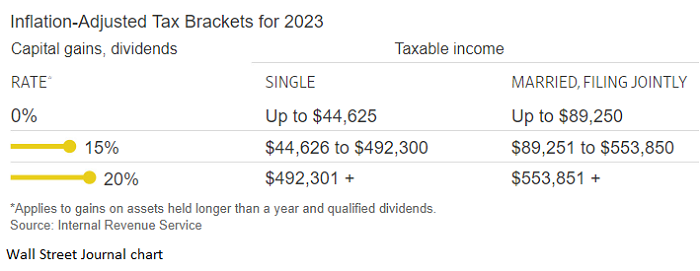

- Capital gains brackets.

- Standard v. Itemized.

- Form 8300 and crypto.

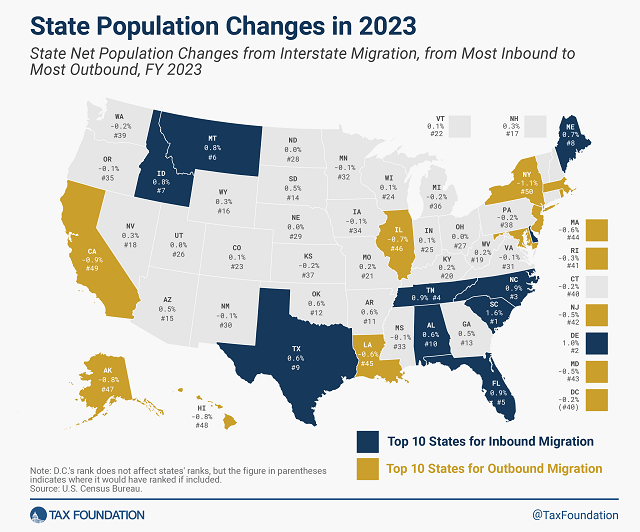

- Taxes and migration.

- IRS "cave" dangers.

- Static Electricity Day.

2024 tax filing season set for January 29; IRS continues to make improvements to help taxpayers - IRS:

The Internal Revenue Service today announced Monday, Jan. 29, 2024, as the official start date of the nation's 2024 tax season when the agency will begin accepting and processing 2023 tax returns.

The IRS expects more than 128.7 million individual tax returns to be filed by the April 15, 2024, tax deadline.

Although the IRS will not officially begin accepting and processing tax returns until Jan. 29, people do not need to wait until then to work on their taxes if they're using software companies or tax professionals. For example, most software companies accept electronic submissions and then hold them until the IRS is ready to begin processing later this month.

Good advice: start gathering your information. Unfortunately, many taxpayers will still be awaiting 1099s on January 29. Many others will be waiting weeks or months for K-1s from partnerships and S corporations.

The IRS had an interesting note on their much-touted Direct File program (emphasis added):

IRS Free File will also be available on IRS.gov starting Jan. 12 in advance of the filing season opening. The IRS Direct File pilot will be rolled out in phases as final testing is completed and is expected to be widely available in mid-March to eligible taxpayers in the participating states.

That won't be welcome news to a taxpayer impatient for a refund who wants to use the new Direct File plan. Of course, there's no guarantee that the "mid-March" date will be achieved.

Filing Season Start Date New Target for Lawmakers’ Tax Package - Cady Stanton, Tax Notes ($):

Senate Finance Committee Chair Ron Wyden, D-Ore., told reporters January 8 that the looming government funding deadlines — set at January 19 and February 2 — have been the subject of congressional tax deal negotiations in recent days, but that the January 29 start of the 2024 filing season is the true deciding factor when it comes to timing.

“We're honing in on a very specific target, which is to get this done in time for filing season, and I'm going to pull out all the stops and stay at it every day,” Wyden said.

Wyden emphasized that parity between the two primary sides of the deal — addressing three major expired tax provisions from the Tax Cuts and Jobs Act and expanding the child tax credit — is paramount in discussions, defining the terms of the agreement as needing to provide for equal spending in both areas.

Who to watch in the tax talks - Punchbowl News (scroll down):

Top tax writers are closing in on a bipartisan deal to revive some business tax benefits and expand the child tax credit. The questions now: Is everyone bought in? And can it pass?

...

Hill sources told us Monday it’s unclear if senior Senate Republicans — including Finance Committee Ranking Member Mike Crapo (R-Idaho) — will back the potential agreement. Crapo is in line to become chair of the panel if Republicans win the Senate this year, giving him a shot to negotiate his own expansive tax package.

The other wrench to watch: Speaker Mike Johnson is facing internal pushback over his handling of the funding talks, as we detailed above. And House leadership is exceedingly skeptical a tax deal can get done in this political climate anyway.

Freedom Caucus Blasts Budget Deal, Progressives Lament IRS Cuts - Doug Sword and Cady Stanton, Tax Notes ($):

“It’s even worse than we thought,” the House Freedom Caucus said on X, formerly known as Twitter.

