The Internal Revenue Service today reminded individuals and businesses in most of California and parts of Alabama and Georgia that their 2022 federal income tax returns and tax payments are due on Monday, Oct. 16, 2023. The normal due date of April 18 was postponed for many residents of these states in the wake of natural disasters earlier this year.

Who has this October 16 deadline?

- Thirteen counties in Alabama due to severe storms, straight-line winds and tornadoes starting on Jan. 12. The disaster area includes Autauga, Barbour, Chambers, Conecuh, Coosa, Dallas, Elmore, Greene, Hale, Mobile, Morgan, Sumter and Tallapoosa counties.

- Fifty-five of California's 58 counties—all except Lassen, Modoc and Shasta counties. IRS relief is based on three different FEMA disaster declarations covering various jurisdictions and event time frames.

- Nine counties in Georgia due to severe storms, straight-line winds and tornadoes beginning on Jan. 12. The disaster area includes Butts, Crisp, Henry, Jasper, Meriwether, Newton, Pike, Spalding and Troup counties.

If you are a taxpayer in one of these areas and you haven't gotten your information to your preparer, do so now. There are no more extensions available, and there are probably many people already ahead of you in line.

Bipartisan Tax Package Hopes Dim Amid Shutdown, Impeachment Talk - Chris Cioffi, Bloomberg ($):

Talks to craft a bill with tax breaks for businesses and an enhancement of the child tax credit simmer in the background, lawmakers say, though agreement wouldn’t likely emerge until closer to December. But a potential government shutdown and House Republicans’ impeachment inquiry of President Joe Biden could drown out the potential amity.

But they're saying there's a chance:

Rep. Randy Feenstra (R-Iowa) expressed optimism Senate Finance Committee Chair Ron Wyden (D-Ore.)and Ways and Means Chair Jason Smith (R-Mo.) would forge a pact.

...

The exchange of ideas across the aisle suggests lawmakers are closer to finding compromise on the CTC than it may seem, said Andrew Lautz, a senior policy analyst at the Bipartisan Policy Center. But there are still significant obstacles.

“I think the biggest one right now is the calendar,” he said.

Related: Capitol Hill Recap: Few Focused on Tax Legislation.

House GOP 10-Year Budget With TCJA Extensions Headed to Markup - Doug Sword, Tax Notes ($):

The House Budget Committee is scheduled to mark up a 10-year budget resolution that includes an extension of the 2017 individual and business tax cuts but doesn’t say how those cuts would be paid for.

House Budget Committee Republicans unveiled their budget resolution September 19, which they say will cut $16.3 trillion off of deficits through 2033, extend Tax Cuts and Jobs Act provisions past their 2025 expiration, roll back $129 billion in energy grants and tax breaks, and rescind Inflation Reduction Act funding for the IRS.

...

Cuts to mandatory spending include, in addition to clawing back funding for the IRS, large cuts to programs under the following budget categories: natural resources and the environment; commerce and housing; transportation; and education, training, employment, and social services.

Balanced-budget plan unveiled by House Republicans - Paul Karwzak and David Lerman, Roll Call. "It stands no chance of winning support in the Democratic-controlled Senate, which is already at loggerheads with House appropriators over fiscal 2024 spending levels. But the document makes good on a political promise by the new House GOP majority to offer a road map to a balanced budget by curbing spending growth."

U.S. National Debt Tops $33 Trillion for First Time - Alan Rappeport, New York Times:

But slowing the growth of the national debt continues to be daunting.

Some federal spending programs that passed during the Biden administration are expected to be more costly than previously projected. The Inflation Reduction Act of 2022 was previously estimated to cost about $400 billion over a decade, but according to estimates by the University of Pennsylvania’s Penn Wharton Budget Model it could cost more than $1 trillion thanks to strong demand for the law’s generous clean energy tax credits.

