Your First Look at 2023 Tax Brackets, Deductions, and Credits - Kelly Phillips Erb, Bloomberg ($):

Bloomberg Tax’s projected US tax rates forecast that inflation-adjusted amounts in the tax code will increase by roughly 7.1% from 2022, more than double last year’s increase of 3%. What will inflation mean for your 2023 tax picture? ‘We predict that inflation-adjusted amounts in the tax code will increase significantly in 2023 compared to prior years due to the economic environment,’ said Heather Rothman, vice president for Analysis & Content at Bloomberg Tax.

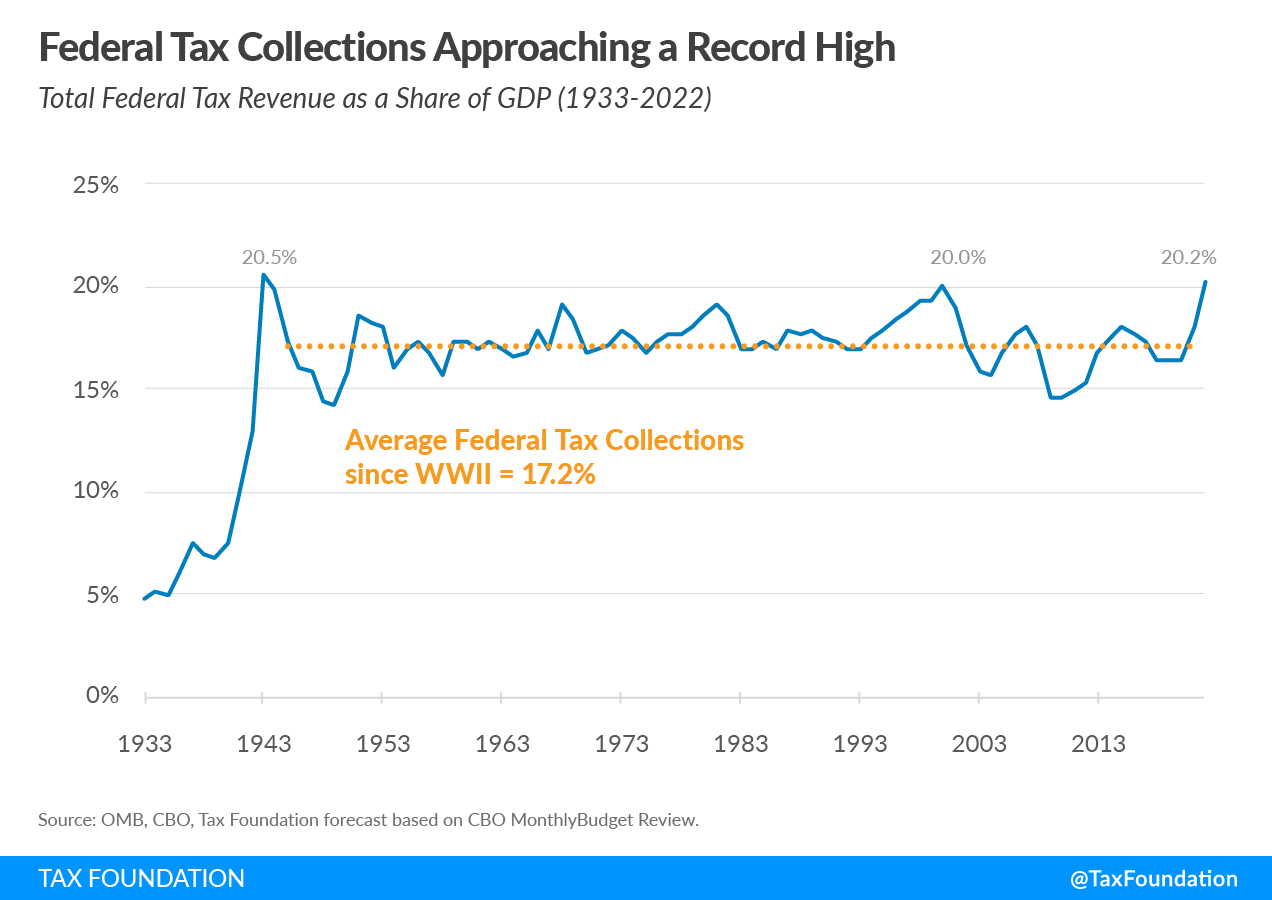

Inflation Is Surging, So Are Federal Tax Collections – William McBride, Tax Foundation:

The latest inflation report confirms that prices for just about everything continue to rise, with the Consumer Price Index (CPI) up 8.3 percent over the last year and many categories up even higher, including food (11.4 percent) and energy (23.8 percent). While not part of the CPI, another measure of inflation (call it the Taxpayer Price Index?) is also surging: federal tax collections are up 23 percent over the last year, according to the latest data from the Congressional Budget Office (CBO). At the current pace, federal tax collections will reach a record high of about $5 trillion in nominal dollars for the fiscal year (FY) 2022 ending September 30, which is about $1 trillion more than last year’s $4 trillion in collections (also a record).

