A New Era: How Revenue Officers Went From Cowboys to Desk Jockeys - Jonathan Curry, Tax Notes ($):

Michael Sullivan had a gut feeling things were about to go south when the owner of the mini-mart he’d come to seize on behalf of the IRS pushed a button locking the front door, trapping him and his partner inside the store.

Moments later, any doubts he still had were erased. “I’m gonna burn you motherf—-ers like St. Joan of Arc!” the store owner shouted as he chased the two IRS revenue officers around his store, gasoline can in one hand and a lighter in the other.

Mr. Sullivan lived to tell the tale - there was an unlocked back door. But his story helps explain why the IRS has decided to cut back on unannounced visits to taxpayers. Some old revenue agents think this may have unintended consequences:

“And one of the ways you promote voluntary compliance is — I don’t know how else to put it — you get into someone’s face,” the revenue officer continued. Take that away, and the result will be a drop in voluntary compliance over the next few years, he predicted.

It's a terrific article on how the roll of IRS agents has evolved since the 1970s, and I hope that Tax Notes at some point will make it available to non-subscribers.

IRS Issues Per Diem Travel Expense Rates - Jared Serre, Law360 Tax Authority ($). "The per-diem rates used to compute business expense travel tax deductions will be $309 for travel to high-cost areas and $214 for travel to low-cost areas starting in October, the Internal Revenue Service said Monday."

Beneficial Ownership Reporting Deadline Extension Inches Closer - Andrew Velarde, Tax Notes ($):

In September 2022 FinCEN released final rules related to the Corporate Transparency Act. Those rules addressed reporting requirements, definitions, exemptions, and timing of reports. Reporting is necessary for both domestic and foreign companies and requires information such as names, addresses, and identifying numbers from the reporting entity, the beneficial owner, and the company applicant.

The final regs provide that companies created after the regs become effective have 30 days to file after receiving notice of their creation or registration. Under earlier proposed regs, the deadline was 14 days. The final regs become effective on January 1, 2024. Previously created reporting companies have until 2025 to file.

A long list of exemptions means these rules will apply primarily to small or inactive LLCs and corporations, with a $500 per-day penalty for not filling out the FinCEN online paperwork. Folks who want to keep an inactive LLC or corporation alive "just in case" may end up with expensive regrets.

IRS Pauses New Audits Under SECA Campaign - Kristen Parillo, Tax Notes ($):

The five-year-old campaign has drawn criticism from tax professionals, who say the IRS should have drafted new guidance clarifying the term “limited partner” for SECA purposes instead of mounting an aggressive audit and litigation campaign on partnerships.

...

Emboldened by several Tax Court victories over SECA tax exemption claims made by owners of various types of passthrough entities, the IRS ramped up its enforcement efforts with the launch of the SECA compliance campaign. The agency said it would target “individual partners, including service partners in service partnerships organized as state-law limited liability partnerships, limited partnerships, and limited liability companies, [who] have inappropriately claimed to qualify as ‘limited partners’ not subject to SECA tax."

"SECA" is self-employment tax. While the 12.4% Social Security portion of the tax is capped (at $160,200 of earnings for 2023), there is no income cap on the 3.8% Medicare/ACA portion. Taxpayers have structured LLC ownership interests to try to qualify for the "limited partner" exception to SECA.

Others have chosen to hold their interests through S corporations, whose K-1 earnings are not subject to SECA. This has led to the IRS reclassifying S corporation distributions as wages and imposing additional FICA Social Security and Medicare taxes.

The tax relief postpones various tax filing and payment deadlines that occurred from Sept. 15, 2023, through Feb. 15, 2024 (postponement period). As a result, affected individuals and businesses will have until Feb. 15, 2024, to file returns and pay any taxes that were originally due during this period.

This means, for example, that the Feb. 15, 2024, deadline will now apply to:

- Individuals who had a valid extension to file their 2022 return due to run out on Oct. 16, 2023. The IRS noted, however, that because tax payments related to these 2022 returns were due on April 18, 2023, those payments are not eligible for this relief. So, this is more time to file not to pay.

- Quarterly estimated income tax payments normally due on Sept. 15, 2023, and Jan. 16, 2024.

- Quarterly payroll and excise tax returns normally due on Oct. 31, 2023, and Jan. 31, 2024.

- Calendar-year partnerships and S corporations whose 2022 extensions run out on Sept. 15, 2023.

- Calendar-year corporations whose 2022 extensions run out on Oct. 16, 2023.

- Calendar-year tax-exempt organizations whose extensions run out on Nov. 15, 2023.

AMC, Sony Escape Tax Biz's 'Better Call Saul' TM Suit - Ivan Moreno, Law360 Tax Authority:

AMC and Sony Pictures did not infringe Liberty Tax Service's trademark and trade dress with a fictional business in the hit show "Better Call Saul" whose owner is imprisoned for embezzlement, a Manhattan federal judge ruled Monday.

In dismissing Liberty Tax's complaint, U.S. District Judge Paul G. Gardephe agreed in an opinion and order with AMC Networks Inc. and Sony Pictures Television Inc. to apply the Rogers test, which holds that a work isn't considered infringement if it is "artistically expressive" and does not "explicitly mislead" consumers.

