As work continues to focus more attention onto high-income compliance issues, the Internal Revenue Service announced plans today to establish a special area to focus on large or complex pass-through entities.

...

"This is another part of our effort to ensure the IRS holds the nation's wealthiest filers accountable to pay the full amount of what they owe," said IRS Commissioner Danny Werfel. "We are honing-in on areas where we believe non-compliance among our wealthiest filers has proliferated over the last decade of IRS budget cuts, and pass-throughs are high on our list of concerns. This new unit will leverage Inflation Reduction Act funding to disrupt efforts by certain large partnerships to use pass-throughs to intentionally shield income to avoid paying the taxes they owe. These efforts are consistent with our broader commitment to use Inflation Reduction Act dollars to end the era of historically low error rates for wealthy and large entities, while making sure middle- and low-income filers continue to see no change in audit rates for years to come."

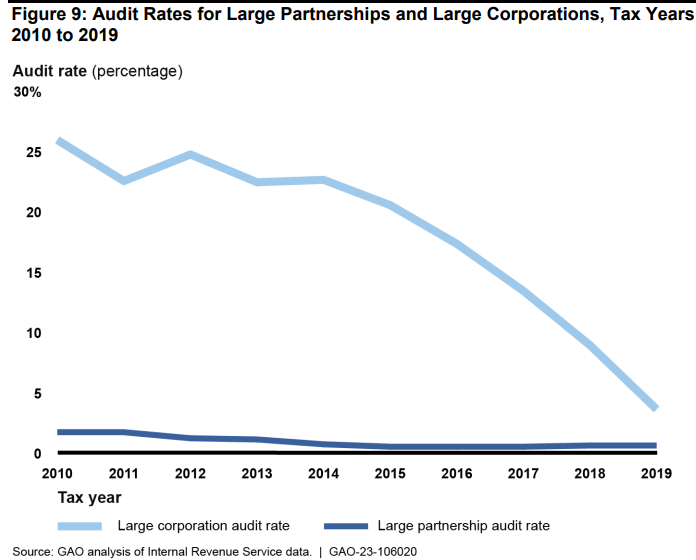

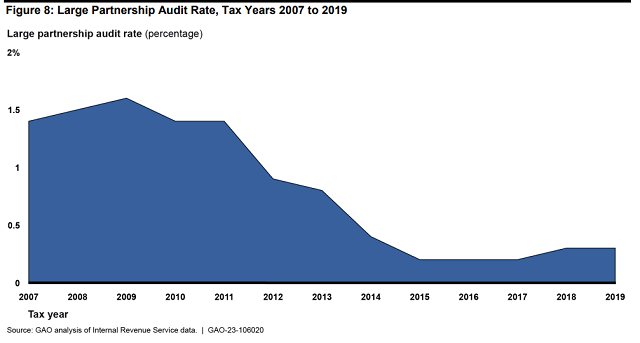

The low audit rate for large pass-through entities has been a problem for the IRS for years. The changes to the rules governing partnership audits in 2015 were meant to make it easier for the agency to examine partnerships, but partnership audit rates continue to lag behind those for corporations.

The GAO earlier this year reported that fewer than 1 in 200 large partnerships - those with over $100 in assets and 100 or more partners - are examined.

Those examined had an 80 percent "no change" rate, more than double the clean audit rate for large corporations. These results likely result from a shortage of IRS agents familiar with partnership taxation and with the specialized rules covering partnership examinations. That won't be easily fixed.

IRS establishes new pass-through division to tax high earners - Tobias Burns, the Hill:

IRS Commissioner Danny Werfel said on a call with reporters earlier this month that during the last decade, pass-through entities and wealthy individuals have been besting the IRS as the agency’s resources and funding have declined.

“During that 10 years, it essentially enabled wealthy individuals, large partnerships, complex and large corporations to come up with increasingly creative ways of reaching their most tax-advantaged status. The issue is that in many of those cases, they took steps that are technically tax evasion under the tax law. That’s where this focus is,” he said.

IRS Announces New Pass-Through Unit To Scrutinize Wealthy - David van den Berg, Law360 Tax Authority ($). "The pass-through group will be housed in the IRS' Large Business & International Division, according to the agency. The pass-through entity's workforce will eventually also include current employees in both Large Business & International and the Small-Business & Self-Employed divisions, the agency said. The IRS' statement also said the pass-through group will include the more than 3,700 revenue agents it plans to hire for expanded enforcement work geared toward large corporations and complex partnerships."

IRS Announces Next Steps In Plans To Focus On Pass-Throughs, Including Complex Partnerships - Kelly Phillips Erb, Forbes. "Goals include helping compliance teams better detect tax cheating, identify emerging compliance threats, and improve case selection tools to avoid burdening taxpayers with those needless "no-change" audits. Last year, a report from the Treasury Inspector General for Tax Administration (TIGTA) revealed that IRS examinations of partnerships tended to result in no additional tax liability."

IRS Examiners Get Marching Orders on 75 Large Partnership Audits - Kristen Parillo, Tax Notes ($):

The IRS field examiners tasked with auditing 75 of the country’s largest partnerships will be getting their first briefing September 21 on the new initiative, according to an agency official.

The IRS discussed the launch of these exams at a conference of the Tax Executives Institute. IRS representatives discussed how the 75 partnerships were selected for examination:

Clifford Scherwinski, LB&I director of passthrough entities, said that in the context of the largest partnerships, “You do want to think about it in terms of our large corporate compliance program.”

“These are the largest of the large, so they deserve special attention because they could require a team audit,” Scherwinski explained. “So we did want to identify which are similar, if you will, in size and scope to our large corporate compliance — that’s kind of your economic aspect.”