IRS management blamed for tax return backlog – Michael Cohn, Accounting Today. The backlog has captured headlines since the pandemic began. This time, management is being blamed for it.

Despite the IRS's efforts to catch up on the backlog, including by expediting its hiring and setting up ‘surge teams’ this past tax season of employees from other departments to help with processing tax returns, the report faulted IRS officials for delays in processing tax transcripts, amended returns and other work.

‘Management has not taken steps to either reallocate staff or realign work to address the backlog of tax transcript requests,’ said the report. ‘As a result, taxpayers who need these transcripts to validate information for mortgages or apply for student and small business loans will continue to be burdened. In addition, the IRS's mail-processing equipment is 20 years old. Although IRS management previously agreed to take the necessary actions to replace this outdated equipment, as of May 11, 2022, funding has yet to be allocated. Until the funding is allocated and equipment replaced, the federal government will continue to lose millions of dollars in interest revenue. Finally, a strategy is needed to address the delays in processing amended returns, which is not only causing significant burden on taxpayers but also results in the Federal Government continuing to pay substantial amounts of interest.’

Remember when it was reported that the IRS trashed millions of unprocessed, paper-filed information returns from 2020?

Here’s their reason why they did it:

IRS Avoids Do-Over of Information Return Handling Mistakes – Jonathan Curry, Tax Notes ($):

According to a TIGTA report released September 21, the agency justified that decision by contending that it could do nothing with those returns once the processing year concluded and its system was updated for the next tax year. To avoid running into that problem again, TIGTA previously recommended that the IRS pay closer attention to when paper information returns are processed to ensure they’re completed on time. If that wasn’t feasible, it also suggested scanning and digitally storing any returns still outstanding at the end of the processing year.

I recently spoke with congressional staffers about drafting an IRS reform bill. During that meeting, it was said that "in an age driverless cars, the IRS is a buggywhip."

The TIGTA is here.

IRS Increasing Staff to Focus on High-Income Filers, Appeals - Isabel Gottlieb, Bloomberg ($). “The IRS is looking to increase staff who focus on high-income individual filers, an official said Wednesday.”

‘This is a really high priority area for the service,’ said Holly Paz, deputy commissioner of the IRS’s Large Business & International Division. She was speaking at a Tax Executives Institute event in New York.

This hiring effort will be years long – assuming the tax agency gets the full $80 billion promised by the Biden Administration. Elections have consequences and the upcoming one could put lawmakers in charge of Congress who don't want to give the agency a single penny. They could pass legislation that repeals the funds going to the IRS.

IRS Large-Company Unit to Focus on New Green Energy Tax Credits – Michael Rapoport, Bloomberg ($). “The changes to green energy tax credits in the new tax and climate-spending law will be a major focus in the coming months of the IRS division that handles matters affecting large companies, an IRS official said Wednesday.”

The green-energy credits in the law, enacted in August, are ‘a really large undertaking’ that will require special systems and processes, said Holly Paz, deputy commissioner of the IRS’s Large Business & International division, at a Tax Executives Institute conference.

Re: aforementioned comment: The IRS may want to put the pedal to the metal in getting these regs out while they still have the resources to hire folks.

IRS Collection of One-Time Transition Tax Flawed, Watchdog Says - James Munson, Bloomberg ($):

An IRS watchdog found numerous flaws in the way the tax agency sought to collect a one-time tax from the 2017 tax overhaul.

The IRS didn’t follow-up with non-responsive taxpayers, failed to systematically identify non-compliant taxpayers, and didn’t apply payments to the correct tax periods or miscoded them, the Treasury Inspector General for Tax Administration said in a report released Wednesday.

While a Congressional committee estimated the repatriation tax—also known as the transition tax—and other measures would generate $338.8 billion, individuals and businesses have only reported $251 billion as of March 17, 2022, and just over $94 billion of that amount has been paid, the report says. The remainder has been deferred or is being paid in installments.

The report is here.

IRS Looks to Extend Transition for Research Credit Claims – Chandra Wallace, Tax Notes ($):

Nearly a year after it announced new guidance for research credit refund claims under section 41, the IRS is considering extending the transition period for compliance, an agency official said.

