Key Takeaways

- Democrats propose tax credits for developers, tenants in year-end tax debate.

- You may have a reporting requirement next year with $500 daily noncompliance penalties.

- Sourcing rules may limit availability of EV tax credit.

- Moore: a narrow ruling seems likely.

- IRS hosts 1099-K webinar tomorrow.

- California, Washington go after Amazon vendors for sales taxes.

- New California tax credit.

- Indian call center IRS scam figure sentenced.

- National Violin Day, National Ice Cream Day.

Democrats Push for Housing Relief in Upcoming Tax Package - Cady Stanton, Tax Notes ($):

There is a “real window of opportunity” for the Senate to pass bipartisan housing legislation in the coming months, Senate Finance Committee Chair Ron Wyden, D-Ore., said in a floor speech December 12, a week after introducing new bicameral housing tax credit legislation for middle-income taxpayers.

...

Wyden spotlighted his Workforce Housing Tax Credit Act (S. 3436), cosponsored by Sen. Dan Sullivan, R-Alaska, and its House companion bill from Ways and Means committee members Jimmy Panetta, D-Calif., and Mike Carey, R-Ohio, which would provide tax credits to develop affordable housing for tenants with between 60 percent and 100 percent of area median income.

There are other proposals:

Wyden’s speech came the same day that Ways and Means members Danny K. Davis, D-Ill., and Panetta, along with former — and likely soon to return — committee member Jimmy Gomez, D-Calif., reintroduced the Rent Relief Act of 2023, which would create a new tax credit for renters of a personal residence that would cover part of the gap between 30 percent of their income and actual rent.

FinCEN Adds to List of FAQs on New Owner-Info Reporting Rules - Michael Rapoport, Bloomberg. "Under the new reporting requirements, which take effect Jan. 1, tens of millions of companies will have to disclose to FinCEN the identities and other information about their beneficial owners—anyone who owns at least 25% of the company or exerts significant authority over it."

Noncompliance can be expensive. From the FAQ:

What penalties do individuals face for violating BOI reporting requirements?

As specified in the Corporate Transparency Act, a person who willfully violates the BOI reporting requirements may be subject to civil penalties of up to $500 for each day that the violation continues. That person may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000. Potential violations include willfully failing to file a beneficial ownership information report, willfully filing false beneficial ownership information, or willfully failing to correct or update previously reported beneficial ownership information.

What Companies, Including Small Businesses, Need To Know About A New Federal Law - Kelly Phillips Erb, Forbes. "Starting Jan. 1, 2024, many companies will be required to report information to the U.S. government about who ultimately owns and controls them. It's the result of a 2021 law, the Corporate Transparency Act—or CTA—which requires reporting companies to file reports with FinCEN, the Financial Crimes Enforcement Network. The form isn't yet available, but FinCEN has been rolling out guidance—including new information posted as of Dec. 12, 2023. Here's what we know so far."

Why Biden’s EV Tax Credit Could Become Hard to Claim - Scott Patterson and Andrew Duehren, Wall Street Journal:

A 2022 law that President Biden championed revamped a $7,500 tax credit for consumers who buy electric vehicles. Among the new rules, the law stipulated that the credits can’t go toward buying any EVs containing battery parts from a “foreign entity of concern,” which includes China.

Graphite is the largest component of EV batteries, making up roughly one-quarter of a battery’s weight. While graphite is plentiful around the world, China produces about 97% of the rarefied form used in rechargeable batteries, according to Benchmark Mineral Intelligence.

It it is about saving the planet, it seems that the source of the salvation might be a secondary concern.

Post-Arguments, MooreEffect on Wealth Tax Still Up for Debate - Jonathan Curry, Tax Notes ($). "The common wisdom has been that at least four of the Court’s conservative justices granted certiorari in the case to ward off Congress from further considering a wealth tax, a nascent idea among Capitol Hill’s progressive wing in recent years. And yet, by all appearances, the Court appears primed to issue a narrow ruling."

It will reflect last month's announcement that in general, prior-law reporting requirements for Form 1099-K will remain in effect for 2023 and that the IRS is planning for a $5,000-reporting threshold in 2024.

Among other things, the webinar will also cover:

- friends and family transactions

- how to report 1099-K amounts on a 2023 return

- what to do if a 1099-K is incorrect

- recordkeeping

- IRS resources

To register for the webinar, visit Form 1099-K Third party payment network transactions (card and electronic payments).

The High Cost of Untaxed Sales - Paul Jones, Tax Notes ($):

Some merchants that used Amazon's fulfillment service before the adoption of state marketplace facilitator laws were surprised to learn that they were exposed to thousands of dollars in sales and use tax liabilities.

Many of those third-party sellers, which include midsize independent businesses, small retailers with a few employees, and individuals who sold from their homes, only discovered the liability when states identified and pursued them for uncollected taxes.