How not to fix Social Security, by a GOP group and Biden - Glenn Kessler, Washington Post:

Kathleen Romig, the Center on Budget and Policy Priorities’ director of Social Security and disability, said the policy choices have become less effective the longer lawmakers have dawdled on a solution. Eliminating the payroll tax cap entirely, without giving additional benefits in exchange for those additional payments, once would have eliminated the shortfall, she said, but that dramatic step would now only cover three-quarters of the gap, according to Social Security estimates.

Another solution would be to increase the payroll tax, but the latest estimate is that it would need to go up 3.44 percentage points, from 12.4 percent to 15.84 percent — a figure that increases year by year. Alternatively, benefits would need to be cut prospectively by more than 25 percent, the Social Security 2023 trustees report says.

If nothing happens, current law mandates an immediate benefits reduction when the "trust fund" is depleted, in about ten years.

W&M Republicans Push for Pillar 2 Slowdown While Promoting GILTI - Cady Stanton, Tax Notes ($)

House Republican taxwriters are hoping other countries will delay implementation of pillar 2 of the OECD global tax deal while they separately encourage leaders to implement versions of the United States’ global intangible low-taxed income regime.

“The last thing we want is instability in the global economy,” Smith said, according to a press release. “But if this global minimum tax starts being passed in other countries, it's going to create great instability, at least with the United States, because our committee will move forward with tax and trade mechanisms to make sure that we are making whole our companies that are being targeted by other countries.”

The OECD Plan to Increase Taxes Costs More Than It Raises - Adam Michel, Liberty Taxed. "While the JCT analysis makes it clear that the OECD minimum tax is a loser for the United States solely as a matter of the federal government’s finances, a fuller accounting of the proposal’s costs shows that it is also a net negative for the entire world."

IRS’s ESOP Warning Shouldn’t Signal an Enforcement Sea Change - Allison Wilkerson and Christian Nemeth, Bloomberg:

The IRS issued a notice last month warning plan sponsors to be alert to compliance issues associated with employee stock ownership plans. The notice used broad and vague language cautioning “higher-income taxpayers and businesses” against implementing “aggressive schemes involving complex or questionable transactions, including those involving ESOP” to avoid paying the “taxes they [rightfully] owe.”

...

After reviewing the language and considering past investigative focus of the IRS, we don’t believe the IRS bulletin signals a new wave of ESOP oversight; rather, we view it as the IRS’s continued focus on truly abusive transactions, which stems from IRS enforcement steps dating back decades.

It Took Quitting My Job to Finally Pay for Tax Help. It’s Totally Worth It - Tanza Loudenback, Buy Side from WSJ. "Paying taxes is a fact of life. DIY tax software is generally a great value for people with income from one or two jobs and no major assets, such as a house, taxable brokerage account or small business. For sole proprietors like myself, or entrepreneurs with more complex business structures, however, there’s little downside to hiring an expert."

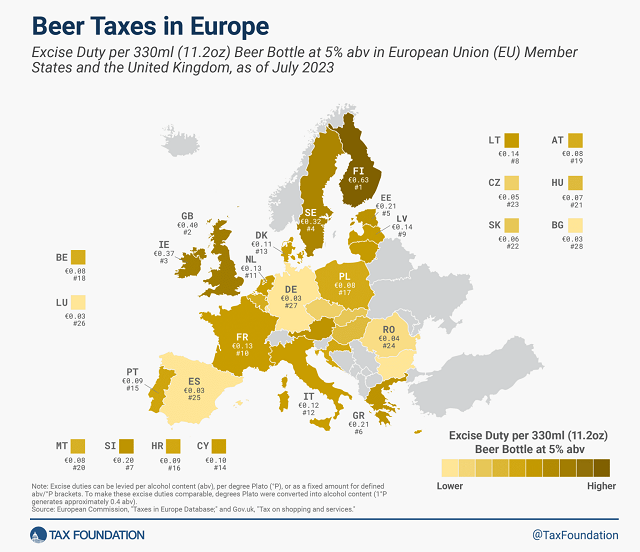

Beer Taxes in Europe - Adam Hoffer, Tax Foundation:

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage. EU law requires every EU country to levy an excise duty on beer of at least €1.87 per 100 liters (26.4 gal) and degree of alcohol content. That amounts to a minimum tax of €0.03 ($0.03) for a 330ml (11.2 oz) beer bottle with 5 percent alcohol content. As this map illustrates, only a few EU countries stick close to the minimum rate; most levy much higher excise duties.