An IRS announcement and accompanying chief counsel memorandum issued October 15, 2021, provided that refund claims for section 41 research credits must include detailed information in five specific areas, in some cases broken down by business component. Refund claims that fail to meet the requirements are invalid.

The IRS provided a one-year transition period during which examiners could correspond with taxpayers and give them 45 days to cure deficiencies. That transition period may be extended, according to Large Business and International Division Deputy Commissioner Holly Paz, speaking September 21 at a Tax Executives Institute meeting in New York.

IRS Catching ‘Low-Hanging Fruit’ Mistakes on Withholding Form - Isabel Gottlieb, Bloomberg ($):

An IRS tool that checks the data on a filing form for withholding taxes could result in more penalties for bad data, an official said.

A freely available IRS ‘data integrity tool’ looks for mistakes on Form 1042-S, on which foreign persons report their US-source income subject to withholding taxes. The tool will check for errors that are ‘low-hanging fruit,’ like making a payment to an unknown recipient and not withholding 30%, said Kimberly Schoenbacher, director of field operations, foreign payments practice and automatic exchange at the IRS.

Further down the article:

The IRS is noticing ‘a lot of errors’ in 1042-S data, she said. Other issues have included incomplete claims for effectively connected income, and claiming qualified intermediary status,

‘but the recipient is not a QI.’ Taxpayers are also claiming tax treaty withholding exemptions when there is no treaty, she said.

Donald Trump, 3 of his children accused of business fraud by New York AG – Shayna Jacobs and Jonathan O’Connell, Washington Post. Most of you have probably read about this. It’s being highlighted here because it involves the IRS.

New York Attorney General Letitia James filed a lawsuit Wednesday accusing former president Donald Trump, three of his grown children and executives at his company of flagrantly manipulating property and other asset valuations to deceive lenders, insurance brokers and tax authorities into giving them better bank-loan and insurance policy rates and to reduce their tax liability.

Further down the article:

It seeks to recover more than $250 million in what James’s office says are ill-gotten gains received through the alleged deceptive practices. While the lawsuit itself is not a criminal prosecution, James said she has referred possible violations of federal law to the Justice Department and the IRS.

Easement Tax Break Emerges in Trump Fraud Case Brought by NY AG – Kaustuv Basu and Aysha Bagchi, Bloomberg ($):

One of the pillars of the multibillion-dollar fraud lawsuit unveiled Wednesday against Donald Trump focused on a fairly common tax break that New York officials said lowered his tax bills by millions: conservation easements.

Such easements involve donating property development rights in order to preserve the property in exchange for a tax break. In her sweeping 222-page civil lawsuit, New York Attorney General Letitia James accused Trump and his company of illegally inflating the valuations of multiple properties to increase tax deductions.

Tax Cut Bill - Alex Clearfield, Bloomberg ($). “Rep. Vern Buchanan (R-Fla.), who is angling to be the next top Republican on the Ways and Means Committee, introduced legislation Wednesday to make permanent tax cuts for individuals and small businesses enacted in the 2017 tax law.”

‘With Americans continuing to suffer under the weight of record-high inflation and an uncertain economic future, we need to provide some much-needed relief and certainty to hardworking families and ensure these tax cuts do not expire,’ Buchanan said.

This bill has no chance for passage in the current Congress. Buchanan would have to reintroduce this bill in the next Congress for it to have a chance at becoming law – which is a longshot. Current projections have Republicans running the House and Democrats maintaining control of the Senate post election. Divided Congresses rarely pass much.

House sends spousal student loan bill to Biden’s desk – Mycheal Schnell, The Hill. "The House passed a bill on Wednesday that allows spouses who combined their student debts under a federal program to split their loans, sending the legislation to President Biden’s desk."

Massachusetts Appeals Court Upholds Solar Tax Exemption Denial – Perry Cooper, Bloomberg ($). “The owner of a solar power facility in Massachusetts was properly denied a property tax exemption under the law in place during the tax years at issue, the state appeals court ruled.”

Missouri Senate passes individual income tax cuts – Summer Ballentine and Cole Banker, Associated Press and KOMU 8:

Missouri taxpayers could get a break on income taxes under a proposal passed by the state Senate.

The GOP-led chamber on Wednesday voted 24-4 in favor of the bill. The measure now heads to the Republican-led House for consideration.

The bill would cut the top income tax rate from 5.3% to 4.95% in 2023. Most Missourians pay the top income tax rate.