...

Although Amazon had made deals with many states to collect and remit tax on its own sales in the years leading up to the Supreme Court's 2018 decision in South Dakota v. Wayfair Inc., state officials began realizing that large amounts of sales and use taxes weren't being collected on third-party sales. Some states pursued those Amazon sellers they identified as having inventory in their states through the FBA service.

Ouch. California and Washington are identified as being "particularly energetic" here.

Related: Eide Bailly State & Local Tax Services.

California Competes Tax Credit: Promoting Economic Investment in the Golden State - Becca Stadtner and Jennifer Barajas, Eide Bailly. "The California Competes Tax Credit application process involves two phases: a cost-benefit ratio and demonstrating the ability to generate potential new high-quality jobs in California."

Ohtani deferred MLB money delays most of California's potential tax collection - Kay Bell, Don't Mess With Taxes. "But here's the really interesting part. The bulk of Ohtani's money, $680 million, will be deferred. He's reportedly getting "just" $2 million a year for 10 years, with the remaining millions to be paid out starting in in 2034, after his 10-year contract with the L.A. team expires, and running to 2043."

Proposed Regs Update Rules on Transactions Between Related Persons and Partnerships - Parker Tax Pro Library. "The regulations affect partnerships that enter into transactions with related persons that result in gain or loss on a sale or exchange of property or result in a difference in the time at which income and deductions are recognized because of the persons' different methods of accounting."

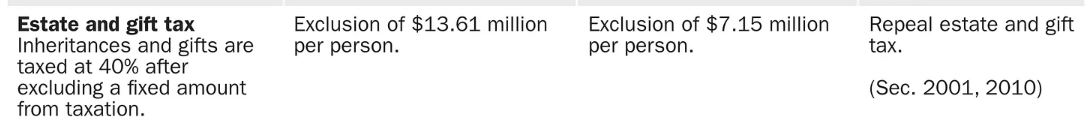

2026 Tax Increases in One Chart - Adam Michel, Liberty Taxed. "The following table provides a summary of current policy, the tax changes that will take effect automatically in 2026, and an abbreviated recommendation for how to address the changes. The table does not include the 2017 corporate income tax cut from 35 percent to 21 percent because the change was permanent. Changes that have already taken effect, such as research spending amortization and stricter limits on interest deductibility, are also excluded. If not addressed before 2025, these will also be important considerations for any tax package."

It's a big chart. For planning, the biggest item may be the last one:

Delinquent FBAR Submission Procedures - Kasia Strzelczyk, 1040 Abroad. "Non-Willful Penalties: If you didn’t file an FBAR due to a misunderstanding or mistake, the penalties are generally less severe. The IRS may impose a FBAR penalty of up to $10,000 for each year of non-compliance, but these penalties are often reduced or waived if you can show reasonable cause for the failure to file."

Related: Offshore Voluntary Disclosure.

Indian national sentenced for money laundering conspiracy related to government impersonator scam - IRS (Defendant name omitted, emphasis added):

U.S. District Judge Susan C. Bucklew has sentenced Defendant of Tampa to four years and three months in federal prison for conspiracy to commit money laundering. As part of his sentence, the court also entered an order of forfeiture in the amount of $372,000, the proceeds of the offense. Defendant had pleaded guilty on July 20, 2023.

According to court documents, India-based conspirators working in call centers placed calls to United States residents. The conspirators falsely and fraudulently identified themselves as federal law enforcement officers, such as Social Security Administration officials, FBI agents, or IRS officers. They provided "official" titles and/or "badge numbers," and threatened their victims with imminent arrest, a lawsuit, and/or other economic consequences—usually based on alleged drug trafficking or money laundering crimes supposedly committed using the victims' identities. The conspirators told victims, the majority of whom were older adults, that they could avoid these consequences by mailing checks or cash equivalents to conspirators in the United States.

From April 2018 through at least September 2018, Defendant laundered money that had been extorted from these victims in the United States. Specifically, Defendant acted as an intermediary between other U.S.-based conspirators who had a direct line of communication to the foreign call centers and the "runners" who received and cashed the victims' checks. Defendant's intermediary role involved relaying information regarding the arrival of packages containing the victims' checks to the runners, driving the runners to pick up the checks and cash them, and retrieving the fraudulently obtained funds from the runners. Once he retrieved the fraud proceeds, Defendant provided them to his coconspirators and was paid for his role in obtaining the funds.

This was a much bigger problem a few years ago, before some call centers were shut down, but scammers are always out there. Remember, if someone calls saying they are from the IRS, and you aren't expecting the call, it's almost always a scam. Call a tax pro if you aren't sure.

Play me a rocky road sonata. It's National Violin Day. For those committed to nonviolins, it's National Ice Cream Day!

Make a habit of sustained success.