In addition, LB&I used data analytics to identify potential compliance issues, Scherwinski said. “We looked at the algorithm to see what the computer can tell us about differences and changes, et cetera,” he said. “We also paired that with our technical experts’ insight into the issues that could potentially be on the return.”

Whether the IRS will have more success than in past partnership exams remains to be seen.

IRS Clarifies Focus of Compliance Campaign on Cost of Goods Sold - Michael Rapoport, Bloomberg. "The IRS’s compliance campaign on inflated cost of goods sold will zero in on issues like inventory valuation and improperly deducted items, according to an updated description of the campaign posted on the IRS’s website."

IRS Prioritizing Fixing U.S. Residency Certification Processing - Andrew Velarde, Tax Notes ($):

Treaty partners frequently require taxpayers to provide an IRS-issued certificate demonstrating that they are a U.S. resident and entitled to treaty benefits. The IRSAC report notes that the turnaround time for processing Form 8802 can be significantly longer than the typical eight to 12 weeks when the applicant is applying for a year in which a return is due but is not yet posted. These delays are common for regulated investment companies whose returns are lengthy and are paper filed. IRS clerical errors on Form 6166 from the manual processing of Form 8802 can also cause problems, according to the IRSAC report.

The issue is not just one of the timing of benefits. As the IRSAC report highlights, delays in receipt of the certificate can lead to permanent loss of benefits in countries requiring that valid certificates be given to withholding agents before the payment date for an income event, with no opportunity for retroactive relief.

Related: Eide Bailly International Business Services.

GOP House Tax-Writing Chair Sees Path for Bipartisan Tax Pact - Samantha Handler, Bloomberg:

Smith said he has had “incredible” lunches with Senate Finance Committee Chair Ron Wyden (D-Ore.), discussing expired business tax extenders like the research and development tax break, tax credits for affordable housing, and the child tax credit. He quipped that if a Democrat will buy lunch, “go for it.”

“There are several tax extenders that have expired that are pretty bipartisan and pretty crucial, and I think we can get to a final product,” Smith said.

Wyden, though, told reporters Wednesday that Democrats still want to see a child tax credit proposal that is “proportional” to the cost of the business breaks. Wyden declined to comment on the specifics of his talks with Smith, but said they are “always about how to move forward in a constructive way.”

"Incredible."

Chief Tax-Writer Seeks Public Input on Extending Tax Reform Measures - Jay Heflin, Eide Bailly. "The leading tax-writer in Congress wants to hear from the public about extending the 2017 tax reform provisions that will soon expire."

A tax to-do list after you say 'I do' - Kay Bell, Don't Mess With Taxes. "1. Make sure everyone knows your new name. After marriage, some spouses change their surnames. If either, or both of the newlyweds legally change their name post-vows, they need to report it to the Social Security Administration (SSA). The Internal Revenue Service matches what's on your 1040 with the SSA data every filing season. If your new name on your return doesn't match the official SSA info, it could delay any refund from your first post-wedding tax filing."

Lesson From The Tax Court: When 'My CPA Did It' Is No Defense To Penalties - Bryan Camp, TaxProf Blog. "Sometimes, however, taxpayers think that relying on a professional to prepare the return absolves them of responsibility for any subsequent errors. Today’s lesson puts the lie to that thought."

Tax Court Sinks Depreciation Deduction for Yacht - Stephen Olsen, Procedurally Taxing/Tax Notes. "The recent case of Conrad v. Commissioner, T.C. Memo 2023-100 (2023), jumped out at me because it felt so relatable to us all; who hasn’t screwed up the depreciation deductions on their yacht and airplane?"

IRS to Halt ERC Processing - Charles Telk and Cody Edwards, Iowa Tax Cafe. "Our firm has since been inundated with questions and concerns as to how this affects businesses who have claimed the credit and are waiting for payment, as well as businesses who claimed the credit and have already received payment."

TikTok’s (Wrong) Tax Advice and How the Trust Tax Rules Really Work - Virginia La Torre Jeker, US Tax Talk. "My earlier post put it very simply – taxable income cannot, and does not, magically disappear with trusts. Someone must always pay tax on it – be it the founder of the trust, the trust itself, and/or the trust beneficiaries."

Related: Foreign Trust & Estate Tax Compliance & Planning

Finding Canadian Online Users - Alex Parker, Things of Caesar. "The Internet runs on non-paying users--how should the global tax system account for them? Canada's controversial digital services tax has an interest approach that could have broader implications."

Leave Worldwide Combined Reporting in the ‘80s, Where It Belongs - Jared Walczak, Tax Policy Blog. "They got it right 40 years ago. There’s no good reason to turn back the clock to implement state tax bases so divorced from activity in any way connected to the taxing jurisdiction."

Owner of construction company agrees to plead guilty to tax evasion - IRS (Defendant name omitted, emphasis added.):

According to the charging document, from 2017 to 2021, Defendant, the owner of Rossy Construction Corporation based in New Bedford, cashed customer checks and did not deposit the receipts in his business bank accounts. Defendant allegedly hid from his tax preparer that he was cashing large numbers of checks from customers. By hiding his income in this manner, Defendant underreported income from the business on his tax returns, resulting in his failure to pay more than $1.1 million in federal income taxes he owed for the tax years 2017 to 2021. Defendant also allegedly ran an unlawful cash payroll, paying Rossy employees in cash while failing to pay over to the IRS more than $670,000 in payroll taxes.

Foolproof. Except that when you pay employees in cash and don't withhold, every worker is a potential informant.

Fore! It's Miniature Golf Day.

Make a habit of sustained success.