House Leadership Taps Jason Smith as Ways & Means Chair - Doug Sword, Tax Notes ($):

The choice by House GOP leadership of the fourth most senior member of the committee accents a meteoric rise for Smith, 42, who was first elected to the House in 2012. In comparison, the committee’s previous chair, Rep. Richard E. Neal, D-Mass., was in the House 30 years before getting the panel’s gavel.

...

Smith promised that the committee would beef up its oversight activities, particularly those aimed at the IRS, “by investigating politically motivated leaks of taxpayer information by the IRS and rolling back efforts by the Biden Administration to use the agency to target the middle class.”

Rep. Jason Smith wins three-way contest for Ways and Means gavel - Laura Weiss, Roll Call:

He’s said that he’d pursue tax policies to incentivize domestic energy, food and health care production; hold hearings to review what worked and should be extended from the 2017 GOP tax code overhaul (PL 115-97); reconsider tax breaks for “woke corporations;” and aim to cut the trade deficit with China and other countries.

Smith said at a Punchbowl News event last year that he believed he could find “true agreement” with Democrats on issues like expanding the child tax credit.

He’s emphasized the need for work requirements on the benefit for families with children, while Democrats have pressed to open it more broadly, arguing that single mothers and grandparents who serve as primary caregivers might not be able to work, but should still get aid.

New House Tax Chief Outlines Committee's Agenda - Jay Heflin, Eide Bailly. "One of the big legislative issues that the committee is expected to tackle is extending many of the tax cuts from the 2017 tax reform bill."

Republican Rep. Smith of Missouri to Chair Ways and Means - Jeff Carlson, RIA Checkpoint Edge ($):

Smith immediately laid out his priorities for the Committee this session. "Our first step is defunding the $80 billion pay increase Democrats gave the IRS to hire 87,000 new agents to target working families," he said. "But we are not stopping there. If confirmed, the new IRS Commissioner should plan to spend a lot of time before our committee answering questions about the leaking of sensitive taxpayer information and an agency with a history of targeting conservative Americans."

In Symbolic Move, House Repeals ‘Extra’ Funding for IRS - Jay Heflin, Eide Bailly:

House lawmakers on January 9th voted 221 - 210 to repeal nearly all the $80 billion in funding that goes to the IRS. The vote was more a symbolic gesture than legislating since it is highly unlikely that rescinding the money will become law.

The bill now travels to the Senate, where Democrats control the chamber and are highly unlikely to support this legislation. Without support from the upper chamber, this measure cannot become law.

House GOP votes to slash IRS funding, targeting pursuit of tax cheats - Tony Romm, Washington Post:

Democrats provisioned nearly $80 billion for the IRS last year for a wide range of uses — boosting taxpayer services to quicken agency response times, for example, while upgrading its aging computer systems. The funds included more than $45 billion for enforcement, since party lawmakers hoped to empower the IRS to find and collect unpaid federal taxes, particularly from high-earning individuals and businesses.

But Republicans, who unanimously opposed the Inflation Reduction Act, seized on the spending starting last year. They quickly turned it into an election-year cudgel, accusing Democrats of trying to pry into innocent Americans’ finances. And GOP lawmakers repeatedly — and falsely — claimed that the IRS planned to hire more than 87,000 tax auditors with the money.

GOP House Takes First Swipe at IRS Money - Richard Rubin, Wall Street Journal. "A 2021 Treasury Department plan said the money would hire 87,000 new employees. Some would replace those expected to retire soon. Besides revenue agents who conduct audits and special agents who investigate tax crimes, that figure includes customer-service representatives, tax collectors and information-technology specialists."

Treasury Official Gives Glimpse of Future Staking Guidance - Kristen Parillo, Tax Notes:

During a January 9 Practising Law Institute event, Erika Nijenhuis of the Treasury Office of Tax Policy was asked about a project on the Treasury-IRS 2022-2023 priority guidance plan described as “guidance concerning validation of digital asset transactions, including staking.”

...

“By that, I mean not merely the question of whether the income is ordinary or capital, but also to the extent that when people discuss character, they ask questions like, ‘Could this be rent or royalty income, could it be services income, could it be some other kind of income?’” Nijenhuis continued. “One ordinarily thinks of those types of income as (A) ordinary and (B) taken into account when earned or received. So logically, it seems to me you have to kind of think about those things in some ways simultaneously, but the timing question could have a bearing on the character question.”

Per SoFi.com, "Crypto staking is the process of locking up crypto holdings in order to obtain rewards or earn interest."

Supreme Court Won’t Review Conservation Easement Deduction Cases - Patrice Gay, Tax Notes ($).

The Supreme Court on January 9 denied review of two partnership cases that involved disallowed deductions for conservation easement donations.

Oakbrook Land Holdings LLC petitioned the Supreme Court for review of a Sixth Circuit decision that upheld the validity of reg. section 1.170A-14(g)(6)(ii) — the proceeds regulation — in a conservation easement deduction case.