New Jersey Gets 22 Companies for New Tax Dispute Settlement Plan - Donna Borak and Michael Bologna, Bloomberg ($). “Twenty-two companies that may have engaged in questionable intercompany transactions to lower their New Jersey tax obligations have registered for a voluntary program to resolve disputes with the state, according to a spokeswoman for the state Treasury Department.”

Citi Mulls N.J., Connecticut Facilities to Ease NYC Commutes – Jenny Surane and Max Reyes, Bloomberg ($). Increased commuting costs prompted Citigroup Inc. Chief Executive Jane Fraser to say her bank may provide facilities in New Jersey and Connecticut so workers in those states don’t have to commute into New York to do their job. Her proposal piggybacks off a tax break offered by a New Jersey Congressman.

Fraser’s comments came in response to questions from Rep. Josh Gottheimer, a democrat from New Jersey, who said he’s been working with state legislators to create tax incentives for New York employers who open up regional hubs in New Jersey to allow residents of his state to avoid the rising cost of commuting into Manhattan. That move comes as New York’s Metropolitan Transportation Authority is weighing plans to charge some motorists as much as $23 to drive into Manhattan’s central business district.

This effort is ironic considering the lengths many employers and large cities have gone to get workers back into the office.

Louisiana Software Maker Can Get Manufacturer Tax Treatment - Perry Cooper, Bloomberg ($). “Louisiana improperly calculated its assessment of corporation income and franchise tax for a company that makes software, the state tax board ruled.”

Ariz. Gov. Asks 9th Circ. To Revive Suit Over COVID Funds – Jaqueline McCool, Law360 Tax Authority ($). “Arizona Gov. Doug Ducey told the Ninth Circuit that the federal government went too far in restricting how the state could use pandemic relief funds, arguing a lower court misread the American Rescue Plan Act when tossing the governor's suit.”

Partnership Foreign-Income Form Could See More Changes: IRS – Michael Rapoport, Bloomberg ($). “The Internal Revenue Service is open to further changes to improve new, much-criticized filing requirements for partnerships’ foreign income, an agency official said Wednesday.”

UK’s Truss Tells Businesses She Wants Lower, Simpler Taxes - Alex Morales, Bloomberg ($):

Prime Minister Liz Truss said her government will pursue an ‘unashamedly pro-business’ agenda by lowering and simplifying taxes in the UK.

‘We want lower, simpler taxes in the UK to incentivize investment, to get more businesses going,’ Truss told a meeting of senior business figures in New York on Wednesday, according to a readout from her office.

If a U.S. lawmaker used the same language that person would be blasted for giving tax breaks to the rich. Just sayin’.

Hot mike!

South Korea President Caught on Hot Mic Insulting US Congress - Jeong-Ho Lee, Bloomberg ($). “South Korean leader Yoon Suk Yeol was overheard insulting American lawmakers, after briefly meeting President Joe Biden to discuss issues including US electric-vehicle subsidies that South Korea wants to change.”

‘What an embarrassment for Biden, if these idiots refuse to grant it in Congress,’ video broadcast on South Korean television showed Yoon telling Foreign Minster Park Jin in New York. The comments were caught on a microphone as Yoon and Park were leaving a brief chat with Biden at a Global Fund event.

Background:

Yoon has come under pressure at home to remedy provisions in the Inflation Reduction Act signed last month by Biden, which includes tax credits of as much as $7,500 for purchases of electric vehicles made in North America. That could disadvantage major South Korean brands like Hyundai and Kia, which don’t yet have operational EV plants in the US.

From the “Plate Already Full” file:

Investors, Analysts Back Income Tax Accounting Disclosure Plan - Nicola White, Bloomberg ($):

Requiring companies to break down their reported lump-sum income tax payments by country or state would help analysts get long-sought insight into multinational companies’ future financial risks, investors and academics told US accounting rulemakers on Tuesday.

Analysts in particular want insight to distinguish between ongoing tax expense versus significant changes, such as rate hikes in a country or a company getting more aggressive with its tax planning, said Karen Korn, head of alternative product development at Fidelity Investments at a meeting of the Financial Accounting Standards Board’s main advisory panel.

‘Every day, we’re sitting here trying to predict the future, and that’s not different with taxes than it is about any other important aspect of the company’s operations or reporting,’ Korn said.

Fulfilling this goal would be a lot more work for people already buried with responsibility.

Happy American Business Women’s Day AND National Girls’ Night!

Business Women’s Day “honors the accomplishments of the businesswomen across the nation,” according to National Day Calendar.

And after a hard day’s work, Girls’ Night “encourages women to gather with their best girlfriends for a night in to relax, recharge, and foster meaningful connections,” according to the same source.

Quite the combo!

We're Here to Help