In the U.S., federal government in the US taxes beer at from about 1 cent to five cents per can, depending on various factors. State taxes can add another 10 cents or so.

7 tax considerations for divorcing couples - Kay Bell, Don't Mess With Taxes. "4. Decide who gets child-related tax breaks. Raising a family isn't easy when both parents are together. It, and related taxes, get more difficult after a formal split."

IRS Says Disability Pay Is Taxable Or Tax Free, Here’s How To Tell - Robert Wood, Forbes. "Perhaps your employer paid for your disability coverage, and you were covered as a fringe benefit. In that case, when you are disabled and the coverage kicks in, the benefits you receive are taxable."

IRS Issues Interim Guidance on Amortization of Research and Experimental Costs - Parker Tax Pro Library. "The IRS provided interim guidance intended to clarify the application of Code Sec. 174, as amended by the Tax Cuts and Jobs Act (Pub. L. 115-97), which generally disallows deductions specified research or experimental expenditures for amounts paid or incurred in tax years beginning after December 31, 2021, and requires taxpayers to charge such expenditures to a capital account and amortize them ratably over the applicable amortization period. "

IRS Looks To Hire 3,700 Employees Nationwide To Audit Wealthy Taxpayers - Ronald Marini, The Tax Times. "These compliance positions will be open in more than 250 locations nationwide and is part of a larger effort to add fairness to the tax system and expand tax enforcement involving areas of concern with high-income earners, partnerships, large corporations and promoters."

New regulations require reporting by digital asset brokers - NATP Blog. "Proposed regulations would extend current broker information reporting requirements to digital asset brokers beginning in 2025. Notably, they do not extend the reporting requirements to crypto miners or stakers."

Treasury Takes Big-Picture View With Newest Crypto Proposal - John Buhl, TaxVox. "The proposed rules appear to strike a good balance. There are many types of businesses involved in cryptocurrency, and not all are equipped to gather and report gross proceeds and basis information to determine gains and losses. However, the ecosystem is evolving quickly; narrow rules might force policymakers to quickly return to the drawing board and catch up to where the crypto market is going."

Former Pittsburgh health services company executive sentenced to prison for tax fraud - IRS (Defendant name omitted, emphasis added):

A resident of Sewickley, Pennsylvania, was sentenced today to one year and one day in prison for conspiring to defraud the United States. Defendant, former CEO and President of Pittsburgh-based Automated Health Systems (AHS), will serve – in addition to his prison sentence – three years of supervised release, which includes six months on home detention, and pay approximately $15,824,056 in restitution to the government, United States Attorney Eric G. Olshan announced today.

Court documents and statements outline Defendant's scheme between 2006 and 2012 to illegally classify millions of dollars of personal expenses as deductible business expenses and finance construction of a 51,000-square-foot mansion valued at approximately $30 million. Defendant named the home "Villa Noci." The falsified expenses included interior and exterior construction costs; design and furnishings; an outdoor pool and pool house; tennis, basketball and bocce courts; and landscaping for the grounds. Defendant also fraudulently expensed millions of dollars for other personal expenses such as luxury vehicles, artwork, country club memberships, homes for his children and private school tuition for grandchildren.

Nice house. So nice, it made the IRS curious, reports Kelly Phillips Erb in Forbes: "The size of the home, considered the largest in Pennsylvania at the time, is precisely what attracted attention... According to local sources, federal agents flying in and out of Pittsburgh noticed the size and scope of the mansion and started asking questions."

Using business funds for personal expenses is a common tax crime. IRS exam programs look for it. Don't do that.

Why not both? Today is National Fried Rice Day and National String Cheese Day.

We're Here to Help