Calling the agreement “a total failure,” the conservative caucus’s reaction was reminiscent of late May 2023, when members of the group condemned former House Speaker Kevin McCarthy for negotiating the Fiscal Responsibility Act of 2023 (H.R. 3746), the debt-limit agreement largely enshrined in the new budget framework agreement.

Supreme Court Skips Case Over How to File Delinquent Tax Returns - John Wooley, Bloomberg ($): "The US Supreme Court on Monday declined to review a ruling that held a partnership had failed to file its late return because it had submitted the return directly to IRS agents, rather than to a designated service center."

Iowa House GOP leader ‘pretty confident’ 2024 will bring more action on taxes - Mike Mendenhall, Business Record. "When asked if the timeline to 3.9% could be accelerated to as soon as this year, the Republican from New Hartford said, 'I think that’s a possibility.'"

What the 2024 Capital-Gains Tax Brackets Mean for Your Investments - Ashlea Ebeling, Wall Street Journal:

Short-term capital gains are profit on investments held a year or less, and they are taxed at the higher rates that apply to ordinary income. This is a key distinction frequent traders should pay careful attention to. The favorable tax rates for long-term gains also apply to “qualified” dividends, and most dividends fall in this category. Nonqualified dividends are taxed at the higher rates for ordinary income like wages.

Standard vs. itemized: choosing the tax deduction method that's best for you - Kay Bell, Don't Mess With Taxes. "The latest available Internal Revenue Service data, a preliminary analysis of filings for the 2021 tax year, show that 88.4 percent of returns claimed the standard deduction. That's up a bit from the 87.5 percent of returns for tax year 2020 that claimed the standard amounts."

IRS Issues Standard Mileage Rates for 2024 - Parker Tax Pro Library. "67 cents per mile driven for business use (up from 65.5 cents per mile for 2023)"

Form 8300, Cryptocurrency, and Gambling: An Update - Russ Fox, Taxable Talk. "Of course, we’re dealing with the federal government so there are issues. While Form 8300 was revised as of December 31st, the revision doesn’t include a place for cryptocurrency. While it’s possible to report a business sending cash, the reporting always asks for the individual who sent it. Well, that won’t be doable for most cryptocurrency transactions–again, a comment will be needed."

Golden Bachelor Wedding Sparks Conversations About Gray Divorce - Kelly Phillips Erb, Forbes. "Movies may suggest that prenups are only for the super rich, but that’s not true."

Americans Moved to Low-Tax States in 2023 - Katherine Loughead, Tax Foundation. "This population shift paints a clear picture: Americans are leaving high-tax, high-cost-of-living states in favor of lower-tax, lower-cost alternatives. Of the 32 states whose overall state and local tax burdens per capita were below the national average in 2022, 24 experienced net inbound migration in FY 2023. Meanwhile, of the 18 states and D.C. with tax burdens per capita at or above the national average, 14 of those jurisdictions experienced net outbound migration."

Assessing IRS Employee Safety; Weighing Use of State Surpluses - Renu Zaretsky, Daily Deduction. "The Treasury Inspector General for Tax Administration (TIGTA) released a report last month on improving the health and safety of IRS employees at the C-site, an underground file storage site in Independence, Missouri (a.k.a., the “cave”). IRS employees had reported safety concerns, like rocks falling from the ceiling and poor air quality. TIGTA visited and found additional problems, like prohibitions on the use of fire extinguishers in an emergency and the use of ladders to retrieve boxes weighing as much as 50 pounds from shelves as high as 13 feet. IRS experts in May 2023 estimated the agency has 143 million pages of paper documents, which TIGTA says need to be digitized or better accounted for in the site’s safety procedures."

California man pleads guilty to tax fraud -IRS (Defendant name omitted):

A California man pleaded guilty today to conspiring to file false claims against the United States.

According to court documents and statements made in court, from 2016 to 2020, Defendant conspired with another individual to submit false individual income tax returns seeking refunds to which they were not entitled. Defendant and his co-conspirator filed income tax returns in their own names, as well as in the names of two other unwitting individuals, that falsely reported they were employed by a company, received wages from that company, and had federal taxes withheld from those wages, fraudulently claiming a refund was due. Most of the returns filed as part of the scheme also falsely reported alimony payments to increase the refund amount.

Based on these fraudulent returns, the IRS issued $873,723.53 in unwarranted refunds to the co-conspirators. Defendant deposited $757,075.53 of these fraud proceeds into his own bank accounts and subsequently purchased nearly $360,000 worth of new cars. He also distributed to his co-conspirator about $170,000 in cash and gold bars for his role in the scheme.

I bet he didn't issue a 1099 for the cash and gold bars either.

If you just fried your computer with a carpet shock, cheer up - It's Static Electricity Day!

We're Here to Help