See "Streisand Effect."

Swifties & BeyHive provide the IRS with targets for lower resale tax reporting law - Kay Bell, Don't Mess With Taxes. "Starting in 2024, third-party payment processors such as PayPal, Amazon, eBay, Facebook Marketplace, rideshare companies, and yes, Ticketmaster and StubHub, must report to their users/clients the money they got during the year."

Losses Flowing to S Portion of an ESBT Can Be Carried to Other Years as NOLs - Parker Tax Pro Library. "The Office of Chief Counsel advised that the S portion of an electing small business trust (ESBT) may carry to another tax year a net operating loss (NOL) attributable to a loss passed through to the ESBT by an S corporation of which it is a shareholder."

Two Promoters Charged In Alleged Sham Trust Tax Shelter Fraud Scheme - Kelly Phillips Erb, Forbes. "According to the indictment, the pair allegedly instructed clients, most of whom were business owners, to assign their legitimate business income to a sham “business trust” to make it appear as if the income was no longer owned or controlled by the client. The sham business trust then distributed income to a second sham trust, which distributed its income to a third sham trust. Each trust in the series reported deductions matching or exceeding its income, and the third sham trust purportedly “donated” any remaining income to a private family foundation, which in turn “loaned” the funds back to the client’s business or business trust, tax-free. The income and deductions were reported on Forms 1040 and Forms 1041 in a manner that allegedly fraudulently eliminated nearly all taxes owed."

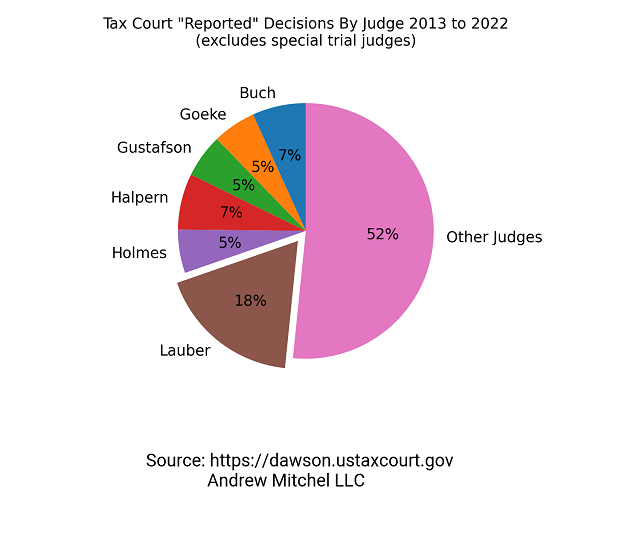

Tax Court Judge Lauber Is a Rock Star - International Tax Blog. "During the 10-year period he has been on the court, Judge Lauber has published 18% of all Tax Court Reported decisions."

There are 13 full-time "regular" Tax Court judges, with another 13 on senior status. That means anything over about 7.7% is the mark of a curvebreaker.

Apprentices and Emergency Repairs - Marie Sapirie, Tax Notes ($):

Moving new workers and those being retrained into apprenticeships for highly skilled jobs and ensuring opportunities for them to learn their new trades are the key objectives of the apprenticeship rules in section 45(b)(8). However, there’s a potential hitch in the proposed regulations (REG-100908-23). They indicate that apprentices must be used for repairs in order to satisfy the apprenticeship requirements. But that rule could become complicated to satisfy when post-placement-in-service repairs are needed urgently and apprentices aren’t easy to come by.

...

As a practical matter, if a project needs immediate repairs to continue producing energy, finding apprentices to assist in doing the work might be hard, if not impossible... The good-faith exception requires an application to a registered apprenticeship program and a five-business-day waiting period, which isn’t feasible when a facility needs an urgent repair to restore operations. (Planned alterations are a different matter.)

Related: Business Credits & Incentives

How Budget Commissions Can Make Deficit Reduction Harder - Howard Gleckman, TaxVox. "If they really want deficit cutting ideas, House Republicans could save time simply by going to the Congressional Budget Office website. In its Budget Options, it regularly lists hundreds of tax increases and spending cuts that lawmakers are free to choose from."

From the "hard life makes a good song" file comes a Tax Court case that seems made for the Nashville jingle factory. Jared Serre of Law360 Tax Authority provides a summary ($):

The man's wife, after he encouraged her to obtain power-of-attorney status, fraudulently withdrew more than $240,000 while he was incarcerated. She used about $180,000 to relocate and to renovate her new home after she filed for divorce...

So the guy is in jail. He gives his wife power of attorney to handle his affairs, and does she ever. She empties his retirement accounts, uses the proceeds to move into a new home far away, and files for divorce. Then the IRS tries to tax him on the withdrawal of the funds from the retirement accounts.

Unlike many sad songs, this one has, if not a happy ending, at least a somewhat just one. From the Tax Court opinion: "Under the circumstances of this case, we therefore conclude that petitioner was not the distributee, payee, or recipient of any portion of the disputed amounts, and those amounts are not includible in petitioner's gross income for 2014."

The moral? There ain't no good in an evil-hearted woman, I guess.

To the bitter dismay of certain waffle fans, today is National Pancake Day!

We're Here to Help