You Might Get a Smaller Tax Refund This Year - Ashlea Ebeling, Wall Street Journal. "Since Congress chose not to extend the tax breaks put in place at the height of the Covid-19 pandemic as part of its year-end budget bill, many taxpayers will get smaller refunds when they file their tax returns for tax year 2022, tax preparers said. And some who received refunds in recent years may now have a balance due."

SUV definition critical to one GM vehicle's EV tax credit - Kay Bell, Don't Mess With Taxes. "Now the Treasury Department and Internal Revenue Service are part of the SUV definition mix. In proposed rules as to what makes and models qualify for the new electric vehicle (EV) tax credit, Treasury and IRS have deemed the Lyriq a passenger car, not an SUV."

IRS Says Corrected Taxes Resulted In 12 Million New Refunds - Rebekah Barton, TaxBuzz. "According to a CBS report, the tax agency primarily corrected returns that included overpayments for unemployment benefits after the passage of President Joe Biden's American Rescue Plan of 2021."

What Taxpayers Need To Know About Digital Asset Loss Harvesting - Amber Gray-Fenner, Forbes. "Tax-loss-harvesting “marketplaces” have cropped up to offer a place for investors to offload their now largely valueless NFTs. But what, you may be asking, would these marketplaces gain by buying up valueless digital “property”? Transaction fees. The investor must pay fees to the marketplace to sell their NFTs. Often the fees are more than what is being paid for the NFT(s) being sold. The seller still thinks this is an opportunity because, after tax savings, it won’t be such a big loss."

2023 Consolidated Appropriations Act Signed into Law; Overhauls Retirement Plan Tax Rules - Parker Tax Pro Library. "Section 101 of Title I of CAA 2023 adds new Code Sec. 414A, which requires 401(k) and 403(b) plans to automatically enroll participants in the respective plans upon becoming eligible (and the employees may opt out of coverage)."

Year-End Appropriations Legislation Contains Group Health Plan Provisions - Thomsen Reuters Tax & Accounting. "Much attention has been focused on the legislation’s retirement plan provisions (see our Checkpoint article), but group health plan sponsors and advisors should take note of these applicable provisions and be on the lookout for further developments in 2023."

Forms 1099 Impact Your Taxes And IRS Audit Risk - Robert Wood, Forbes. "Even if you never receive a Form 1099, if you receive income, you must report it. You don't need a 1099 to report income."

CFO of KC company sentenced for 3 million dollar embezzlement scheme, filing false tax returns - IRS (Defendant name omitted):

Defendant was the chief financial officer for Genesys Industrial Corporation, doing business as Genesys Systems Integrator in Kansas City, Missouri. Genesys engineers and designs automated production systems and production machinery.

On Jan. 20, 2022, Defendant pleaded guilty to one count of mail fraud and one count of filing a false tax return. Defendant admitted that he embezzled at least $3.1 million from Genesys from 2013 to his termination in September 2020 by writing checks on the Genesys account to pay the personal expenses of himself and a co-worker whom he supervised.

Defendant embezzled $2,853,370 for himself and aided and abetted another Genesys employee's embezzlement of approximately $325,000 from the company, for a total of $3,183,024. (another taxpayer), the accounting manager at Genesys, pleaded guilty in a separate but related case to conspiracy to commit mail fraud and awaits sentencing.

...

Defendant also admitted that he failed to report the stolen income on his federal income tax returns and his Kansas state personal income tax returns.

It would be an unusual embezzler who would report the stolen income on tax returns. This one received 6 1/2 years in federal prison. That still doesn't get the money back to the victim, though. Good accounting controls and oversight are often cheap in the long run.

Related: Seven Fraud Schemes You Need to Watch For Right Now.

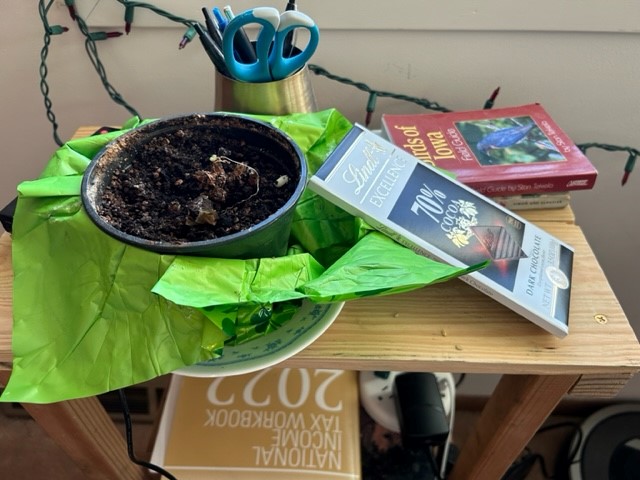

Bittersweet. Today is both National Houseplant Appreciation Day and National Bittersweet Chocolate Day.

Evidence indicates that I do better with the chocolate.

We're Here to Help